Creating a personalized receipt template ensures consistency in transactions and simplifies record-keeping. Whether for a small business, freelance work, or personal use, a well-structured template includes key details like date, item descriptions, prices, and payment methods.

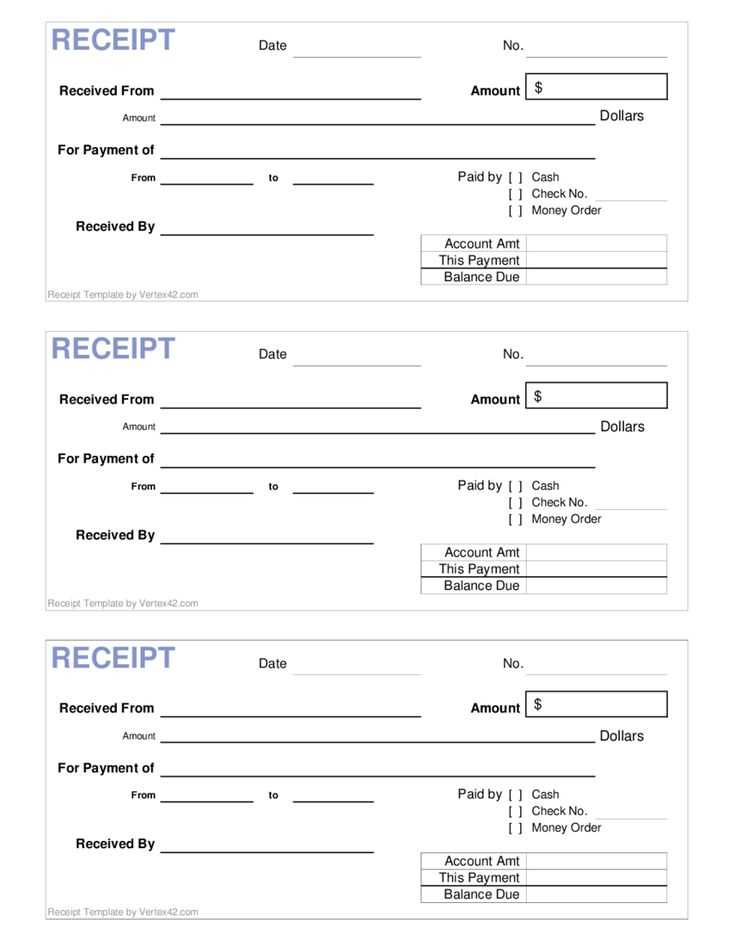

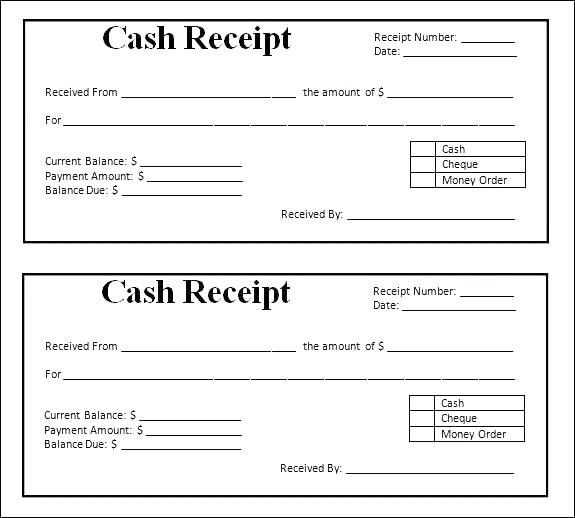

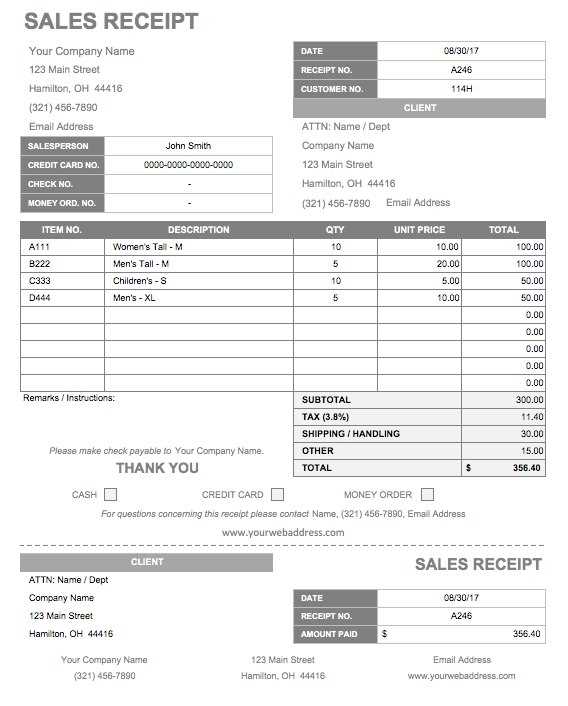

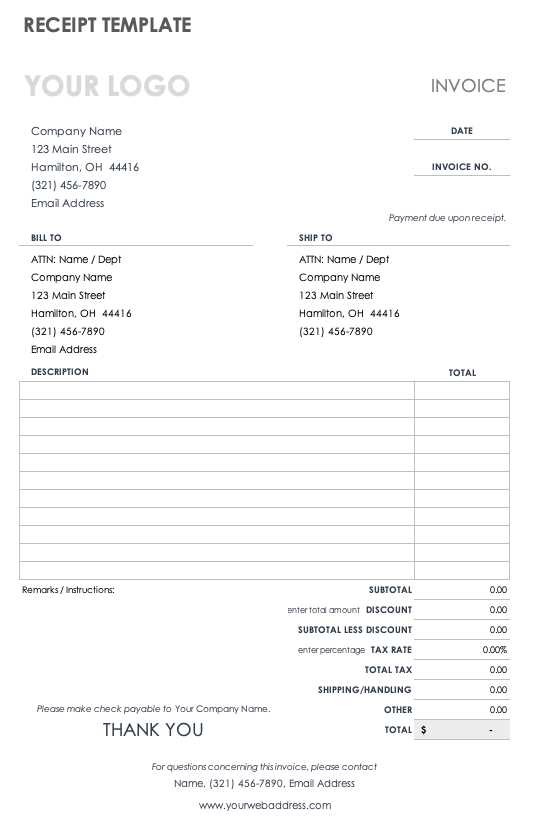

Use a clear layout with distinct sections for essential information. A typical receipt features the seller’s name and contact details at the top, followed by the buyer’s details if necessary. Below that, list the purchased items with their quantities, unit prices, and total amounts. Add tax calculations if applicable, and include a payment confirmation section.

Digital templates in Excel, Word, or PDF formats offer flexibility, allowing easy customization and automated calculations. If receipts need to be printed frequently, a pre-formatted template with predefined fields saves time. For online transactions, consider integrating an auto-generated receipt system within an invoicing platform.

Ensure legal compliance by including all required information based on your location. Adding a signature or unique identifier enhances authenticity. If receipts are for tax purposes, maintain an organized record-keeping system for future reference.

Own Receipt Template: Practical Guide

Use a clear structure with essential details: date, receipt number, payer and payee names, payment method, itemized list, subtotal, taxes, and total amount. This ensures accuracy and compliance with record-keeping standards.

Include a unique receipt number for tracking. Sequential numbering helps maintain order, while a combination of letters and digits enhances security. If issuing multiple receipts, use a consistent format to avoid duplication.

Specify payment details. Indicate whether the transaction was completed via cash, credit card, bank transfer, or another method. For digital payments, mention the transaction ID.

Break down costs. List items or services separately with quantities, unit prices, and applicable taxes. This helps both parties understand the charges and simplifies tax reporting.

Add a signature or company stamp. While digital receipts may not require physical signatures, an electronic signature or company logo enhances authenticity.

Ensure readability. Use a legible font size and align text properly. If using a printed template, test it on different paper sizes to confirm layout consistency.

Keep a copy. Whether storing digitally or physically, maintain organized records for reference, audits, or disputes.

Key Elements to Include in a Custom Receipt Template

Ensure every receipt provides complete transaction details for clarity and record-keeping. Missing key elements can lead to disputes or confusion.

Business and Customer Information

- Business Name and Contact Details – Include the legal name, phone number, email, and physical address.

- Customer Name – Personalize the receipt with the buyer’s name or company.

- Date and Time – Clearly display when the transaction took place.

Transaction and Payment Details

- Receipt Number – Use a unique identifier for tracking and reference.

- Itemized List – Break down each product or service, including quantity and unit price.

- Subtotal, Taxes, and Discounts – Show a transparent calculation of charges.

- Total Amount – Highlight the final cost in a noticeable format.

- Payment Method – Specify if the payment was made via cash, credit card, or other means.

Design the layout for readability, keeping fonts legible and sections well-spaced. A clear format ensures customers can quickly verify the information.

Best File Formats and Software for Creating Receipts

PDF ensures compatibility across devices and maintains formatting, making it a reliable choice for receipts. Adobe Acrobat or free alternatives like PDF-XChange Editor allow easy customization and secure document storage.

Editable Formats: DOCX and XLSX

DOCX (Microsoft Word) suits businesses needing styled, professional receipts with branding elements. XLSX (Excel) is ideal for automated calculations, batch processing, and integrating with accounting software like QuickBooks or FreshBooks.

Lightweight and Structured: TXT and CSV

TXT files work for basic receipts without formatting, while CSV enables structured data storage, allowing seamless import into financial tools. These formats integrate well with automation scripts and POS systems.

Choose the format based on storage needs, integration capabilities, and ease of use. Cloud-based tools like Google Docs and Sheets provide collaborative editing, while dedicated software like Zoho Invoice and Wave simplifies automated receipt creation.

How to Ensure Legal Compliance in Receipt Design

Include all legally required details such as business name, address, contact information, transaction date, itemized charges, tax breakdown, and total amount. Omitting these elements may lead to disputes or regulatory issues.

Meet Tax and Financial Regulations

Ensure receipts reflect accurate tax calculations based on jurisdictional requirements. Specify applicable VAT, sales tax, or other levies separately. In some regions, receipts must include a tax identification number or a unique transaction code.

Adhere to Consumer Protection Laws

Clearly state refund and exchange policies if legally mandated. Use legible fonts and structured layouts to avoid misinterpretation. Digital receipts should comply with data privacy laws, protecting customer information from unauthorized access.

Consult legal guidelines specific to your location to confirm compliance, as laws vary by country and industry. Regularly review and update receipt formats to align with regulatory changes.