Using EMV compliant templates for receipts is a critical step in ensuring the security and validity of transactions. These templates are designed to meet industry standards and safeguard cardholder data during payment processing.

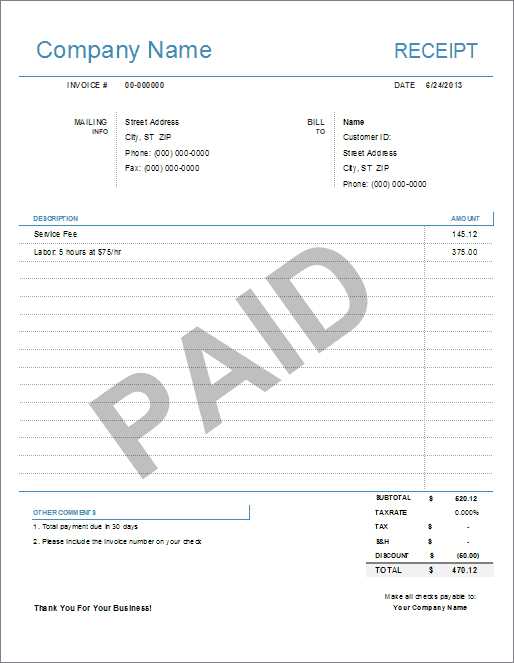

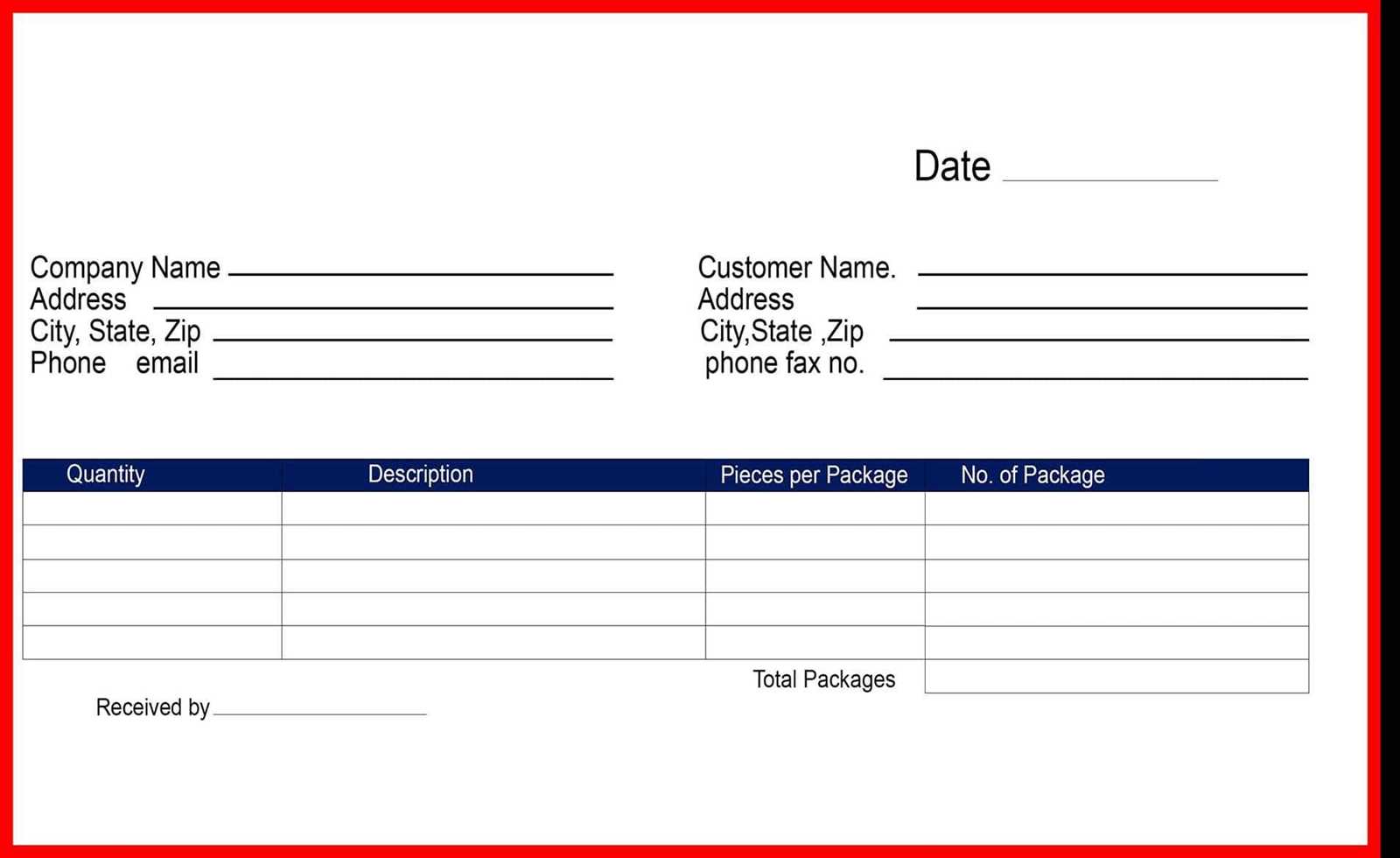

First, ensure your receipt template includes all required elements: the transaction amount, merchant details, card type, and authorization code. These details should be formatted correctly to avoid errors during processing and to comply with EMV requirements.

Another key consideration is the inclusion of the EMV chip data (if applicable), along with the transaction’s unique identifier. This data helps reduce fraud and verifies the authenticity of the transaction. Double-check that your template includes the proper coding for secure data transmission.

Ensure that all receipt data is clearly visible and legible to avoid confusion and enhance customer trust. A well-structured layout not only aids in compliance but also improves the overall customer experience.

Lastly, remember to update your templates regularly to keep up with the latest security protocols and industry standards. Staying compliant helps you avoid penalties and fosters a safer transaction environment for both merchants and customers.

Here’s the corrected version:

Ensure all receipt templates are EMV compliant by incorporating the necessary security features, such as encryption and tokenization. These features must protect cardholder data and meet PCI DSS standards. Use secure transmission protocols like HTTPS to safeguard the data when sending receipts electronically.

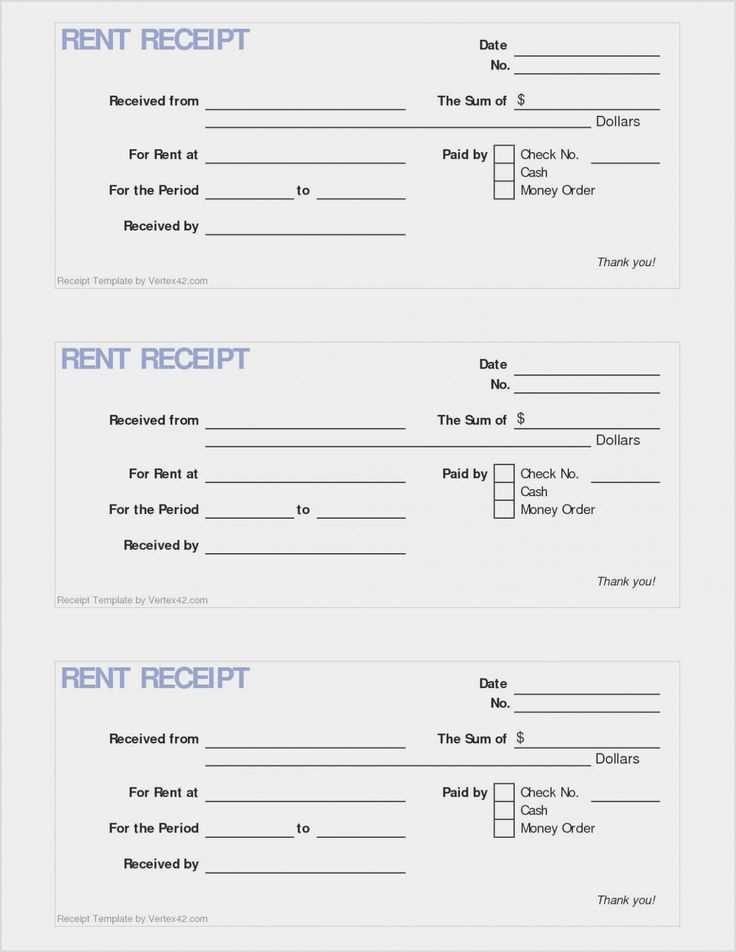

The template should clearly display the necessary transaction details, including the merchant’s name, address, and transaction date. The card number should be masked (showing only the last four digits), and include a unique transaction ID for easy reference in case of disputes.

Make sure the total amount and applicable taxes are displayed transparently, along with any additional information related to the payment method or loyalty program, if relevant. Provide a clear breakdown of fees and discounts, if applicable, and always include a prompt for the customer to report any issues with the transaction.

Review the receipt layout regularly to ensure it meets the latest compliance standards and stays user-friendly, offering clear legibility on both digital and printed formats.

- Please ensure you are using EMV-compliant templates for receipts.

Ensure your receipt templates are designed according to EMV (Europay, MasterCard, and Visa) standards. This helps in keeping your transactions secure and compliant with payment industry regulations. EMV templates need to include specific data, such as the full card number (masked), transaction amount, terminal ID, and authorization code. Make sure all required fields are present and that any sensitive information, such as PINs or full card numbers, is properly masked or omitted from printed receipts.

Key Information to Include

When crafting your receipt templates, be sure to display:

- The masked card number (only the last four digits should be visible)

- Transaction date and time

- Amount of the transaction

- Transaction ID and authorization code

- Merchant name and terminal ID

- EMV response code or authorization status

Common Pitfalls to Avoid

Avoid printing full card numbers or PINs, as this is not compliant with EMV requirements. Additionally, ensure that any unencrypted sensitive data is not inadvertently captured in your receipts. Regularly update your receipt templates to reflect any changes in compliance standards.

Ensure your receipt templates meet EMV (Europay, MasterCard, and Visa) standards by including key transaction details in a clear and structured manner. This includes the following essential components:

Transaction Details

Receipts should include transaction-specific information such as the date and time of purchase, the merchant’s name and location, and the total amount paid. The total amount should be clearly separated from taxes and fees to avoid confusion. The last four digits of the card number should be visible, while the full card number must be masked for security purposes. Additionally, include the authorization code to confirm that the transaction was processed successfully.

Card Authentication Information

Include a statement confirming that the transaction was authenticated through EMV chip technology, if applicable. This can be done with a note stating “Chip-enabled” or by indicating the type of card used (e.g., chip or contactless). This provides clarity that the cardholder’s identity was verified using EMV standards, reducing fraud risks.

Ensure your receipt also adheres to local regulatory and privacy guidelines for data storage and handling, such as masking or truncating sensitive card details. By keeping the format consistent and clear, you contribute to both security and customer trust in your transactions.

Design your EMV-compliant receipt templates with these key principles in mind to ensure clarity and security across different payment methods.

1. Include Required EMV Information

Each receipt must feature the essential EMV transaction data. This includes:

- Transaction Type: Clearly indicate whether the payment was a purchase, refund, or other transaction type.

- Authorization Code: Display the unique authorization number to authenticate the transaction.

- Card Details: Mask the card number (e.g., showing only the last four digits) for privacy and security.

- Transaction Amount: Show both the original amount and any fees or taxes applied.

- Terminal ID: Include the terminal identifier used for processing the payment.

2. Support for Different Payment Methods

Receipt templates must adjust to accommodate various payment methods, such as chip cards, contactless payments, and mobile wallets. For each payment type:

- Chip Cards: Provide the chip transaction data, including the Application Transaction Counter (ATC) and Application Identifier (AID).

- Contactless Payments: Include additional details like the NFC transaction ID and the method of authentication used.

- Mobile Wallets: Display transaction details in the same manner as a card, ensuring that the card number is masked and payment provider data is included.

3. Security Features

EMV receipts should include mechanisms to protect transaction integrity:

- Tokenization: When applicable, display a token instead of actual card details to protect customer information.

- Secure QR Code: For mobile payments, embed a QR code with encrypted transaction data that can be scanned for verification.

- Signature Verification: If necessary, include a space for customer signature or other forms of confirmation, ensuring it complies with EMV standards.

By following these design guidelines, you will create clear, secure, and EMV-compliant receipt templates suitable for multiple payment methods.

Ensure the proper use of EMV-compliant receipt templates. Inaccurate formatting can lead to transaction delays or rejections. It’s important to include all required data fields such as the Authorization Code, Transaction ID, and the full card number (last four digits), but without including sensitive information like the CVV.

1. Incomplete or Incorrect Data

Double-check that all essential fields are included. Missing or incorrect details can lead to the transaction being flagged or invalidated. For example, the absence of a transaction timestamp or merchant details might cause issues in reconciling records, resulting in lost time and resources.

2. Failing to Use Proper Encryption and Security Measures

Never overlook security. Encrypt sensitive data like card numbers using the latest industry standards to prevent data breaches. The EMV standards require that sensitive data is protected both during the transaction process and when stored. Not using sufficient encryption protocols could expose the transaction to vulnerabilities.

It’s also crucial to regularly update your software and hardware systems to ensure they remain compliant with the latest EMV security protocols and industry regulations. Regular audits can help identify any areas of weakness.

3. Inconsistent Formatting Between Receipt Copies

Ensure consistency in formatting across all receipt versions (e.g., paper, digital). Inconsistent or misaligned text can confuse customers or cause issues during transaction disputes. The key data must be easily readable across different formats and devices to avoid misunderstandings or delays in the validation process.

By addressing these issues proactively, you reduce the likelihood of complications and improve the overall customer experience. Ensure your system is regularly updated and always check your templates before final implementation.

Ensure your receipts use EMV-compliant templates to prevent errors in processing payments. The receipt should include clear transaction data, including the EMV transaction identifier and authorization code. These elements are key for verifying the authenticity of the transaction and maintaining security standards.

Make sure the receipt layout adheres to the following structure:

| Field | Description |

|---|---|

| Merchant Name | Clearly state the merchant name or business identifier. |

| Transaction Amount | Display the total amount of the transaction, including any taxes or additional fees. |

| EMV Transaction ID | A unique identifier that confirms the transaction’s compliance with EMV standards. |

| Authorization Code | Include the authorization code from the card issuer to confirm the transaction’s legitimacy. |

| Card Type | Show the type of card used (e.g., Visa, MasterCard, etc.). |

| Receipt Number | A unique receipt identifier that helps in tracking transactions for both the merchant and the customer. |

All fields should be legible, with a clean layout for both digital and printed receipts. This helps streamline processing and reduces errors in transaction disputes.