Why a Paid in Full Receipt Matters

A paid in full receipt confirms that a customer has settled their balance. It protects both parties by documenting the transaction and preventing future disputes. Businesses use this receipt to close accounts, while customers keep it for personal records or tax purposes.

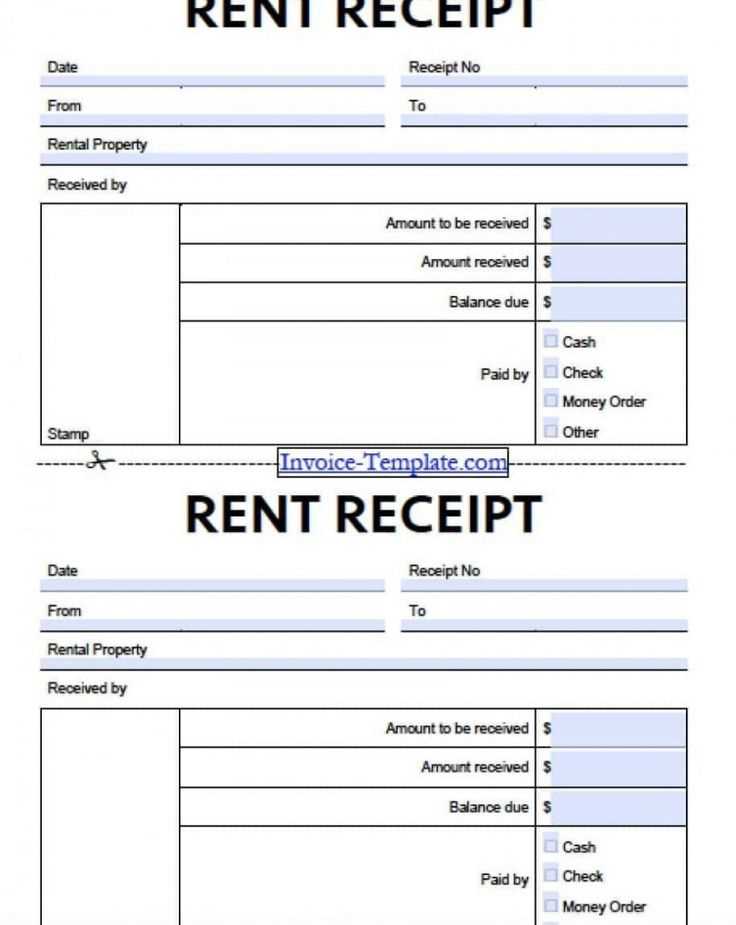

Key Elements of a Paid in Full Receipt

- Receipt Number: A unique identifier for tracking.

- Date of Payment: The exact day the payment was received.

- Payer Information: Name and contact details of the customer.

- Business Information: Name, address, and contact details of the seller.

- Description of Purchase: Details of the goods or services paid for.

- Total Amount Paid: The full amount received.

- Payment Method: Cash, check, credit card, or bank transfer.

- Confirmation Statement: A clear note stating that the payment was made in full.

- Authorized Signature: A signature from the seller or business representative.

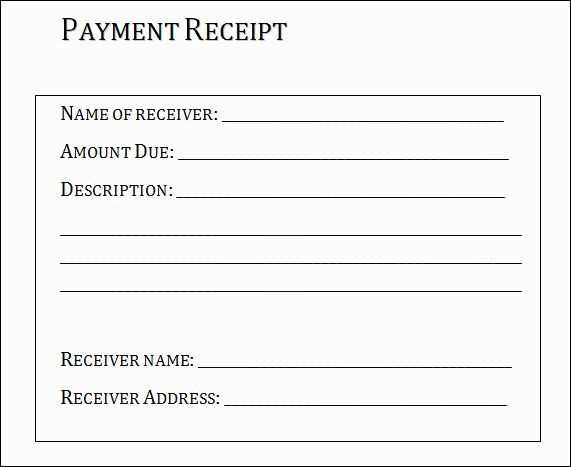

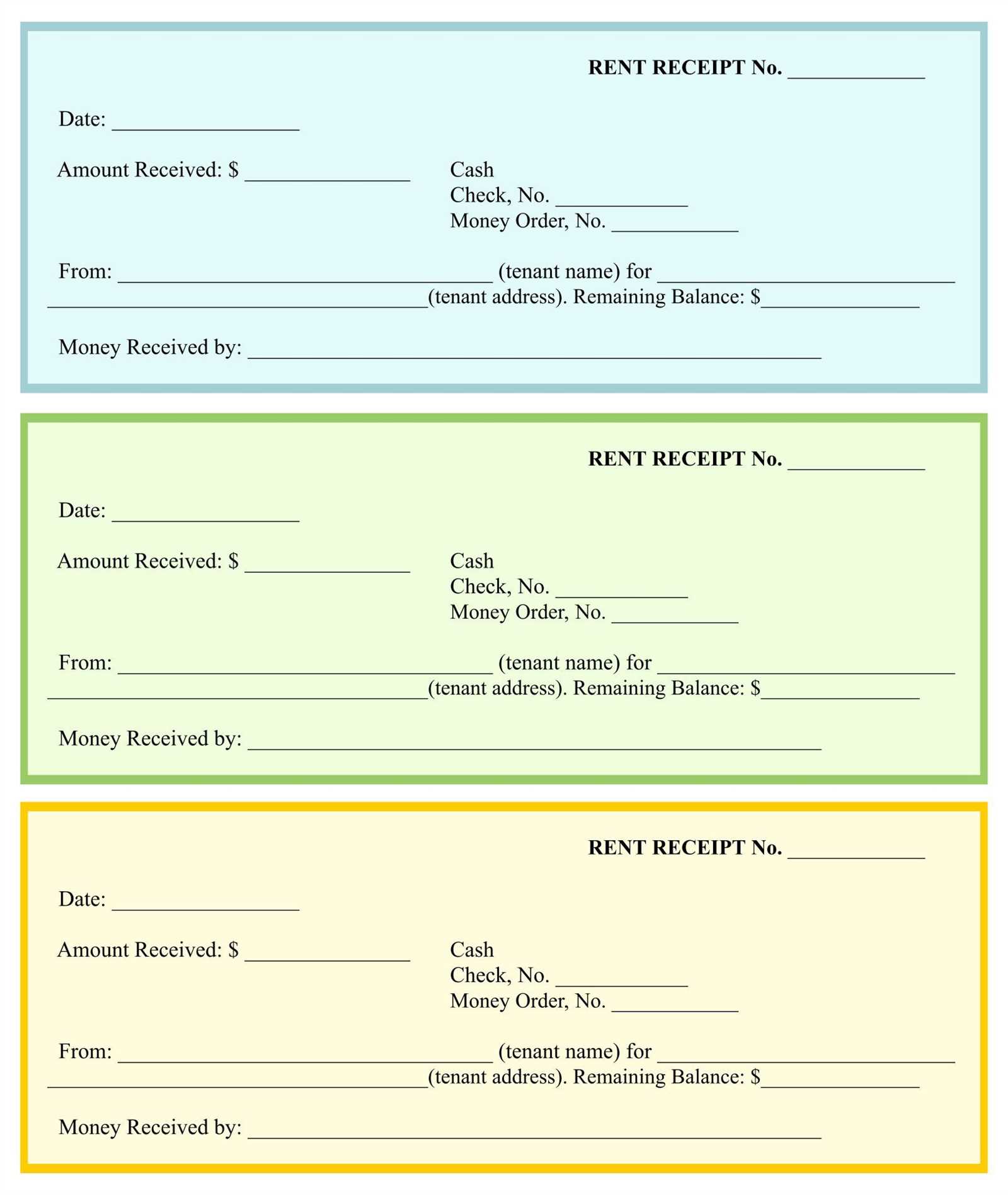

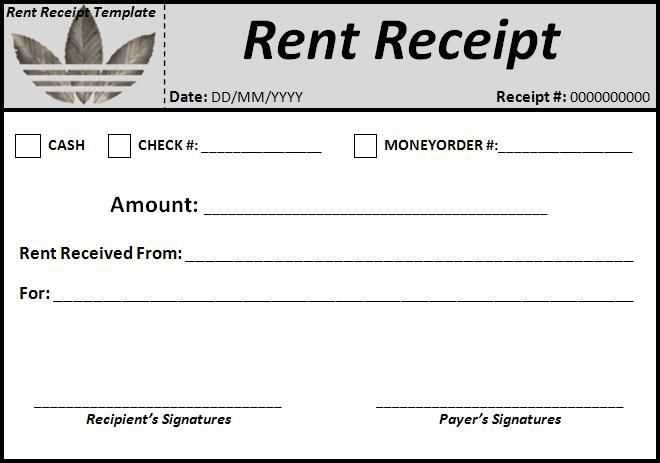

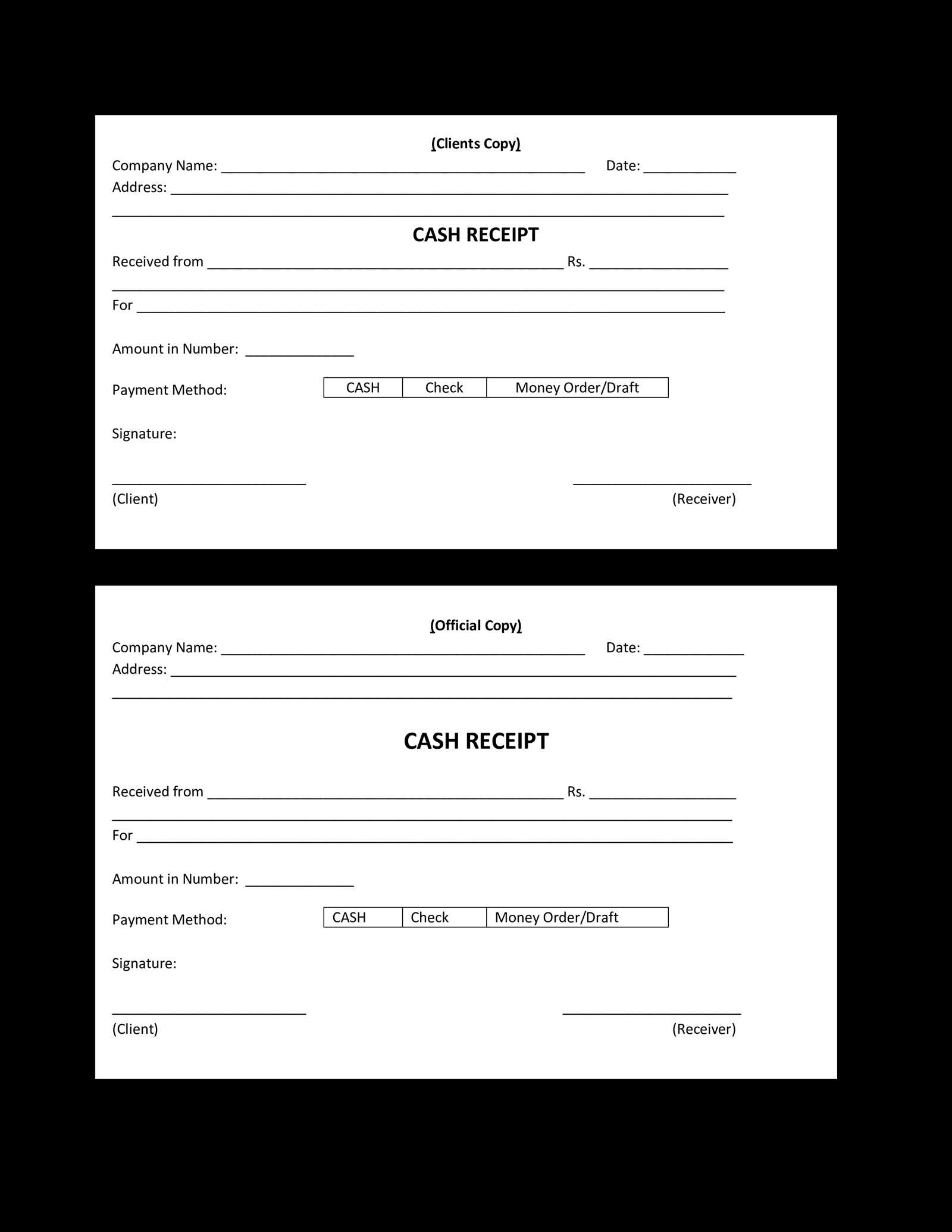

Sample Template

Use the format below as a reference when creating your own paid in full receipt.

Receipt of Payment Date: [MM/DD/YYYY] Receipt No.: [12345] Received from: [Customer Name] Address: [Customer Address] Phone: [Customer Contact] Amount Paid: $[Total Amount] Payment Method: [Cash/Credit Card/Check] Description: [Goods/Services Description] This payment settles the full balance due. Signature: _______________________ Business Name: [Your Business Name]

Best Practices for Using This Receipt

- Provide a copy to the customer and retain one for business records.

- Use a digital or printed format based on customer preference.

- Ensure all details are accurate to prevent misunderstandings.

A paid in full receipt ensures clarity in transactions. Customize the template to fit your needs and maintain organized records.

Paid in Full Receipt Template: Key Aspects and Practical Use

What Is This Receipt and When Is It Needed?

A paid-in-full receipt confirms that a payment has been completed with no remaining balance. Businesses and individuals issue it after receiving full payment for goods, services, or loans. It protects both parties by serving as proof of settlement, reducing the risk of disputes.

Mandatory Information to Include in the Document

A proper receipt must include:

- Payer and payee details: Full names and contact information.

- Transaction date: The exact date of payment.

- Payment amount: The total paid sum, including currency.

- Payment method: Cash, check, credit card, or bank transfer.

- Invoice or reference number: If applicable, to link the receipt to a specific transaction.

- Confirmation statement: A phrase like “Paid in full” to clarify that no further payment is due.

- Signature: The payee’s signature or official stamp, if required.

Clear and complete details ensure the receipt is legally valid and easy to reference.