Creating a payment receipt template can simplify your business transactions, making it easier to track payments and maintain accurate records. By using a clear and concise format, both you and your clients will have a reference for future dealings, ensuring transparency and professionalism in every exchange.

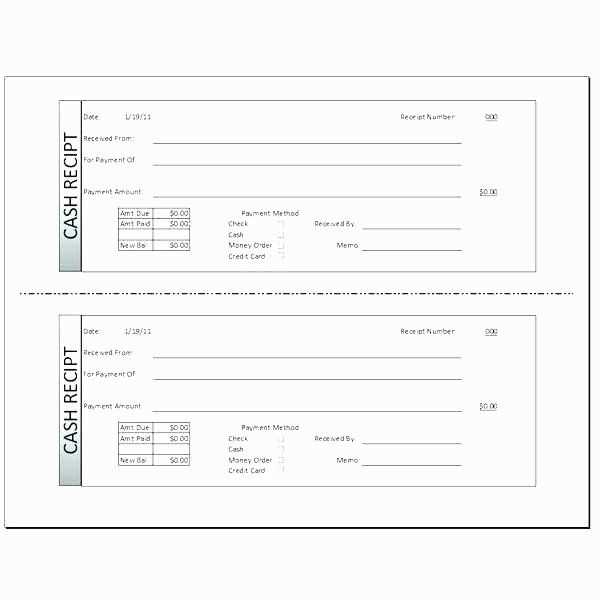

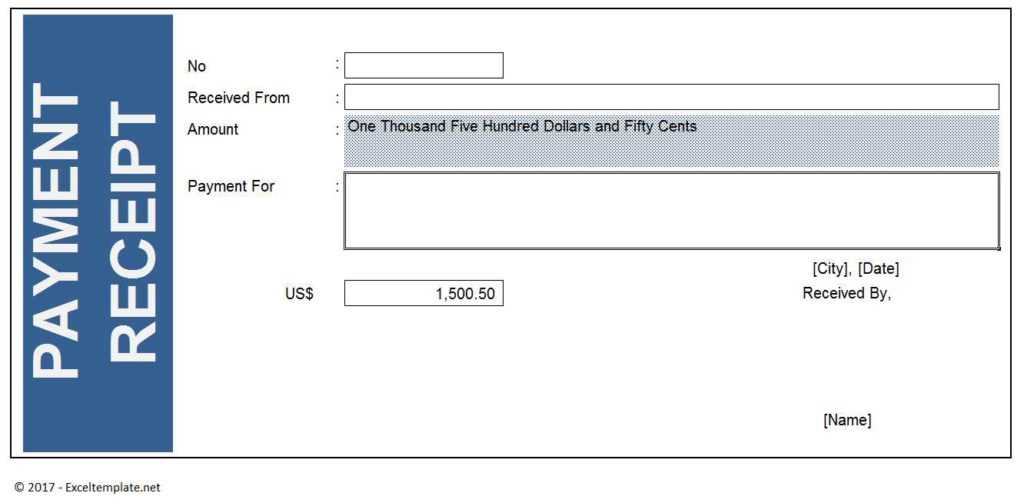

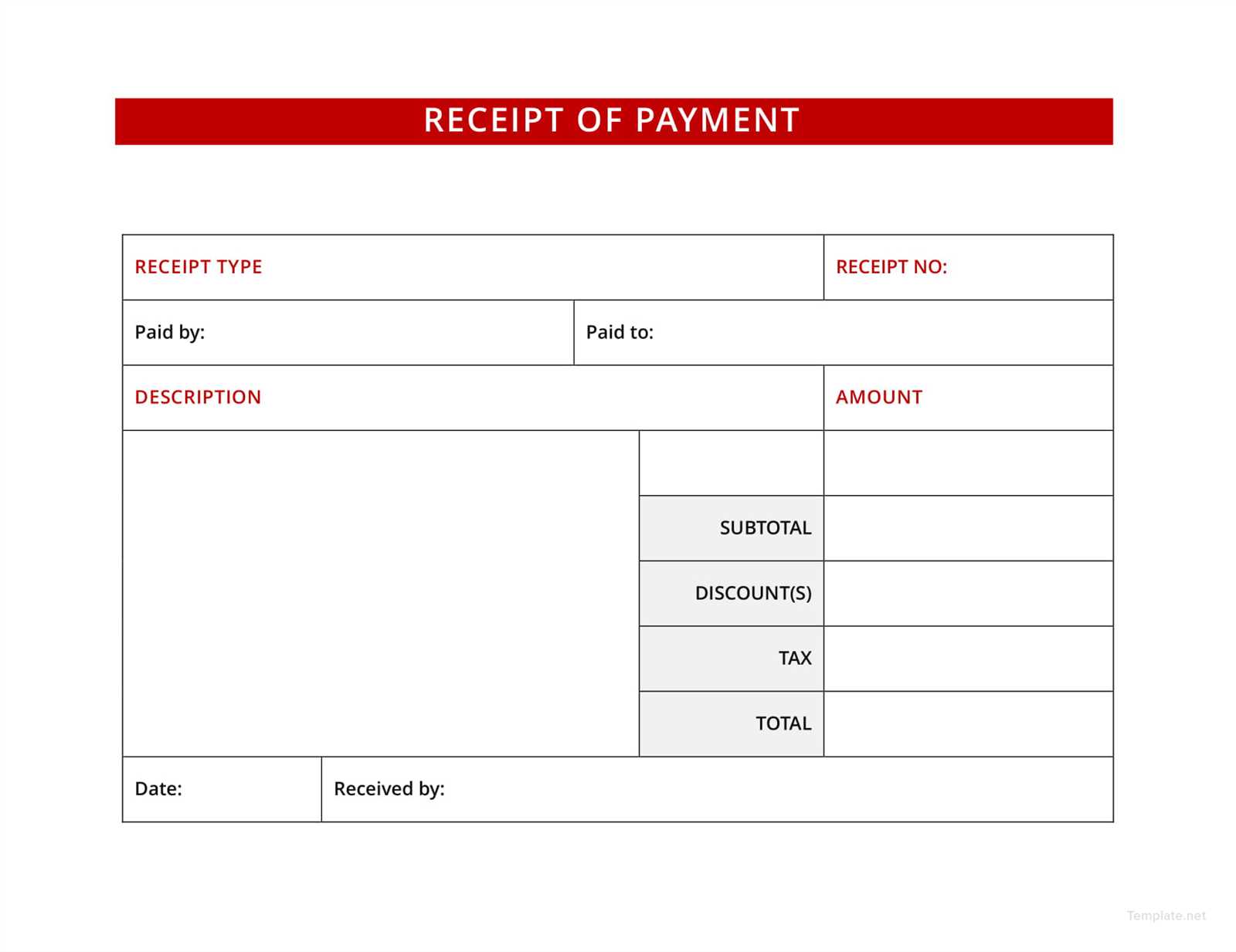

Start with basic details: include the date of the transaction, the payer’s name, and the amount paid. This information forms the backbone of the receipt and provides immediate clarity about the payment made. It’s also helpful to add a unique reference number for quick identification of the transaction.

For a complete template, consider sections for payment method (cash, credit card, online transfer) and any relevant notes or descriptions about the product or service paid for. This will help prevent confusion and ensure all details are clearly documented. Lastly, leave space for both parties’ signatures, if required, to confirm the transaction was completed and agreed upon.

Here’s the corrected version with fewer repetitions:

To create a clearer and more streamlined payment receipt template, focus on minimizing redundant information. Ensure each section serves a distinct purpose and doesn’t repeat key details unnecessarily. This makes the receipt more professional and user-friendly.

Key Sections to Include

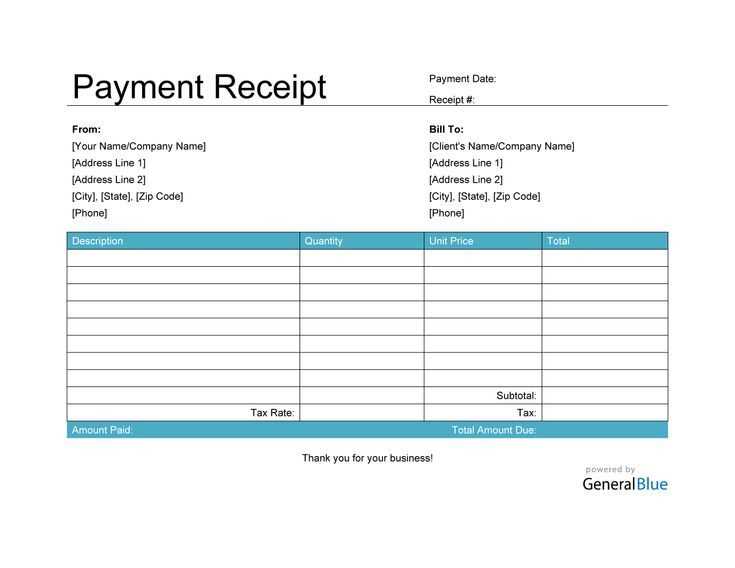

| Section | Description |

|---|---|

| Payment Details | Include the payment method, transaction ID, and date. Avoid listing the same information multiple times. |

| Item Breakdown | Show each product or service purchased with its price. Only repeat the subtotal once to avoid confusion. |

| Tax Information | List the tax rate and total tax paid, but don’t repeat individual item tax calculations. |

| Total Amount | Clearly state the total amount due, including any discounts, taxes, and additional charges, without repeating the subtotal or tax amount again. |

How to Avoid Unnecessary Repetitions

Each entry in the payment receipt should provide new information. For example, the customer’s address and payment method do not need to appear in multiple areas of the document. Keep the format clean and to the point.

By structuring the receipt in this way, you eliminate confusion and ensure that the customer can quickly understand the payment details without having to read the same information multiple times.

- Paymet Receipt Template Guide

A well-structured receipt template simplifies transactions. To create a payment receipt, ensure it includes key elements: the company name, contact details, transaction date, itemized list of services or products, payment amount, and any relevant taxes or discounts.

Key Elements of a Payment Receipt

The template should start with your business’s name and contact information at the top. Include the customer’s name or company, followed by a unique transaction or receipt number for record-keeping. Below, clearly itemize the products or services provided along with the quantity and price. Include the total amount paid and specify the payment method (e.g., cash, credit card). If applicable, mention any taxes or fees and show a final total amount.

Formatting and Customization Tips

Ensure your template is simple to read. Use clear sections with bold headings for each part (e.g., “Customer Information”, “Transaction Details”, “Payment Summary”). Keep font sizes consistent and avoid overloading the template with unnecessary details. If you’re using software, customize the template to fit your brand by adding logos or specific color schemes. Always save a digital version for easy printing or emailing.

For each business type, adjust the receipt template to match the specific needs of your transactions. By doing so, you create clarity and ensure your receipts provide all necessary information for both customers and your records.

Retail Businesses

- Include a detailed list of each product purchased, including item names, quantities, and prices.

- Clearly show any taxes, discounts, or promotions applied to the transaction.

- Provide store contact information and return/exchange policies to improve customer service.

Service-Based Businesses

- Detail the services provided, including descriptions and individual pricing for each service.

- Highlight any additional fees, tips, or taxes that apply to the service cost.

- Provide your business’s contact information for inquiries or follow-up services.

Online Shops

- Break down the cost of each item, including shipping fees and applicable taxes.

- Include order tracking details and expected delivery dates.

- Ensure that return policies and instructions for online purchases are clearly stated.

Restaurants and Cafes

- List each menu item ordered along with its price, including drinks and any extras.

- Show applicable service charges, tips, and taxes to avoid confusion.

- Include any loyalty program details or promotions for future visits.

Customizing your receipt template for your business type improves customer trust and ensures transparency in every transaction.

To integrate payment methods and transaction details into your receipt template, focus on clarity and accuracy. Begin by identifying which payment options you accept, such as credit cards, PayPal, or bank transfers. For each payment type, include a field to specify the transaction amount and method of payment.

Payment Method Section

List payment methods in a dedicated section with clear labels. For example, “Credit Card” should be followed by the last four digits of the card used, “PayPal” should indicate the associated email address, and “Bank Transfer” should list the bank details. These fields should be optional, depending on the method used.

Transaction Information

Under transaction details, ensure you capture essential data like the transaction date, amount paid, and any reference numbers. If applicable, include the approval code for card transactions or a transaction ID for PayPal payments. These details help in both accounting and customer verification.

Make sure that these fields are well-structured and easily readable. Include any relevant tax information, such as VAT rates or taxes applied, especially if you provide goods or services in different regions. This step ensures that your receipt is fully informative and meets local financial regulations.

Start by including the necessary legal details in your receipt template, such as the business name, registration number, tax identification number, and relevant transaction information. These elements ensure compliance with tax laws and other regulatory requirements.

Incorporate Security Features

To protect sensitive customer information, implement encryption for data storage and transmission. Avoid including unnecessary personal details such as full credit card numbers or bank account information. Opt for secure payment gateways and ensure any online payment systems comply with industry standards like PCI-DSS (Payment Card Industry Data Security Standard).

Consider Local and International Regulations

Review both local and international requirements for receipts. Some jurisdictions may require specific disclosures, like refund policies or return instructions, while others may mandate electronic receipt formats for certain types of transactions. Stay up to date with applicable regulations to avoid legal issues.

Clearly state the payment method used in the receipt. Specify whether it was made via credit card, bank transfer, or other means. This helps both the payer and payee track the transaction method efficiently.

Include a concise description of the goods or services provided. If there are multiple items, list them separately, ensuring each is accompanied by a price. This will offer clarity for both parties.

Incorporate any discounts or promotional offers applied to the payment. This will provide transparency and prevent any confusion regarding the final amount due.

If the payment is for an installment or partial payment, mention the remaining balance. This will avoid misunderstandings and allow for easy reference in future transactions.