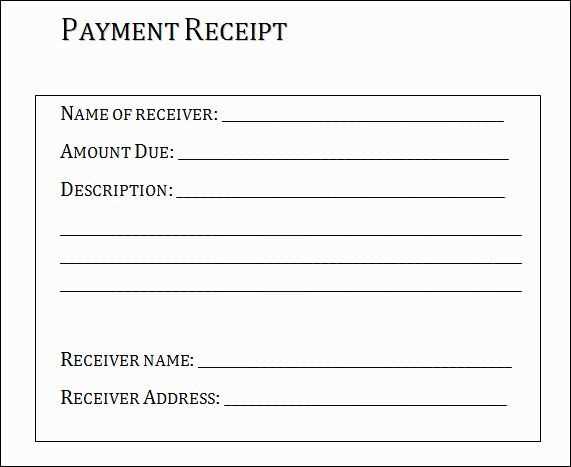

Creating a payout receipt is simple and straightforward, but it requires attention to detail. A clear, accurate template ensures both parties–payer and payee–have a transparent record of the transaction. Whether you’re handling payroll, freelance payments, or refunds, having a standard format makes the process smoother and minimizes misunderstandings.

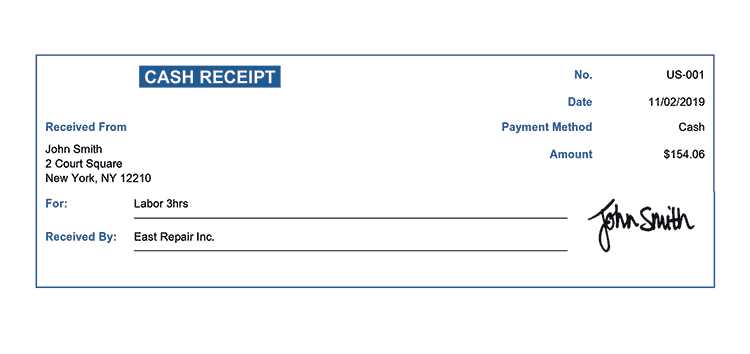

Start by including the date of the transaction. This sets the timeline and avoids confusion down the line. Then, list the payee’s name and contact information, followed by the payer’s details. This way, both parties are clearly identified. After that, specify the amount being paid, the payment method (e.g., cash, bank transfer), and the reason for the payment. It’s also a good idea to add a unique receipt number for easy reference.

To make the receipt legally binding, include a section for both parties to sign. This confirms that the transaction has taken place and that both agree with the details. It’s also a helpful tool for record-keeping, whether for personal or business use. Consider creating a template you can reuse, streamlining future transactions and ensuring consistency across all receipts.

Here’s the corrected version:

To ensure a clear and professional payout receipt template, include the following key details:

Basic Information

Begin with the recipient’s full name and the business name issuing the payment. Include the date of the payout and a unique transaction ID for reference. This helps track payments in case of disputes.

Payment Breakdown

List the amount paid, including any deductions or adjustments, such as taxes or fees. If the payment covers multiple items or services, detail each of them individually. This transparency reduces confusion and increases trust in the payment process.

Conclude with a section for any additional comments or instructions. This section can address specific terms of the payment, such as due dates or payment methods.

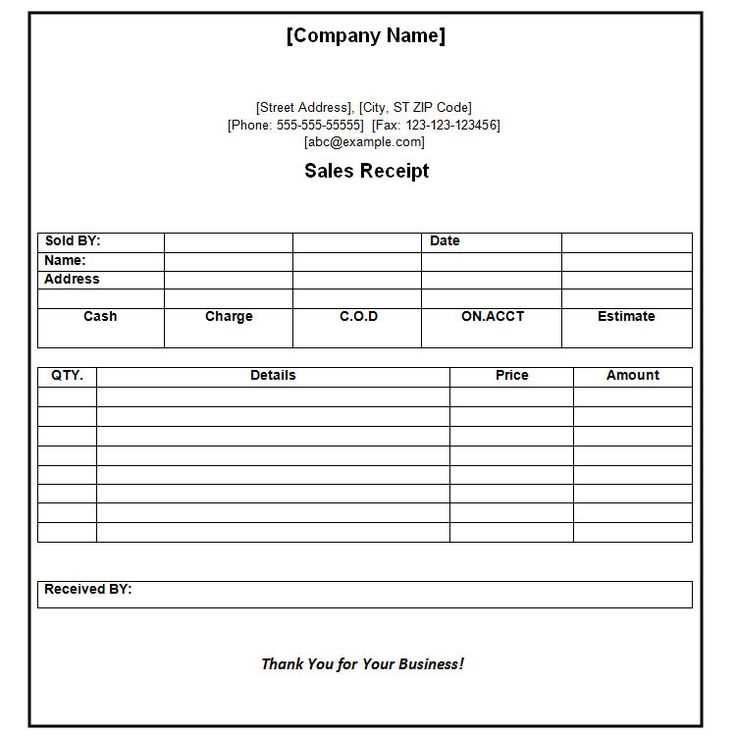

- Payout Receipt Template

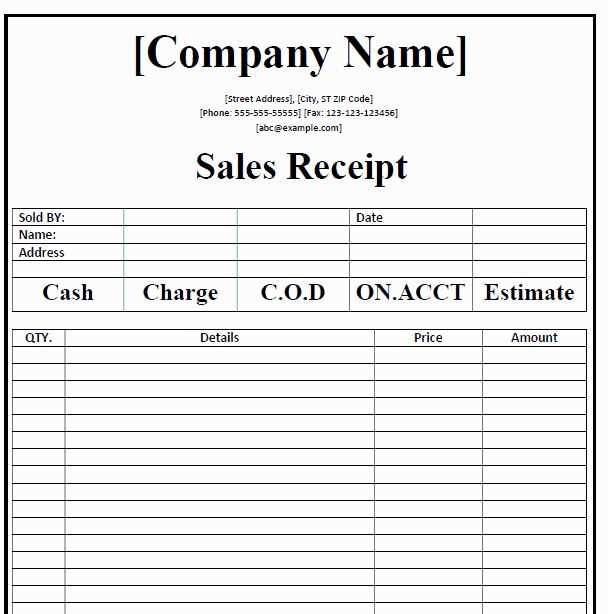

To create a payout receipt template, follow these steps to ensure clarity and professionalism:

- Header: Include the title “Payout Receipt” at the top for easy identification.

- Receipt Number: Assign a unique reference number to each receipt for better tracking.

- Recipient Information: Add the name, address, and contact details of the recipient.

- Payment Details: Include the amount paid, the payment method (bank transfer, cheque, etc.), and the payment date.

- Payment Purpose: Clearly state the reason for the payout, whether it’s for services rendered, a refund, or another reason.

- Sender Information: Provide the name and contact details of the party making the payout.

- Signature: Leave space for an authorized signature or stamp to validate the receipt.

- Additional Notes: Include any relevant terms or notes, such as payment terms or conditions, if necessary.

Ensure that the template is well-organized and easy to read. This helps both parties maintain accurate financial records and avoid any confusion. Keep the language clear and professional, with specific details regarding the transaction. You can use a simple word processor or a spreadsheet to create and save these templates for future use.

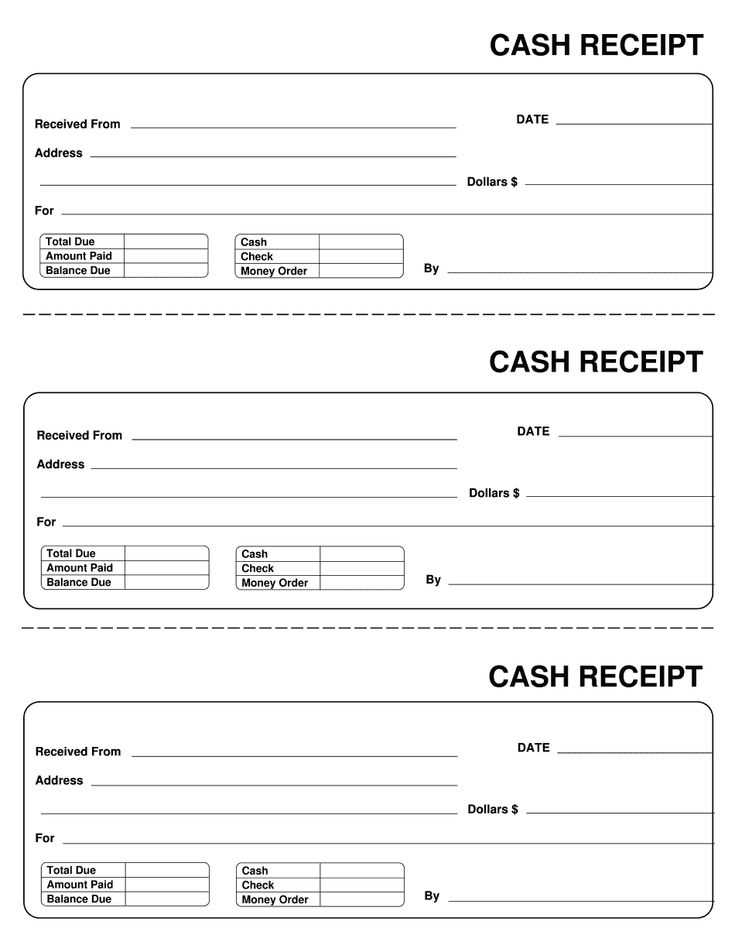

To create a payout receipt, gather the necessary details about the payment. This includes the payer’s name, payment method, date of the transaction, and the amount. Include any relevant reference numbers or payment IDs for easy tracking.

Step 1: Add Basic Payment Information

Start by adding the payer’s information, such as their full name or business name. Include the payment date, method (bank transfer, check, cash, etc.), and the transaction amount. If applicable, reference the invoice or contract tied to the payout.

Step 2: Include a Breakdown of the Payout

If the payout includes multiple components (e.g., salary, commission, or refund), itemize these details. This gives clarity on how the total amount was calculated, ensuring both parties understand the breakdown. Add a section for any deductions, taxes, or fees that apply to the payout.

Conclude by providing a space for signatures if needed, or a simple acknowledgment that the payout has been received. Keep the format clean and clear for both legal and bookkeeping purposes.

A payout receipt must include several key elements to ensure clarity and avoid any future disputes. This is the detailed breakdown you need:

1. Payer Information

List the full name or business name of the entity making the payment. Include their contact details such as phone number or email address for reference in case of any issues with the payout.

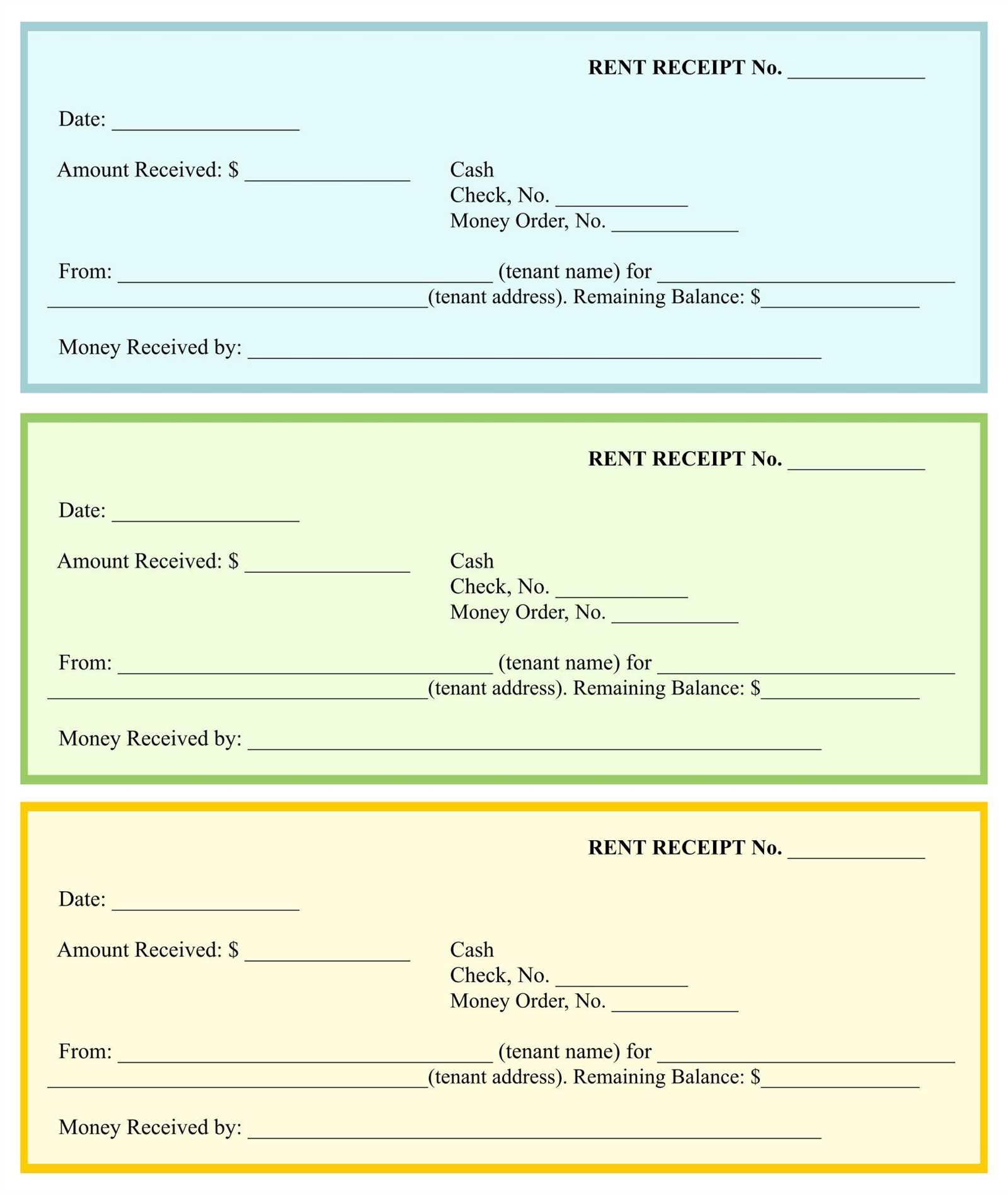

2. Payee Information

Include the recipient’s full name or business name. If applicable, add the recipient’s contact details or any relevant identifiers, such as a customer or account number.

3. Date of Payment

Clearly indicate the date the payout was issued. This is important for record-keeping and verifying payment timelines.

4. Amount Paid

The exact amount of the payment should be stated, preferably broken down into currency (if necessary). If any taxes or deductions apply, those should also be noted separately.

5. Payment Method

Specify how the payment was made–whether by bank transfer, cheque, cash, or another method. This ensures the recipient can track and confirm the payment source.

6. Reference Number or Transaction ID

A unique reference number or transaction ID helps track the payment in systems and serves as an important tool for both the payer and payee in case of disputes.

7. Description or Purpose of the Payment

Include a brief description of the reason for the payout. This can help both parties understand the context of the transaction and avoid confusion later on.

8. Deductions or Fees (if applicable)

If any fees or deductions have been applied to the payout (such as transaction fees or taxes), list them clearly to give a full understanding of the net amount received.

9. Signature or Authorization (if required)

If necessary, include a space for signatures or an electronic authorization to confirm the validity of the payout.

Ensure that your receipt is clear and easy to read. Avoid cluttering the document with excessive text or unnecessary information. Keep the layout clean with clear section breaks to separate key details like the transaction amount, date, and payment method.

One frequent mistake is failing to include all required information, such as tax rates, business details, or a unique transaction number. Omitting these details can cause confusion and lead to compliance issues.

Make sure the fonts are legible. Too many font styles or overly decorative fonts can make a receipt hard to read. Stick to simple, professional fonts and use a consistent size throughout.

Don’t forget to check the alignment of the text. Misaligned elements can make a receipt look unprofessional and may lead to important details being missed. Ensure all the sections line up properly for a neat presentation.

In some cases, designers neglect the importance of sufficient white space. A cramped layout can make the receipt look overwhelming and difficult to follow. Adequate spacing around each element will improve readability and make the document more user-friendly.

Lastly, avoid using vague descriptions. Be specific about items or services purchased and ensure each charge is accurately described. This will help the customer understand their transaction and prevent misunderstandings.

Customizing a receipt template for different payment methods ensures that each transaction is accurately represented, making it easier for both customers and businesses to track payments. Here’s how to adjust your receipt layout for specific payment methods:

- Credit and Debit Cards: Include the last four digits of the card number, the card type (Visa, MasterCard, etc.), and the authorization code. If applicable, add a section for any fees charged by the payment processor.

- Cash: Clearly indicate the amount tendered and the change given. It’s also useful to provide a note like “Paid in full” for clarity.

- Bank Transfers: Add the bank name, transfer reference number, and transaction date. If the payment method requires a confirmation code or other verification details, ensure they are visible on the receipt.

- Digital Wallets (e.g., PayPal, Apple Pay): Include the payment method’s transaction ID and the method used (e.g., PayPal, Apple Pay). You may also want to add a section for the transaction fee, if applicable.

- Checks: Provide the check number, the bank name, and the date the check was issued. Specify whether the payment was processed or pending.

By tailoring the receipt template to each payment method, you ensure that all the necessary details are provided, helping to avoid confusion and disputes. This can also support accounting processes and improve customer trust.

A template streamlines financial tracking by providing a consistent structure for recording transactions. It ensures you don’t miss key details, improving accuracy. Templates make it easy to input data regularly, avoiding manual errors and saving time. With predefined fields, you can quickly categorize expenses, incomes, and other financial activities, which enhances clarity and organization.

By using a template, you gain a clear overview of your financial situation. It simplifies the identification of trends, such as recurring expenses or periods of higher income. With this insight, budgeting becomes more precise and forecasting more reliable. Templates also allow for easy adjustments and comparisons, letting you track progress over time and assess the effectiveness of your financial strategies.

Templates provide a sense of discipline by helping you maintain consistency in how you approach financial tracking. This prevents oversights and ensures that you stay on top of your finances without extra mental effort. The simplicity of using a template encourages daily use, which makes tracking a habit rather than an occasional task.

Integrating an automated receipt generation process requires connecting your payment or transaction system with receipt templates. This can be achieved using simple scripting languages like Python, PHP, or JavaScript, or by employing specialized software solutions. The key is to generate receipts dynamically based on transaction data.

1. Utilize a Template Engine

Template engines allow you to design customizable receipt formats, then populate them with transaction details automatically. Popular options include Jinja2 (Python), Twig (PHP), and Handlebars (JavaScript). These engines enable you to define placeholders for dynamic fields such as amounts, customer names, and payment methods, making the generation process straightforward.

2. Implement API Integration

Most modern payment systems offer APIs that let you retrieve transaction data in real-time. By integrating these APIs into your receipt generation system, you can automate data collection. Once the payment is completed, the API sends relevant information, which is fed directly into your template engine, and a receipt is generated on the fly and sent to the customer.

With this method, receipts can be created instantly after the transaction, improving accuracy and reducing manual errors. The API handles data security, so sensitive information is protected while still automating the process.

Lastly, you can send receipts via email or SMS, which can also be automated using email services like SendGrid or Twilio. This ensures that your system operates smoothly, and customers receive their receipts without additional effort on your part.

Now, repetitive words appear no more than 2-3 times, maintaining the meaning of each point.

Focus on simplifying your payout receipt template by avoiding redundancy. Limit the use of key terms to 2 or 3 instances to prevent unnecessary repetition while keeping the meaning clear. Ensure each section is direct and informative.

For example, when listing payout details, use concise phrasing like “Amount,” “Payment Method,” and “Transaction ID” without repeating the same word too frequently. This keeps the structure clean and easy to follow.

| Payment Information | Details |

|---|---|

| Amount | $200.00 |

| Payment Method | Bank Transfer |

| Transaction ID | TXN12345678 |

Another effective strategy is using different but related terms for repeated concepts. For example, instead of using “payment method” in each line, you might opt for “transaction type” or “method of transfer.” This prevents the document from feeling monotonous while ensuring clarity.

By refining the language in your payout receipt template, you can make it more efficient, easier to understand, and more visually appealing. Always keep the language direct and relevant, with minimal redundancy, for a smooth reading experience.