Using a receipt template for tax purposes streamlines the process of maintaining proper records for your business. A well-structured receipt ensures that all necessary details are captured for tax reporting, making it easier to track your income and expenses. This not only helps with transparency but also keeps your financial activities organized and compliant with regulations.

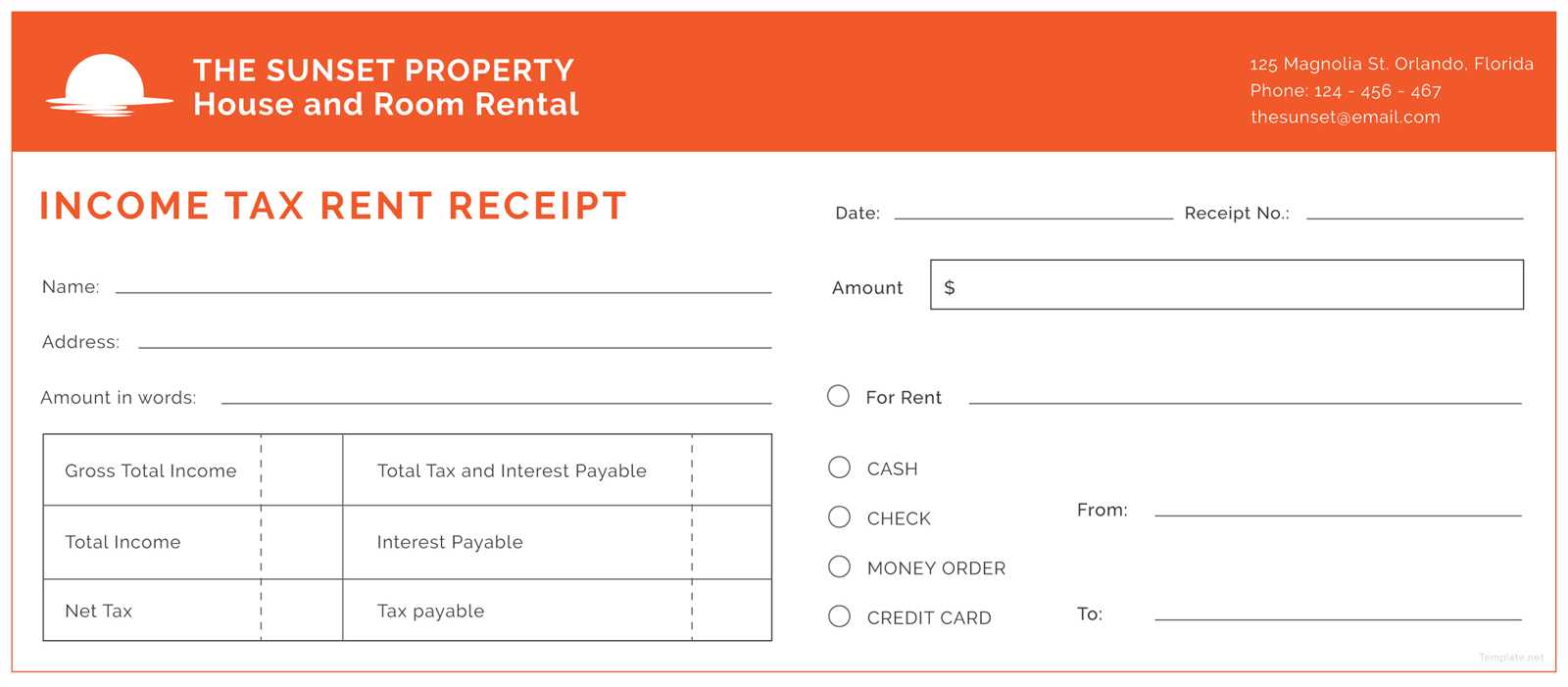

Start by including basic information such as the date of transaction, the name of the buyer and seller, a description of the product or service provided, and the total amount paid. Including the applicable tax rate and the amount of tax collected is important for both parties to stay on top of tax obligations. A receipt should also specify the method of payment, which provides further clarity on the transaction.

It’s advisable to store these receipts digitally or in a physical archive for easy retrieval during tax season. By doing so, you can ensure that you are ready to file your taxes without delays or confusion. Keeping accurate records throughout the year will save you time and help you avoid costly mistakes when preparing your taxes.

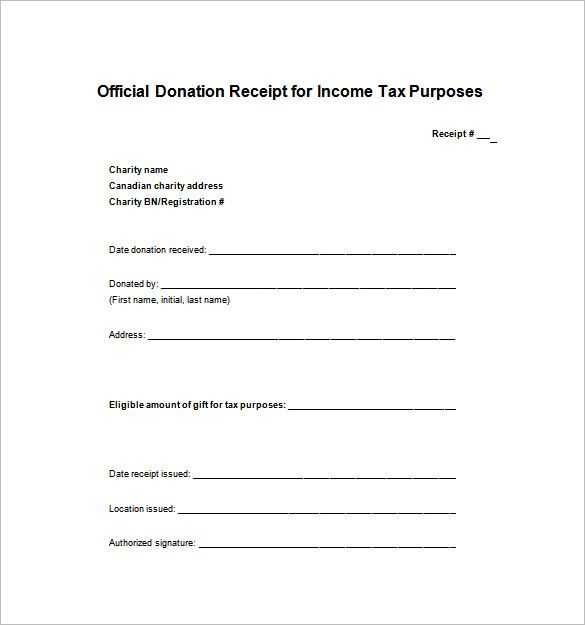

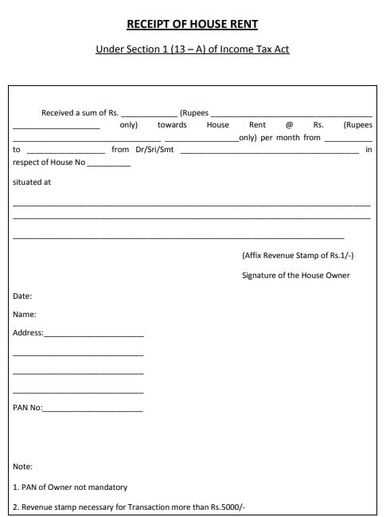

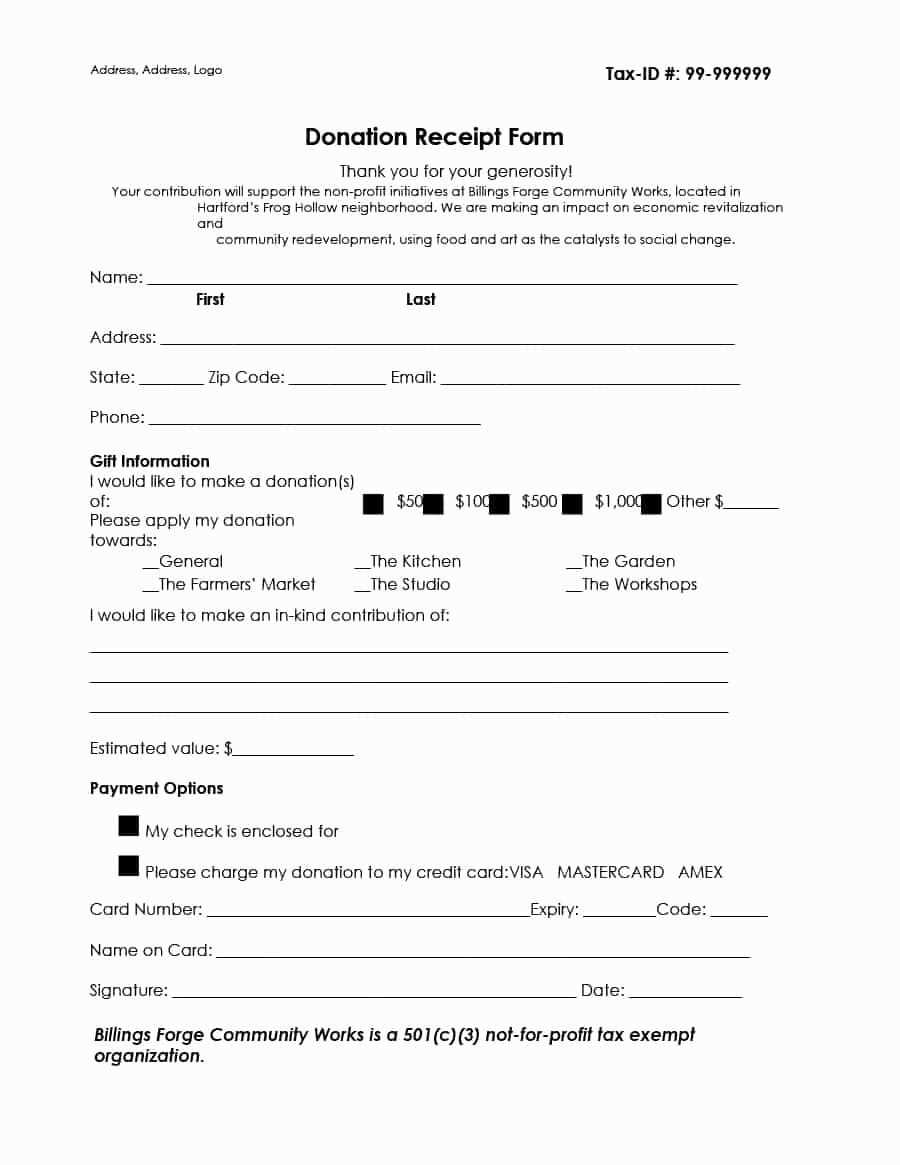

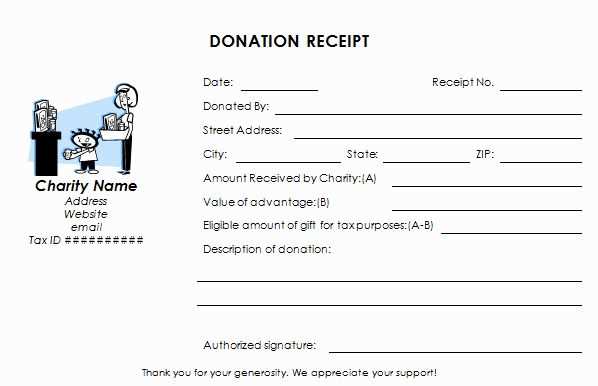

Receipt for Tax Purposes Template

When creating a receipt for tax purposes, ensure that it includes all necessary details to maintain clarity and compliance. A well-organized receipt provides transparency and helps you track your financial activities efficiently.

- Business Information: Include your full business name, address, phone number, and tax identification number (TIN). This helps identify your company for tax reporting.

- Customer Details: Add the customer’s full name and contact information to confirm who made the purchase.

- Transaction Date: Record the exact date of the transaction. This is critical for tax filing and auditing purposes.

- Description of Goods or Services: List the products or services provided. Be specific and clear about what was purchased, including quantities and unit prices.

- Subtotal and Tax Amount: Clearly show the subtotal, applicable tax, and the total amount paid. Specify the tax rate used if necessary.

- Payment Method: Indicate how the payment was made (e.g., cash, credit card, bank transfer) to document the transaction method.

Ensure all figures are legible and that the template is easy to understand. This format will help streamline your tax reporting and reduce potential issues with audits or discrepancies.

How to Create a Tax-Ready Receipt Format

Begin by including clear details about your business, such as the name, address, and tax identification number. This helps authorities verify your company’s legitimacy and ensures the receipt complies with tax requirements. Place this information at the top of the receipt for easy access.

Include Itemized Information

List each product or service purchased, along with the corresponding price and tax rate applied. This breakdown is necessary for both the buyer and tax authorities to understand the transaction. Be sure to include the date of purchase and the total amount paid, inclusive of taxes, at the bottom of the receipt.

Provide Payment Method and Terms

Clearly state the payment method used (e.g., credit card, cash, bank transfer) and, if applicable, any payment terms. For example, if there is a payment plan, specify the amount paid upfront and any balance due. This adds transparency and supports your tax reporting.

Customizing the Template for Different Business Needs

Adjust the layout to match your business’s unique requirements. For example, if you run a service-based business, consider adding a section for hours worked or services rendered. For product-based businesses, ensure that product descriptions, quantities, and unit prices are clearly displayed. Modify the template’s fields to match your transaction details accurately.

Incorporate your branding elements. Customize the logo placement, font, and color scheme to make the template reflect your business’s identity. Consistent branding will improve the professionalism of the receipts and enhance customer recognition.

If you offer discounts or special pricing, include a separate line for discounts or promotions. This can help clarify pricing structures and avoid confusion for both the business and the customer.

Adjust tax information fields to fit local regulations. Make sure that tax rates, tax IDs, and applicable VAT fields are correctly formatted and visible. This will help maintain transparency and ensure compliance with tax laws.

For businesses with recurring billing, add a section for subscription details or payment intervals. This can include start and end dates for services, payment cycles, or subscription tiers.

Finally, review the template periodically to ensure it still meets your business needs. Adjust for any regulatory changes or shifts in your product or service offerings to keep the receipt template relevant and up to date.

Legal Considerations When Issuing Receipts for Tax Reporting

Ensure that receipts include the correct details, such as the date of the transaction, the name and address of the business, and a description of the goods or services sold. These elements help avoid discrepancies in tax reporting. Always include the total amount paid, specifying taxes where applicable, to reflect the true cost and allow proper tax deductions.

Verify that the receipt complies with local tax laws, including any specific formats or requirements set by tax authorities. Failing to do so may result in penalties or rejected claims during tax audits. Always check if there are additional obligations, like issuing receipts for certain types of transactions, especially in regulated industries.

Incorporate a tax identification number (TIN) or VAT number on receipts, as this is often required for businesses involved in taxable transactions. It helps verify that your business is registered and compliant with tax regulations. Ensure your business maintains proper records of all issued receipts, as tax authorities may request them during audits.

For digital receipts, ensure that they meet the same legal standards as paper ones. Digital receipts should be securely stored, and businesses must retain them for the required period, which varies depending on local tax laws.

Regularly review local tax laws to stay informed about any changes that could affect receipt issuance. Keeping up with these regulations is crucial for maintaining compliance and avoiding legal complications.