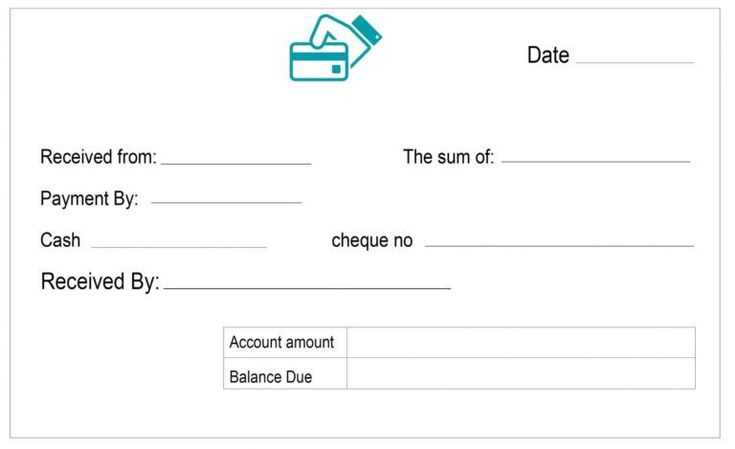

Using a “Paid in Full” receipt template streamlines the documentation process, ensuring clear proof of payment for both parties. A well-structured receipt reduces misunderstandings and provides a professional touch to any transaction.

Ensure your template includes key details such as the date of payment, payment method, and the amount paid. Including the transaction reference number or invoice number adds clarity, especially in case of future queries or disputes.

Be concise but thorough–list the services or products provided, along with the total cost and the payment amount. Clearly mark the document as “Paid in Full” to signify that no further payments are owed. This simple phrase prevents confusion and establishes closure.

Using a customizable template saves time and helps maintain consistency across all receipts. A clear and professional receipt builds trust with your clients and protects you from potential misunderstandings down the line.

Here’s the corrected version with minimized word repetition:

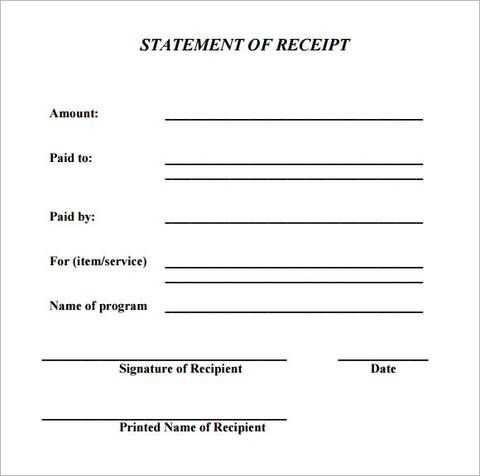

To create a professional and clear “Paid in Full” receipt, use a template that includes the payment amount, date, and transaction details. Start with a header that states “Paid in Full” prominently, followed by the payer’s name and the recipient’s business details. Ensure the receipt includes a brief description of the product or service paid for, as well as the total amount paid.

Make sure the template also features a confirmation statement, such as “This payment clears all outstanding balances,” along with any relevant reference numbers or invoice IDs. To prevent confusion, avoid repeating payment terms or excessive information that could clutter the document. Always double-check for clarity, and leave room for signatures if necessary.

With these elements in place, your “Paid in Full” receipt will be both functional and straightforward for both parties to understand.

- Paid in Full Receipt Template Guide

A “Paid in Full” receipt confirms that a debt or payment has been completely settled. To ensure clarity and proper record-keeping, use a structured template that includes essential details. The template should include sections such as:

Key Elements of the Template

- Receipt Title: Clearly label the document as “Paid in Full Receipt” at the top.

- Date of Payment: Include the exact date when the payment was made.

- Payment Amount: Specify the total amount paid in full. This should match the agreed-upon amount.

- Payment Method: Indicate the method of payment (e.g., credit card, check, bank transfer).

- Client Details: List the name and contact information of the individual or company making the payment.

- Payee Details: Include the name and contact details of the entity receiving the payment.

- Description of Goods or Services: Provide a brief description of what the payment covers (e.g., invoice number or service rendered).

- Signature: The signature of the payee confirming receipt of the full payment.

Template Example

Here’s a basic layout for a “Paid in Full” receipt:

Paid in Full ReceiptDate: [Date] Receipt Number: [Unique ID]Received from: [Payer's Full Name] Address: [Payer's Address] Phone: [Payer's Contact Information]Amount Paid: $[Amount] Payment Method: [Cash/Credit Card/Bank Transfer] Invoice/Service Description: [Details of Goods/Services]Paid by: [Payee’s Full Name] Address: [Payee’s Address] Phone: [Payee’s Contact Information]Signature of Payee: ____________________________

This structure ensures transparency and leaves no ambiguity for both parties involved. Always double-check the information for accuracy before issuing the receipt.

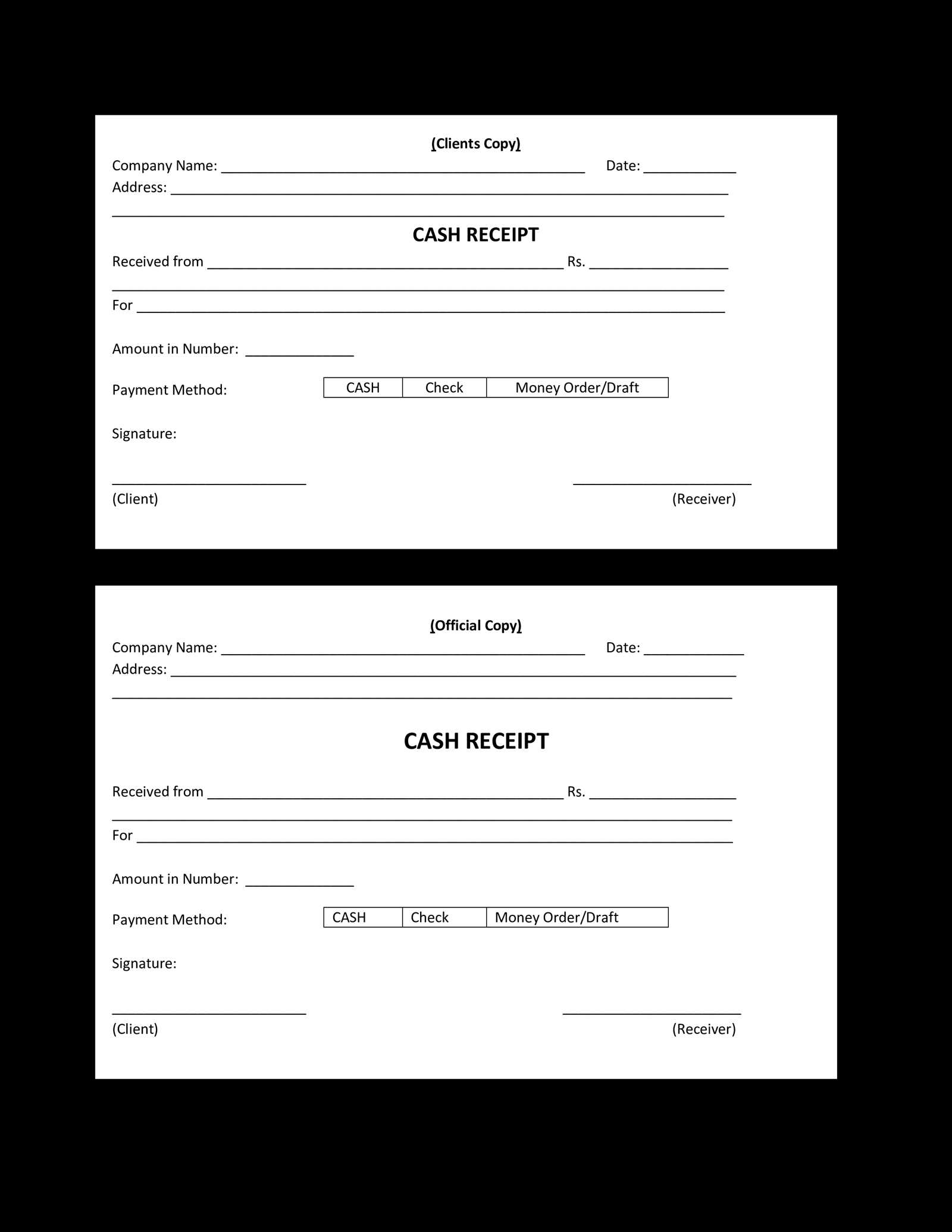

To create a custom full payment receipt template, follow these practical steps:

- Header Information: Include your business name, address, phone number, and email address at the top of the receipt for identification purposes.

- Receipt Title: Clearly state “Paid in Full” at the top to indicate that the payment has been completed in full.

- Receipt Number: Assign a unique receipt number to each transaction for record-keeping.

- Payment Date: Add the date the full payment was received.

- Customer Details: Include the customer’s name, address, and contact information for accurate record-keeping.

- Payment Information: Include the total amount paid, payment method (e.g., cash, credit card, check), and any reference numbers related to the payment.

- Itemized List: If applicable, list the products or services with their corresponding costs to provide clarity on the payment breakdown.

- Balance Due: Clearly indicate that no balance is due, confirming the payment is fully processed.

- Signatures: Include a section for both the business and the customer to sign, acknowledging the transaction.

- Additional Notes: Add any relevant terms, such as return policies or warranties, to provide complete transparency.

Save your template in a format that can be easily customized, such as Word or PDF, and reuse it for each full payment transaction. This helps ensure consistency and professionalism in your receipts.

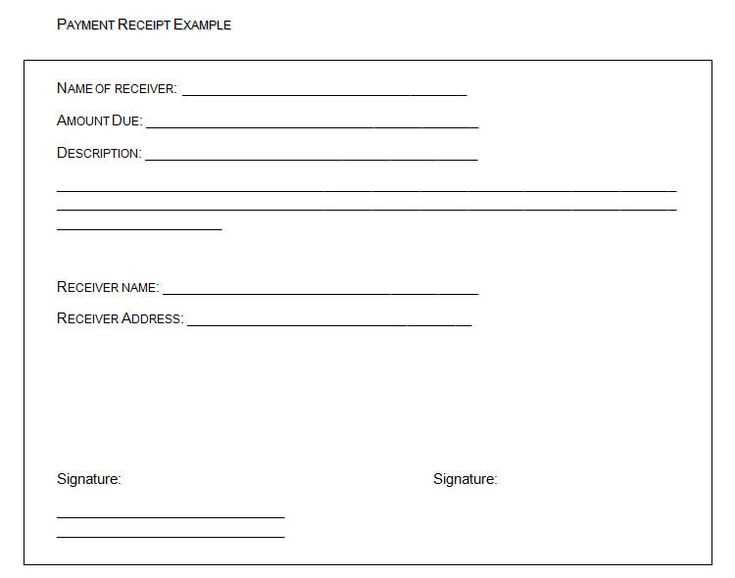

The full payment receipt should include clear, concise details to avoid any confusion. Start with the payment amount, ensuring the sum is clearly listed in both numeric and written formats. This confirms the exact amount received.

Next, include the transaction date. This marks the day the payment was completed and serves as proof of payment at a specific time.

List the payer’s full name or business name. This helps identify the person or entity responsible for the payment.

Include the payment method (e.g., cash, credit card, bank transfer, check). This provides a clear record of how the payment was made and supports tracking in case of disputes.

Reference any invoice number or order number associated with the payment. This links the receipt to a specific transaction, ensuring easy cross-reference.

If applicable, specify the item or service paid for. This clarifies what the payment relates to, helping both parties identify the transaction’s context.

Finally, include a statement confirming the payment is “Paid in Full” to prevent any future confusion or claims of outstanding balances.

Ensure you enter the correct payment date. Leaving it blank or using an incorrect date can lead to confusion or disputes later on. Always double-check the payment date before finalizing the receipt.

Missing Details or Incomplete Information

Always include key information: the payer’s name, the amount paid, and the payment method. Omitting any of these details might make the receipt incomplete and less credible. If necessary, add extra notes to clarify the payment purpose.

Inconsistent Formatting

Use a consistent format throughout the receipt. Avoid using different fonts or inconsistent styles for different sections. Consistency helps keep the receipt professional and easy to read.

Overlooking the Receipt Number

Each receipt should have a unique number. Failing to assign a unique receipt number can cause issues with tracking payments, especially for accounting purposes. Make sure each transaction is properly numbered for reference.

Forgetting to Include Tax Information

If the payment involves taxable goods or services, always include the tax details. Leaving out tax amounts can cause complications if the receipt is required for tax reporting or audits.

Incorrect Payment Method

Clearly state the payment method–whether it’s cash, check, or card. If you use a template with predefined payment methods, make sure to select the correct one. A mismatch can raise doubts about the authenticity of the receipt.

Skipping Terms and Conditions

If your business or transaction has specific terms, ensure they’re noted in the receipt. This is particularly important for refundable payments or deposits, where the conditions should be clear to avoid misunderstandings.

Table Example

| Receipt No. | Date | Payer Name | Amount Paid | Payment Method | Tax Included |

|---|---|---|---|---|---|

| 001 | 2025-02-13 | John Doe | $100 | Credit Card | $8.00 |

| 002 | 2025-02-13 | Jane Smith | $50 | Cash | $4.00 |

Optimizing Your Paid in Full Receipt Template

When designing a “Paid in Full” receipt template, clarity and precision matter most. Here are key components to include for effective communication:

- Payment Details: Clearly state the total amount paid and the method of payment (e.g., credit card, bank transfer). This helps avoid confusion and verifies the payment transaction.

- Recipient and Payer Information: Include the full names, addresses, and contact details of both parties. This ensures the receipt is easily traceable and can be referenced if needed later.

- Transaction Date: Always mention the exact date the payment was received. This provides an accurate timeline of the transaction.

- Payment Confirmation: Add a statement confirming that the payment is complete and no further amounts are due, such as “This receipt confirms that the full payment has been received and no additional balance is owed.”

- Unique Receipt Number: Assign a unique number to each receipt for easier record-keeping and future reference. This helps maintain an organized system.

By including these details in your template, you ensure that both the payer and recipient have a clear, professional record of the transaction.