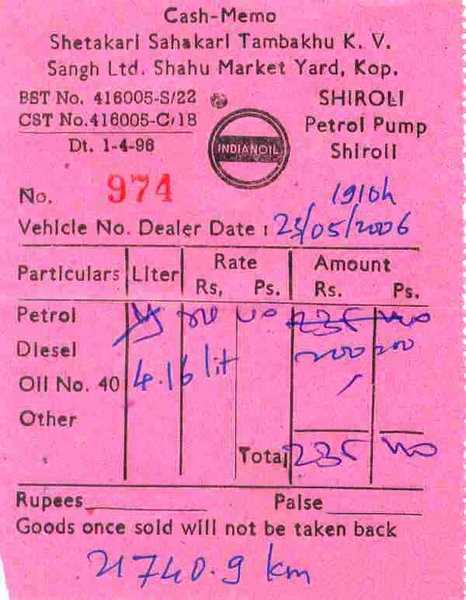

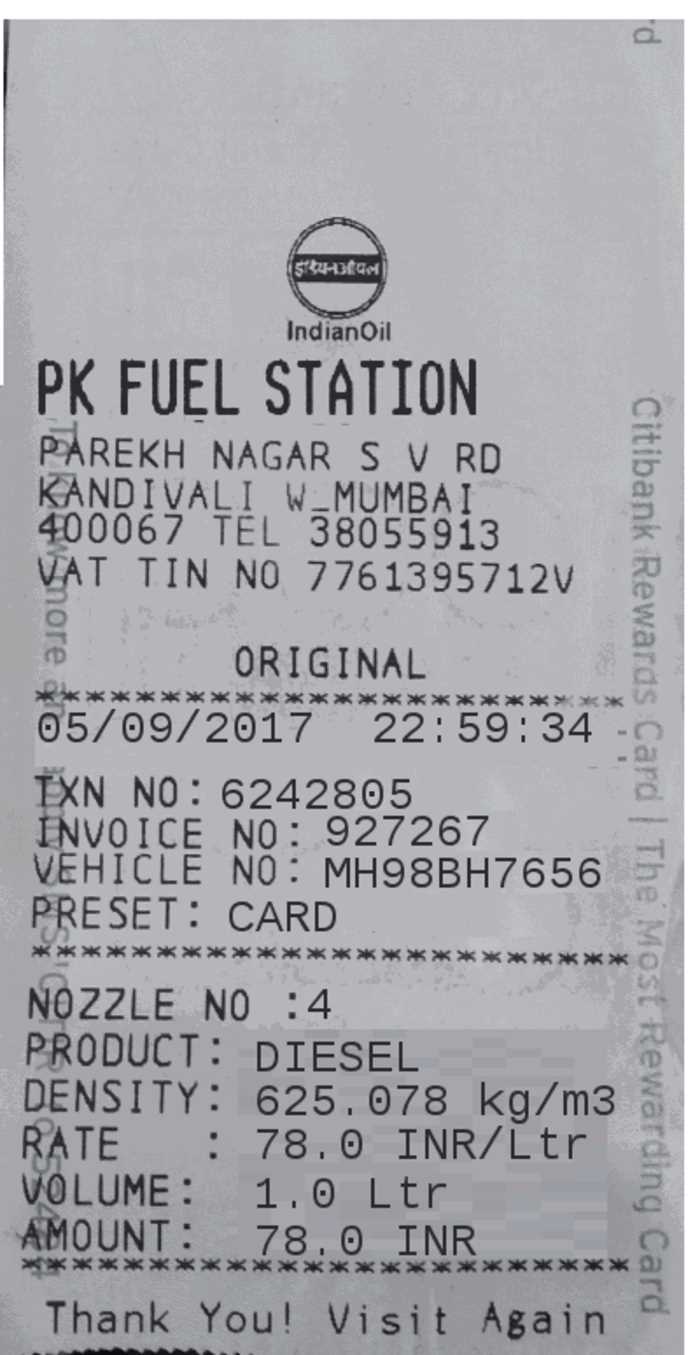

Key Elements of a Petrol Bill Receipt

Ensure your receipt includes all necessary details for clarity and record-keeping. A well-structured receipt should contain:

- Date and Time: Clearly indicate when the transaction occurred.

- Fuel Type: Specify whether the purchase was petrol, diesel, or another fuel.

- Quantity Purchased: Mention the volume in liters or gallons.

- Price per Unit: Display the rate charged per liter or gallon.

- Total Cost: Calculate and present the final amount paid.

- Payment Method: Indicate whether the transaction was completed via cash, card, or another means.

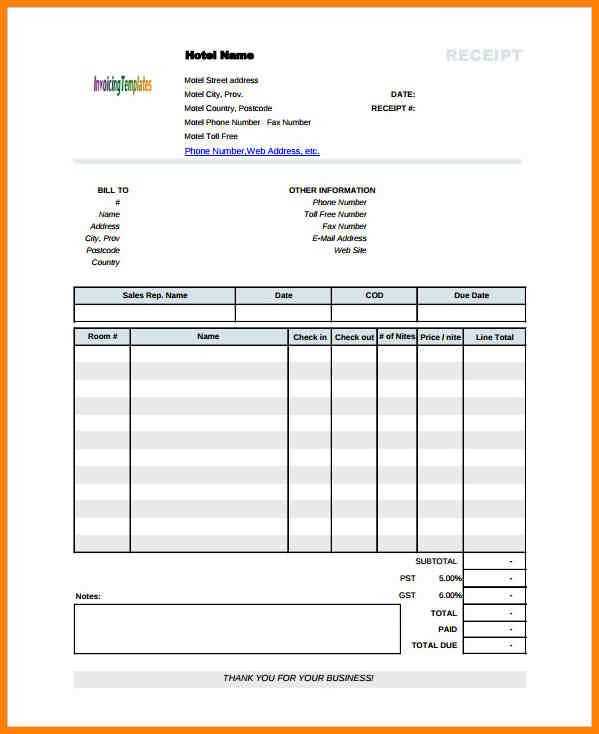

- Station Information: Include the name, address, and contact details of the fuel provider.

Example Format for a Receipt

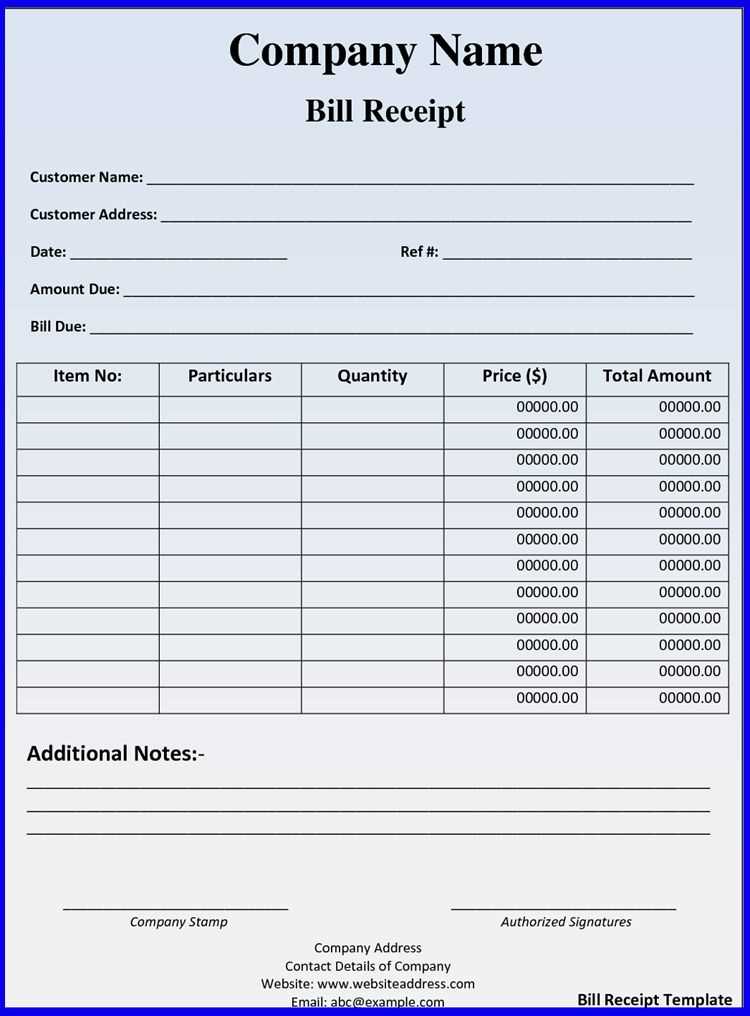

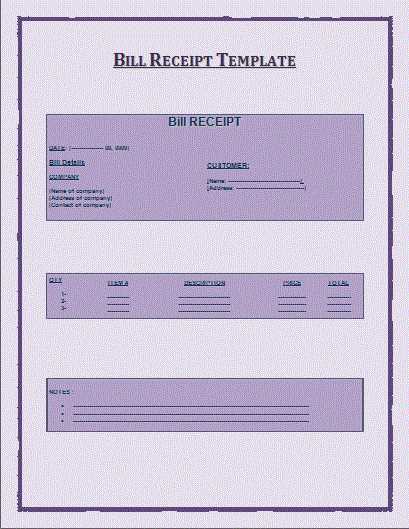

Below is a structured template for a petrol bill receipt:

-------------------------------------- Petrol Station Name Address, City, Zip Code Contact: 123-456-7890 -------------------------------------- Date: YYYY-MM-DD Time: HH:MM AM/PM -------------------------------------- Fuel Type: Petrol Quantity: 20.5 Liters Price per Liter: $1.50 Total Cost: $30.75 Payment Method: Credit Card -------------------------------------- Thank you for your purchase!

Customization Tips

Adapt the receipt to your specific needs by adding:

- Tax Information: If applicable, include tax details for accurate bookkeeping.

- Transaction ID: Assign a unique number to each receipt for tracking.

- Discounts or Loyalty Points: Reflect any applied promotions.

A structured and detailed receipt ensures transparency for both the provider and the customer.

Layout and Readability Factors

Customization for Business and Personal Needs

Legal Requirements and Tax Records

Digital vs. Paper-Based Templates

Frequent Errors and Prevention Tips

Use a clear font with adequate spacing to ensure all details are legible at a glance. Bold headings help differentiate sections, while aligned numerical values improve readability.

Modify templates by adding a logo, adjusting color schemes, or including additional fields for specific business needs. Personal invoices may benefit from simpler layouts with essential data only.

Ensure compliance by including tax identification numbers, itemized charges, and applicable VAT or sales tax rates. Missing mandatory details can result in audit issues or disputes.

Digital formats offer convenience, automatic calculations, and easy storage, whereas printed receipts provide tangible proof in cash transactions. Choose based on documentation preferences and industry norms.

Common errors include misaligned figures, missing dates, and incorrect tax rates. Double-check calculations, ensure consistency in format, and verify all required fields before issuing a receipt.