Creating a clear and concise receipt for gifted funds is a critical step in documenting a financial gift. A well-organized template ensures both the donor and the recipient have an accurate record of the transaction. The receipt should include the donor’s name, the recipient’s name, the amount given, and the date the gift was made.

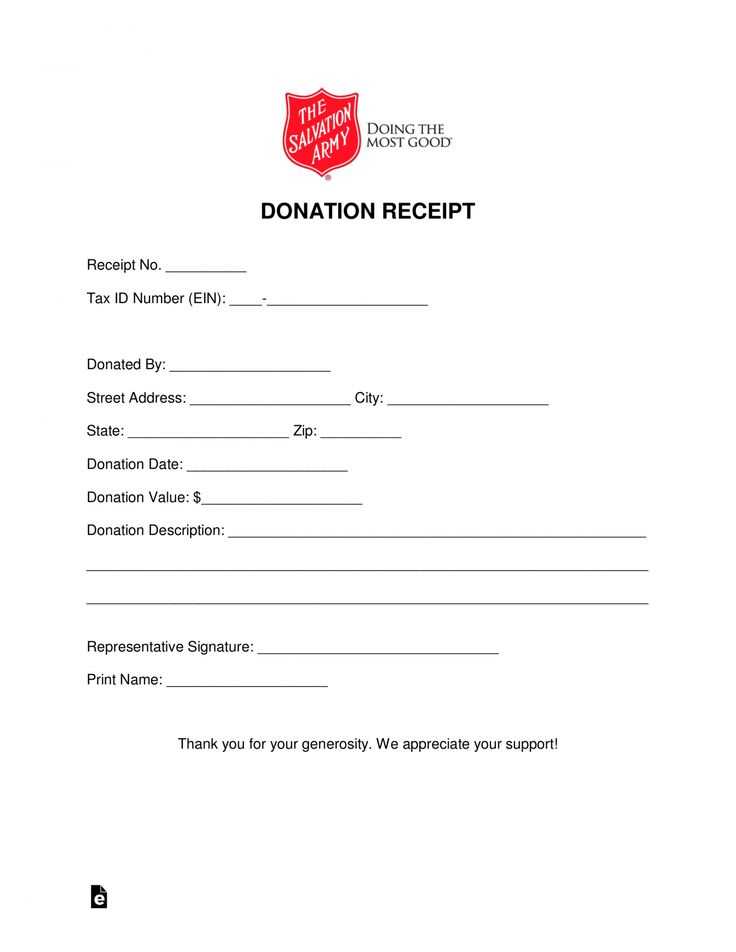

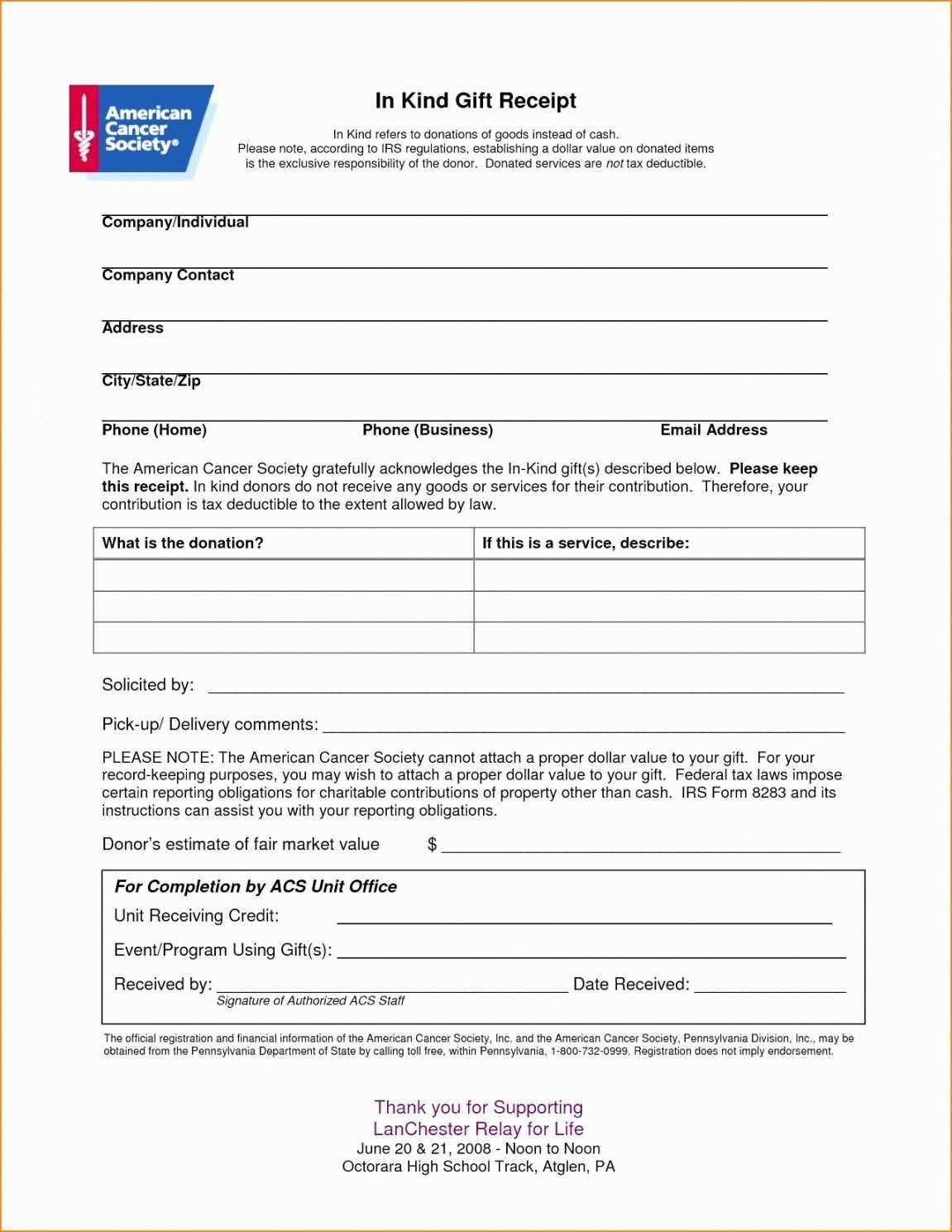

The template should also specify the purpose of the gift, if applicable, and include a statement confirming that no goods or services were exchanged for the donation. This is important for tax purposes, especially if the gift exceeds a certain value. Including the donor’s contact information and a thank-you message can add a personal touch, reinforcing goodwill between the parties.

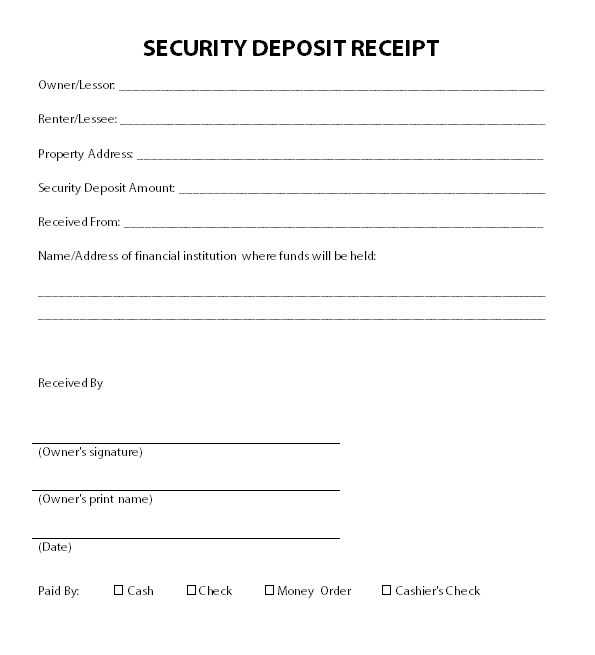

To make the receipt legally valid, both parties may need to sign it. It’s also wise to keep a copy of the receipt for record-keeping. By using a standardized format, you ensure clarity and transparency in all gift transactions, which can be helpful in case of future inquiries or audits.

Here are the corrected lines without word repetitions:

Ensure that every sentence is clear and concise, avoiding redundancy. Rephrase any repetitive phrases to maintain readability. For example, instead of repeating “received a gift” multiple times, use synonyms or restructure the sentence. Always check for unnecessary duplication, especially in formal documents like a receipt of gifted funds.

Focus on making each point distinct while keeping the content professional. Use varied sentence structures to convey the same idea without repeating the same words or phrases. This will improve the flow and make the document more engaging for the reader.

Review your work carefully to spot overlooked repetitions. Small adjustments can lead to smoother and more polished writing. Keep the language formal yet approachable, ensuring clarity in all communication.

- Template for Receipt of Gifted Funds

For a clear record of gifted funds, use the following template. This ensures both the giver and receiver have an accurate account of the transaction.

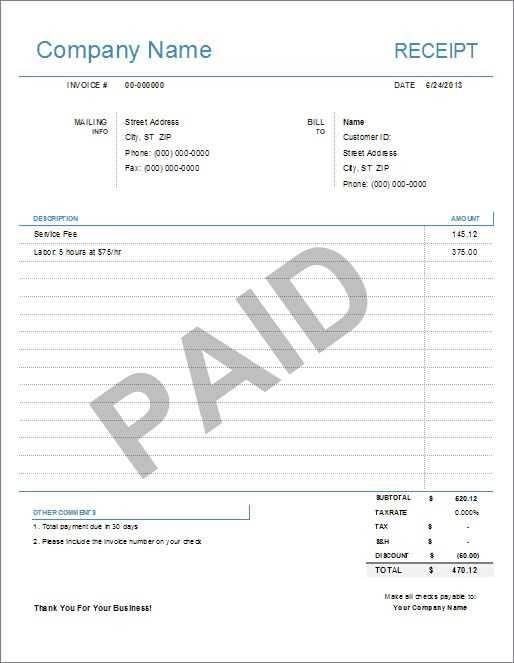

1. Date of Gift: Specify the exact date the gift was made. This provides a clear reference for both parties.

2. Giver’s Information: Include full name, address, and contact details of the person providing the gift. This helps verify the source of the funds.

3. Receiver’s Information: Mention the receiver’s name, address, and contact information for identification purposes.

4. Description of the Gift: Clearly describe the gift. For example, if it’s cash, state the exact amount; if it’s in kind, provide a detailed description of the items or assets involved.

5. Purpose of the Gift: Briefly explain the intent behind the gift, such as for personal use, charity, education, etc.

6. Acknowledgment of No Expectation of Repayment: Both parties should confirm that the gift is given without any expectation of repayment. This clause can prevent misunderstandings in the future.

7. Signature of Giver and Receiver: Ensure both parties sign the document to affirm their agreement. The giver’s signature acknowledges the transfer, while the receiver’s signature confirms acceptance.

8. Witness or Notary: It’s advisable to have a witness or a notary public present during the signing process. This adds an extra layer of validation to the transaction.

Once completed, keep copies of the signed document for both the giver and receiver’s records. This serves as legal proof of the transaction.

To create an acknowledgment receipt for gifted funds, include key details like the donor’s name, the recipient’s name, the amount given, and the date. Start by clearly stating that the funds were a gift, not a loan, to avoid any confusion later. For clarity, specify the gift’s purpose, if any, and confirm the transfer method (cash, check, bank transfer, etc.).

Next, include a statement of acknowledgment, confirming receipt of the gift. Acknowledge the donor’s generosity with a brief thank you note. For instance: “I, [Recipient Name], hereby acknowledge the receipt of [Amount] from [Donor Name] as a gift on [Date].”

Ensure both parties sign the document to validate the transaction. It’s also helpful to add contact information, like addresses or phone numbers, for both the donor and recipient. This adds another layer of clarity should any issues arise in the future.

To wrap it up, store a copy of the receipt for your records and give one to the donor. This creates a simple but effective record of the transaction.

Ensure the receipt for gifted funds includes the following details for clarity and future reference:

- Donor’s Full Name and Contact Information: Clearly list the full name, address, phone number, and email of the person giving the gift. This helps confirm their identity.

- Recipient’s Full Name: Include the recipient’s full name to identify who is receiving the funds.

- Date of the Gift: Specify the exact date the funds were gifted to avoid any confusion regarding the timing.

- Amount of the Gift: State the exact amount gifted, and note whether the funds were given in cash, check, or another form of payment.

- Purpose of the Gift (if applicable): If the gift is intended for a specific purpose, such as for education or medical expenses, make this clear in the receipt.

- Donor’s Declaration: Include a brief statement from the donor affirming that the gift was given willingly and without expectation of repayment.

- Recipient’s Acknowledgment: The recipient should also acknowledge receiving the funds with a signature or statement of confirmation.

- Transaction Details (if applicable): If the gift was made via bank transfer or check, include transaction numbers, bank details, or check numbers for reference.

- Any Applicable Legal Disclaimers: Mention if there are any conditions or restrictions attached to the gift, or if it’s made with any tax considerations in mind.

Each of these elements will ensure the receipt is legally sound and clear to both parties involved.

Ensure that the receipt clearly states the amount of the gift, the date it was received, and the donor’s name. The wording must avoid any implication of a transaction or exchange, confirming that the funds are a gift without expectation of repayment or return services.

Clear Documentation of the Gift

The receipt must reflect that the transfer is indeed a gift. Using terms such as “donation” or “gifted funds” clarifies this and reduces confusion. Avoid language suggesting any form of consideration, as this could mislead both parties and cause tax complications.

Tax Implications for Donor and Recipient

Different jurisdictions have various rules about reporting gifted funds. The donor may need to file gift tax forms if the amount exceeds a certain threshold. The recipient should be aware that such funds are typically not taxable unless they are associated with services or income.

Required Information on the Receipt

| Required Information | Description |

|---|---|

| Donor’s Name | The full name of the person gifting the funds. |

| Amount of Gift | Exact amount of the funds given as a gift. |

| Date of Receipt | The date on which the gift was received by the recipient. |

| Statement of Gift | A clear statement that the funds are a gift without any exchange of goods or services. |

| Donor’s Signature (optional) | Optional, but can be included for further verification. |

While a signature from the donor is not mandatory, having it on the receipt can add an extra layer of credibility. Keep a copy for your records in case of any future questions or audits regarding the gifted funds.

Receipt of Gifted Funds Template

Ensure the receipt document for gifted funds is clear and detailed. Include the donor’s full name, the recipient’s details, and the specific amount received. Include the date of the transaction and the purpose of the gift, if applicable. This will help in keeping accurate financial records and avoid any future misunderstandings.

Information to Include

- Donor’s full name and contact details

- Recipient’s name and contact details

- Exact amount of money gifted

- Date of the gift transaction

- Purpose of the gift (optional)

- Signature of both the donor and recipient (if required)

By incorporating these details, both parties can have a clear record of the transaction, providing security in case of disputes or questions in the future.