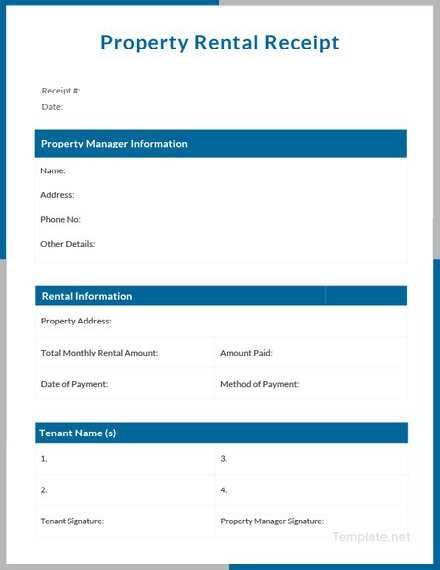

To create a property tax receipt template, focus on simplicity and clarity. Start with the property owner’s name, address, and a clear statement that confirms the payment of property taxes. Add fields for the property’s tax identification number and the payment date to ensure all essential details are captured.

Include a breakdown of the tax amount paid, specifying the different components such as municipal tax, state tax, and any other applicable fees. This helps the recipient understand how the total amount was calculated. You can also add a section for the method of payment, whether it was by check, credit card, or bank transfer.

Keep the layout clean and organized so that all important information is easy to find. Use clear headings and a well-spaced design to improve readability. Always ensure that the document includes a statement confirming the payment has been received in full, along with any necessary instructions for future payments.

Here’s the corrected version without word repetition:

To create a property tax receipt template, include specific fields such as property address, owner details, tax period, and the amount paid. Ensure the format is clear and easy to understand. Include a unique receipt number for tracking purposes. Make sure all calculations are accurate and reflect the correct tax rate. It’s helpful to incorporate a section for the payment method and a confirmation of receipt. Avoid cluttering the template with unnecessary information.

Property Tax Receipt Template: A Practical Guide

How to Customize a Property Tax Receipt for Your Needs

Key Information to Include in a Property Tax Receipt

Common Mistakes to Avoid When Using a Tax Receipt Template

To create an accurate property tax receipt, begin by including the property owner’s full name and address. Specify the property details, such as the property identification number or tax parcel number, to avoid confusion. The date of payment and the tax year for which the payment was made should be clearly visible. Include the total amount paid, along with a breakdown of the property tax amount, including any applicable fees or penalties.

Key Information to Include in a Property Tax Receipt

Make sure to include the following items for clarity and completeness:

– The payer’s contact information

– A unique receipt number for record-keeping

– The municipality or taxing authority issuing the receipt

– The specific amount paid for property taxes

– Payment method, such as check, credit card, or online payment

Common Mistakes to Avoid When Using a Tax Receipt Template

Avoid leaving out key details like the property identification number or the payment method. Double-check that the amount paid matches the expected total, accounting for any deductions or credits. Mistakes in tax year or property address can lead to confusion or errors in records, so always verify the information before finalizing the receipt.