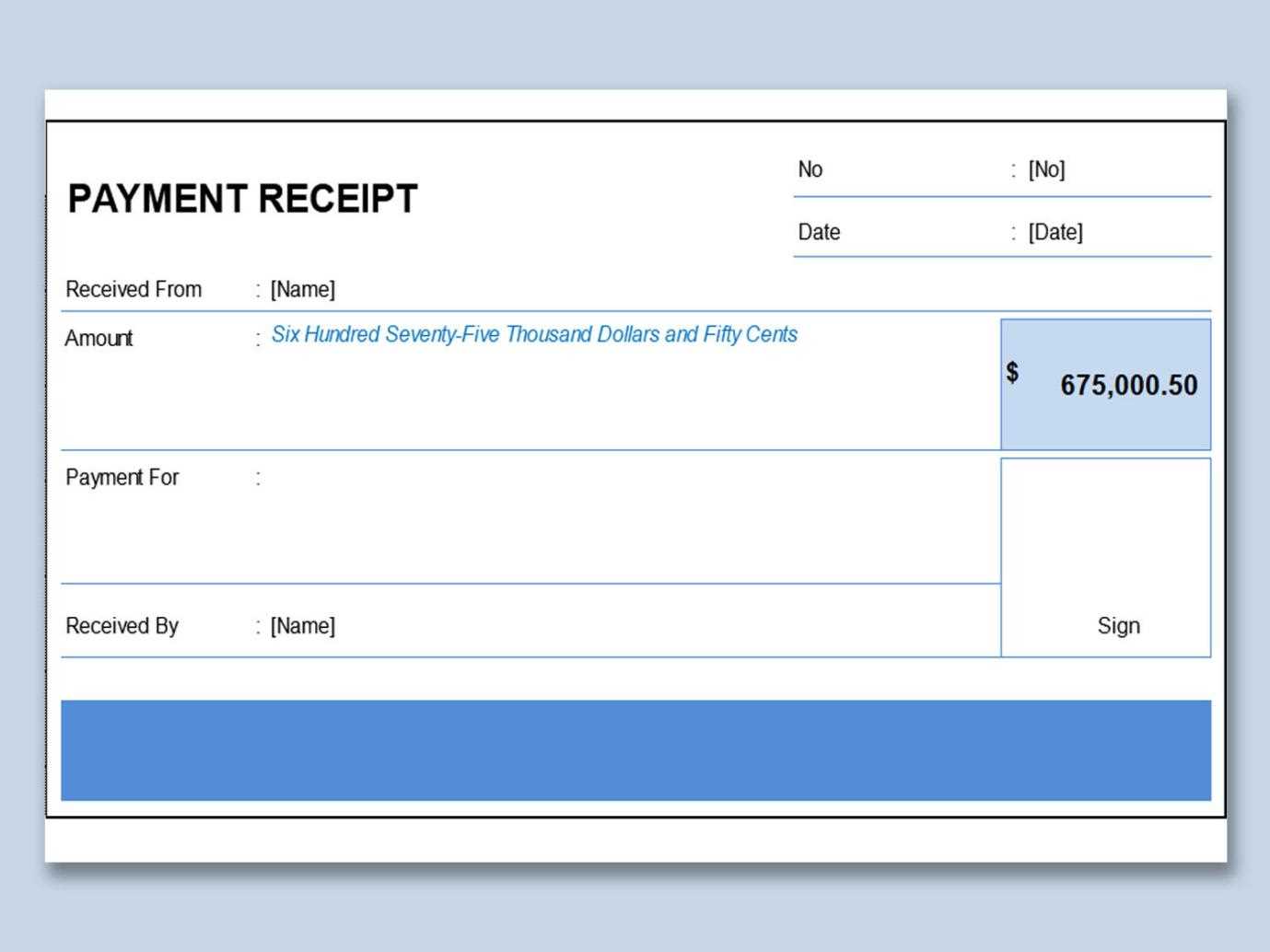

To create a clear and accurate receipt for a debt payment, start by including key details: the payer’s name, the amount paid, the payment method, and the date of the transaction. These elements will ensure both parties have a written record of the payment, reducing any confusion down the line.

Next, specify the debt’s original amount and any outstanding balance after the payment. If applicable, also mention whether this payment covers partial or full repayment of the debt. A well-detailed statement helps prevent any future misunderstandings.

Consider adding an invoice number or a reference code for easy identification. This step will help you track payments and reference specific transactions in your accounting system. Make sure to also include a clear statement that acknowledges the payment, confirming it has been received.

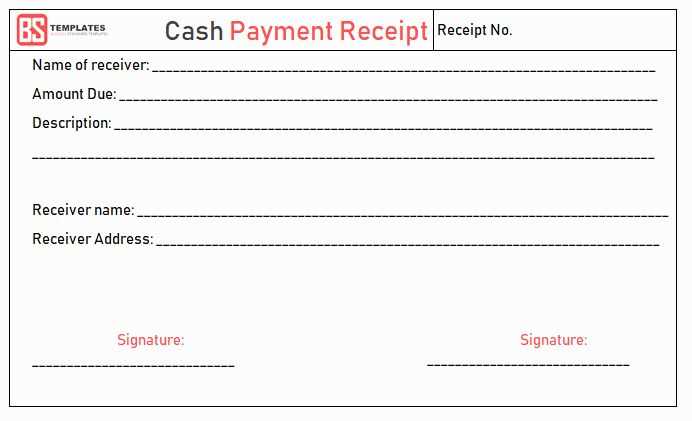

Finally, ensure both parties sign and date the receipt to validate the transaction. This step acts as proof for both the payer and the recipient, protecting everyone involved from potential disputes later on.

Here’s the revised version without repetition, keeping the original meaning intact:

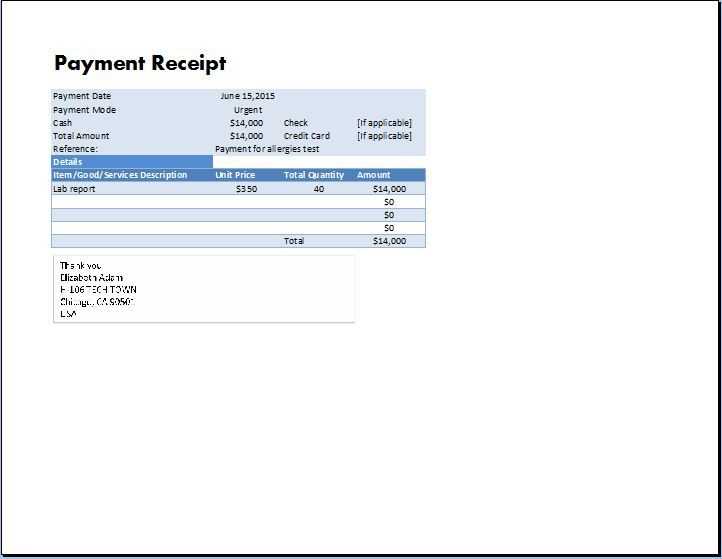

To issue a valid receipt for a paid debt, the document should clearly specify the amount paid, the debtor’s details, and the transaction date. Include a clear statement confirming the full payment of the debt, such as “This is to acknowledge the payment of [amount] in full settlement of the debt.” Ensure that both the debtor and creditor names are listed correctly. If applicable, provide any reference number tied to the debt for further clarity.

What to Include in the Receipt

The receipt should also mention the method of payment (e.g., bank transfer, cash, check) and any additional notes regarding the debt’s nature. If there were any previous payments, they should be acknowledged to reflect the outstanding balance that has now been cleared. The creditor’s signature and date should follow to authenticate the transaction.

Final Steps After Issuance

Once the receipt is issued, ensure both parties receive a copy. The debtor should retain it as proof of payment. The creditor should keep a copy for their records. This ensures both sides have a clear understanding of the debt’s settlement.

HTML plan for an article on “Receipt of Paying Debt Template”

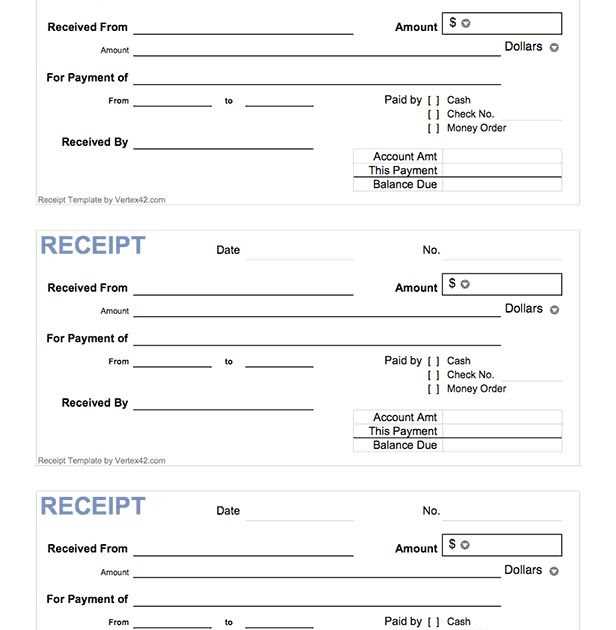

Creating a clear and organized debt payment receipt is key for both parties involved. The receipt should include essential details like the amount paid, the date of payment, and the method of payment. Below is an example of the structure to follow for an effective receipt template:

| Receipt No. | Debtor Name | Amount Paid | Payment Date | Payment Method |

|---|---|---|---|---|

| 12345 | John Doe | $500 | February 5, 2025 | Bank Transfer |

This structure ensures that all critical information is recorded. Include a unique receipt number to track payments effectively. A simple breakdown of payment details makes it easy for both the payer and receiver to reference past transactions.

After completing the receipt, consider adding a statement confirming that the debt has been cleared or partially paid, depending on the situation. A clear indication of the debt balance remaining can help avoid confusion in future communications.

- Creating a Simple Debt Payment Receipt Format

To create a straightforward debt payment receipt, start by including the following key details: the date of payment, the name of the debtor, and the recipient’s details. These elements clarify who made the payment and who received it.

Next, include the total amount paid, specifying the currency. This ensures both parties are clear on the transaction’s value.

It’s also important to add a brief description of the payment. For example, reference the debt being paid, like “Payment for outstanding loan” or “Settlement of invoice #12345”. This helps avoid confusion in the future.

Lastly, sign the receipt or include a digital signature if necessary. This confirms the receipt was received and processed.

Ensure the document includes the full name of the debtor and the creditor, as well as their contact details. Clearly state the exact amount paid, including any interest or additional fees that apply. It’s important to mention the date the payment was made and the method used for the transaction, whether it was cash, bank transfer, or another form. Make sure the receipt has a unique reference number for future tracking.

Payment Breakdown

Include a detailed breakdown of the debt, indicating any principal amount, interest, and any other charges. This transparency helps both parties understand the payment allocation and prevents any misunderstandings in the future.

Signatures and Acknowledgment

Ensure both parties sign the document to confirm the transaction. The debtor should acknowledge the receipt of the payment, and the creditor should confirm the settlement of the debt. If possible, have a witness present to validate the agreement.

Verify all payment details carefully. Begin by cross-referencing the date and amount of the payment with your records or the agreement. Ensure the amount matches the outstanding debt or installment schedule.

Steps to Verify the Receipt:

- Check the payment date: Ensure the payment was made on time and reflects the correct date.

- Confirm the amount: Verify that the amount listed on the receipt corresponds with your expected payment or outstanding balance.

- Review the payment method: Ensure the listed payment method matches what was used, such as bank transfer, cash, or credit card.

- Examine the recipient details: Confirm that the payment was credited to the correct account or service provider.

What to Do if There Are Discrepancies:

- Contact the issuer: Reach out to the entity that issued the receipt for clarification.

- Provide evidence: Have transaction records ready to support your claims, such as bank statements or transaction IDs.

- Follow up: If necessary, follow up until the issue is resolved and documented correctly.

By reviewing these details, you ensure that your debt payment history is accurate and avoids future misunderstandings.

Opt for a PDF receipt format when issuing payment confirmations. It ensures clarity and professional presentation, offering a universally accessible and easily shareable document. PDFs preserve formatting and prevent alterations, which is vital for legal documentation. You can use software tools to generate and customize templates that include transaction details, payment method, and confirmation dates.

Advantages of Digital Receipts

With digital receipts, there’s no need for physical storage or handling. The reduced need for paper contributes to cost savings and is more environmentally friendly. Digital receipts can be automatically stored, indexed, and retrieved on demand, streamlining your record-keeping process and ensuring quick access when needed.

Securing Digital Receipts

To maintain the security of digital receipts, utilize password protection and encryption. This ensures sensitive information remains private and secure, especially for high-value transactions. When sending receipts via email or other digital platforms, verify the authenticity of the recipient to prevent any unauthorized access.

Ensure the receipt includes all necessary details to protect both parties: full names, dates, amounts, and method of payment. The receipt should clearly state that the debt has been fully settled, or indicate any outstanding balance if applicable. This prevents future disputes about the debt status. The issuer must also retain a copy of the receipt for legal purposes, as it serves as proof of payment and may be needed in case of a legal review or audit.

The law often requires the payment receipt to be issued in writing, although electronic records may be valid under certain conditions, depending on local regulations. Verify the format and delivery method to comply with regional legal requirements. For formal debts, ensure the receipt is signed by the appropriate party, such as the creditor or an authorized representative, to confirm the transaction.

Additionally, the wording used in the receipt should align with the terms of the original agreement. Any discrepancy between the agreement and the receipt may raise concerns. It is advisable to consult with a legal expert to confirm that all terms, including interest and penalties, are accurately reflected in the receipt.

Double-check payment details for accuracy. Ensure that the amount, payment date, and transaction reference are correct. Errors in these areas can lead to confusion or disputes down the line.

Incorrect recipient information is another common issue. Verify the name and address of the payee to avoid misdirected payments or delays. Double-checking this information before submission will save time and hassle.

Missing signatures or incomplete authorization can render payment documents invalid. Always confirm that the required signatories have signed and dated the document appropriately before finalizing it.

Unclear payment terms can create misunderstandings. Specify the payment method, due dates, and any terms of agreement clearly to avoid ambiguity that could result in payment disputes or delays.

Failure to keep records can lead to issues if payment documentation needs to be referenced later. Always store copies of receipts and confirmation emails in an organized manner for easy access when needed.

Clear Steps for Acknowledging Debt Payment

Begin by noting the exact amount received from the payer. Make sure to specify the date and time of the transaction for accurate record-keeping.

- Include the payer’s name or company name.

- State the method of payment, whether it was cash, bank transfer, or another method.

- If applicable, mention any reference number or transaction ID related to the payment.

Ensure both parties confirm the details by signing the acknowledgment. This confirms that both sides agree on the transaction’s terms.

Maintain a copy of the document for your records. It’s important to store it securely in case of future reference or clarification.