A clear and structured receipt log helps maintain a smooth tracking process for all transactions. Record each purchase or payment by entering the date, amount, and description of the item or service. Use consistent categories to ensure all information is easy to reference later.

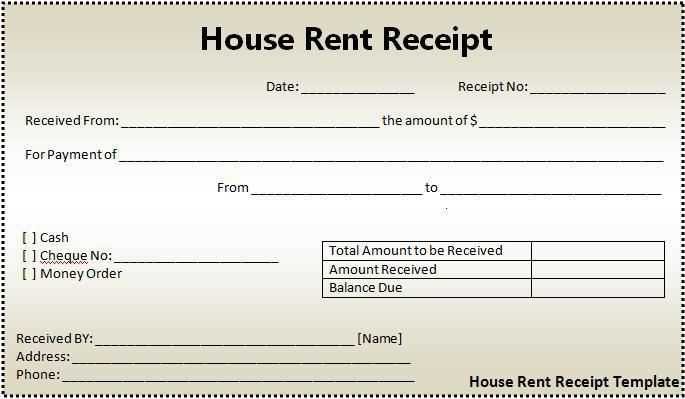

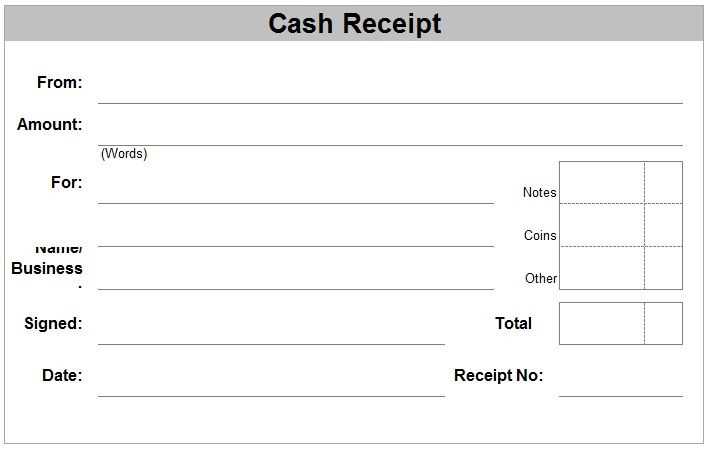

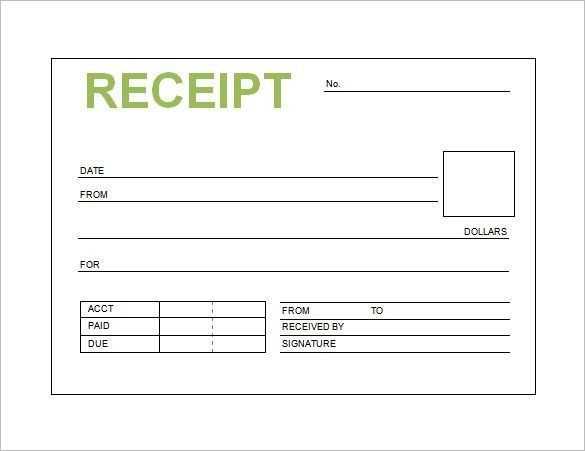

For maximum clarity, include the method of payment for each entry–whether it’s cash, credit, or bank transfer. This additional detail aids in reconciling accounts and understanding spending patterns. Always double-check entries to avoid discrepancies.

Include a unique identifier for each receipt, such as a reference number or transaction ID. This will make it simpler to locate specific receipts if further clarification is needed. Regular updates to the log help keep the records accurate and organized.

Stay consistent with formatting. A simple, straightforward layout improves readability and reduces the likelihood of mistakes. You can use tools like Excel or Google Sheets to easily create and manage your receipt log.

Here’s a revised version with minimal repetition:

To create a functional receipt log, structure the document in a way that provides clear, concise details. Use columns for essential data such as date, receipt number, vendor, amount, and payment method. This layout helps streamline tracking and ensures quick access to any transaction record.

Organizing the Data

Start with a column for dates, then list the receipt numbers sequentially. This makes it easier to cross-reference with bank statements or other documents. Include vendor names to quickly identify sources of expenses. The amount column should show both the total and any taxes or discounts applied, broken down clearly for transparency.

Optimizing for Readability

Keep the font size consistent and opt for a simple, legible typeface. Avoid clutter by limiting the amount of text and using rows that separate each entry distinctly. Make use of borders or shading for a clean, organized look.

Additional Tip: Consider adding a final column to indicate whether the payment has been completed or if it’s pending, providing a useful status update at a glance.

- Receipt Log Template: A Practical Guide

Use a receipt log template to keep track of purchases and payments easily. It helps organize data for quick reference and financial planning. Here are key components to include:

- Date: Record the date of the transaction to ensure an accurate timeline.

- Receipt Number: Assign a unique number to each receipt for easy tracking and future reference.

- Vendor/Store Name: Include the name of the business or individual from whom the goods or services were purchased.

- Description of Items/Services: List each item or service along with relevant details (such as quantity or unit price).

- Amount: Specify the total cost for each item and the overall purchase.

- Payment Method: Note how the payment was made (cash, credit card, etc.).

- Notes: Add any extra information, like warranty or return policy details, if applicable.

To ensure consistency, use the same format for every entry. A digital template with fields that automatically calculate totals can save time. Keep your log updated regularly, and review it at the end of each month for accuracy.

To create an organized receipt log, begin by choosing a clear format that works for you. Use a spreadsheet or a dedicated app with columns for the date, vendor, total amount, payment method, and item description. This makes tracking easy and keeps everything in one place.

Organize with Categories

Group receipts by categories like groceries, office supplies, or travel. This helps you quickly identify spending patterns and keep the log accessible for future reference.

Include Specific Details

For each entry, add notes such as purchase purpose or any warranty information. This detail makes the log valuable beyond simple record-keeping, ensuring all important info is accessible.

Assign each receipt to a clear category, such as office supplies, transportation, or meals. This helps maintain a structured system where receipts are easy to locate. Use simple labels that align with your spending habits, making sure each receipt can fit into one category without confusion.

Implement a consistent naming convention for each receipt. For example, label receipts with the date and category: “2025-02-12 – Office Supplies”. This will help sort receipts chronologically and categorize them quickly when reviewing your logs. Create folders for each category and place corresponding receipts inside them, either physically or digitally.

Regularly update your records. Set aside time each week to file new receipts into the appropriate category. Consistent updates prevent receipts from accumulating and creating unnecessary clutter. With each addition, make sure your logs are organized by both category and date, so you’re always prepared for audits or expense reports.

Consider using a simple receipt scanning app to track and digitize physical receipts. These apps can categorize receipts automatically or allow you to input the category manually. Storing digital copies ensures that you can always access your receipts without worrying about losing paper copies.

Review your categories regularly to ensure they are still relevant and useful. As your spending habits change, you may find the need to add or remove categories. Regularly refining your system ensures it stays aligned with your needs and helps you stay on top of your financial organization.

Keep track of every receipt you receive, including purchases, reimbursements, and any other business-related transactions. This helps ensure accurate reporting and supports tax claims when filing. Every entry should contain clear details such as the date, amount, and purpose of the expenditure.

Organize receipts by category for easier reference. This is especially useful when you need to review your spending or justify deductions to the tax authorities. For instance, separate receipts for travel, office supplies, and meals to simplify the reconciliation process during tax season.

Using a well-maintained receipt log helps prevent errors and missed deductions. Recording receipts in real time is the most effective method, rather than attempting to recall details later. Implement a routine for recording receipts immediately after transactions occur, making sure each entry is legible and accurate.

Keep your log consistent and update it regularly to avoid backlog and ensure no receipt is left unrecorded. This will save you time and effort during tax preparation and audits. Always verify the receipt amounts and cross-check them with bank statements or credit card charges for accuracy.

| Receipt Date | Amount | Category | Description |

|---|---|---|---|

| 01/15/2025 | $150.00 | Travel | Flight to New York |

| 01/20/2025 | $75.00 | Meals | Business lunch with client |

| 02/05/2025 | $30.00 | Office Supplies | Printer paper and ink |

To ensure a streamlined process for tracking receipts, focus on using a consistent format. A simple, clear template helps you stay organized without missing important details.

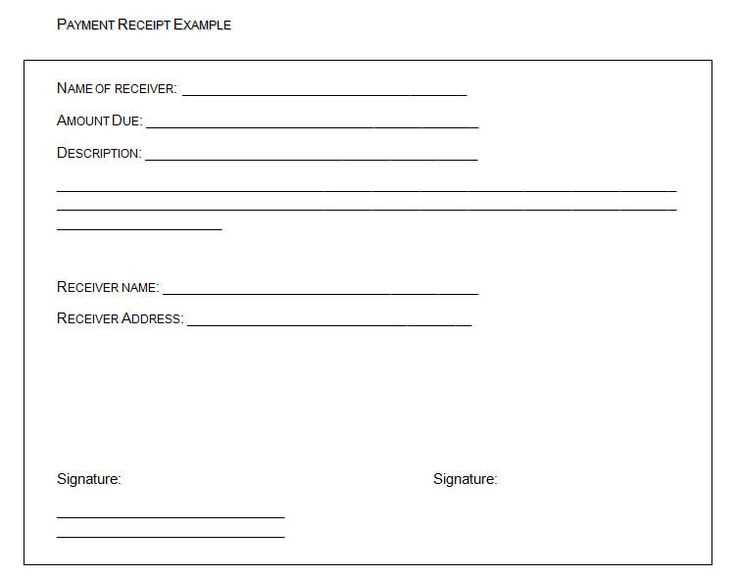

- Include the receipt number for easy reference.

- Ensure the date and time are clearly listed for accurate record keeping.

- Note the total amount and break it down into itemized sections if applicable.

- Make sure the vendor name is visible and easy to read.

- Provide a clear payment method description (credit, debit, cash, etc.).

- If needed, add a space for notes on the purpose of the transaction.

This approach keeps everything in one place, reducing confusion and saving time during audits or reconciliations.