If you’re handling transactions or managing payments, creating a reliable receipt paid in full template is a simple yet effective way to keep track of completed payments. This document ensures both parties have clear confirmation that the payment has been fully settled, eliminating any potential confusion later. The key is to make sure the template includes the essential details in a straightforward manner.

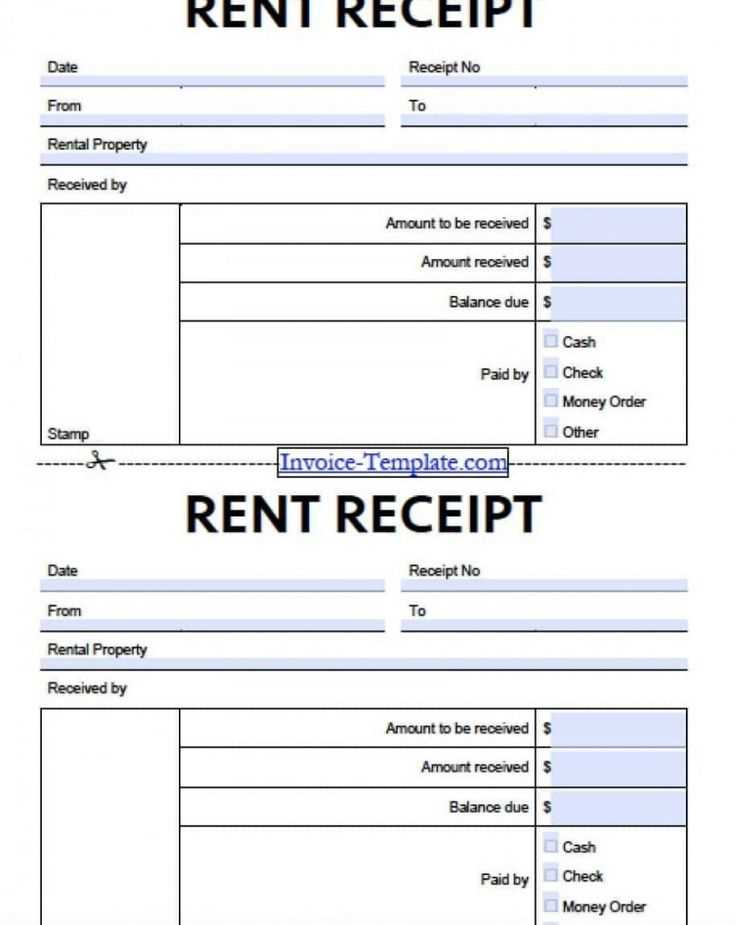

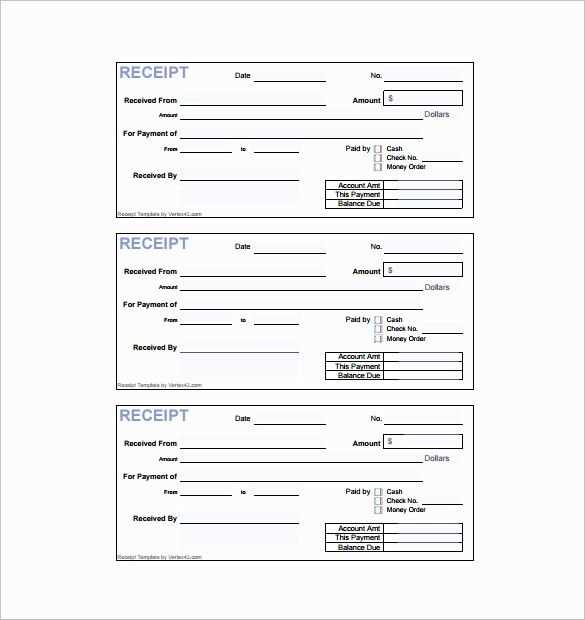

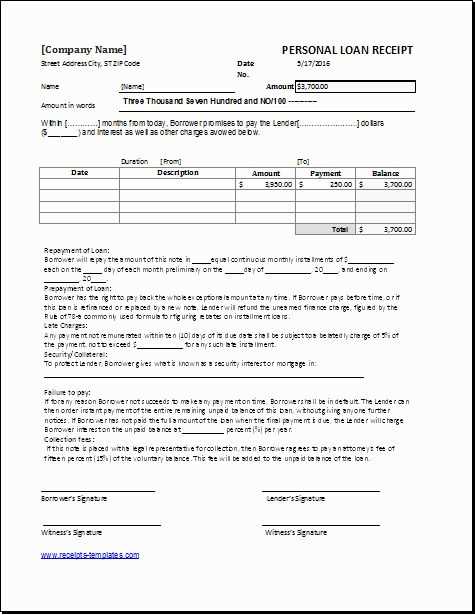

Start by listing the payer’s name, the amount paid, and the date of payment. Make sure to specify the purpose of the payment, whether it’s for goods, services, or something else. It’s also helpful to note the payment method used, whether it was cash, credit, bank transfer, etc. Having this information will make the document clear and professional.

Once you’ve included these details, add a simple statement such as “This receipt confirms that the payment has been received in full.” to reinforce that the transaction is complete. A signature or any form of acknowledgment from both parties can also be added for extra clarity. The goal is to create a document that leaves no room for misunderstanding and keeps both parties on the same page.

Here’s the corrected version:

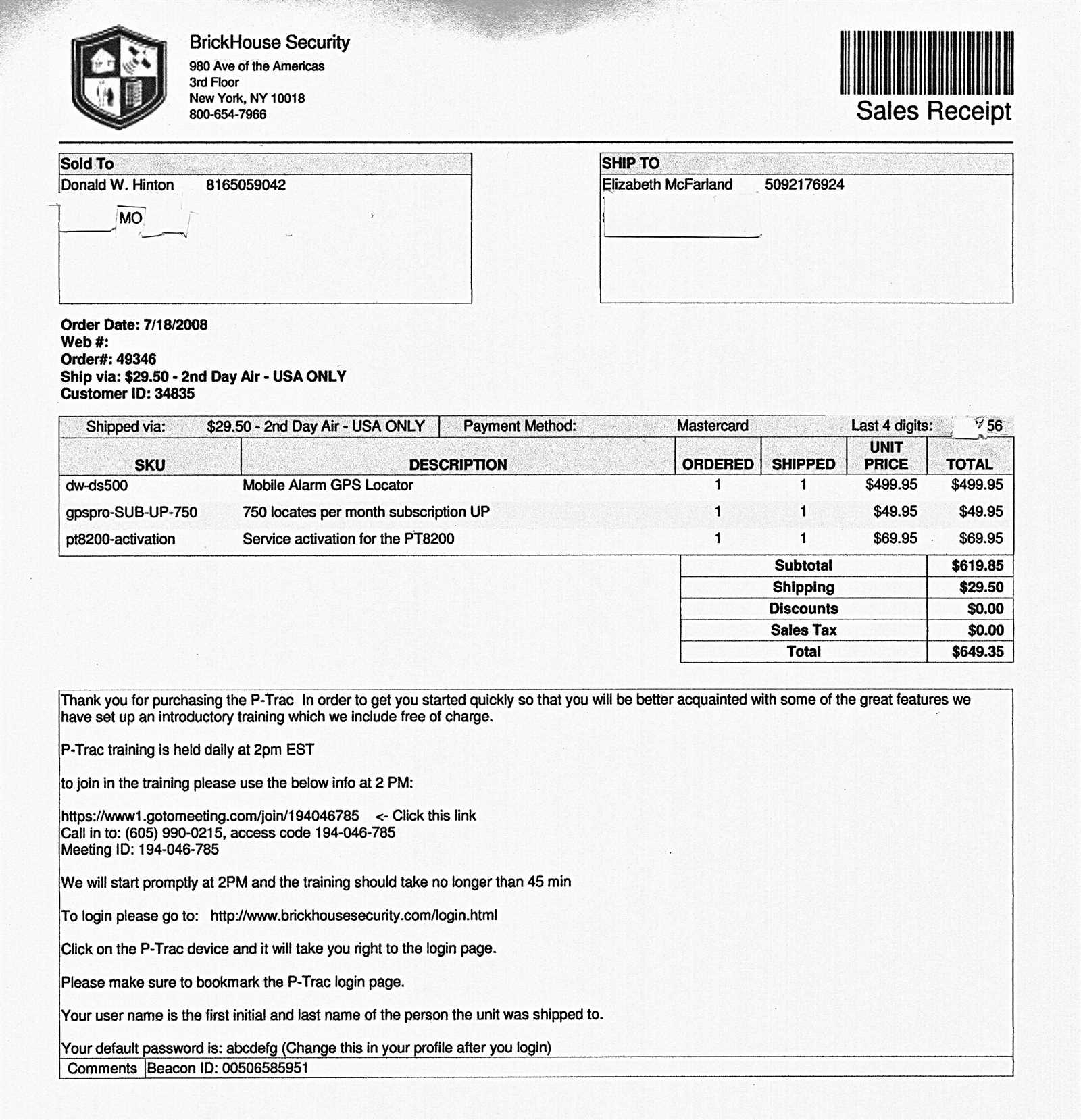

When creating a receipt, clarity and accuracy are key. Make sure the total amount paid is clearly displayed, with any relevant details such as payment method or transaction ID included. This helps prevent confusion later.

Include the payer’s name and contact information, as well as a breakdown of the items or services paid for. Ensure the date of payment is visible and correct. This can help with future reference or any potential disputes.

Consider adding a statement like “Receipt paid in full” to confirm that no further payment is required. This adds certainty for both parties involved.

For a more formal touch, include a receipt number or other unique identifier to track transactions. If the payment covers multiple invoices, list those numbers as well.

Make sure all spelling, dates, and amounts are double-checked to avoid errors that could cause issues later.

- Receipt Paid in Full Template

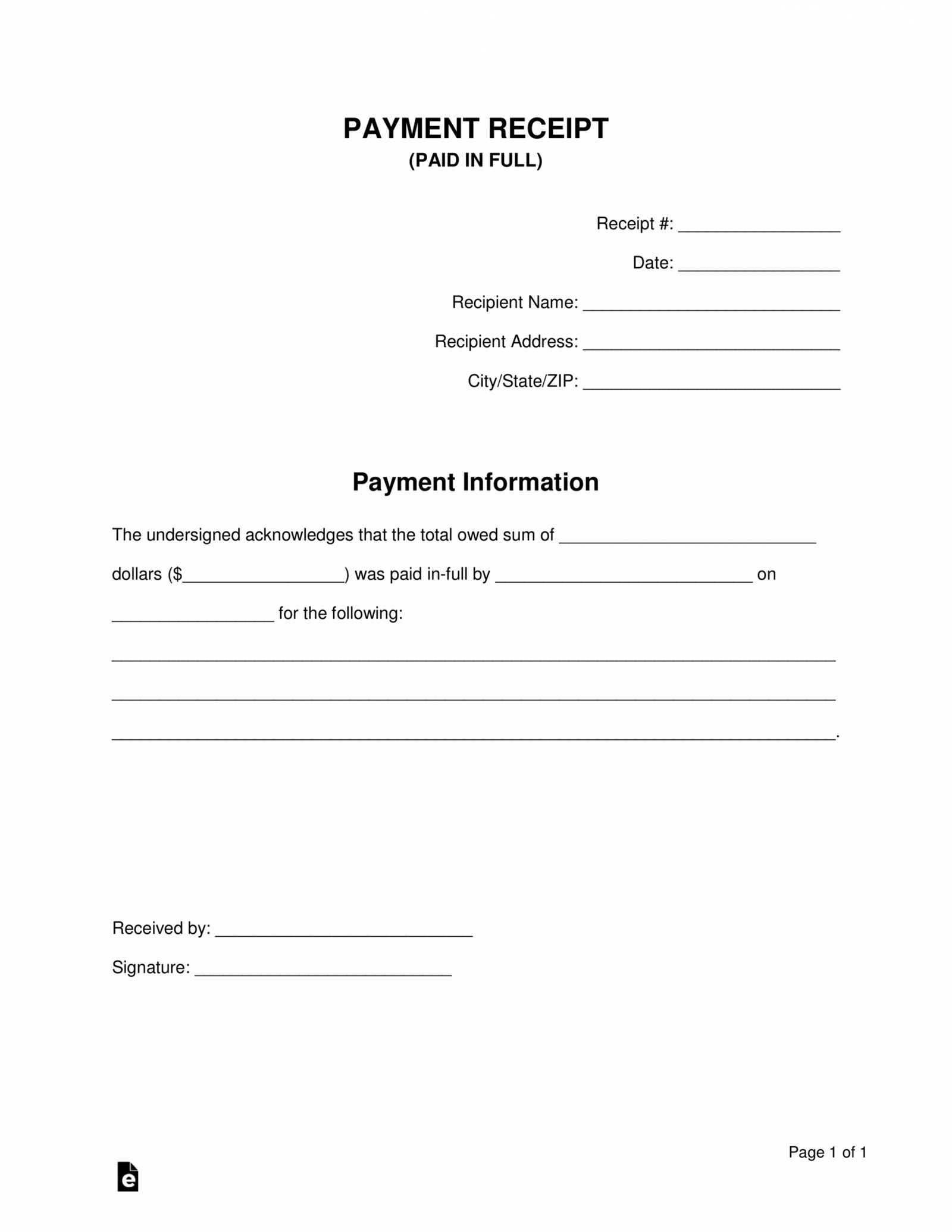

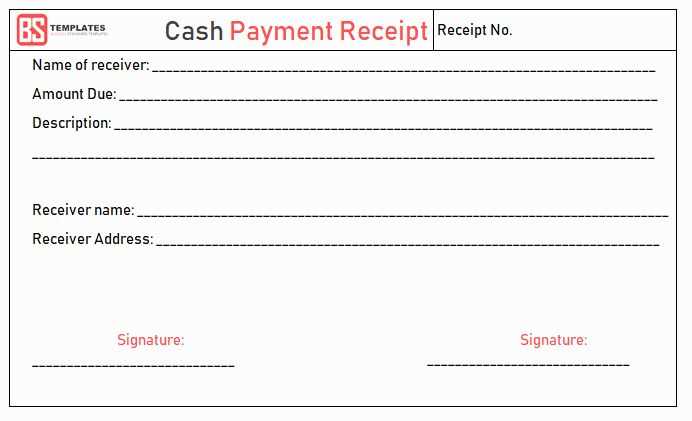

Create a clear and simple receipt by using the following template to confirm that payment has been made in full. This template should include basic details such as the transaction date, buyer information, seller details, and a statement confirming the balance is zero.

Receipt Template

Receipt Number: [Insert Receipt Number]

Issue Date: [Insert Date]

Buyer Name: [Insert Buyer’s Full Name]

Seller Name: [Insert Seller’s Full Name or Company Name]

Description of Goods/Services: [Briefly describe the product or service provided]

Amount Paid: [Insert Amount Paid]

Payment Method: [Insert Payment Method: e.g., Cash, Credit Card, Bank Transfer]

Remaining Balance: $0.00 (Paid in Full)

Payment is confirmed as completed, and no further amounts are due.

Seller’s Signature: ___________________________

Buyer’s Signature: ___________________________

Thank you for your business!

This receipt should be kept for your records and can be used as proof of payment in case of any future disputes. Be sure to adapt the template to fit your specific transaction details as needed.

Create a straightforward and professional receipt template by focusing on the core details: payment confirmation, transaction information, and contact details. Follow these steps:

1. Header Information

Include the name of your business or individual name at the top, along with the contact information such as address, phone number, and email. This allows the recipient to identify the source quickly.

2. Date and Receipt Number

Provide the date the payment was received and a unique receipt number. This helps both you and the customer keep track of the transaction in case of any future questions.

3. Customer Information

Include the customer’s name and contact details (if applicable). This makes the receipt specific to the individual and confirms the payment was made by them.

4. Payment Details

Clearly state the amount paid, the method of payment (e.g., cash, check, or credit card), and a brief description of the product or service provided. For example: “Paid in full for web design services.”

5. Confirmation Statement

State that the payment was made in full. Use a clear phrase such as: “Payment received in full for services rendered.” This avoids ambiguity.

6. Signature (Optional)

If needed, include a space for both the recipient and payer to sign. This adds a layer of formality and can be useful for legal purposes.

Once you’ve set up your template, make sure to save it as a reusable document to save time on future transactions.

A paid in full receipt should include the following key elements to ensure clarity and prevent any misunderstandings:

- Receipt Title: Clearly label the document as a “Paid in Full Receipt” at the top to distinguish it from other documents.

- Payment Date: Specify the exact date when the payment was made. This helps both parties track the payment timeline.

- Amount Paid: Include the full amount that was paid. Break down the payment if necessary, especially for partial payments over time.

- Transaction Method: Indicate the method of payment (e.g., cash, credit card, bank transfer, etc.). This provides additional proof of payment.

- Payee and Payer Information: Clearly state both the payer’s and payee’s names, addresses, and contact details. This ensures that both parties are easily identifiable.

- Invoice or Account Number: Reference the relevant invoice or account number to connect the receipt to the specific transaction.

- Description of Goods or Services: Include a brief description of the goods or services for which the payment was made. This provides context for the transaction.

- Signature: While not always required, a signature from the payee or authorized representative adds legitimacy and authenticity to the receipt.

Example of Key Information

- Paid in Full Receipt

- Payment Date: February 5, 2025

- Amount Paid: $500.00

- Payment Method: Credit Card

- Payer: John Doe, 123 Main St, City, State

- Payee: XYZ Corporation, 456 Market St, City, State

- Invoice No: 123456

- Description: 2 office chairs

- Signature: ____________________

Including these elements ensures that the receipt is clear, verifiable, and professionally structured.

Adjust your “Paid in Full” template based on the nature of each transaction. A simple product sale differs from services rendered or subscription-based agreements. Customize the details to reflect the type of transaction, ensuring accuracy and clarity for both parties.

For product sales, include the following details:

| Detail | Explanation |

|---|---|

| Product Description | List the name and key features of the product sold. |

| Serial Numbers (if applicable) | Include serial numbers or unique identifiers for the items. |

| Quantity | Specify the number of units sold. |

| Sale Terms | Clarify the agreed-upon terms of the sale, such as warranties or return policies. |

For services rendered, your template should highlight the scope of work and timeline:

| Detail | Explanation |

|---|---|

| Service Description | Clearly describe the services provided. |

| Service Dates | Specify the start and end dates of the service period. |

| Hourly Rate or Fixed Price | Indicate how the service fee was calculated, whether hourly or fixed price. |

| Completion Confirmation | Include a statement confirming the services were fully delivered. |

For subscription-based agreements, note recurring payments and cancellation policies:

| Detail | Explanation |

|---|---|

| Subscription Period | Clarify the start and end dates of the subscription. |

| Payment Schedule | Include the payment frequency (e.g., monthly, annually). |

| Cancellation Terms | Outline the conditions for cancellation and any required notice periods. |

By tailoring your template to these specifics, you make the payment confirmation clearer and ensure both parties have the correct information for their records.

Ensure that a paid receipt clearly reflects the transaction’s details to avoid disputes. Include the full name and address of both parties, the date of the transaction, and a precise description of the goods or services provided. Specify the amount paid, including any taxes or discounts. This transparency helps prevent any confusion in future legal proceedings.

When issuing a receipt, it’s important to remember that it serves as proof of payment. Make sure to include a statement like “Paid in Full” to indicate that no further payments are owed. This can protect both the payer and the recipient from any claims of outstanding balances later on.

Keep copies of all paid receipts for at least a few years. This is particularly important if you need to refer to them in case of a legal dispute or if they are required for tax purposes. Proper documentation helps substantiate your claims and provides a clear record of the transaction.

If you are a business, ensure that your paid receipt complies with local tax laws. Some jurisdictions require specific information or formats for receipts, such as tax identification numbers or transaction codes. Check local regulations to avoid potential fines.

Lastly, consider using a receipt template that includes all the required fields and is easy to customize. This can streamline your process and minimize errors when issuing receipts. It is also a good practice to provide a digital copy of the receipt to the buyer for easy access and storage.

Ensure all amounts are accurate. Double-check that the total amount paid matches the payment received, including any taxes or additional fees. Missing or incorrect figures can lead to confusion and disputes.

Verify that the document is properly signed. A receipt without an authorized signature can cause uncertainty regarding the transaction’s legitimacy. Ensure it is signed by both parties, or by an authorized representative if necessary.

Failure to Include Payment Method

List the method of payment used, whether it’s cash, check, credit card, or another method. Omitting this detail leaves room for ambiguity, making it harder to confirm the payment was fully processed.

Not Stating the Purpose of Payment

Clearly specify the reason for the payment. Whether it’s for a product, service, or debt settlement, including the purpose helps both parties track the transaction accurately and can prevent future confusion or legal complications.

Don’t forget to include the payment date. A receipt without a date is incomplete and could create issues for record-keeping or proof of payment.

First, choose the right delivery method for the receipt. You can send it via email, postal mail, or through a secure online portal, depending on your client’s preference. If email is the preferred method, consider sending the receipt as a PDF attachment. This ensures the document is professional, easy to access, and printable.

1. Include Key Information in the Receipt

- Client’s name and contact details

- Invoice number and date

- Full amount paid and the payment date

- Method of payment (e.g., credit card, bank transfer, cash)

- Statement confirming the payment in full

- Company details (name, address, and contact information)

2. Confirm Receipt Delivery

After sending the receipt, confirm its delivery by requesting a read receipt or follow-up with a brief email or phone call. This ensures your client has received and reviewed the document. If sent by postal mail, track the package if possible for extra assurance.

Sending a clear and accurate paid in full receipt maintains a professional relationship and helps both you and your clients stay organized. Always keep copies of the receipts for your records as well.

Receipt word is now less common, yet its meaning is preserved

The word “receipt” is less frequently used today, but its core meaning still remains intact. The term, traditionally referring to a written acknowledgment of a transaction, has largely been replaced by phrases like “proof of payment” or “payment confirmation.” However, these alternatives carry the same purpose of confirming a completed transaction.

In modern business communications, instead of saying “receipt,” you might encounter terms such as “paid invoice” or “payment confirmation statement.” These terms maintain clarity while simplifying language in some contexts. For instance, a “receipt paid in full template” might now be labeled as a “paid invoice template” for greater accessibility, yet it communicates the same message.

It’s important to remember that the change in terminology doesn’t affect the function of the document. The goal remains the same: providing clear evidence that payment has been made and that the balance is settled. Businesses and individuals can use whichever term suits their needs without losing the effectiveness of the document.