A well-structured tax receipt for pre-K tuition helps parents claim deductions and ensures compliance with tax regulations. The document should include key details such as the provider’s name, tax identification number, payment dates, and the total amount paid.

Accuracy is crucial. Double-check that all information matches official records. The receipt should specify whether the payments were for educational services or childcare, as tax deductions may vary depending on the classification.

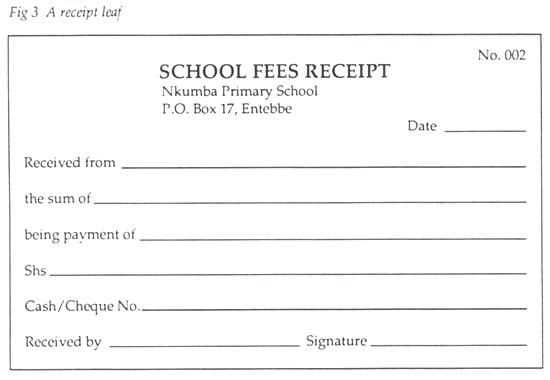

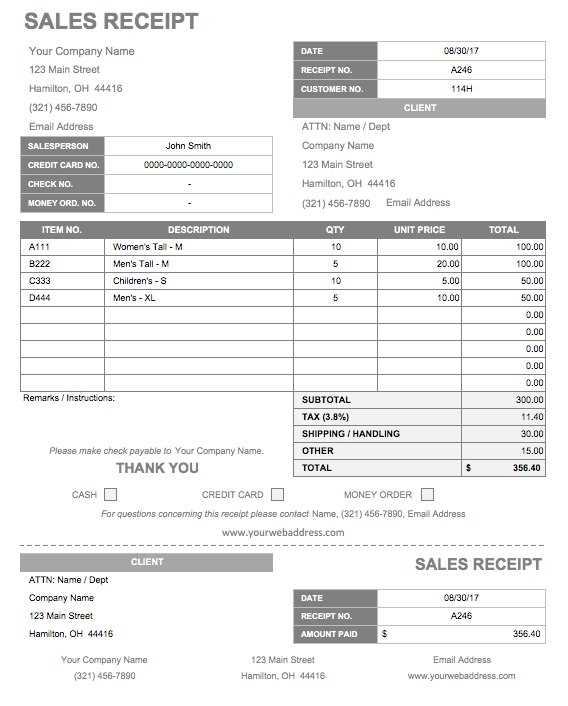

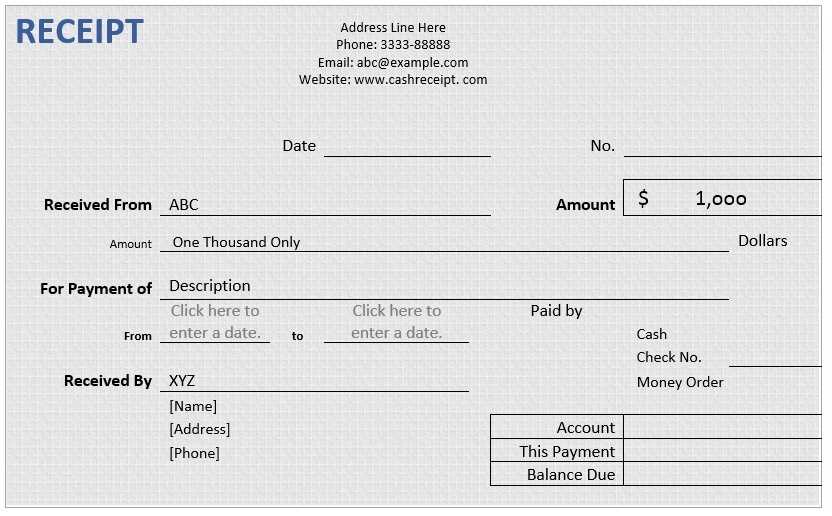

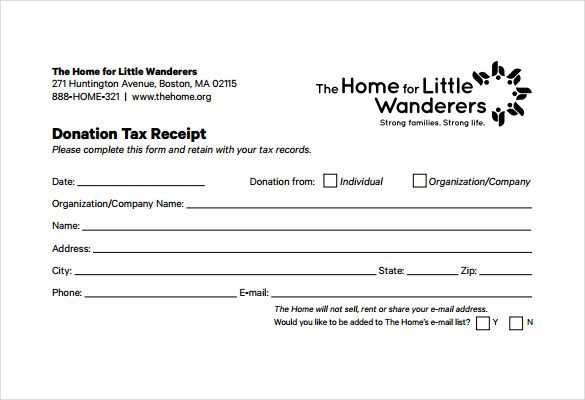

For ease of use, consider creating a standardized template. A clear format with labeled sections ensures consistency and simplifies record-keeping. Digital versions in PDF or Word format allow for easy distribution and secure storage.

Including a signature or an official stamp from the institution adds credibility. Parents may need to submit these receipts when filing taxes, so clarity and completeness help avoid delays or rejections.

Pre K Tuition Tax Receipt Template: Key Aspects and Practical Guidance

A well-structured Pre-K tuition tax receipt should include specific details to ensure compliance with tax regulations and provide clarity for parents. Accuracy is essential to avoid discrepancies when filing tax returns.

Required Information

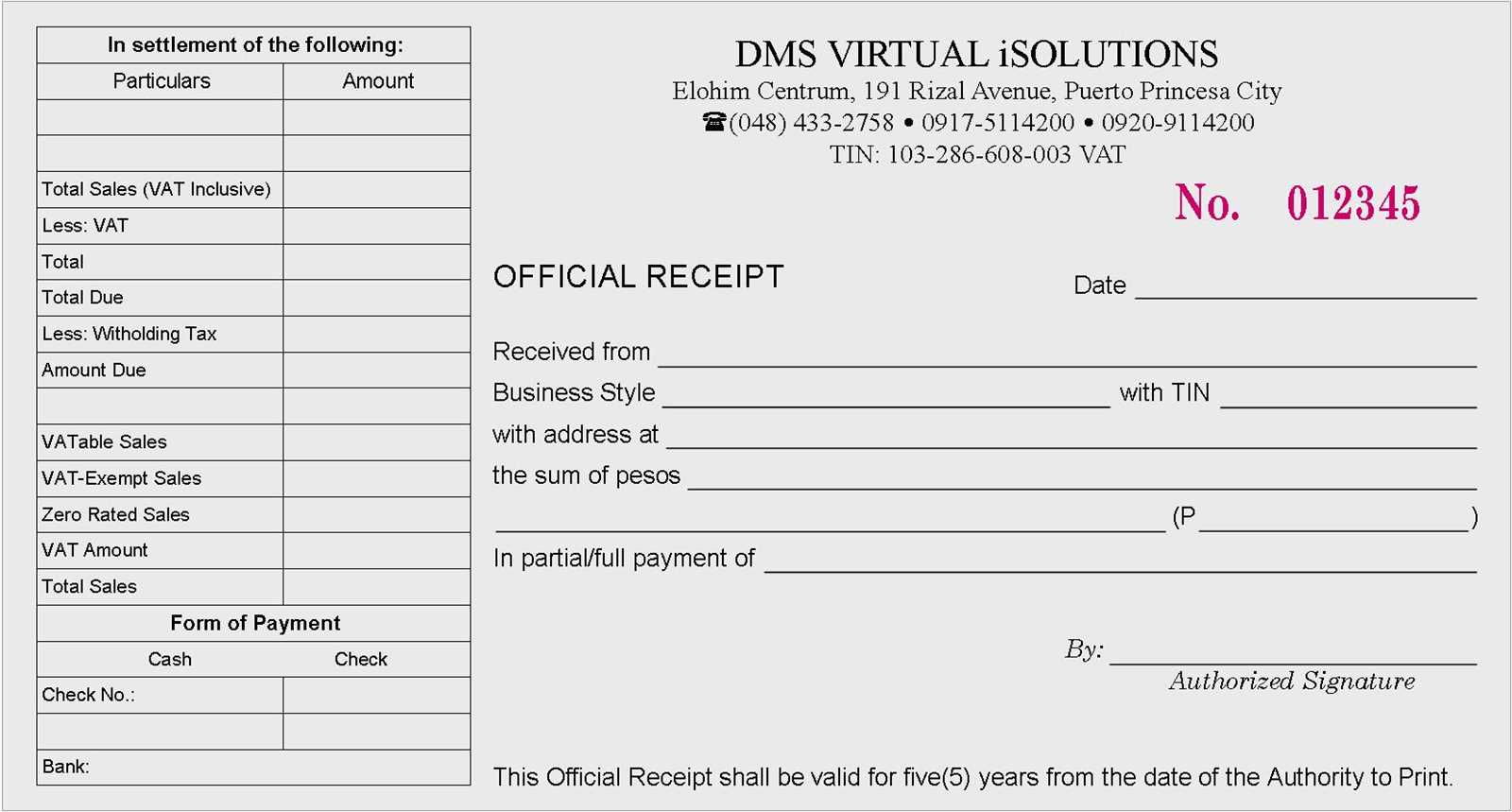

- Institution Details: Legal name, address, and tax identification number.

- Parent and Child Information: Full names of the payer and enrolled child.

- Payment Breakdown: Amount paid, payment dates, and covered period.

- Receipt Number: Unique identifier for record-keeping.

- Authorized Signature: Signature or printed name of an official representative.

Best Practices for Accuracy

- Use Clear Formatting: Organize information in a structured layout for readability.

- Verify All Entries: Ensure names, amounts, and dates match official records.

- Provide Digital and Paper Copies: Offer both formats for convenience.

- Retain Copies: Maintain records for at least three years for audit purposes.

Following these guidelines helps parents claim eligible tax benefits while ensuring compliance with financial regulations.

Required Information for a Valid Pre K Tuition Tax Receipt

Full name and address of the childcare provider must appear exactly as registered with tax authorities. If the provider operates under a business name, include that as well.

Tax identification number (TIN) or employer identification number (EIN) is required for tax reporting. Without this, parents may not be able to claim deductions.

Parent or guardian’s full name and address should match the information used for tax filings. Inconsistencies can lead to delays or rejections.

Child’s full name must be listed to confirm the tuition applies to the correct dependent.

Total amount paid should be clearly stated, including a breakdown of payments if necessary. Specify the dates covered to avoid confusion.

Payment method (cash, check, credit card, or bank transfer) can add transparency. Some tax authorities may require proof of payment.

Provider’s signature and date confirm the receipt’s authenticity. If issued electronically, include a digital signature or an official stamp.

Formatting Guidelines for Clear and Accurate Documentation

Use a Consistent Layout: Align all text elements uniformly. Maintain the same font, spacing, and margins across the document to enhance readability.

Label Sections Clearly: Use headings and subheadings to structure information. Keep titles concise and descriptive to help readers find key details quickly.

Standardize Date and Number Formats: Choose a single format for dates (e.g., MM/DD/YYYY or DD/MM/YYYY) and stick to it. Apply consistent decimal and currency formatting to prevent misinterpretation.

Avoid Ambiguity: Use precise wording. Replace vague terms like “varies” or “as needed” with specific instructions or numerical values.

Ensure Legibility: Select a readable font size and contrast colors appropriately. Dark text on a light background works best for printed and digital formats.

Include All Required Fields: Verify that every section contains necessary details, such as payer and recipient names, payment amounts, and applicable tax references.

Proofread for Accuracy: Check for typos, incorrect figures, and missing information. Errors in financial documents can lead to disputes or delays.

Provide a Clear Footer: Add a footer with the issuer’s contact details, document version, and any relevant disclaimers.

Common Errors to Avoid When Creating a Tax Receipt

Omitting essential details invalidates a receipt. Include the provider’s name, address, and tax identification number to ensure compliance. Missing these elements can lead to rejection during tax filing.

Failing to specify payment dates creates confusion. Clearly list the exact dates when payments were received. A general date range may not be accepted by tax authorities.

Incorrectly calculating totals results in discrepancies. Double-check that amounts match payment records. Rounding errors or miscalculations can lead to audits.

Leaving out parent or guardian information makes verification difficult. Include the full name of the individual who made the payment to prevent processing delays.

Forgetting to sign or authorize the receipt reduces credibility. A receipt should always be signed by an authorized person to confirm its validity.

Using vague descriptions causes misunderstandings. Specify the type of service provided, such as “Pre-K tuition for January” instead of just “tuition payment.”

Ignoring local tax laws risks non-compliance. Check relevant regulations to ensure all required details are present. Tax authorities may reject incomplete receipts.