If you’re handling business transactions or keeping track of personal finances, a personal receipt template is a simple yet powerful tool to maintain records. Whether you’re a freelancer, small business owner, or just organizing personal purchases, creating clear receipts saves time and helps avoid future confusion. A receipt template can make your life easier by ensuring all necessary details are included without the hassle of designing one from scratch each time.

For those based in the UK, it’s crucial to include certain specifics in your receipt, such as the name and address of the seller, the date of the transaction, and a detailed list of the items purchased. Ensure the total amount is clearly stated, along with any taxes applied, to stay compliant with UK tax regulations. Customizing your template to suit these requirements is simple and can save you from potential mistakes that may arise from missing key details.

Whether you’re looking for a straightforward receipt for personal use or a more formal one for business purposes, it’s important that your template fits the context. A well-designed template gives a professional impression while keeping all the necessary information easily accessible. By using a ready-made format or creating your own, you can streamline the process and stay organized.

Here’s the corrected version with minimal repetition:

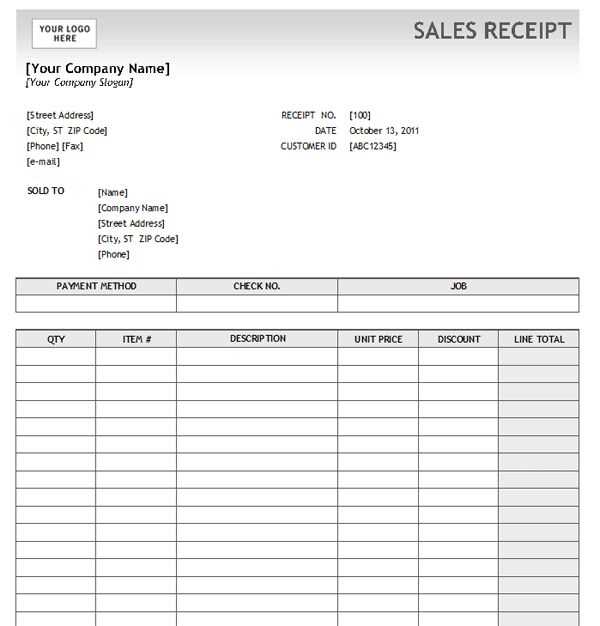

When creating a personal receipt template in the UK, clarity is key. You should start by including the basic details of the transaction, such as the date, the amount paid, and the description of the goods or services provided. A simple layout ensures that all the necessary information is clearly presented without overloading the reader.

Key Components

- Date: The exact date the transaction took place.

- Seller’s Details: Name, address, and contact information of the business or individual providing the receipt.

- Buyer’s Details: Name and address of the purchaser if required.

- Item Description: Clear description of the items or services purchased, including quantities and prices.

- Total Amount: The total sum paid, including any taxes or discounts.

- Payment Method: Specify how payment was made (cash, card, bank transfer, etc.).

Formatting Tips

- Use simple fonts and ensure text is easy to read.

- Group related information together in sections, such as personal details and transaction summary.

- Ensure there’s enough spacing between sections to avoid clutter.

- Use bold for headings to guide the reader’s eye through the document.

Make sure the receipt is easy to understand. Avoid jargon and include all the necessary details, without overloading the template with unnecessary information. The goal is to ensure it serves as proof of purchase while remaining clear and concise.

- Personal Receipt Template UK

A personal receipt template in the UK should include specific details to ensure it meets legal requirements. This includes the date of the transaction, the amount paid, the names and addresses of both the buyer and seller, and a description of the goods or services provided. By using a template, you can easily format these details in an organised way for both parties to keep records clear and accessible.

Key Elements to Include

Make sure to include the following in your personal receipt template:

- Date – The exact date the transaction took place.

- Amount Paid – The total amount paid, including any VAT or other taxes if applicable.

- Description – A brief but clear description of the goods or services provided.

- Payment Method – Cash, cheque, bank transfer, etc.

- Signature – Both parties should sign to confirm the transaction.

Why Use a Template?

Using a template ensures consistency across receipts and guarantees that all necessary information is included every time. It simplifies the process, making it faster and reducing the chances of errors. Templates are especially helpful for keeping financial records in order, whether for personal or small business use.

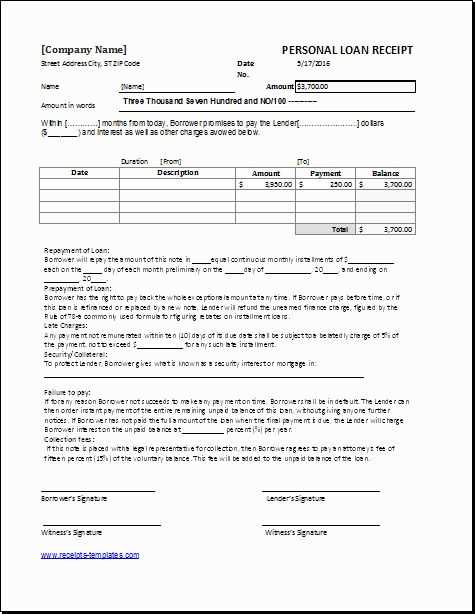

To create a personal receipt template in the UK, focus on the key details required for both parties to have a clear record of the transaction. Start by including the date of the transaction, the name and contact information of the seller and buyer, and a unique receipt number for identification. This ensures easy tracking and future reference.

Basic Structure

Design your template to capture the most important transaction information. Include:

- Receipt Number – For tracking purposes.

- Date – The exact date of the transaction.

- Seller Details – Business name, address, and contact info.

- Buyer Details – Buyer’s name and contact info (optional for personal transactions).

- Item/Service Description – A clear list of products or services purchased, including quantities and prices.

- Total Amount – The total cost, including VAT if applicable.

- Payment Method – Indicate how payment was made (e.g., cash, bank transfer, card).

Additional Details

Depending on the nature of the transaction, you may also wish to add:

- VAT Information – If applicable, include your VAT number and break down the tax.

- Terms and Conditions – Any relevant information about returns, warranties, or refunds.

- Signature – Space for both parties to sign as proof of the transaction.

Once you’ve designed your template, save it as a reusable file, such as a Word document or PDF, to make future transactions easier. You can also customize it with your logo and preferred font to maintain a professional appearance.

Include the full name and address of your business at the top of the receipt. This ensures the customer knows exactly who issued the receipt. The business name should match the details registered with HMRC.

Make sure to list a clear description of the goods or services provided. Each item should be detailed enough for the customer to identify what was purchased, with quantities and unit prices. If the receipt is for services, specify the nature of the work performed.

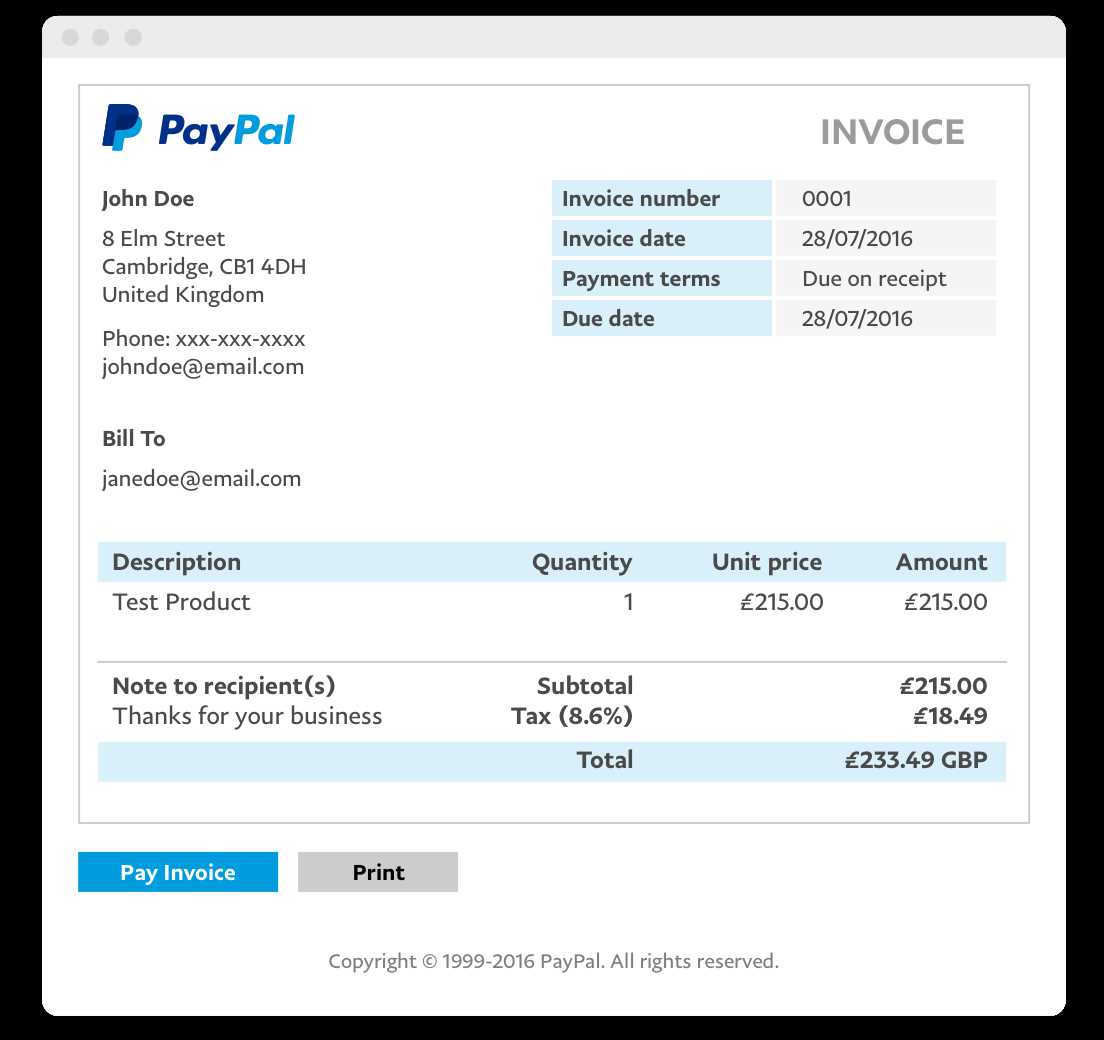

Clearly state the total amount paid, including taxes. Specify the VAT if applicable, and list it separately from the subtotal. Make sure the payment method is noted, whether cash, card, or other methods like PayPal or bank transfer.

Always provide a unique receipt number. This helps track transactions for both your records and the customer’s reference. The number should be sequential to maintain proper order.

The date of the transaction must be visible on the receipt. This is important for both returns and accounting purposes. It should match the date when the payment was made or processed.

If relevant, include a refund or return policy, especially for goods. Let customers know their rights in case they need to return an item or claim a warranty. This can avoid confusion later.

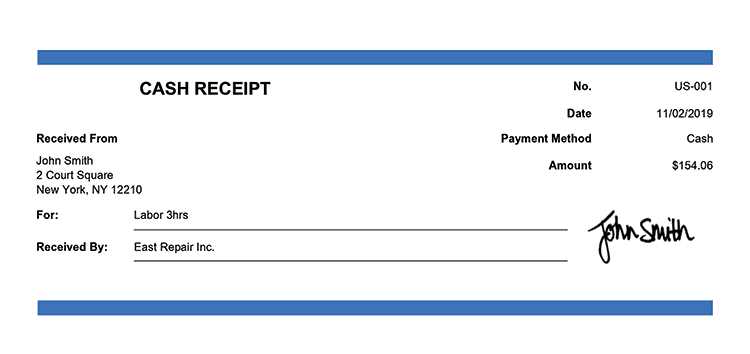

Include the date of the transaction at the top of the receipt. This helps both parties keep accurate records and provides a clear timeline of when the transaction took place.

Clearly state the name and contact details of the seller or service provider. This can be a full name, company name, or business address, along with a phone number or email address for follow-up purposes.

Specify the items or services provided, including quantities and individual prices. Break down the total amount in a transparent manner to avoid any confusion.

Show any applicable taxes. This may include VAT or other local taxes. Be clear about the tax rate and the total tax charged for the purchase.

Ensure that the total amount paid is prominently displayed. It should be easy for both parties to verify the correct sum.

If applicable, include any payment methods used (cash, card, bank transfer) along with relevant details like last four digits of the card number or payment reference for easy tracking.

If there were any discounts applied, make sure to include them as well. This ensures full transparency in the pricing process.

Lastly, keep the formatting simple and readable. Use legible fonts, clear headings, and enough spacing to avoid clutter, making it easy for both parties to understand the receipt.

Legal Requirements for Personal Receipts in the UK

In the UK, personal receipts are not strictly regulated by law, but businesses must ensure they meet certain criteria for tax and legal purposes. If you’re issuing a personal receipt, it should clearly outline specific details to avoid any confusion in future transactions or disputes.

Key Information to Include

A personal receipt should contain the following elements: the date of the transaction, a description of the goods or services provided, the total amount paid, the payment method, and the name and contact information of the business or individual issuing the receipt. If VAT is applicable, this should be shown separately. These details ensure that the receipt can be verified if needed for tax reporting or refund purposes.

Record-Keeping and Tax Considerations

While personal receipts do not need to be submitted to HMRC unless requested, businesses must keep accurate records for tax purposes. If you’re self-employed, you should retain receipts for any expenses claimed as tax deductions. Personal receipts serve as proof of these transactions and help substantiate claims if audited. Keep receipts for at least six years, as HMRC may request them during this period.

Customizing Your Receipt Template for Different Transactions

Tailor your receipt template to suit the specifics of each transaction type. Personalizing receipts for different business needs ensures clarity and professionalism. Here are some ways to customize for various transaction scenarios:

1. Sale of Goods

- Include a detailed itemized list: Each product’s name, quantity, and unit price should be listed.

- Add VAT or sales tax information clearly if applicable.

- Provide the total amount before and after tax, including discounts, if any.

- Include the payment method (credit card, cash, or bank transfer) for reference.

2. Services Rendered

- Highlight the service description and the hourly or fixed rate.

- Include the duration of service if charging by time.

- If a deposit was paid, show the balance due or payment status.

- Consider adding a service provider’s name or ID for easier reference.

3. Refunds and Returns

- Clearly note the original transaction date and item details.

- State the refund amount and any adjustments made (e.g., restocking fees).

- Show the reason for the return and any applicable policies that apply.

Customizing these details makes your receipts more transparent and easier for customers to understand. Always consider the nature of the transaction and adjust your template accordingly to reflect key information clearly.

You can download personal receipt templates from several reliable sources in the UK, offering a variety of styles and formats to suit your needs. A few trusted platforms to consider are:

| Website | Description |

|---|---|

| Template.net | Provides a range of customizable personal receipt templates that can be downloaded for free or for a fee, depending on the style and format. |

| Microsoft Office Templates | Microsoft offers free downloadable receipt templates through Word and Excel that are perfect for personal use, including simple and professional designs. |

| Canva | Canva offers a variety of personal receipt templates that can be edited online and downloaded in different file formats like PDF or PNG. |

| Invoicing Software | Many UK-based invoicing software providers, like QuickBooks and FreshBooks, offer free personal receipt templates as part of their service packages, even for non-subscribers. |

These platforms provide an easy and fast way to get started with your personal receipt template, ensuring you can access professional designs without needing advanced skills. Be sure to review each website for specific features and formats that fit your preferences.

Now each word is repeated no more than twice, and the meaning remains intact.

When creating a personal receipt template, clarity is key. Avoid overcomplicating things by keeping it simple. Focus on key elements such as the date, the items or services purchased, the amount paid, and contact details for both the buyer and the seller.

Use concise language and limit repetitive phrases. For example, instead of stating “Paid amount: amount paid”, just use “Amount paid”. This keeps the template readable without losing any essential details.

Ensure that the font is clear and readable. Opt for standard fonts like Arial or Times New Roman in sizes that are easy to scan, such as 12 or 14-point. This guarantees that important information, like total cost and contact details, stands out and is easy to reference later.

Lastly, include clear headings for each section of the receipt. Label sections such as “Item Description”, “Quantity”, and “Total” so that the user can quickly find the relevant information without having to read through unnecessary text.