Creating a Simple and Clear Receipt

A receipt for hay should include specific details to ensure clarity and accountability. Include the date of the transaction, the seller’s and buyer’s contact information, and a description of the hay purchased. Be sure to list the quantity, price per unit, and any applicable taxes or discounts. This transparency ensures both parties are on the same page.

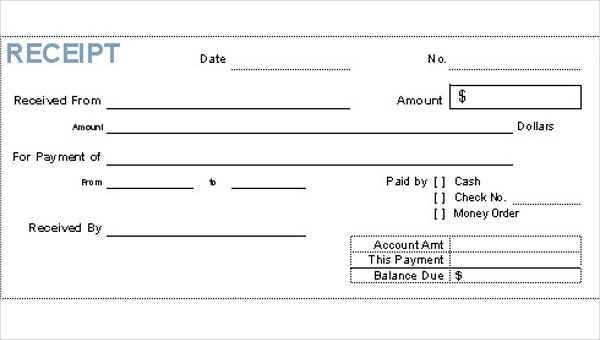

Basic Receipt Structure

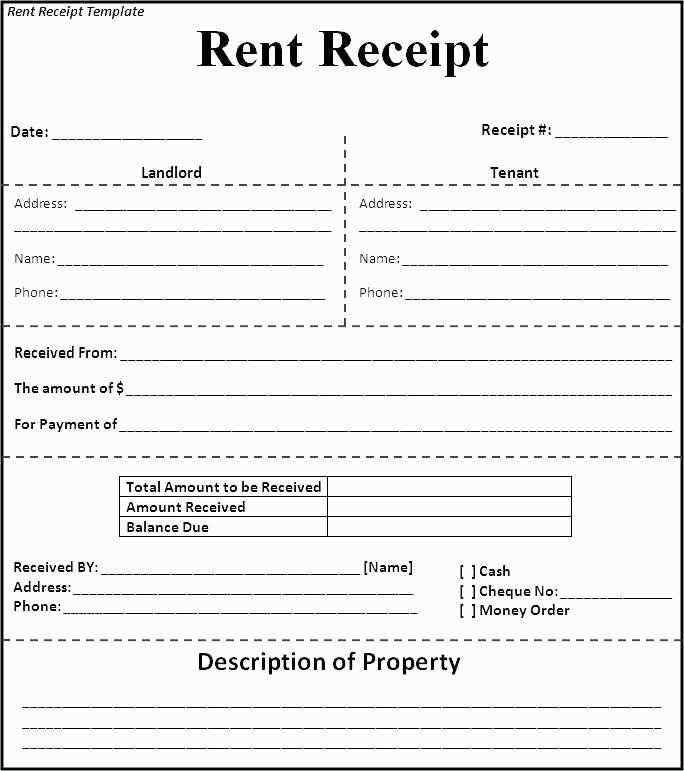

- Date of Purchase: Record the exact date the transaction took place.

- Seller Information: Include the name, address, and contact details of the seller.

- Buyer Information: Include the buyer’s name and contact details.

- Hay Description: Clearly describe the type of hay, including its weight, grade, and any other relevant details.

- Price Details: List the price per unit and the total cost.

- Payment Method: Specify how the buyer paid for the hay (e.g., cash, credit, check).

- Signature: Both parties should sign the receipt to confirm the transaction.

Additional Tips for Customizing Your Receipt

- Include Delivery or Pickup Details: If applicable, note the delivery method, location, or pickup time to avoid confusion.

- Provide Terms and Conditions: If there are any specific conditions or guarantees regarding the hay, include them on the receipt.

- Use a Simple Layout: Keep the layout straightforward, ensuring all key details are easy to find.

- Maintain a Copy for Records: Always keep a copy of the receipt for both the buyer and seller for future reference.

Receipt for Hay Template: Practical Guide

Creating a Basic Format for Hay Sales Receipts

Key Information to Include: What to List on Your Receipt

Adding Payment Details to Your Hay Receipt

Customization Tips for Adapting the Receipt to Your Business

Ensuring Legal Compliance: Essential Elements on a Receipt

Common Errors to Avoid When Issuing Hay Receipts

Include the Following Key Details:

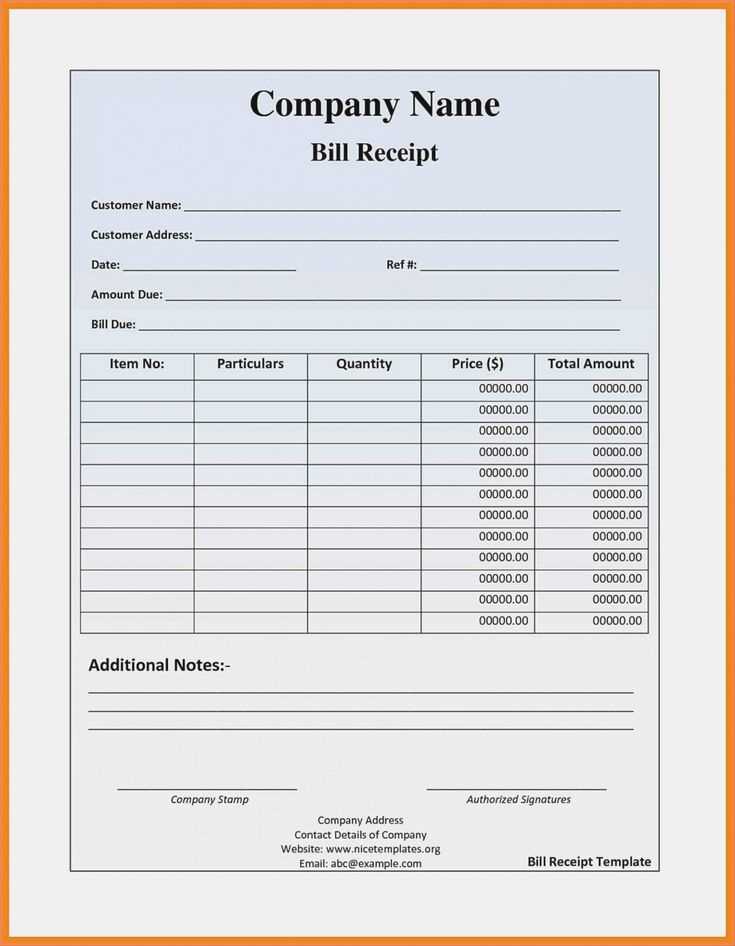

The receipt should clearly list the buyer’s name, contact information, and the items purchased. Specify the amount of hay sold, the price per unit, and the total amount due. The date of the sale is a must, along with a unique receipt number for tracking purposes.

Adding Payment Details

Clearly document how the buyer paid–whether through cash, card, or another method. Record any transaction fees or discounts applied to avoid confusion later. It’s also helpful to include the transaction reference number for electronic payments, should any issues arise.

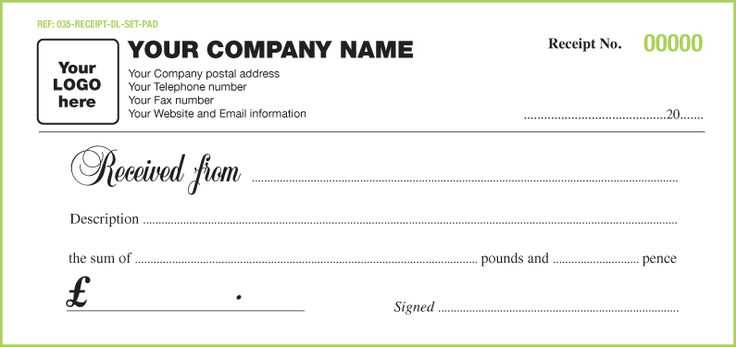

Customizing the Template for Your Business

Make sure the receipt aligns with your brand by adding your business name, logo, and contact details. You might also want to include specific fields for delivery details or additional services, such as transportation or bundling options. A clean, professional design will ensure the document is easy to read and trust-inspiring.

Ensuring Legal Compliance

Check local regulations regarding sales receipts. Include necessary tax information such as sales tax rate and the amount collected. If you offer refunds or exchanges, include your policy or reference a link to your terms of service. The receipt should comply with both local and national financial reporting standards.

Common Errors to Avoid

Be cautious of incorrect calculations, missing payment details, and incomplete buyer information. Double-check the amounts and ensure the receipt reflects accurate pricing. Always issue a receipt for each transaction to avoid any future discrepancies.