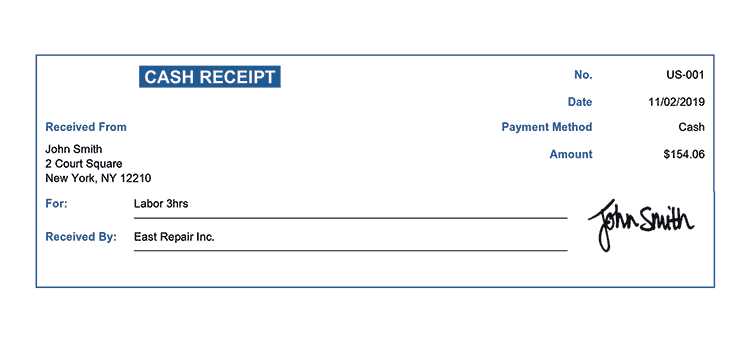

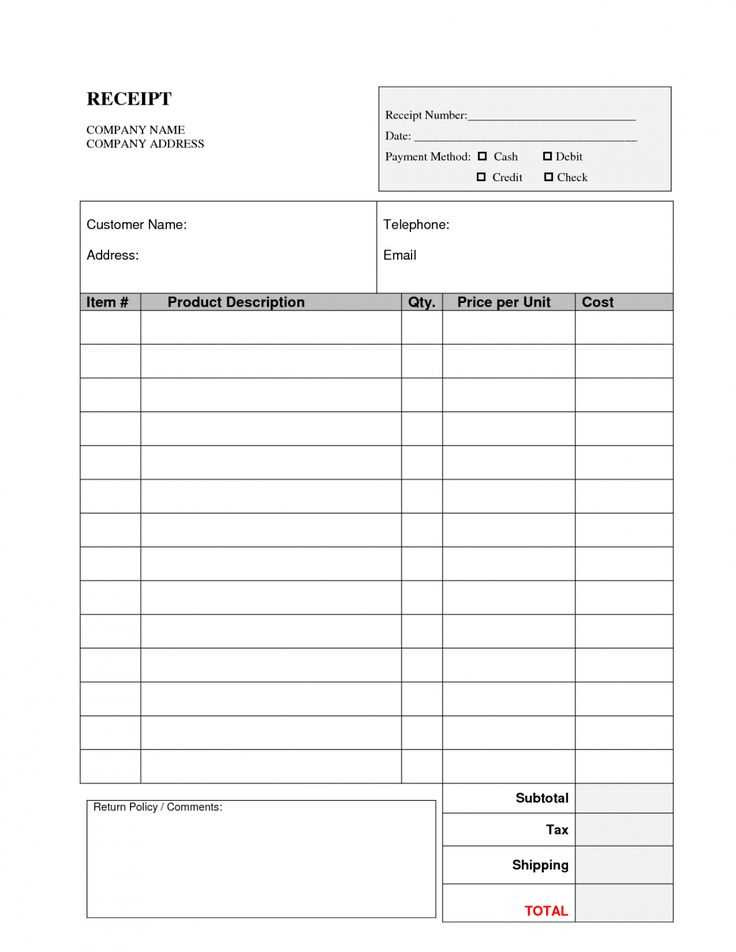

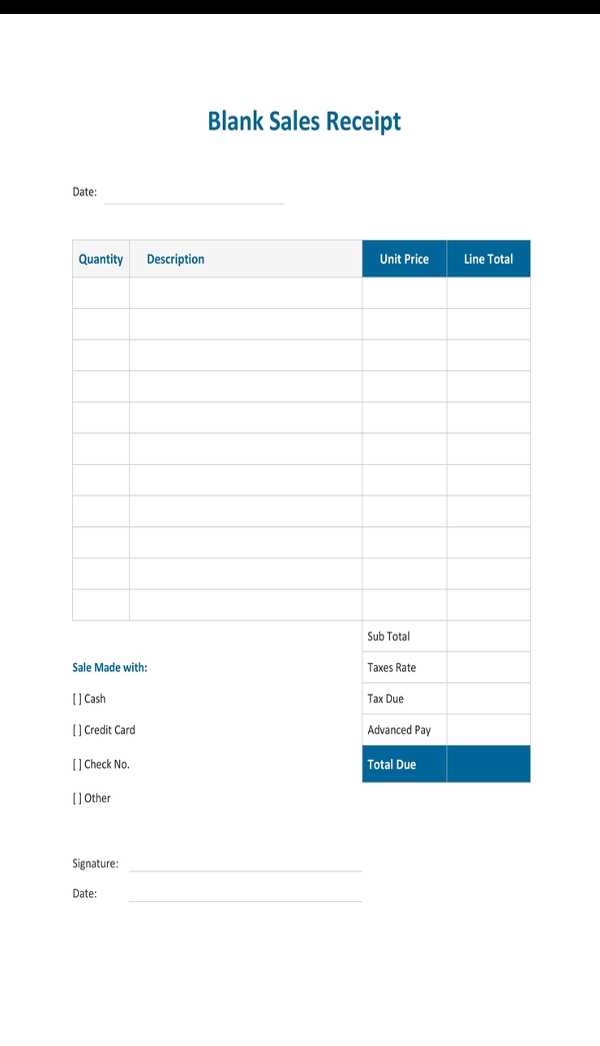

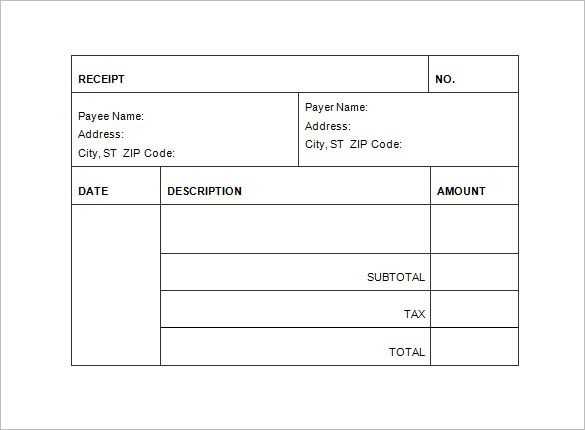

Creating a well-structured play receipts template can streamline the process of recording transactions and ensure accuracy in financial tracking. To start, make sure the template includes fields for the date, the payer’s name, the amount paid, and the reason for the payment. Each entry should be clear and easy to read, avoiding any unnecessary jargon.

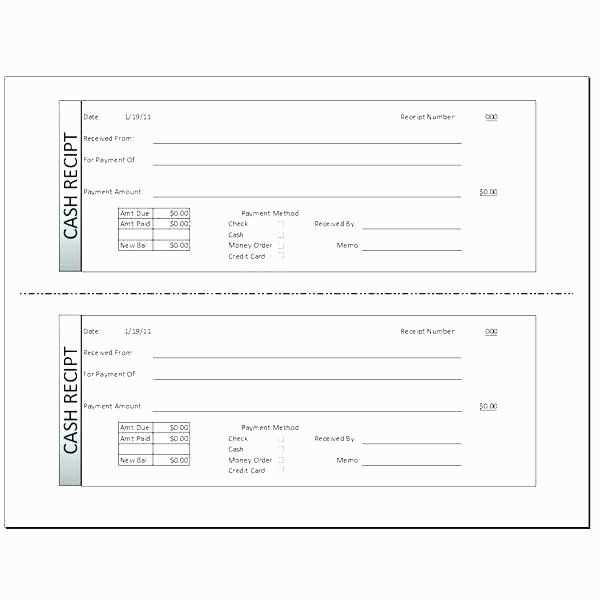

Consider adding a section for any applicable tax or discounts, especially if the payment involves such elements. This ensures full transparency and reduces the chance of errors when reconciling records. It’s also helpful to include a unique reference number for each receipt, making it easier to track payments over time.

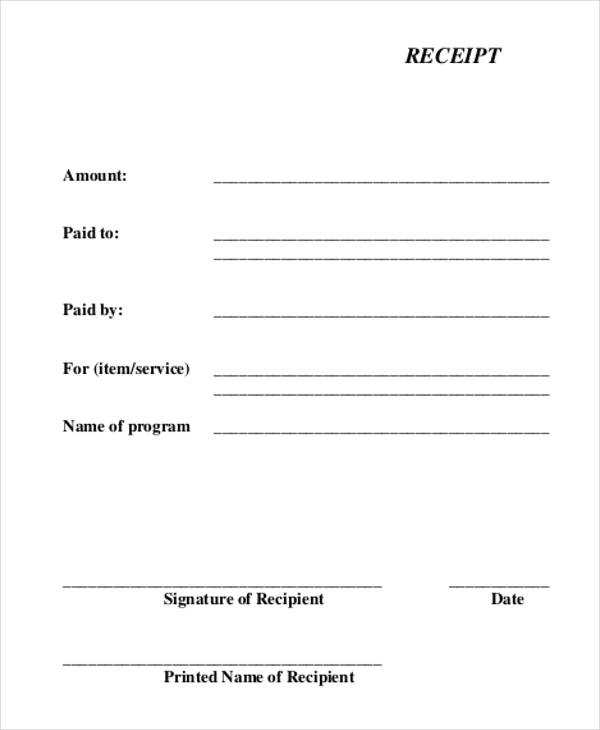

For the template layout, focus on simplicity and clarity. Use consistent formatting for all text, and make sure there’s enough space between each field to prevent crowding. It’s best to include a footer with additional notes or terms and conditions if needed. This makes the receipt both functional and professional.

Here’s the revised version with reduced repetition of words:

Optimize your receipts template by organizing the content logically. First, include all the necessary information such as the transaction date, amounts, and product details. Avoid redundancy by keeping the phrasing clear and concise. For example, instead of repeating terms like “product” or “service,” group related items together in sections with headings for better structure.

Adjust the Layout

Ensure that your template has a clean design, prioritizing readability. Use space effectively to avoid clutter. Include distinct sections such as the transaction summary, taxes, and total amount, but refrain from unnecessary subheadings or excessive labels that repeat the same idea. This streamlines the overall presentation.

Review and Test

Regularly review your template and test it with real receipts to identify any areas of improvement. Aim for simplicity while ensuring all vital information is included. Update the template based on feedback, removing any superfluous phrases that don’t add value to the overall purpose.

Play Receipts Template Overview

Choosing the Best Format for Your Play Receipts

How to Tailor a Play Receipts Template for Various Needs

Steps to Add Transaction Information Correctly

Including Key Payment Details in Receipts

Ensuring Clear Date and Time Entries

Best Practices for Organizing Play Receipts for Future Use

Start with a clean, structured layout for your play receipts template. Ensure there is space for all key details, including transaction amounts, dates, and customer information. Choose a format that fits your business or personal needs. A simple template with fields like amount, date, and payment method often works best for most use cases.

Customize Your Template for specific needs by adding or removing sections based on the type of transaction. For example, if you’re dealing with subscriptions or recurring payments, include fields for payment frequency. This makes your receipts adaptable for various scenarios, whether you need a receipt for a single payment or a subscription-based service.

Transaction Information should be entered clearly. Use consistent terms for payment methods (e.g., “Credit Card,” “Cash,” or “Online Transfer”). Include unique transaction identifiers to track payments easily. This reduces confusion and improves your record-keeping.

Payment Details such as the total amount, taxes, and any discounts should be easy to identify. Highlight important figures like the subtotal, tax amount, and total payment. Make sure the calculation is correct and easily verifiable by both parties.

Date and Time entries should be formatted clearly. Use a consistent date format (e.g., “MM/DD/YYYY”) and time notation (e.g., 24-hour clock or AM/PM). Clear, accurate time stamps are critical for referencing when the transaction occurred.

Organize Your Play Receipts by categorizing them based on transaction types, customers, or time periods. This makes retrieval easy and ensures efficient tracking. Use folders or digital software to group and label receipts for quick access. Storing receipts by year, quarter, or category helps in audits and record keeping.