For a streamlined approach to managing your fuel expenses, utilize a petrol receipt template. This handy tool simplifies record-keeping, ensuring you track your spending efficiently. Start by including vital details such as the date of purchase, the name of the fuel station, and the amount spent.

Incorporate sections for the type of fuel purchased and the total liters dispensed. This information is valuable for monitoring fuel consumption trends over time. A clear breakdown of costs helps identify patterns, allowing for better budgeting and expense management.

Consider adding a section for notes. This could include reminders about discounts or promotions available at specific stations. Keeping these details organized enhances your ability to make informed decisions when refueling, maximizing savings.

By implementing a petrol receipt template, you not only simplify your record-keeping but also gain insights into your fueling habits. This proactive approach to managing expenses contributes to better financial awareness and control.

Here’s the corrected text with reduced repetitions:

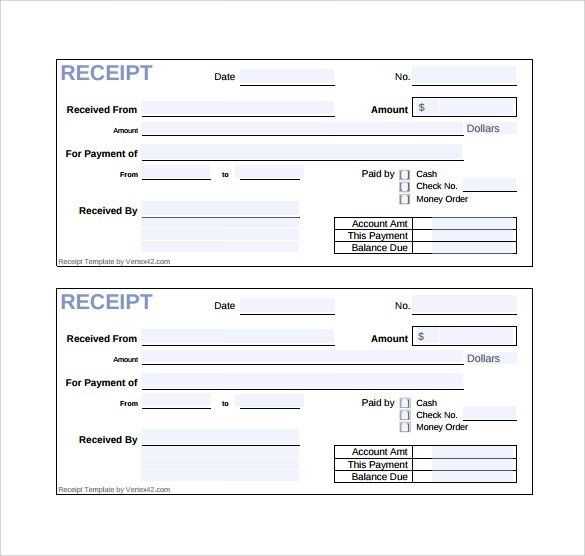

To create a petrol receipt template, focus on key elements like date, time, fuel type, quantity, price per litre, and total amount. Organize the layout for clarity and easy reading. Use a clean font and ensure sufficient white space to avoid clutter.

Include Relevant Details

Incorporate the station name, address, and contact information at the top. This helps customers identify the location and reach out if needed. Clearly state payment method and any loyalty program information at the bottom to encourage future visits.

Use Consistent Formatting

Keep font styles and sizes uniform across all sections. Align text consistently to enhance readability. Utilize borders or shading to separate different areas of the receipt, making it visually appealing while maintaining professionalism.

- Petrol Receipt Template Guide

A petrol receipt template should include key elements for clarity and organization. Start with your business name and contact information at the top. This establishes your brand and provides essential details for customers. Include the date and time of the transaction for accurate record-keeping.

Required Information

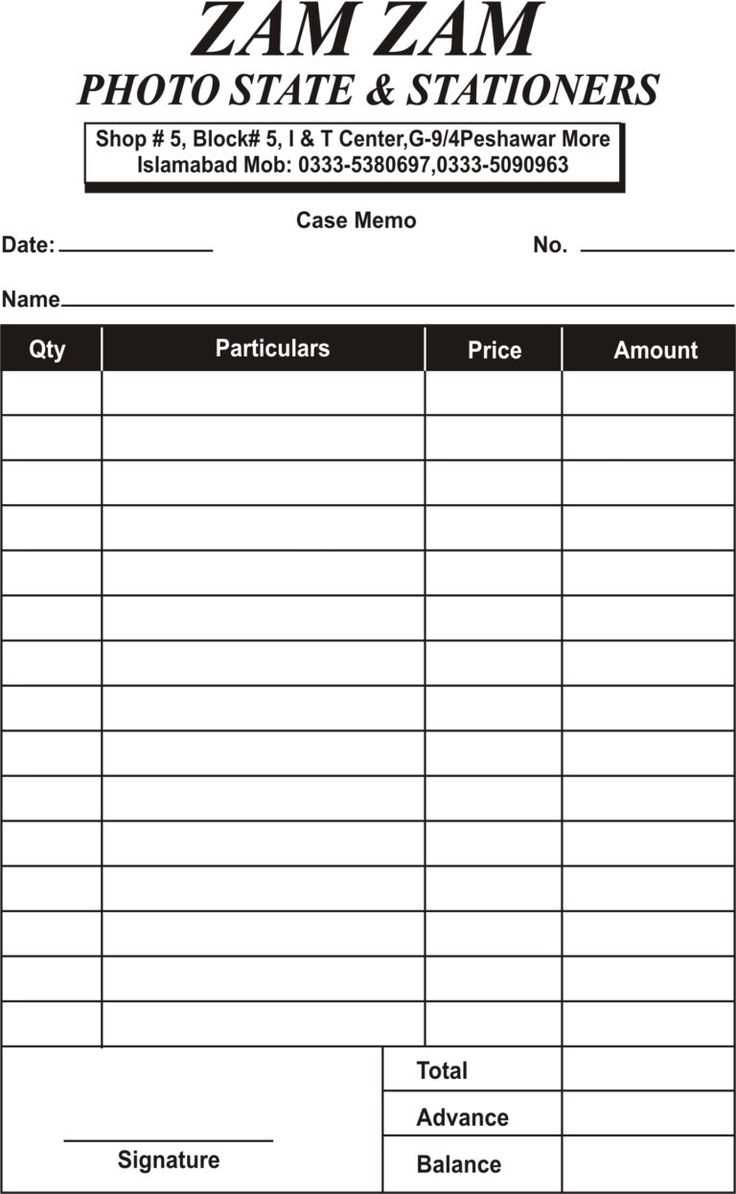

Next, itemize the purchased products and services. The template should list:

| Item | Quantity | Price |

|---|---|---|

| Petrol | 10 liters | $30.00 |

| Car Wash | 1 | $10.00 |

| Snack | 1 | $2.50 |

Conclude with the total amount, which includes any taxes or additional charges. It’s helpful to specify payment methods accepted, whether cash, credit card, or digital payments. Providing a space for any notes or additional information can enhance customer service and ensure clear communication.

Template Benefits

Utilizing a template streamlines the receipt creation process, ensuring consistency across transactions. It simplifies record-keeping for both the business and the customer, making it easier to track expenses and manage finances.

A petrol receipt contains several key components that help you track your fuel expenses and ensure accuracy. Familiarizing yourself with these elements can enhance your financial management.

- Date and Time: This indicates when the transaction occurred, allowing you to monitor your fuel usage over specific periods.

- Location: The name and address of the petrol station provide context for where you purchased the fuel, which can be useful for tracking expenses by location.

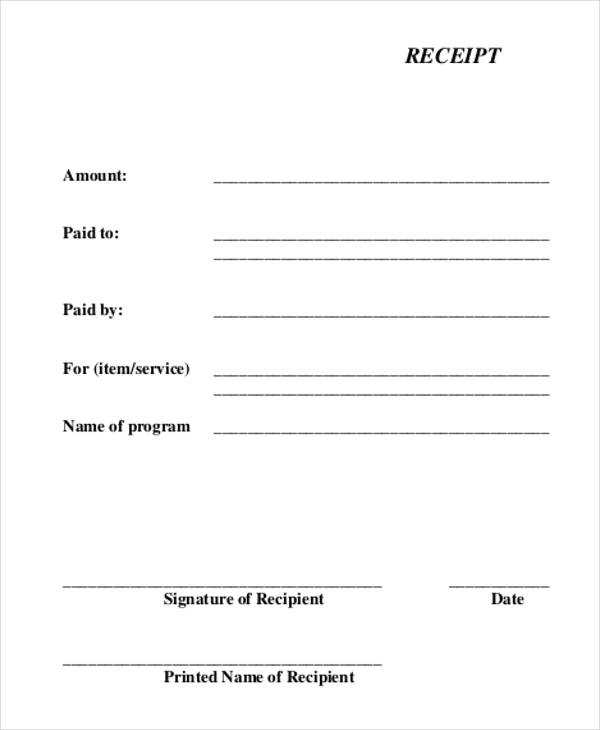

- Payment Method: Whether you paid by cash, card, or another method, this section clarifies how the transaction was completed.

- Fuel Type: Identifying the specific type of fuel purchased, such as petrol or diesel, helps in understanding consumption and expenses.

- Volume: The quantity of fuel dispensed is crucial for calculating fuel efficiency and expenses.

- Price Per Liter: This allows you to assess the cost-effectiveness of your fuel purchase compared to market rates.

- Total Amount: The total cost of the transaction includes taxes and fees, providing a clear view of your expenditure.

- Receipt Number: A unique identifier for the transaction can aid in tracking and referencing purchases in case of discrepancies.

Understanding these elements not only helps in personal budgeting but also assists in making informed decisions regarding fuel purchases.

Choose a reliable template editor, such as Microsoft Word, Google Docs, or a dedicated receipt generator. Begin with the header, including your company logo, name, address, and contact information. Use clear fonts and adequate spacing to enhance readability.

Include a date field for the transaction, the vehicle registration number, and the customer’s name. This adds personalization and helps in tracking transactions. Clearly label the fuel type, quantity purchased, price per liter, and the total amount paid. Consider adding a breakdown of any taxes applied.

Incorporate payment method details, whether cash, credit, or loyalty points. A section for additional notes can be useful for promotions or special messages to customers. Ensure that your template adheres to local regulations regarding receipt requirements.

Save your template in an easily accessible format, like PDF, for consistent printing. Regularly update the template to reflect any changes in pricing or branding. Test print the receipt to confirm all information is displayed correctly before using it for actual transactions.

Including specific data fields in petrol receipts enhances clarity and helps in record-keeping. Here are key fields to consider:

- Business Name: Clearly state the name of the petrol station or company providing the service.

- Address: Include the physical address of the location where the transaction occurred.

- Date and Time: Document the exact date and time of the purchase to establish a clear transaction record.

- Receipt Number: Assign a unique identification number for each transaction, aiding in organization and retrieval.

- Transaction Details: List the items purchased, including fuel type, quantity, and price per unit.

- Total Amount: Clearly indicate the total cost of the transaction, including taxes and fees.

- Payment Method: Specify the method of payment, such as credit card, cash, or mobile payment.

- Customer Information: Optionally include customer details if applicable, such as loyalty program numbers.

- Tax Information: Display applicable taxes separately to ensure transparency and compliance.

- Contact Information: Provide customer service contact details for inquiries or feedback.

Including these fields enhances the utility of petrol receipts for both consumers and businesses. Each element plays a role in ensuring that the receipt serves its purpose effectively.

Utilize a clear font style, such as Arial or Helvetica, with a minimum size of 10 points. This ensures easy readability for all users.

Implement consistent margins and spacing throughout the receipt. Aim for at least 0.5 inches on all sides to prevent content from feeling cramped.

Organize information in a logical order:

- Company name and logo

- Date and time of the transaction

- Fuel type and quantity

- Total cost

- Payment method

Highlight key information using bold text or larger font sizes. This draws attention to important details such as the total amount paid and the type of fuel purchased.

Use bullet points or numbered lists for multiple items. This breaks down information and aids comprehension, especially when listing fuel types or additional services.

Incorporate visual elements, such as horizontal lines, to separate sections. This helps guide the reader’s eye and improves the overall flow.

Ensure sufficient contrast between text and background colors. Dark text on a light background or vice versa enhances visibility and reduces strain on the eyes.

Test the receipt layout by printing a sample. Verify that all details are legible and properly aligned, making adjustments as necessary for clarity.

Incorporate all mandatory information, such as the seller’s name, address, and tax identification number, to meet legal requirements. Each receipt must clearly state the transaction date and detailed itemization of the purchased goods or services, including quantities and prices. Ensure the inclusion of applicable tax rates and the total amount charged, which should be easy to read and understand.

Adhere to Local Regulations

Research the specific laws governing receipts in your jurisdiction. Different regions may have unique requirements regarding the format and information displayed on receipts. Consult local tax authorities or legal advisors to ensure compliance.

Maintain Digital Records

For businesses, maintaining digital copies of receipts can facilitate easier audits and financial management. Utilize accounting software that automatically generates compliant receipts, storing them securely to meet both legal and organizational needs. Regularly review these records to ensure ongoing adherence to legal standards.

Utilize high-quality thermal paper for receipt printing to ensure clarity and durability. This paper type prevents fading and enhances readability over time, which is especially important for record-keeping.

Incorporate clear branding elements on the receipt, such as your logo and business name. This not only reinforces brand identity but also makes the receipt look professional.

Include all necessary transaction details, including date, time, itemized purchases, and total amount paid. This transparency builds trust with customers and aids in their future reference.

| Detail | Description |

|---|---|

| Date & Time | Capture the exact moment of purchase. |

| Itemized List | Show each product with prices for clarity. |

| Total Amount | Display the final price clearly to avoid confusion. |

| Payment Method | Indicate whether it was cash, credit, or another method. |

Offer digital receipt options to cater to customer preferences. Sending receipts via email not only reduces paper waste but also provides a convenient reference for future transactions.

Ensure compliance with local regulations regarding receipt requirements. Familiarize yourself with mandatory information that must be included to avoid potential legal issues.

Regularly review and update receipt templates to adapt to any changes in branding or legal requirements. This practice keeps your documents current and aligned with your business needs.

Include the correct company information in the receipt, such as the name, address, contact number, and tax identification number. This provides transparency and ensures the receipt is valid for business and tax purposes.

Transaction Details

Clearly state the date, time, and specific details of the transaction. Include the fuel type, quantity purchased, and unit price. This helps both the business and the customer track their purchases.

Payment Information

Indicate the payment method used (e.g., credit card, cash) and the total amount paid. This ensures the receipt accurately reflects the transaction and payment flow.