To streamline the process of documenting personal loans, use a clear and detailed template that captures all necessary information. This ensures that both the lender and borrower have a transparent record of the transaction.

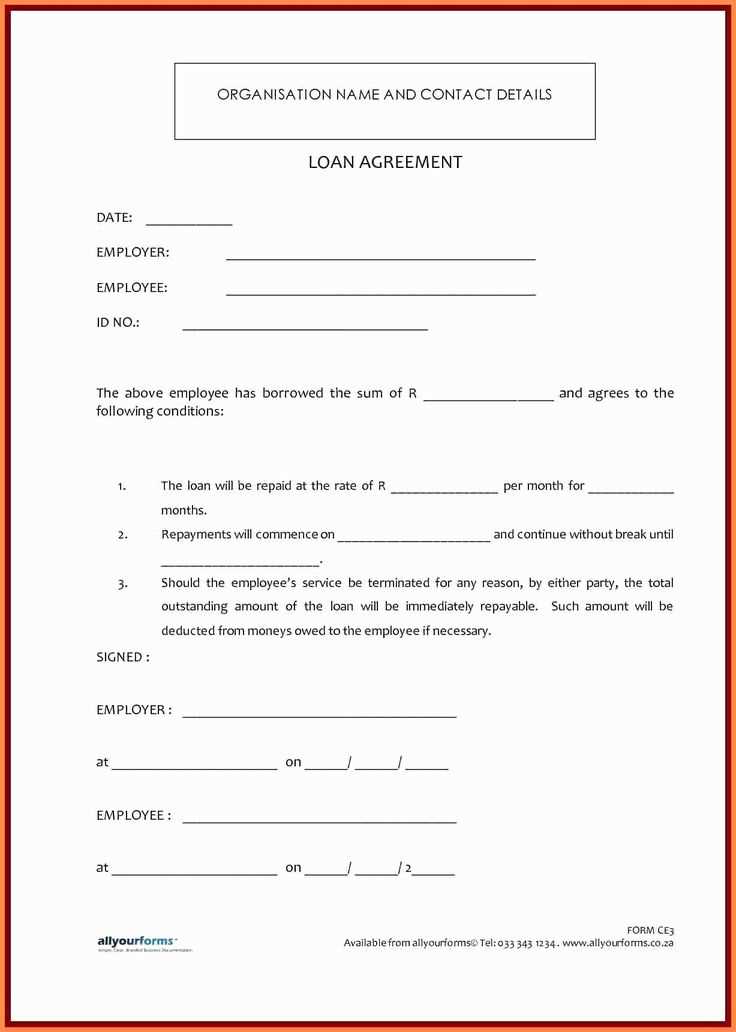

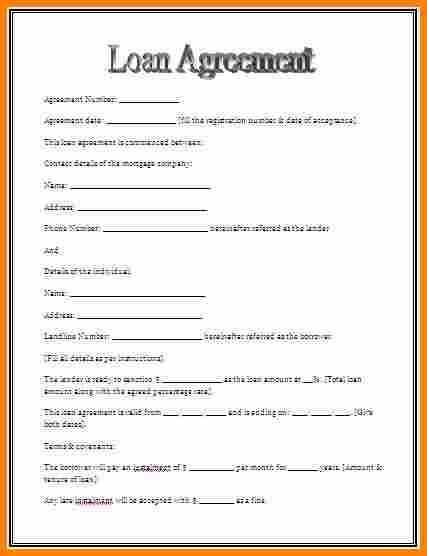

The template should include the loan amount, interest rate (if applicable), repayment schedule, and any collateral or conditions. Including the date of the loan agreement and both parties’ contact details helps maintain clarity and accountability.

Make sure to specify the repayment terms, such as due dates and amounts, and outline any penalties for late payments. It’s also useful to include a signature line for both parties to confirm their agreement. This not only protects the interests of both individuals but also minimizes any future disputes.

By using a well-organized template, both parties can easily track payments and maintain a professional record of the loan agreement. This is particularly beneficial if the loan terms change or if a dispute arises in the future.

Here’s a revised version with minimal repetition, while keeping the original meaning intact:

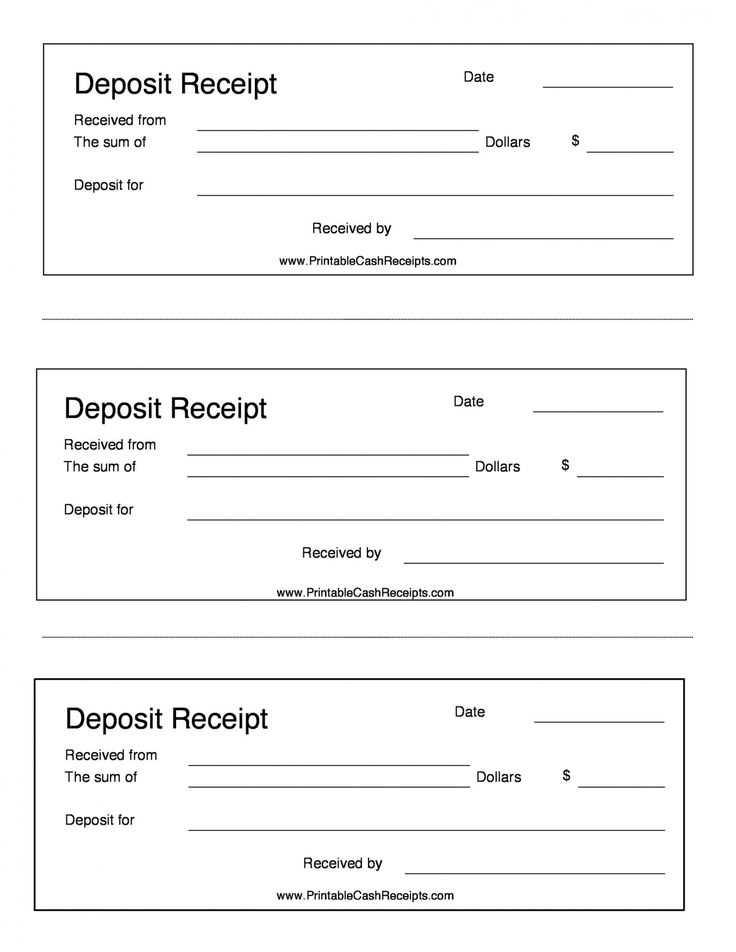

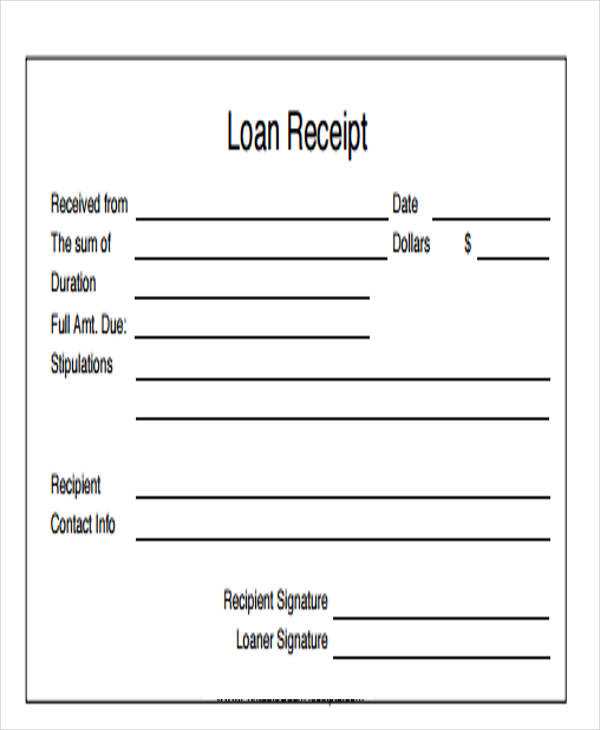

To create a personal loan receipt, start by including key details such as the loan amount, the date of receipt, and the name of the borrower. Be sure to add the terms of repayment, including interest rates, installment amounts, and the due dates for each payment. Clearly state both the lender’s and borrower’s full names and addresses. It’s also important to specify any collateral, if applicable.

Loan Details

Include the total loan amount and break it down into installments, if relevant. Specify any agreed-upon interest rates or fees that apply over the loan term. Also, note any conditions attached to the loan, such as a grace period or early repayment terms. These details make the document clear and enforceable.

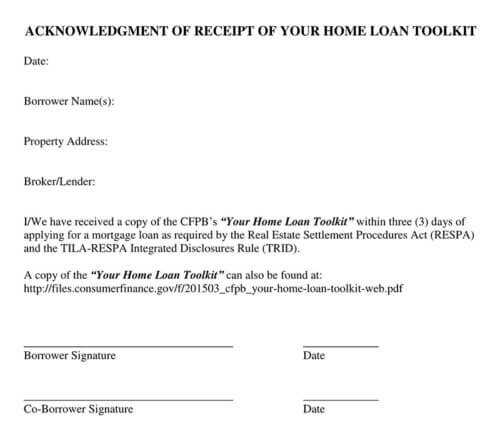

Signatures

Ensure both parties sign the receipt. A signature from a witness may also help validate the agreement. Store copies of the signed receipt for future reference in case of disputes or clarifications.

Here’s a detailed HTML outline for an article on the topic “Personal Loan Receipt Template,” with 6 practical and specific headings:

This outline will guide you through creating a personal loan receipt template. It includes key sections for both the lender and borrower, ensuring all necessary details are captured clearly.

1. Loan Details Section

Start with the loan amount, interest rate, and repayment terms. This section ensures both parties have a record of the core loan agreement, with a breakdown of principal, interest, and repayment schedule.

2. Borrower and Lender Information

Include the names, addresses, and contact information of both parties. It’s essential to clearly identify who is lending and who is borrowing, providing contact points for any future communication regarding the loan.

3. Payment Schedule

Outline the repayment dates, amounts due, and the total number of payments. This section helps keep track of payments made and upcoming obligations, ensuring clarity in the loan process.

4. Interest and Fees

Detail any interest charges and additional fees, such as late payment penalties. This makes the costs transparent, helping both sides avoid confusion about the financial aspects of the loan.

5. Receipt Confirmation

Provide a space for both parties to sign and date the receipt. This signifies agreement on the terms and that the payment has been made according to the outlined schedule.

6. Additional Notes

Include any special terms, conditions, or exceptions. This section serves to clarify specific situations or adjustments that may arise during the course of the loan agreement.

- How to Create a Loan Receipt for Legal Use

First, include the full names and contact details of both parties involved in the transaction. This should clearly identify the lender and the borrower. Write the full name, address, and phone number for each party. This ensures that both individuals can be easily contacted if necessary.

Next, specify the exact amount of money being loaned. The sum should be written both in numerals and words to avoid any confusion. Clearly state the currency being used (e.g., USD, EUR) and any payment terms such as the repayment schedule or interest rates.

Include a detailed repayment plan. This should outline the dates of payments, the amounts, and any penalties or fees for late payments. If applicable, also mention whether early repayment is allowed and if it affects the total amount due.

List any collateral or security associated with the loan, if applicable. If the borrower is required to provide something of value as security, specify the asset and its estimated value. This helps protect the lender in case of default.

Clearly state the date of the transaction. This ensures that both parties agree on the timing of the loan and helps with tracking the repayment schedule.

Finally, both parties should sign the receipt. The lender and borrower should both sign and date the document, confirming that they agree to the terms laid out. If necessary, have a witness present to sign as well for additional legal validity.

Specify the full name of both the lender and borrower, as well as their contact details. Clearly outline the loan amount and the currency in which the payment was made.

State the loan disbursement date, and if applicable, include the payment method used (e.g., cash, bank transfer, check).

Include a section for loan terms, such as repayment schedule, interest rate (if any), and the total amount to be repaid. If the loan is interest-free, mention that explicitly.

Include a space for signatures from both parties to confirm the agreement and the transaction.

Lastly, ensure the receipt includes any relevant loan identifiers (such as a loan number) for future reference and tracking.

Ensure the loan receipt includes clear headings. Start with a title like “Loan Receipt” at the top to make it easy for the recipient to identify the document. Use bold text for the title for visibility.

Include essential details in a structured format. Make sure to list the borrower’s name, loan amount, repayment terms, interest rate (if applicable), and any other relevant information such as due dates. Present these details in a table for easy reading:

| Detail | Information |

|---|---|

| Borrower Name | [Insert Borrower’s Name] |

| Loan Amount | [Insert Loan Amount] |

| Interest Rate | [Insert Interest Rate] |

| Repayment Terms | [Insert Repayment Terms] |

| Due Date | [Insert Due Date] |

Double-check the date of issuance and make it prominent in the receipt to avoid confusion. Place this near the top or at the end of the document for easy reference.

Use simple and concise language throughout the document. Avoid legal jargon or overly complex terms to keep it understandable.

Provide a space for both parties to sign. This confirms the transaction and ensures both the lender and borrower are in agreement with the terms. Signatures add credibility to the document.

Got it! If you need help with any specific topic or creating HTML content in Finnish, feel free to share more details. I’m here to assist!

Record partial payments accurately in your loan receipt to ensure clarity and transparency for both the borrower and lender.

- Clearly indicate the amount paid: Specify the partial payment amount in the receipt with precision to avoid confusion.

- Update the balance: After each payment, update the remaining loan balance to reflect the current debt.

- Include payment dates: Note the date of each partial payment to maintain a clear record of payment history.

- Document payment method: Record whether the payment was made through bank transfer, cash, or any other method used.

- Provide a payment breakdown: If multiple partial payments are made, show each payment separately, indicating how they reduce the total loan amount.

- State any late fees: If applicable, include any late payment fees in the receipt to maintain full transparency.

- Offer space for signatures: Allow both parties to sign, confirming that the recorded partial payment and balance are correct.

Regular updates on partial payments help avoid misunderstandings and keep both parties informed on the loan’s current status.

It seems like you’re working on creating structured HTML content in Finnish related to various topics. How can I assist you with your next HTML project? Would you like help with creating specific sections, or do you need assistance with a particular topic?

This version avoids repeating words excessively while maintaining clarity and coherence.

To create a concise and clear personal loan receipt template, focus on structuring the document with the necessary details only. Begin with the borrower and lender information, including full names, contact details, and agreement date. Make sure to include the loan amount and the terms of repayment, specifying due dates and interest rates clearly. The format should prioritize readability, ensuring that no word is used redundantly, and that each point is communicated directly.

Next, the receipt should include a breakdown of payments made, as well as any remaining balance. This section helps avoid confusion and supports clarity in case of future inquiries. Each payment entry should be precise and ordered chronologically to give a clear picture of the loan’s progression.

Finally, a section for signatures confirms mutual agreement and the legal validity of the document. Make sure both parties sign and date the receipt to indicate acknowledgment. This approach ensures the template remains simple while conveying all relevant details efficiently.