Creating an official receipt in Singapore requires compliance with local tax regulations and business standards. A well-structured receipt should include the company’s name, registration number, and address, ensuring it meets the requirements set by the Inland Revenue Authority of Singapore (IRAS).

Every official receipt must contain essential transaction details such as the date, receipt number, description of goods or services, total amount paid, and applicable taxes like the Goods and Services Tax (GST) if the business is registered for it. Clear formatting and accurate calculations help maintain transparency and professionalism.

For businesses issuing multiple receipts, using a structured template ensures consistency and reduces errors. Digital receipts are increasingly common, and businesses can issue them electronically as long as they remain compliant with Singapore’s record-keeping guidelines.

By following these best practices, businesses can maintain proper financial records while providing customers with clear and legally valid receipts. Using a customizable template simplifies the process and ensures compliance with regulatory standards.

Here is the corrected version with repetitions removed:

Ensure that each receipt is clear and professional. Include a unique receipt number for tracking purposes, followed by the date of the transaction. The seller’s name and contact details should be listed, along with the buyer’s name. Specify the description of the goods or services provided, along with their individual prices and quantities. Summarize the total amount paid, indicating the currency used. Finally, include a footer with any legal disclaimers or return policies relevant to the transaction.

By following these steps, you can produce an accurate and clean official receipt template, ensuring that all necessary details are present without redundancy.

- Official Receipt Template Singapore

To create a compliant official receipt in Singapore, follow these simple steps:

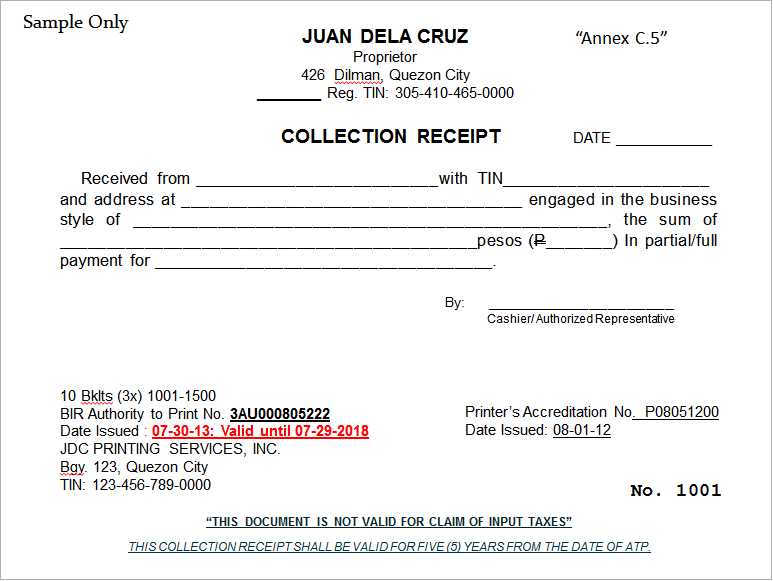

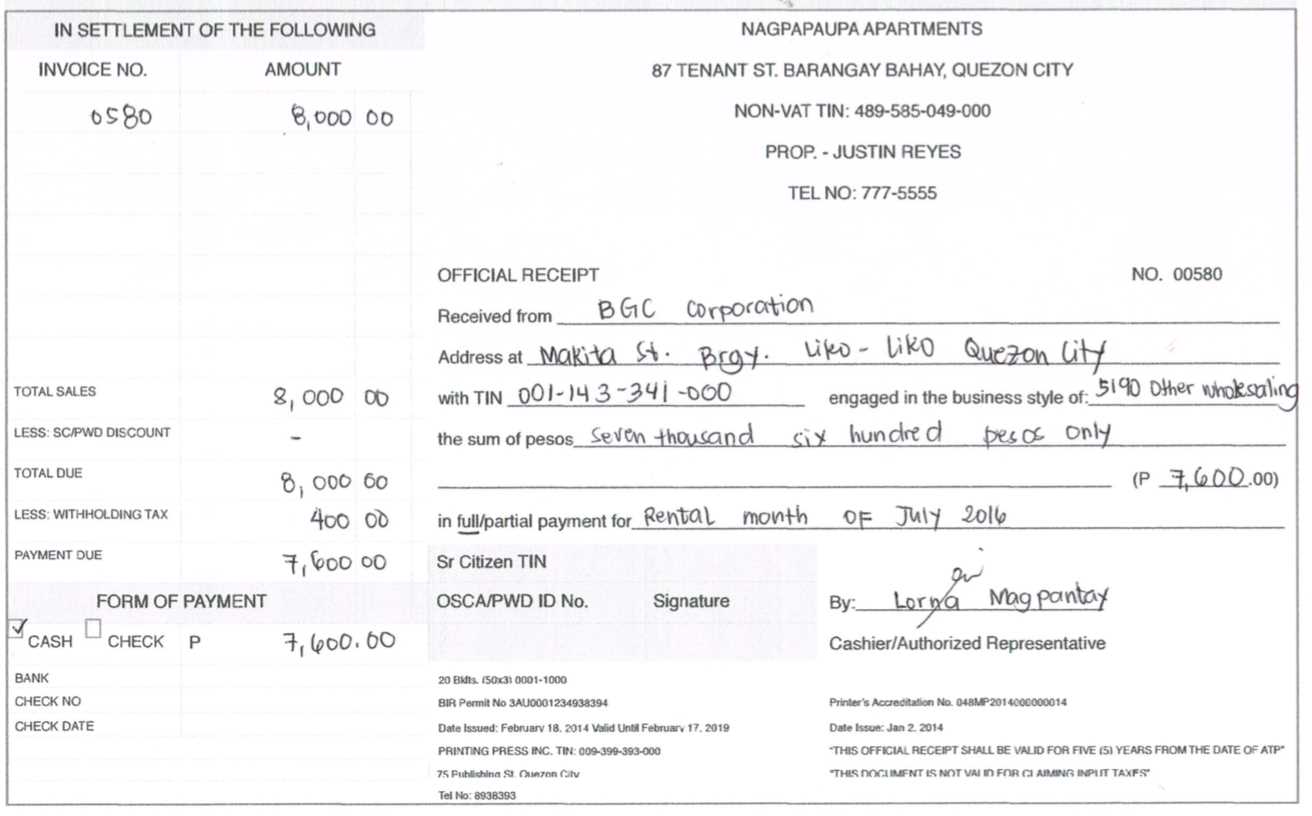

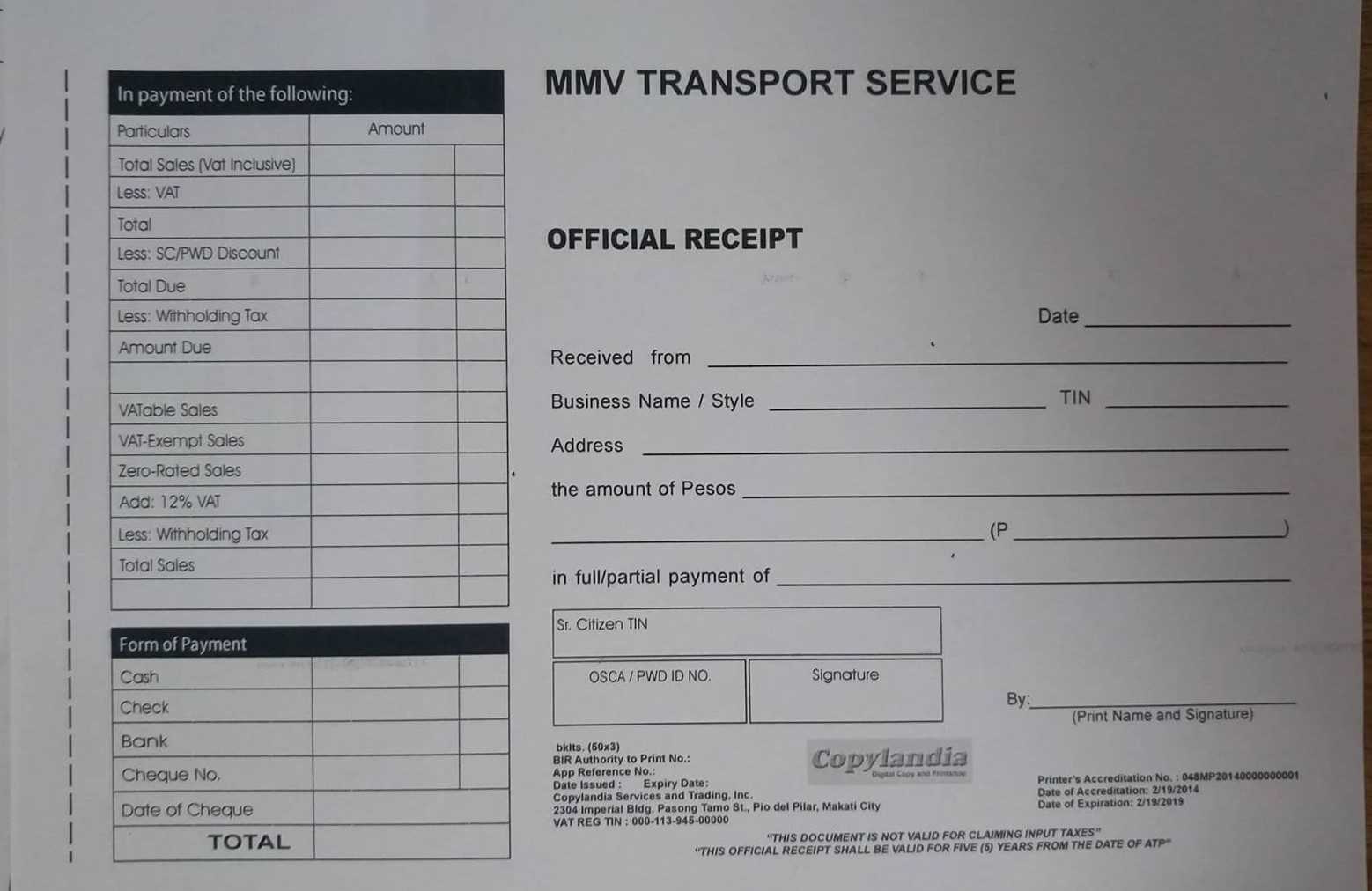

- Include business details: Add your business name, registration number (e.g., UEN), and address. This ensures transparency and legal compliance.

- State receipt number: Each receipt should have a unique identifier for tracking purposes. This is important for both your records and tax filings.

- Provide transaction details: Clearly list the goods or services sold, including a description, quantity, and price. Break down taxes or discounts if applicable.

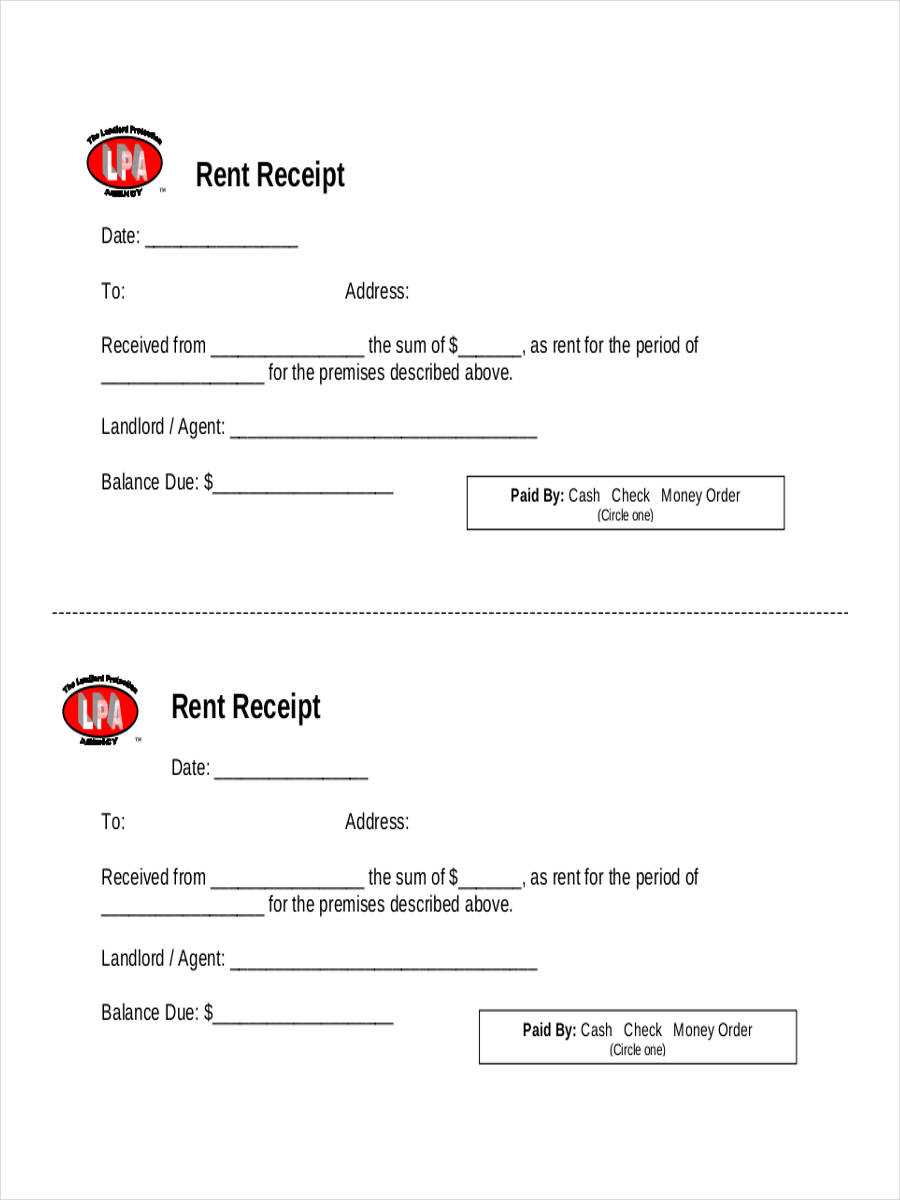

- Date and payment method: Mention the transaction date and specify how the payment was made (e.g., cash, cheque, credit card, etc.).

- Signature or stamp: Depending on your business, you may need to include an authorized signature or company stamp for added legitimacy.

Receipt Template Components

- Company Name and Address

- Transaction Date

- Receipt Number

- Description of Goods/Services

- Total Amount Paid

- Payment Method

- Authorized Signature/Stamp

By ensuring all these components are included, you’ll meet the requirements for issuing an official receipt in Singapore.

Receipts in Singapore must clearly outline certain information to comply with the legal standards. Businesses are required to include the following details:

- Date of transaction – The exact date when the transaction occurred.

- Vendor details – The business name, address, and tax identification number (GST registration number if applicable).

- Description of goods or services – A clear description of what was sold or provided.

- Amount paid – The total amount, including taxes, if applicable.

- GST amount – If the business is registered for GST, the receipt must show the breakdown of GST charged.

Failure to meet these requirements may lead to legal consequences. Businesses should ensure that their receipts reflect these details to stay compliant with Singapore’s regulations.

Clearly itemize the transaction. Each payment receipt should list the goods or services provided, along with their corresponding prices. This ensures transparency for both parties.

| Element | Description |

|---|---|

| Receipt Number | A unique identifier for each transaction, ensuring easy reference and tracking. |

| Payment Date | The exact date when the payment was made. |

| Amount Paid | The total amount that was settled, including taxes and discounts, if any. |

| Payment Method | Specify how the payment was made, e.g., cash, credit card, bank transfer. |

| Seller’s Information | Include the business name, address, and contact details to identify the seller. |

| Buyer’s Information | If applicable, add the buyer’s name or company name, especially for business transactions. |

Verify that all details are accurate. Double-check the amount, payment method, and any associated reference numbers to avoid confusion later. Clear formatting also contributes to professionalism and credibility.

To customize a receipt template effectively, ensure it includes business-specific elements. Add your company logo, contact details, and a unique receipt number for easy tracking. Make the template adaptable to different types of transactions by incorporating various payment methods, like cash, credit card, or bank transfer, depending on your business type.

Include customizable fields that reflect the nature of your products or services, such as discounts, taxes, and service fees. This way, the receipt can be tailored to fit the pricing structure of your business.

If your business deals with multiple currencies, ensure the template supports easy currency adjustments, allowing clients to see the accurate total in their preferred currency. This is especially important for international transactions.

For industries that require additional legal or compliance information, such as food or retail businesses, make space for mandatory disclaimers or business-specific terms and conditions. This helps in meeting local regulatory requirements.

Finally, ensure that the template is compatible with the software or systems you use for invoicing and bookkeeping, allowing for seamless integration and reduced manual entry.

When creating an official receipt template for Singapore, ensure that it complies with the guidelines set by the Inland Revenue Authority of Singapore (IRAS). A receipt must clearly indicate the transaction details, such as the business name, address, date, description of goods or services, the total amount paid, and the payment method. Including these details not only ensures legal compliance but also promotes transparency with your customers.

Key Information to Include

Your receipt should display the name and GST registration number of your business if applicable. The transaction date and a unique receipt number are also required for tracking purposes. Always list the item or service description, including quantity and price per unit, followed by the total amount. If a discount was given, mention it separately.

Formatting Tips

For clarity, use a clean and organized layout. Highlight important information, like the total amount due and the payment method, using bold or larger fonts. Ensure the template is easy to read and professional in appearance, reflecting your business’s reputation.