How to Use a Receipt Ledger

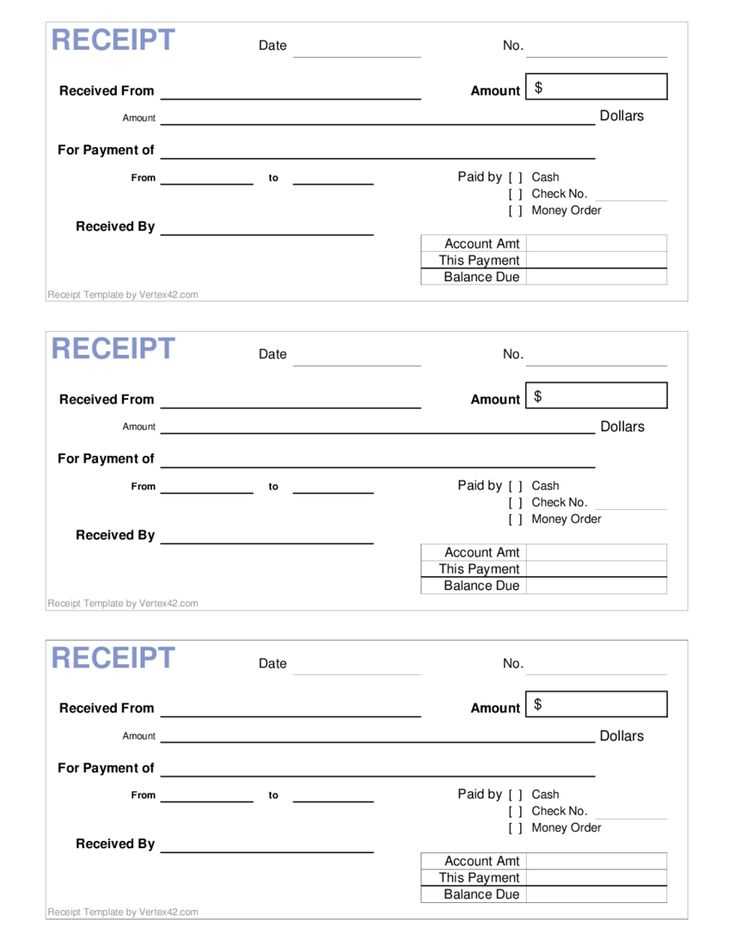

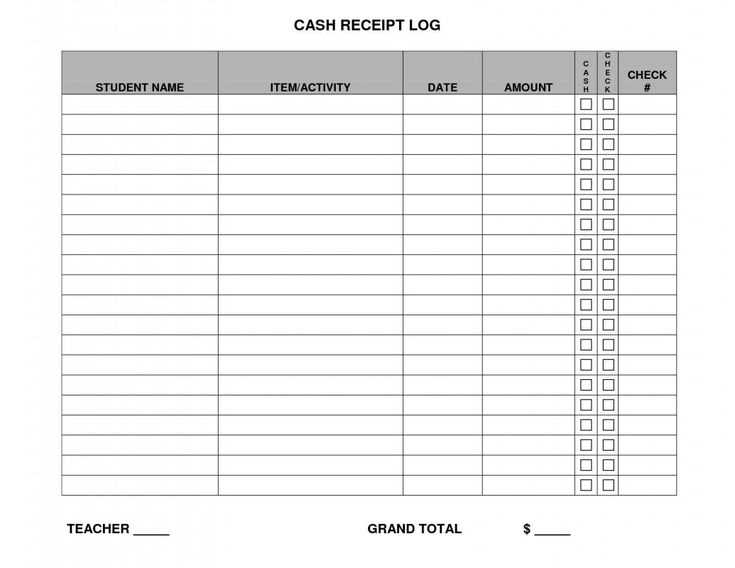

A receipt ledger helps keep track of transactions and provides an organized way to monitor income and expenses. This template is designed to easily record payments, ensuring clarity and accuracy. Fill in each field with relevant details to maintain a precise record.

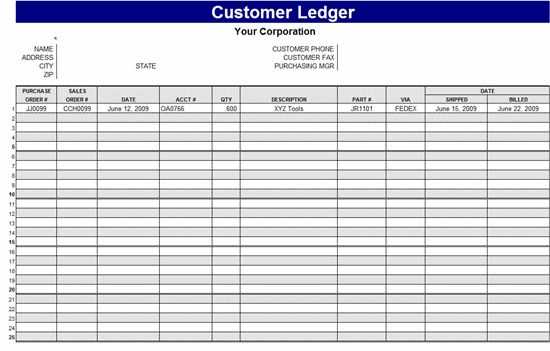

Template Structure

- Date: The date of the transaction.

- Receipt Number: Assign a unique identifier to each receipt.

- Payee/Payer: Name or business involved in the transaction.

- Description: A brief note about the nature of the transaction.

- Amount: The total amount of the transaction.

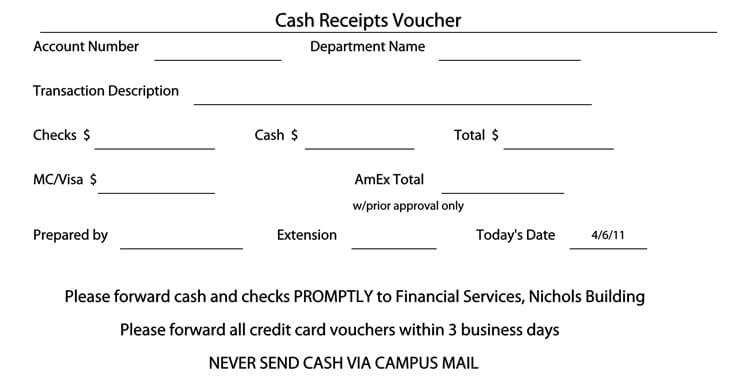

- Payment Method: Specify the form of payment used, such as cash, credit, or check.

- Category: Classify the transaction (e.g., sales, service fee, etc.).

- Notes: Additional details about the transaction, if needed.

Best Practices for Maintaining the Ledger

- Enter transactions promptly to avoid forgetting important details.

- Double-check amounts and categories for accuracy.

- Organize receipts by date for easy reference and tracking.

- Use separate ledgers for different categories if necessary (e.g., business and personal expenses).

Benefits of Using a Receipt Ledger

Tracking receipts through a ledger makes financial management simple and transparent. It helps with budgeting, tax preparation, and reviewing spending habits. By maintaining accurate records, you can quickly identify discrepancies and stay on top of your finances.

Receipt Ledger Template: Practical Guide

How to Set Up Your Ledger

Choosing the Right Format for the Template

Key Columns to Include in the Ledger

Tracking Payment Methods in Your Record

Tips for Organizing and Sorting Entries

How to Maintain and Update Your Ledger Regularly

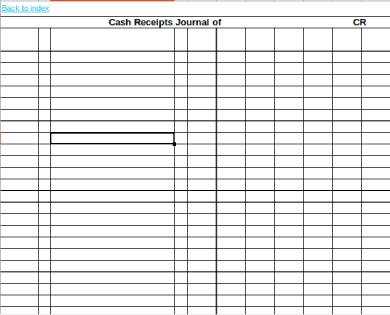

Begin by selecting a simple layout that allows for easy tracking. A basic receipt ledger typically includes columns for the date, description, amount, payment method, and balance. Customize these sections to suit your needs, ensuring that the structure supports your record-keeping goals.

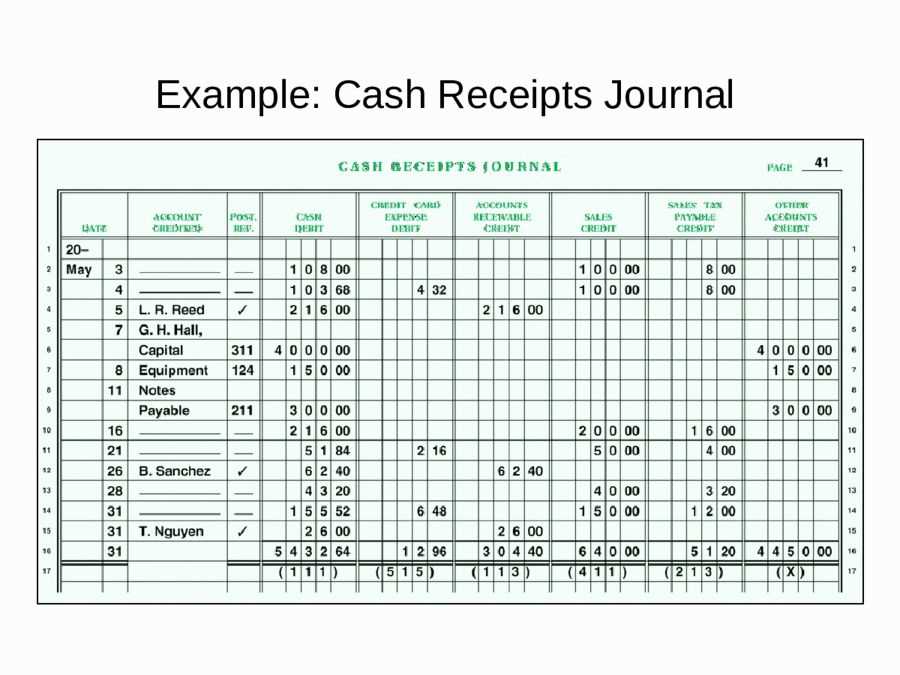

Choose a format that makes data entry easy and keeps the information readable. A spreadsheet can be highly effective, offering flexibility in organizing and sorting the data. Alternatively, use a paper ledger or accounting software, depending on your preference and the volume of transactions.

Key columns should include: the date of the transaction, a brief description of the item or service, the total amount, the method of payment (cash, credit card, bank transfer, etc.), and the running balance after each entry. These columns will provide a clear overview of the financial activity.

Tracking payment methods is critical for reconciling records with bank statements. Make sure to note the payment type next to each entry, especially for businesses that use multiple methods. This helps avoid confusion when reviewing payments and ensures accurate accounting.

Organize your ledger by sorting entries chronologically. This way, you can easily follow the flow of transactions. Additionally, consider using categories for larger ledgers (e.g., income, expenses, refunds) to keep everything neatly separated and searchable.

Regularly update your ledger after each transaction. Make it a habit to review and enter details daily or weekly. This will keep your records up-to-date and prevent backlog from accumulating. Double-check entries for accuracy to avoid discrepancies when reviewing balances later on.