When creating a receipt for a purchased item, clarity is key. A well-structured template not only provides essential information to the buyer but also ensures compliance with business standards. Use clear, concise sections such as item description, price, taxes, and total amount to avoid confusion. Including the date of the transaction and contact details can enhance transparency and trust.

Make sure to specify the quantity and unit price for each item listed. This helps customers confirm what they paid for and in what quantity. You can also add space for discounts, promotional codes, or any additional fees to give a complete breakdown. For electronic receipts, ensure that the formatting is easily readable, whether viewed on a computer or mobile device.

Including your company’s name, address, and payment method details can further professionalize the receipt. Don’t forget to add a unique receipt number for easy tracking and reference. This ensures that both parties have a clear record of the transaction.

Here’s the revised HTML outline with reduced word repetition while preserving the meaning:htmlEdit

Begin with a clear title that specifies the transaction, such as “Receipt for [Item Name] Purchase.” This will help avoid ambiguity when reviewing the receipt later. Then, include the seller’s name and contact details, followed by the buyer’s information. Make sure to list the date and time of the transaction, as this serves as a record of the purchase. Keep item descriptions brief but clear, with quantities and prices for each listed. Use bold for totals to highlight the final amount and make it easy to find at a glance.

To finalize, include a payment method section, indicating how the transaction was completed (e.g., credit card, cash). If applicable, also add any discounts or taxes applied to the total. If a return policy or warranty is in place, briefly mention these terms at the bottom of the receipt to avoid confusion later on. Finally, ensure there’s a footer with the store’s terms or additional instructions, making the document complete and professional.

Choosing the Right Format

Pick a receipt format that aligns with your business and customer needs. A simple text format works well for small transactions, while more detailed invoices are suited for larger purchases or businesses requiring itemized lists. PDF formats are widely used for formal receipts because they ensure consistent formatting across devices. For digital receipts, choose email or app-based formats to save on paper and make retrieval easier for your customers.

If you are offering receipts through your website or e-commerce platform, ensure they are mobile-friendly. Many users access receipts on smartphones, so the format must be legible and easy to navigate. When considering file size, keep it manageable to avoid issues with email delivery or loading times for users.

For physical receipts, make sure the printed text is clear and concise. Avoid overcrowding the receipt with unnecessary information. Choose a format that is easy to read and includes the necessary transaction details, such as date, itemized list, and total amount. Consistency is key for both digital and paper formats to maintain professionalism.

Learn how to pick the best format for your receipt.

Choose a format that matches the type of transaction and the needs of your customer. For quick purchases, a simple, short format works best, displaying key information like the item name, price, and date. For more complex transactions, include additional details such as payment method, discount applied, and tax breakdown.

If you’re using digital receipts, ensure they are easy to read and navigate. Offer a PDF version that can be saved or printed. Keep the layout clean, with clear sections for each piece of information. Avoid overwhelming your customers with unnecessary details. Keep the receipt uncluttered and focused on the essentials.

For physical receipts, consider using a format that is easy to store and manage, especially for businesses that issue many receipts daily. Standardize the layout to make it easier for both your team and customers to find the information they need quickly.

Lastly, be mindful of your branding. Make sure your logo, contact details, and any promotional offers are displayed clearly, but avoid overcrowding the receipt. The format should enhance the experience, not distract from the main details.

Key Elements to Include

To create a clear and functional receipt, include the following elements:

- Business Name and Contact Details: Display the name, address, phone number, and email of the store or service provider. This helps customers identify where the transaction took place and how to reach the business if necessary.

- Receipt Date and Time: Make sure to record the exact date and time of purchase. This ensures the receipt serves as a time-stamped record of the transaction.

- Unique Receipt Number: Assign a distinct number to each receipt for easy reference. This is useful for both businesses and customers in case of returns or exchanges.

- List of Purchased Items: Include the name, quantity, and price of each item bought. This provides clarity and ensures the customer understands what was purchased and the price breakdown.

- Tax Information: If applicable, specify the tax rate and total tax amount. This helps both the business and the customer keep track of tax obligations.

- Total Amount Paid: Clearly state the total cost of the purchase, including any taxes or fees. This avoids confusion and confirms the final amount owed.

- Payment Method: Indicate how the payment was made, whether by cash, card, or other methods. This adds transparency and clarity to the receipt.

Optional Information

- Discounts or Promotions: If any discounts or special offers were applied, list them. This shows customers the exact savings they received.

- Return or Exchange Policy: Provide a brief reminder of the store’s policy regarding returns or exchanges, so customers are informed.

- Loyalty Program Information: If relevant, include details about loyalty points or membership benefits that the customer may have earned with their purchase.

What essential information should be on your receipt?

A receipt should include the business name and contact details. This allows customers to reach out if needed. Include the transaction date and time to track purchases accurately. Clearly list the items bought with their prices and quantities, so it’s easy to verify the purchase. Show the total amount paid, including any taxes and fees. If applicable, add details about payment methods–cash, card, or digital–so it’s clear how the transaction was completed. Lastly, ensure there’s a unique transaction or receipt number for reference. This helps in case of returns or inquiries later on.

Designing a Custom Template

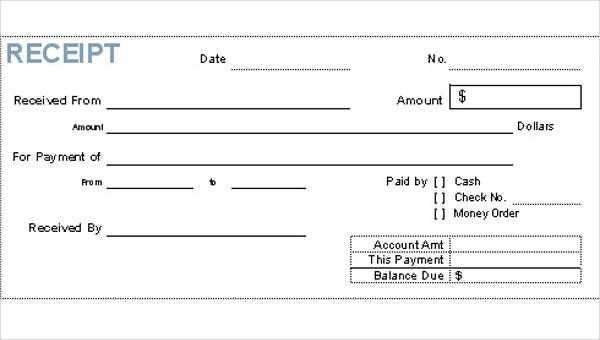

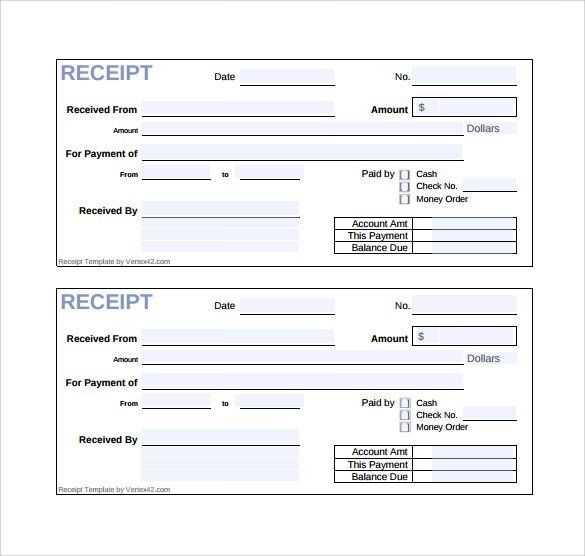

Create a custom receipt template by focusing on the key elements. Ensure it clearly displays necessary transaction details. The most important sections to include are:

- Company Information: Include your business name, address, and contact details at the top.

- Item Details: List each item purchased with its description, quantity, price, and total cost.

- Payment Information: Add the method of payment and transaction number for future reference.

- Taxes: Clearly show applicable taxes, including tax rates and amounts.

- Total Amount: Display the grand total, ensuring it’s easily visible.

Customizing the Layout

The layout should be clean and easy to read. Use clear headings and adequate spacing between sections to avoid clutter. Organize the template with a grid system that aligns information properly for better readability.

Adding Branding

Incorporate your logo and brand colors to make the receipt more professional. Use consistent fonts and styles that align with your business’s visual identity. Keep the design simple and avoid using too many fonts or graphics that could distract from the transaction details.

Steps to create a personalized receipt layout.

Choose a simple, clean design. Focus on essential details, such as store name, date, items purchased, and total amount. Use legible fonts and avoid overcrowding the space.

Ensure your layout is consistent. Keep the alignment of text and prices uniform to make it easy to read. Use headers for sections like “Item Description,” “Quantity,” and “Price” to separate different types of information.

Incorporate branding elements. Add your store logo and select a color scheme that matches your business identity. Make sure the design doesn’t distract from the necessary details.

Set up placeholders for dynamic content. Include variables for the transaction number, item list, and customer details. This makes the receipt adaptable for different purchases.

Test the layout. Print out sample receipts to ensure that the design fits well on standard paper sizes and the information is clear. Adjust any elements that may be too close together or difficult to read.

Digital vs. Paper: Pros and Cons

Digital receipts offer immediate access and are easy to store in organized folders, reducing the risk of losing them. They take up no physical space and can be accessed at any time, allowing for better tracking of purchases. However, some might find it hard to locate a specific receipt without a good filing system or might worry about security and data breaches.

Paper receipts are tangible and do not rely on technology. They are useful when internet access is unavailable or in case digital systems fail. However, paper receipts can fade over time, especially when exposed to heat or sunlight. They also take up physical space and can easily be misplaced, which may require keeping a separate system for storing and organizing them.

Comparing the advantages and disadvantages of digital and physical receipts.

Digital receipts offer the convenience of easy storage and retrieval, reducing the clutter of paper receipts. They are often automatically saved in emails or apps, making them accessible at any time. However, their reliance on technology means that issues such as email clutter or app compatibility can occasionally cause difficulties in accessing them when needed.

Physical receipts, on the other hand, provide immediate proof of purchase and do not require digital devices to store or view them. However, they are prone to fading over time, and keeping them organized can be challenging, especially for long-term storage. Physical receipts also take up space and can contribute to environmental waste.

Here’s a breakdown of the key points to consider:

| Aspect | Digital Receipts | Physical Receipts |

|---|---|---|

| Convenience | Easy to store and access through apps or emails. | Can be stored instantly without any tech requirement. |

| Environmental Impact | Eco-friendly, as no paper is used. | Contributes to paper waste. |

| Durability | Can be lost due to email issues or app glitches. | Can fade over time or be damaged by water. |

| Storage | Requires device storage or cloud service. | Takes up physical space and requires organization. |

| Security | Vulnerable to hacking if not properly secured. | No online threats, but can be lost or stolen easily. |

Choosing between digital and physical receipts depends on what is most important to you–whether it’s accessibility and eco-friendliness or immediate and straightforward documentation. For long-term storage or for avoiding potential tech issues, physical receipts might be a better option, while digital receipts are ideal for convenience and reducing paper waste.

Editing and Updating Your Template

To modify your receipt template, open the document in your chosen editor. Identify sections that need to be updated, such as the item description, pricing, or store details. Make changes directly within the corresponding fields, ensuring accuracy in every part.

Adjusting Layout and Design

If the layout requires tweaking, focus on organizing the information clearly. You can resize text boxes, change font styles, or adjust margins to make sure the details are presented neatly. Keep in mind the user experience, making the template easy to read and understand.

Updating Information Automatically

If you are using dynamic fields (e.g., for prices or dates), ensure they are properly linked to the relevant data sources. This can save time by automatically updating values based on your input or transactions.

| Section | Common Updates | Notes |

|---|---|---|

| Item Description | Modify names, quantities, or details of items | Ensure accuracy to avoid confusion |

| Pricing | Change unit prices, discounts, or taxes | Double-check calculations |

| Store Details | Update address, contact info, or branding | Confirm all contact info is current |

How to modify and improve your receipt template for future use.

Adjusting your receipt template for better functionality starts with simplifying the layout. Keep key information like item names, prices, and totals clear and easy to locate. If you include a transaction ID, ensure it stands out for easy reference. Consider adding or modifying sections like tax breakdowns, payment methods, and discount applications to reflect changes in your business practices or local regulations.

Make the design more user-friendly.

Use a clean, readable font and avoid cluttering the receipt with unnecessary details. Group similar information together (e.g., subtotal, tax, total) so that the customer can quickly review their purchase. It’s also helpful to add sections that guide the customer, such as instructions for returns or how to contact support, without overwhelming the main content.

Incorporate flexibility for different transaction types.

Adapt the template to suit various payment methods, such as cash, card, or digital payments. Include a section for the payment method used and make room for any additional fees that may apply in the future. This flexibility will ensure your receipt template stays relevant as your business or customer needs change.

Best Practices for Storing Receipts

Organize receipts by category to make retrieval easier. Create separate folders for business, personal, or tax-related expenses. Label each folder clearly to avoid confusion later.

Use a consistent method for storing receipts. Whether you prefer paper or digital formats, consistency ensures better organization and reduces the chances of losing receipts.

If you opt for paper receipts, keep them in a dry, cool place to prevent damage. Consider using plastic sleeves or file folders for protection.

For digital receipts, scan or photograph each receipt immediately after purchase. Store them in a cloud-based system with clear naming conventions. For instance, use the date and item name in the file name for easy identification.

Set reminders to review and archive receipts periodically. This helps you keep track of purchases and makes it easier to find them when needed for returns or tax purposes.

Here are some tips for organizing digital receipts:

- Use cloud storage platforms for secure backup.

- Organize receipts into subfolders based on categories or months.

- Label files with keywords for quick searchability.

Ensure your storage solution complies with any legal or tax requirements for keeping receipts. This may vary depending on your location and the purpose for which you’re keeping the receipts.

Effective methods for organizing and keeping your receipts safe.

Store receipts in labeled envelopes or file folders. Assign categories such as “electronics,” “groceries,” or “home improvement” to help you locate them quickly when needed.

Digital organization with cloud storage

Take pictures of receipts with your phone and store them in a cloud storage service. Label each image with the date and purpose to easily search through your receipts later. This method reduces the risk of physical damage or loss.

Using receipt-tracking apps

Consider using a receipt-tracking app that automatically stores and organizes digital copies. Many apps offer features like scanning barcodes and categorizing expenses for easy access.

This version reduces repetition while keeping the content clear and focused.

Streamline your receipt template by eliminating unnecessary elements. Keep only the key details like item name, price, and date of purchase. Remove redundant descriptions and avoid overloading the template with too much information.

Use bullet points for a clean layout that highlights essential details, such as transaction number and store contact information. Ensure the structure is intuitive–group similar items and keep related information close together for easy reading.

Consistency in font size and style ensures the template remains professional and legible. Minimize distractions by avoiding excessive use of bold or underlined text. Focus on clarity, and ensure all important data stands out without repetition or clutter.