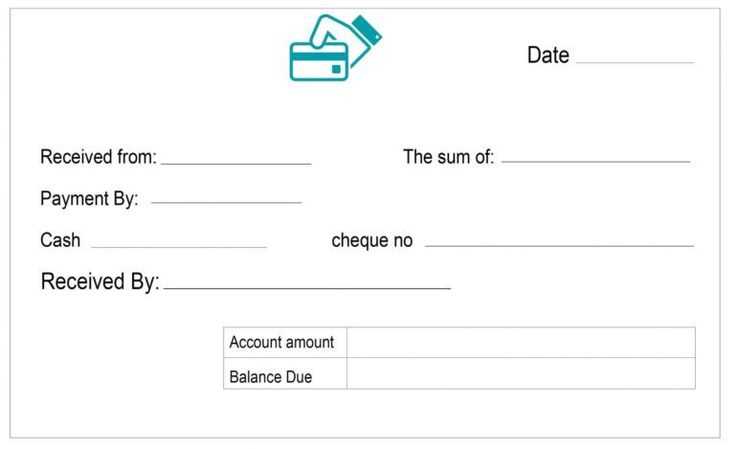

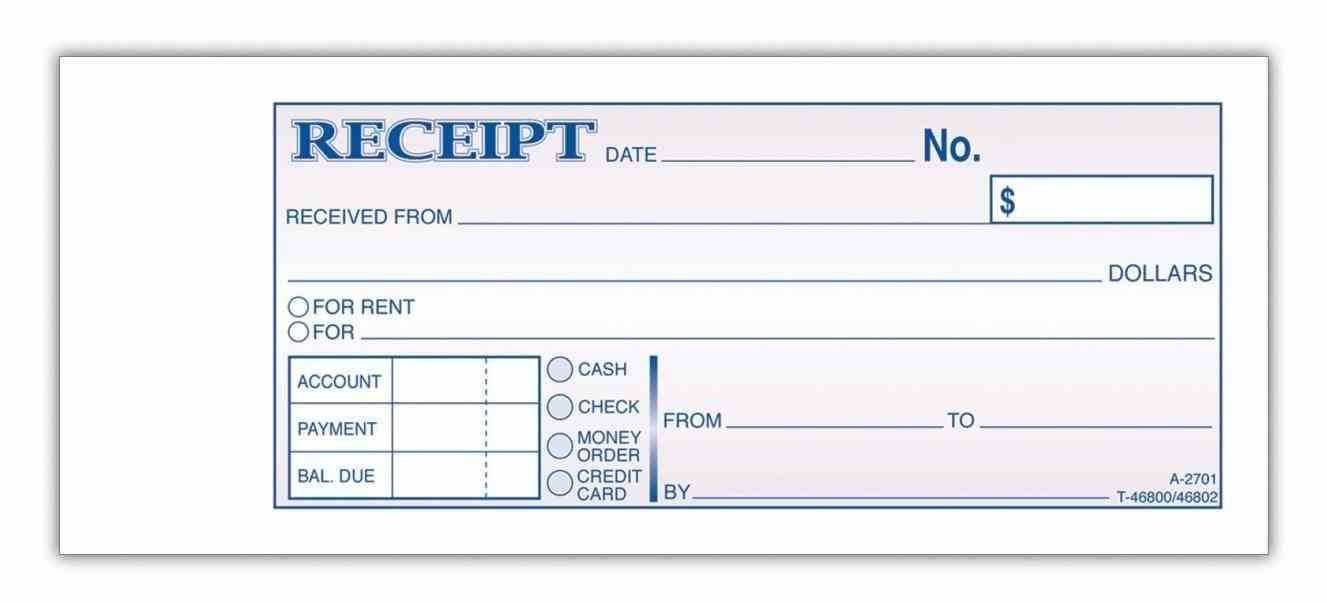

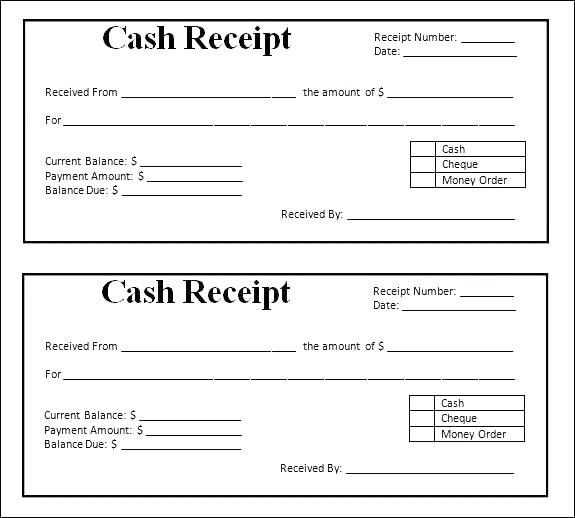

A receipt for a check template should include key details such as the check number, date of issue, amount, and payee name. This structure helps ensure that both the payer and payee have clear documentation of the transaction. Always include the check’s written amount and a description of the purpose of payment if applicable. The layout should be simple yet complete, offering all necessary information at a glance.

Include the following details in your receipt: the check number at the top, followed by the payee’s name and address, along with the payer’s name and address if relevant. Ensure the payment amount appears both numerically and in words, ensuring clarity for all involved parties. Always add a section for any additional notes that may be necessary to describe the transaction clearly.

When drafting the template, focus on clarity. Use a consistent font size and layout to ensure that all important information is easy to find. Space out the different sections so each element stands out. This way, the recipient can quickly reference the payment details if needed in the future.

Here’s the corrected version:

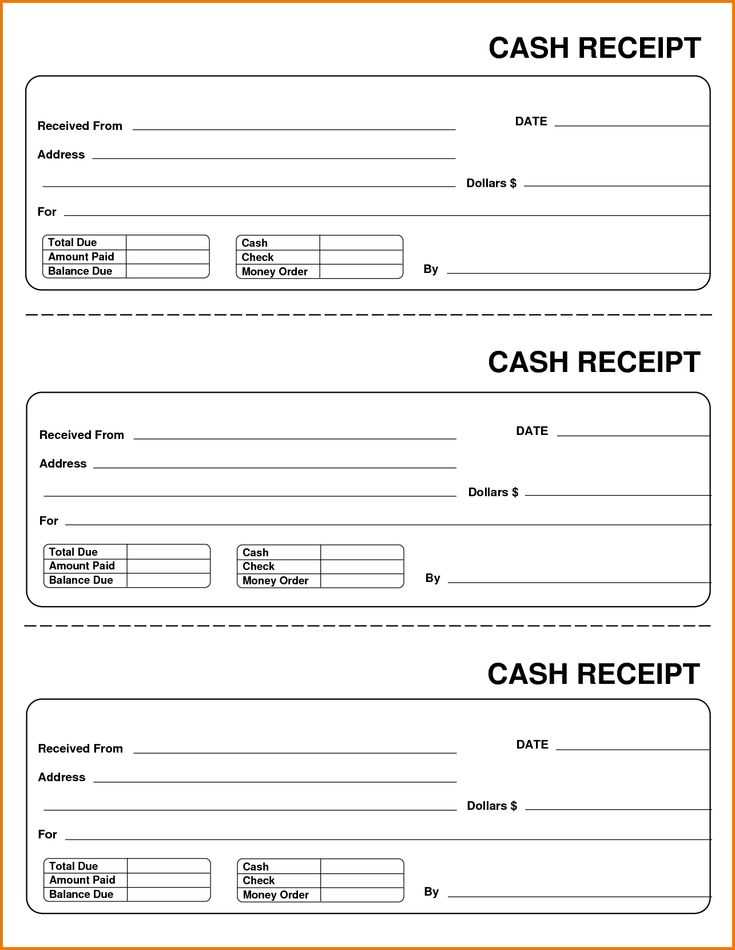

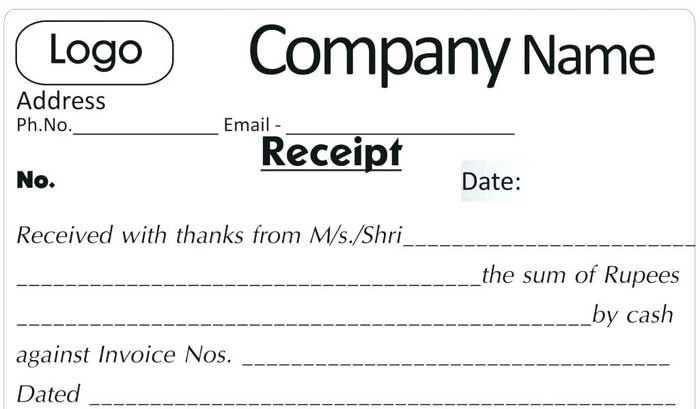

Ensure the receipt template includes all the key details. Start with the store name, address, and contact information at the top. Clearly label the receipt with “Receipt” or “Sales Receipt” for easy identification. Then, include the transaction date, item descriptions, quantities, and prices. Always calculate the total amount at the bottom and include the payment method used, such as cash, card, or digital payment. Finish with a thank-you note or return policy for customer satisfaction. Make sure the layout is clear and easy to follow, with appropriate spacing between sections for readability.

Receipt for Check Template: Practical Guide

How to Create a Professional Receipt for Payment by Check

Customizing Your Receipt for Various Payment Scenarios

Legal Considerations When Issuing a Receipt for Check Payments

To create a professional receipt for a check payment, include key details such as the payee’s name, the amount paid, the check number, and the date of receipt. Clearly state that the payment was made by check and specify the check’s issuing bank. This helps to avoid confusion and provides a clear record of the transaction.

Customizing Your Receipt for Various Payment Scenarios

Tailor the receipt for different payment situations by adding fields for specific items or services paid for. If the payment involves multiple installments, include a breakdown of each payment and a running total. If a deposit was made in advance, clearly state this on the receipt, along with any remaining balance owed.

Legal Considerations When Issuing a Receipt for Check Payments

Ensure that the receipt complies with local laws by including appropriate disclaimers, such as stating that the payment is considered final once the check clears. Additionally, keep a copy of the receipt for record-keeping purposes, as it may be necessary for tax or auditing reasons.