Use a Receipt and Disbursement Statement template to streamline financial tracking. This template simplifies the process of recording incoming and outgoing funds, providing clear visibility into financial transactions for businesses or individuals. It’s designed to offer a straightforward, easy-to-use format that ensures accurate accounting and transparency.

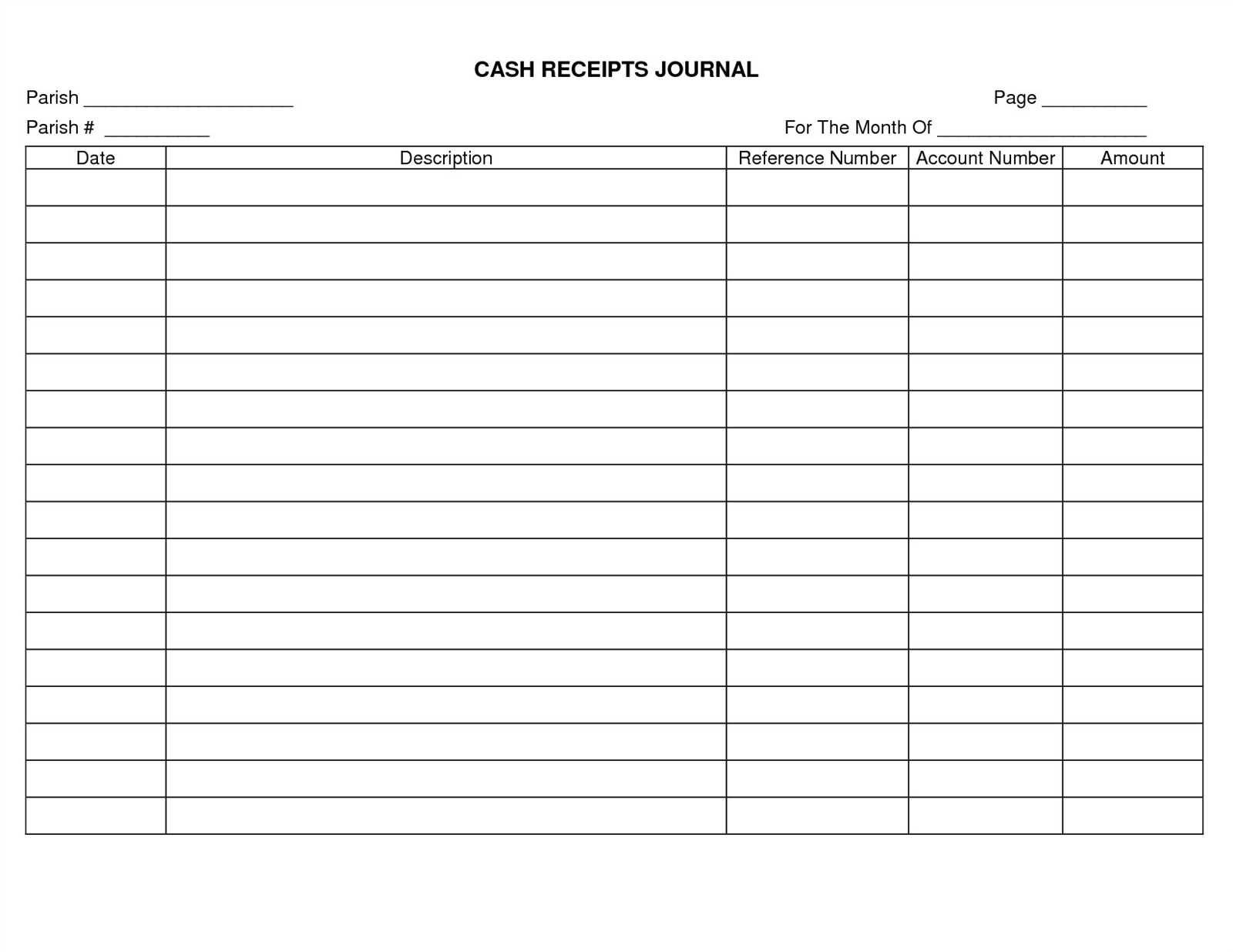

Start by categorizing all receipts and disbursements according to their nature. This will help you quickly identify patterns and make informed decisions. Each entry should include key details such as the date, amount, payer/recipient, and purpose of the transaction. A well-organized statement helps reduce errors and ensures compliance with financial reporting standards.

To improve usability, incorporate simple formulas or linking to automated tools where possible. This will save time and minimize manual work. Always ensure that the sum of receipts equals the total of disbursements for each period, offering a clear financial picture without complications.

Here’s the revised version with redundancy removed:

To improve clarity, eliminate unnecessary repetition in your statements. Focus on using precise terms that convey the necessary information without redundancy. For example, instead of repeating terms like “receipt and disbursement” multiple times, consolidate them into clear phrases that are only mentioned when needed for context.

Break down complex sections into smaller, more digestible parts. Replace long-winded descriptions with straightforward language that provides just the right amount of detail. Prioritize the most relevant information and avoid repeating points or restating the same facts in different ways.

Streamline the format: Use bullet points or numbered lists to present key data clearly. This keeps the statement concise and helps focus attention on the core message. Keep the sections well-organized, and remove any extraneous explanations.

Be mindful of the tone: A straightforward approach helps maintain reader engagement without overwhelming them with excessive content. Your goal is clarity, so choose words that simplify the message without losing any critical details.

- Receipt and Disbursement Statement Template

For a clear and organized presentation of financial transactions, create a receipt and disbursement statement with these key components:

- Date: Include the specific date for each transaction.

- Receipt Description: Briefly describe the source of the funds, such as a client name or invoice number.

- Amount Received: Clearly list the amount received for each transaction.

- Disbursement Description: Provide details on the payment made, including recipient and purpose.

- Amount Disbursed: List the amount paid out for each disbursement.

- Balance: Calculate and display the running balance after each transaction.

Ensure all amounts are correctly formatted and clearly identified. The statement should be easy to read and track, with no ambiguity about the flow of funds. Use consistent terminology across the document to avoid confusion.

This template serves as an efficient tool for both financial reporting and auditing purposes. Include any necessary references to supporting documents like invoices or receipts to maintain transparency.

A Receipt and Disbursement Statement should clearly outline the inflows and outflows of funds, ensuring transparency and accuracy in financial tracking. Below are the key elements to consider:

1. Receipt Section

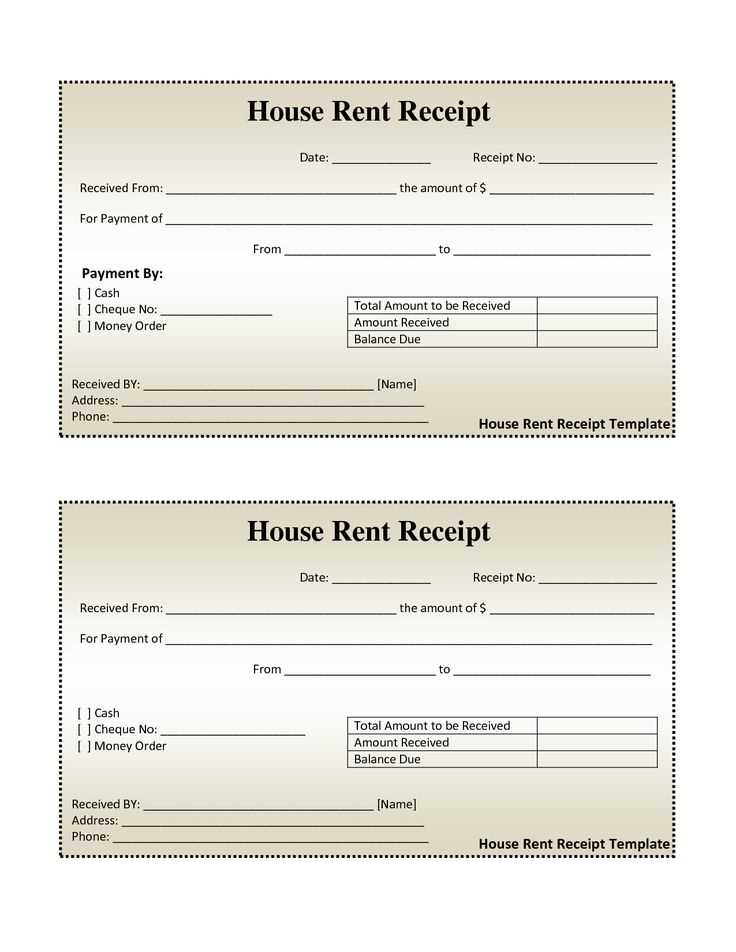

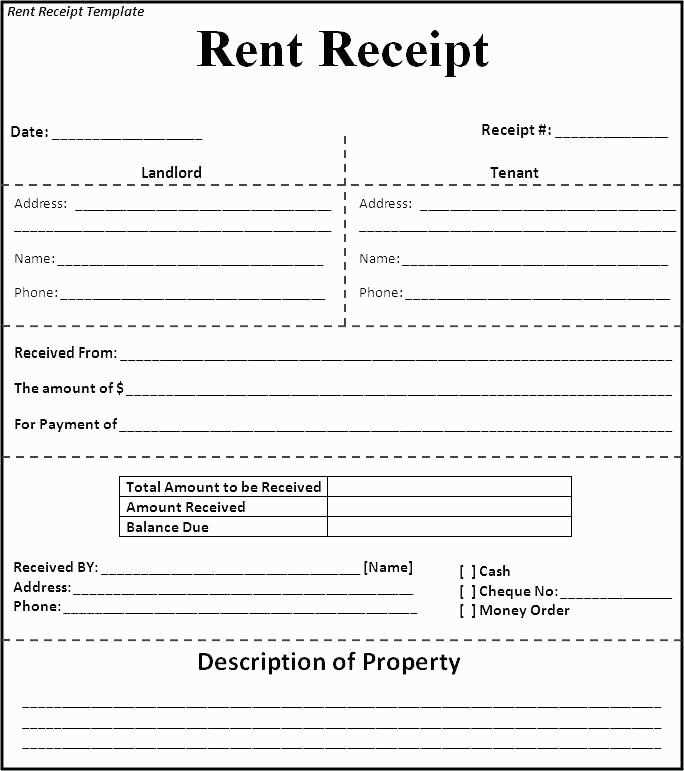

List all incoming funds, categorizing them by source. This can include payments from customers, loans, grants, or investments. Each entry should have the following details:

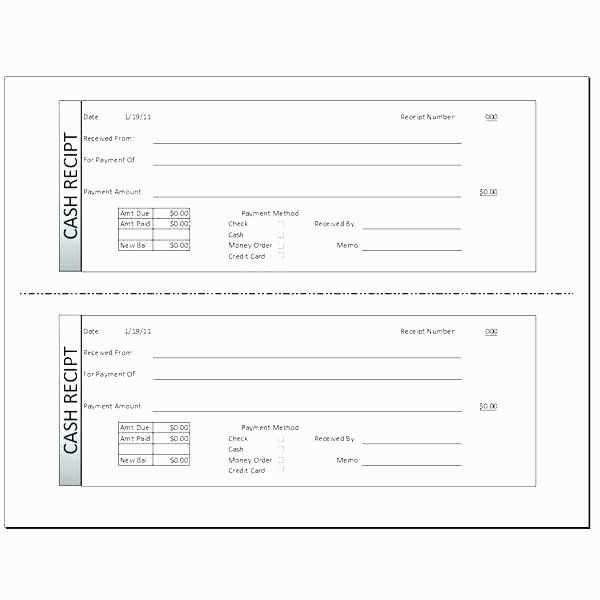

- Date: Indicate the date of the transaction.

- Source: Specify the party or entity providing the funds.

- Amount: Clearly state the amount received.

- Method: Specify how the funds were received (e.g., cash, check, bank transfer).

2. Disbursement Section

Track all outgoing payments with similar detail as the receipt section. Disbursements might include payments for services, salaries, or loan repayments. Include:

- Date: Indicate the date of the transaction.

- Payee: Identify the individual or entity receiving the payment.

- Amount: Specify the amount paid.

- Purpose: Clarify what the payment was for.

- Method: Indicate the method of payment (e.g., cash, bank transfer).

3. Balancing Section

Ensure the totals from receipts and disbursements are properly summed up. The difference between total receipts and total disbursements will indicate the net balance. This section is crucial for tracking whether your funds are increasing or depleting.

4. Transaction Reference Numbers

Each transaction should be associated with a unique reference number for easy tracking and auditability. This helps maintain an organized system for record-keeping.

5. Notes and Explanations

If there are any unusual transactions or discrepancies, make sure to provide explanations. These could relate to payments that might be higher than usual, refunds, or adjustments that affect your financial reporting.

6. Totals and Summaries

At the end of the statement, provide a summary table for quick reference, showing the total receipts, total disbursements, and the net balance for the period covered.

| Category | Amount |

|---|---|

| Total Receipts | $10,000 |

| Total Disbursements | $7,500 |

| Net Balance | $2,500 |

These elements make it easier to review the statement and ensure accuracy in your financial reporting.

Begin with clear categories: Create separate sections for receipts and disbursements. This helps in organizing data and tracking both inflows and outflows efficiently. Label each section with a specific title, such as “Receipts” and “Disbursements,” followed by subheadings for relevant details, such as date, source or payee, amount, and description.

Use columns for easy comparison. For instance, in the receipts section, include columns like “Date,” “Source,” “Amount,” and “Payment Method.” Similarly, for disbursements, use “Date,” “Payee,” “Amount,” and “Expense Category.” This structure ensures every transaction is recorded with clarity and consistency, making it easier to track financial movements.

Be consistent with data entry. Always maintain the same format for amounts, dates, and descriptions. Using a standard currency format (e.g., $1,000.00) and a consistent date format (e.g., MM/DD/YYYY) avoids confusion. Keep the descriptions brief but informative to ensure every transaction is easily understood at a glance.

Include a running balance. For both receipts and disbursements, track the balance after each entry. This helps you see the financial impact of each transaction and provides an ongoing overview of your cash flow. You can add a “Balance” column next to each entry, updating it after each receipt or disbursement.

Conclude each section with a total. Summing up the receipts and disbursements at the bottom of their respective sections provides a clear overview of the financial activity. This makes it easy to compare total receipts against total disbursements and quickly identify any discrepancies.

Avoid mixing income and expenses from different periods. Each statement should only reflect transactions within the specified reporting period. Mixing amounts from multiple periods leads to confusion and errors in financial reporting.

Ensure all receipts and disbursements are documented. Omitting even a small transaction can distort the final figures. Double-check every entry to prevent incomplete reporting.

Don’t neglect to reconcile the statement with bank records. Failure to match figures with actual bank transactions can cause discrepancies that may go unnoticed, leading to financial mismanagement.

Be cautious with rounding. Even minor rounding errors can add up, especially when dealing with large sums. Stick to precise figures to avoid inaccuracies in the final amounts.

Do not leave out necessary categories. Ensure all required sections are included, such as receipts, disbursements, and adjustments. Missing categories may prevent the statement from fulfilling its intended purpose.

Refrain from using unclear descriptions. Each transaction should have a detailed and understandable description to prevent ambiguity. Vague labels can make it difficult to track the origin or purpose of funds.

Receipt and Disbursement Statement Template

A receipt and disbursement statement template allows for easy tracking of financial transactions. It helps organize and document the receipt of funds and the disbursement of expenses, making financial oversight clear and manageable.

Key Components of the Template

- Date: Always include the date for each transaction to maintain an accurate timeline.

- Transaction Description: Provide a clear description of the nature of each transaction, whether it’s income or expenditure.

- Amount: List the exact amount of money received or disbursed for each transaction.

- Payment Method: Specify the method used for each transaction, such as cash, check, or bank transfer.

- Balance: Maintain a running balance of funds after each transaction to track available money.

- Account: If relevant, include the specific account where the funds are held or from which they were disbursed.

Tips for Using the Template Effectively

- Regular Updates: Keep the statement up to date, recording each transaction promptly.

- Clarity: Use simple and clear descriptions to avoid confusion later.

- Consistency: Apply the same structure to every entry, so the statement remains easy to follow.

- Track Trends: Regularly review the statement to identify any patterns in income or spending.

- Reconcile Periodically: Cross-check your statement with bank records to ensure accuracy.