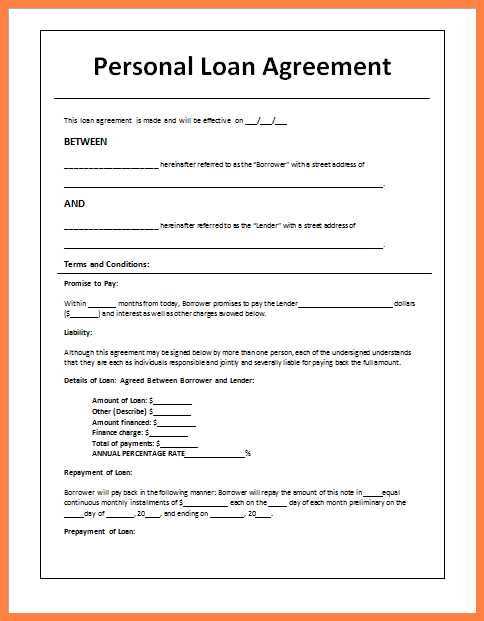

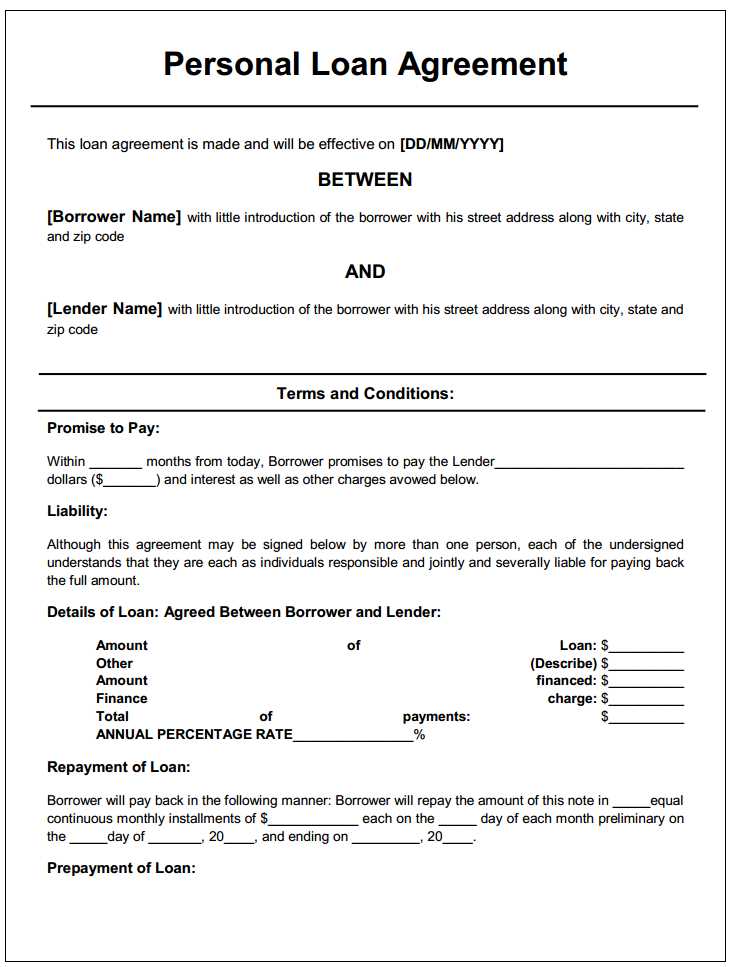

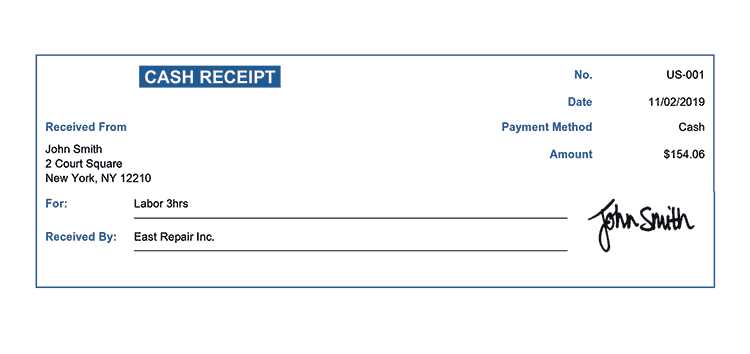

Key Details to Include

A well-structured payday loan receipt should clearly outline essential transaction details. Ensure the following elements are present:

- Loan Provider Information: Business name, address, and contact details.

- Borrower Details: Full name, contact information, and identification number if applicable.

- Loan Amount: The total sum provided to the borrower.

- Repayment Terms: Due date, interest rate, and any associated fees.

- Payment Confirmation: Amount repaid, date of payment, and remaining balance.

- Signature Section: Space for both lender and borrower to sign.

Formatting the Template

Basic Structure

Keep the receipt easy to read by organizing information into distinct sections. Use clear headings and consistent formatting to improve clarity.

Digital vs. Paper Receipts

For businesses using digital receipts, ensure the template allows for electronic signatures and automated timestamps. Paper receipts should be printed on durable material and include a duplicate copy for records.

Customization Tips

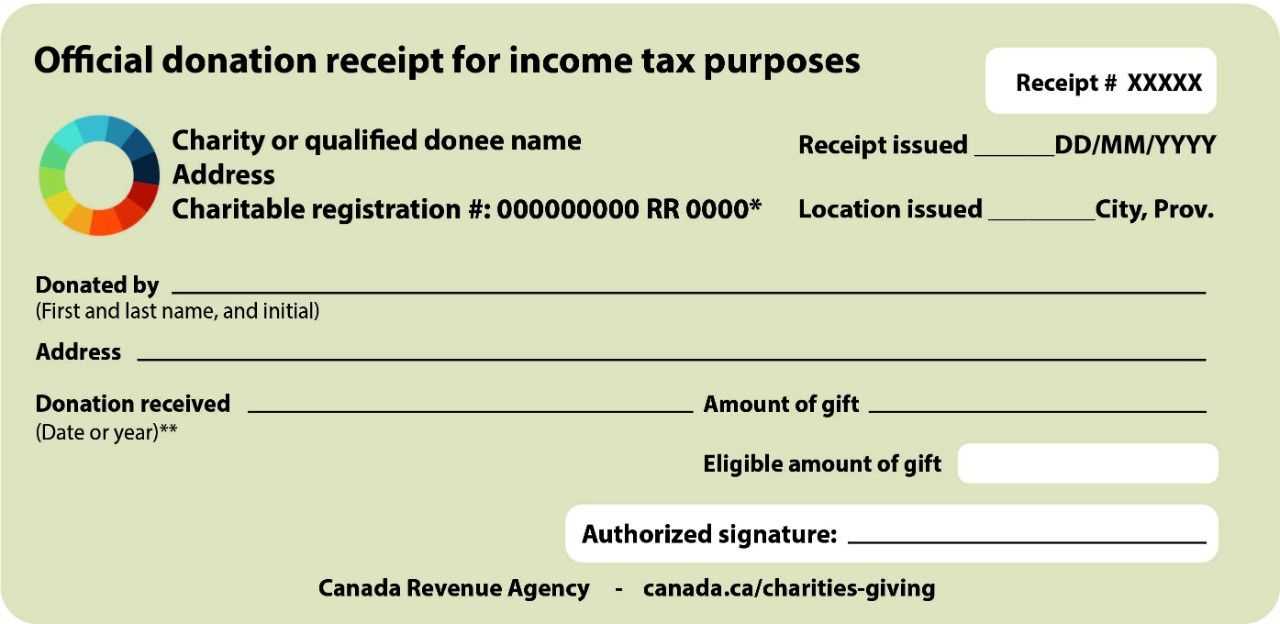

Adapt the template based on local regulations and business requirements. Add branding elements such as a logo or company slogan for a professional touch.

Providing a detailed and organized payday loan receipt not only ensures compliance but also builds trust with borrowers.

Payday Loan Receipt Template

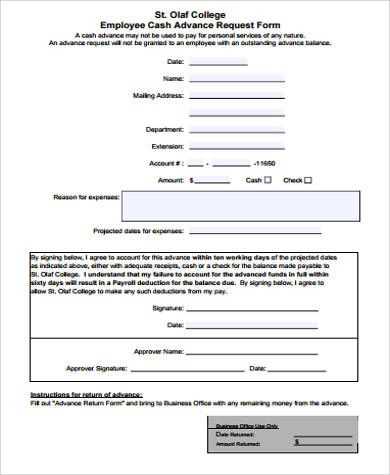

Key Elements to Include in a Short-Term Loan Receipt

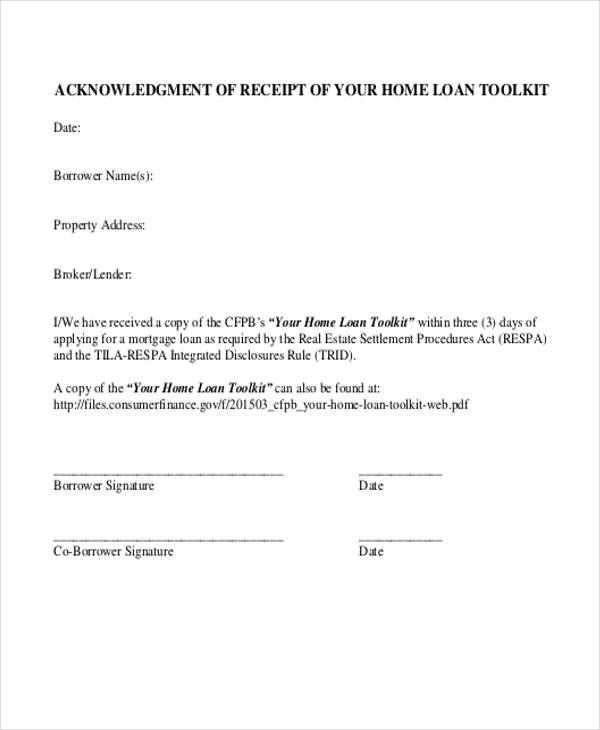

A proper short-term loan receipt must list essential transaction details to ensure clarity and legal compliance. Include the lender’s and borrower’s full names, contact information, loan amount, interest rate (if applicable), repayment terms, and due date. A unique receipt number helps with record-keeping. Add a signature line for both parties to confirm agreement.

Legal Considerations for Instant Loan Receipts

Every receipt should comply with local lending regulations. Clearly state the total repayment amount, applicable fees, and any penalties for late payments. If required by law, disclose the annual percentage rate (APR) to avoid disputes. Using precise language reduces legal risks and ensures both parties understand their obligations.

Customizing a Cash Advance Receipt for Different Transactions

Adapt the receipt format based on the loan type. For one-time cash advances, emphasize the repayment date and amount. If the loan involves installments, outline the schedule with dates and amounts. For business-related cash advances, include a company name and tax identification number to maintain proper financial records.