A well-structured PTA tax receipt template ensures compliance with tax regulations and simplifies financial reporting. Whether you’re managing donations or membership fees, a properly formatted receipt provides transparency and accuracy. Below, you’ll find key elements that should be included in every PTA tax receipt.

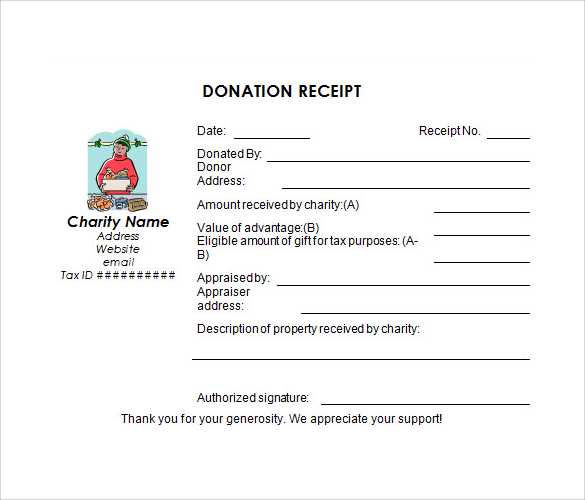

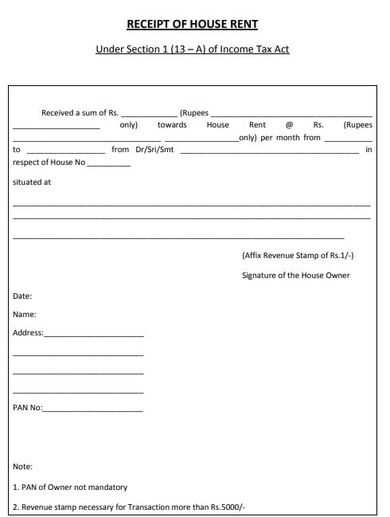

Mandatory details: Every receipt must specify the organization’s name, tax identification number, and contact details. It should also include the donor’s name, the date of the donation, and a description of the contribution, whether monetary or in-kind.

IRS compliance: For tax-deductible donations, include a statement confirming that no goods or services were provided in exchange, unless applicable. If benefits were received, their estimated value must be clearly indicated.

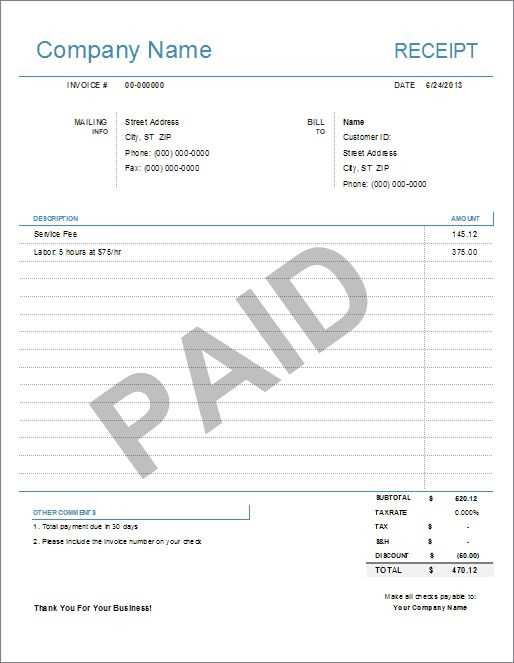

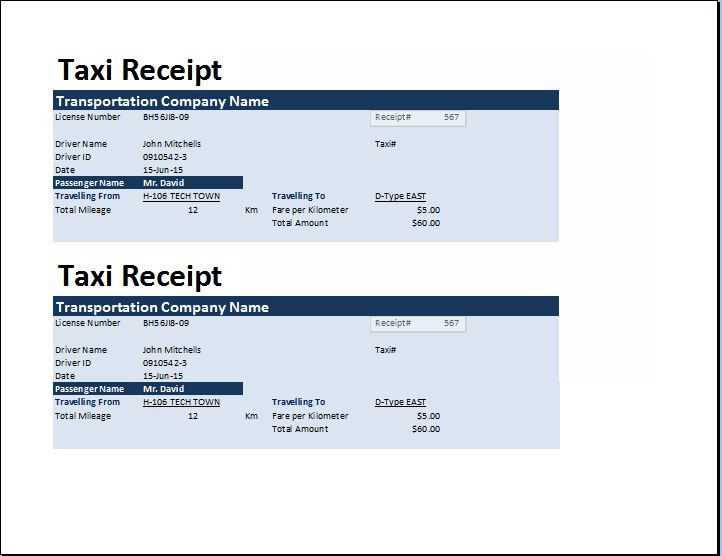

Formatting tips: A clean and professional layout enhances readability. Use a structured table for itemized details and ensure that all information is easy to verify. Digital templates allow for quick modifications and automated calculations.

A properly designed PTA tax receipt not only meets legal requirements but also reinforces trust with donors. Standardizing your template will streamline record-keeping and support financial transparency.

PTA Tax Receipt Template

Ensure your PTA tax receipts meet legal requirements by including key details. A well-structured template simplifies tracking and reporting while providing transparency for donors.

Essential Information

- PTA Name and Contact: Include the official name, address, and contact details.

- Receipt Number: Assign a unique identifier for easy reference.

- Donor Details: Capture the name and contact information for record-keeping.

- Donation Amount: Specify the exact contribution with the correct currency.

- Date of Donation: Record the transaction date for accurate reporting.

- Purpose of Donation: Clarify if the funds support a specific project or general activities.

- Tax Exemption Statement: Confirm the PTA’s tax-exempt status and eligibility for deductions.

- Signature: Include an authorized signature for authenticity.

Formatting Tips

- Use a clear, professional layout with aligned sections.

- Keep fonts legible and avoid excessive styling.

- Save a digital copy for easy retrieval and audits.

- Provide a duplicate for the donor’s records.

Implementing a standardized template streamlines documentation and builds trust with contributors. Regularly update the format to reflect any tax regulation changes.

Key Elements to Include in a PTA Tax Receipt

Include the organization’s full legal name and tax identification number to ensure the receipt is valid for tax purposes. This information confirms the PTA’s nonprofit status and allows donors to claim deductions.

Specify the donor’s name and contact details. A properly addressed receipt helps with record-keeping and ensures compliance with tax regulations.

Clearly state the donation amount or a description of the contributed goods or services. If the donation was non-monetary, provide a detailed description but avoid assigning a monetary value.

Include the date of the donation to establish when the contribution was made. This is important for tax reporting, as deductions apply to the year of the gift.

Provide a statement confirming whether any goods or services were received in exchange for the donation. If nothing was provided, include a note stating, “No goods or services were received in return for this contribution.” If something was given, describe it and note its estimated value.

Add a signature or official PTA contact information to validate the document. While not always required, this reinforces authenticity and credibility.

Formatting Guidelines for a Legally Compliant Receipt

Include the date of issuance at the top. Use a clear, standard format such as YYYY-MM-DD to prevent confusion. The receipt number should be unique and sequential to maintain proper records.

Required Business and Customer Information

List the full legal name, address, and contact details of the issuing entity. If applicable, include the tax identification number. For the recipient, capture their name and relevant details to establish a clear transaction record.

Transaction Breakdown and Payment Details

Provide a detailed list of items or services rendered, including descriptions, quantities, and unit prices. State the total amount, separating tax components where required. Indicate the payment method (cash, card, transfer) and include a note confirming receipt of payment.

End with an authorized signature or digital stamp, ensuring authenticity. If applicable, include a disclaimer regarding returns or refunds to clarify terms for both parties.

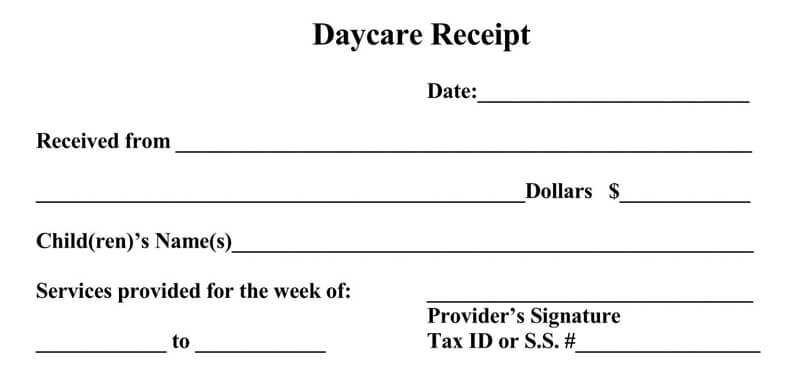

Customizing the Template for Different PTA Activities

Adjust the receipt layout by modifying section titles to match specific events, such as “Bake Sale Contribution” or “Field Trip Donation.” Ensure clarity by updating descriptions to reflect the nature of each transaction.

Include a custom header with the PTA’s name and event details. A dedicated notes section helps specify additional information, such as donor acknowledgments or tax-deductible status.

For ticketed events, add fields for ticket numbers and attendee names. If handling membership fees, include a category for different membership levels and corresponding amounts.

Standardize formatting by maintaining consistent fonts and spacing. Test the template with sample data to confirm readability before distribution.