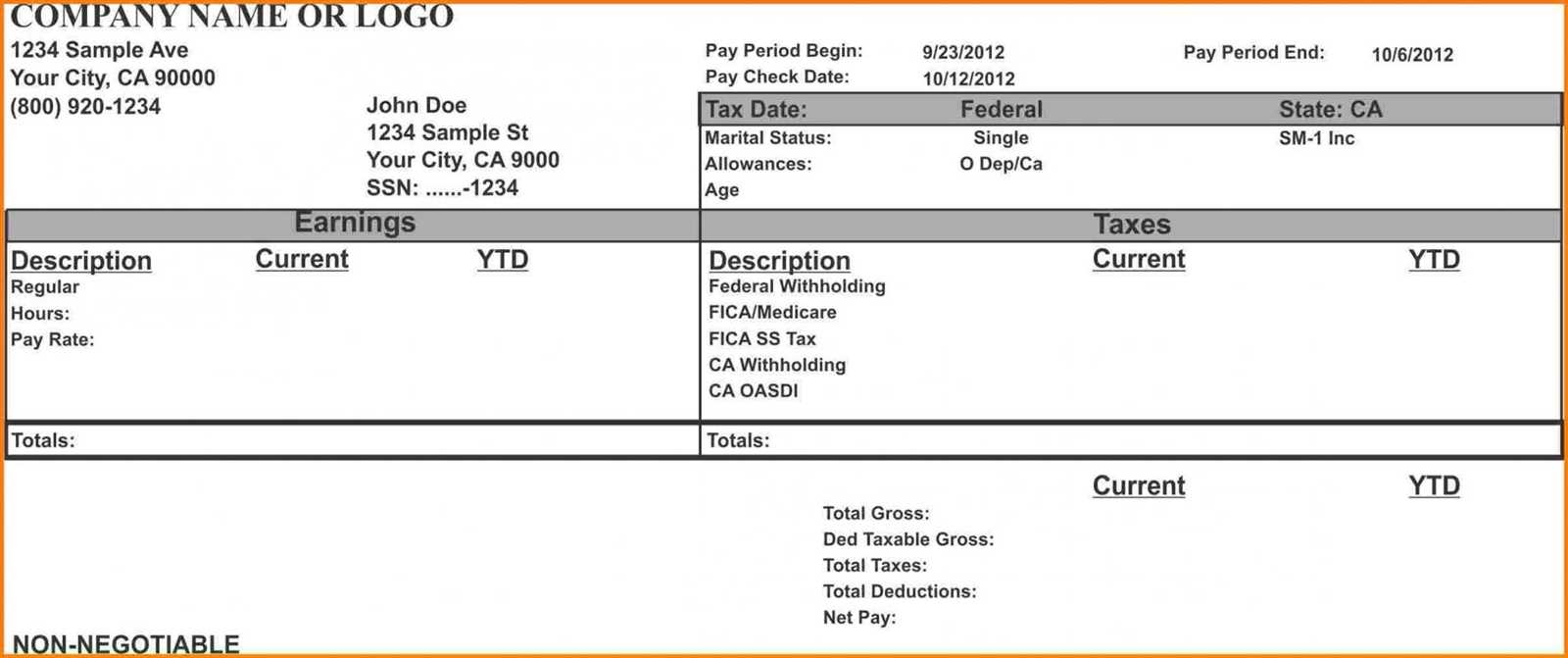

Use a payroll receipt template to simplify your payroll management and ensure clear communication with your employees. These templates help in organizing payment details in an easy-to-read format, making it simpler for both employers and employees to track earnings, deductions, and taxes. You can create a custom template that meets your specific needs, including space for employee name, pay period, and net salary.

Consider adding sections for bonuses, overtime pay, and tax deductions. The more details you include, the clearer the paycheck will be. Each pay stub should break down the total earnings, showing how much an employee made before and after deductions, with clear labels for each component. This transparency helps avoid confusion and builds trust.

Make sure your template is easy to fill out and can be updated easily, whether manually or through payroll software. Using a digital template also helps streamline record-keeping for future reference and tax purposes. Having a standard format saves time and ensures consistency across all payroll receipts.

Here are the corrected lines:

Ensure all employee names are spelled correctly. If needed, double-check with HR for any discrepancies. Accurate name representation is a must to avoid confusion.

Verify Payment Amounts

Cross-check the payment amounts with the payroll software. Look for any inconsistencies between the calculated salary and the final figure. This will help prevent errors before the receipt is issued.

Correct Tax Deductions

Ensure tax deductions are in line with the current tax rates. Double-check both federal and state taxes to guarantee proper calculations. Mistakes here can result in issues for both employees and the company.

Review Benefits and Bonuses

Verify that all bonuses, overtime, and benefits are accounted for correctly. This includes checking if any adjustments were made in the current period that might affect the final amount.

Final Review of Date and Pay Period

Double-check the pay period dates and the date the payroll is issued. Ensure these are accurate to avoid confusion or complaints from employees regarding pay dates.

Payroll Receipt Template

How to Create a Payroll Receipt Template for Small Businesses

Customizing Payroll Receipts for Various Employee Categories

Legal Considerations for Payroll Receipts: Essential Information to Include

To create a payroll receipt template for small businesses, focus on clarity and simplicity. Include the employee’s name, pay period, total earnings, and deductions, along with the net pay. This provides transparency and ensures employees understand their compensation. For a professional touch, include your business name and contact details at the top.

Customizing Payroll Receipts for Various Employee Categories

Different categories of employees may have varying payroll requirements. For hourly employees, list the hours worked and hourly rate alongside the total gross earnings. For salaried employees, simply provide their regular salary and any bonuses or commissions. Customizing receipts according to these categories ensures accuracy and prevents confusion.

Legal Considerations for Payroll Receipts

Ensure your payroll receipt includes all legally required information. This often includes the employee’s tax deductions, benefits, and any retirement contributions. Check your local regulations to ensure compliance, as these can vary by location. Failing to include mandatory information can lead to penalties for non-compliance.