To create a clear and functional receipt policy, focus on defining the key information that needs to be included on all receipts. This will ensure consistency and prevent confusion for both customers and staff. A well-crafted receipt policy should outline the specific details that need to be recorded, such as the transaction date, total amount, tax breakdown, payment method, and any discounts applied.

Make sure to specify who is responsible for issuing receipts and the process they must follow. This includes when receipts should be given (immediately after payment or upon request) and how to handle situations like refunds or exchanges. Consider including a standard format for receipts that makes the process quick and simple for employees to follow.

Lastly, don’t forget to address legal requirements and local regulations regarding receipt issuance. This ensures that your business stays compliant while maintaining transparency with customers. With the right template, your receipt policy can streamline transactions and improve customer trust in your business.

Receipt Policy Template: A Practical Guide

Clearly define the conditions under which receipts are issued. Start with specifying whether receipts are provided automatically or upon request. This ensures transparency for both customers and staff.

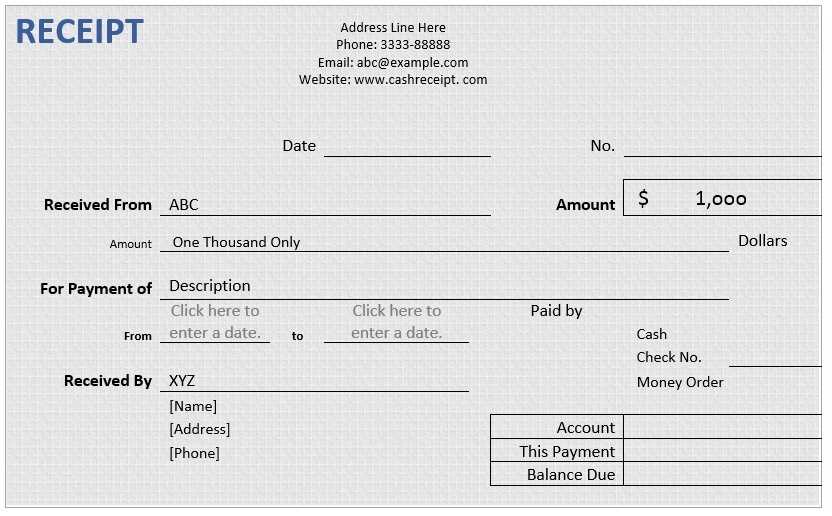

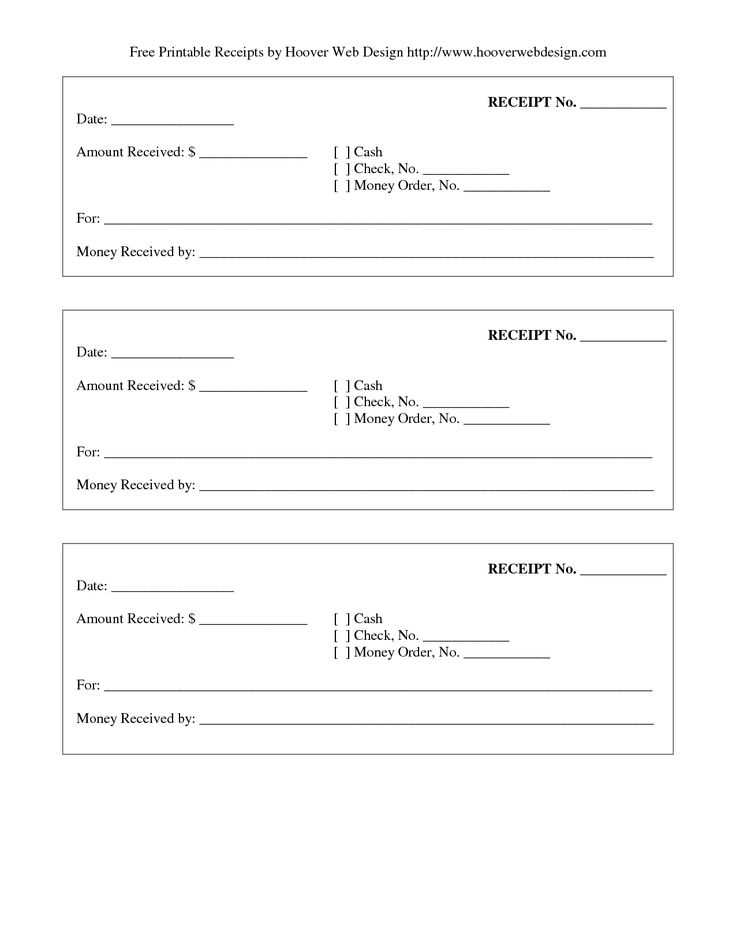

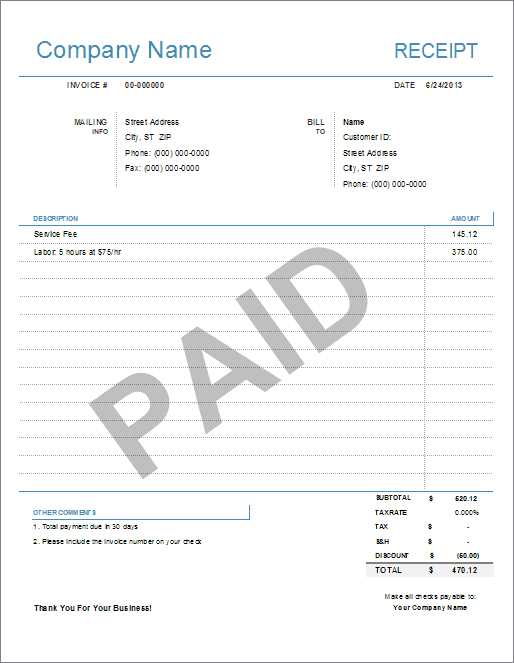

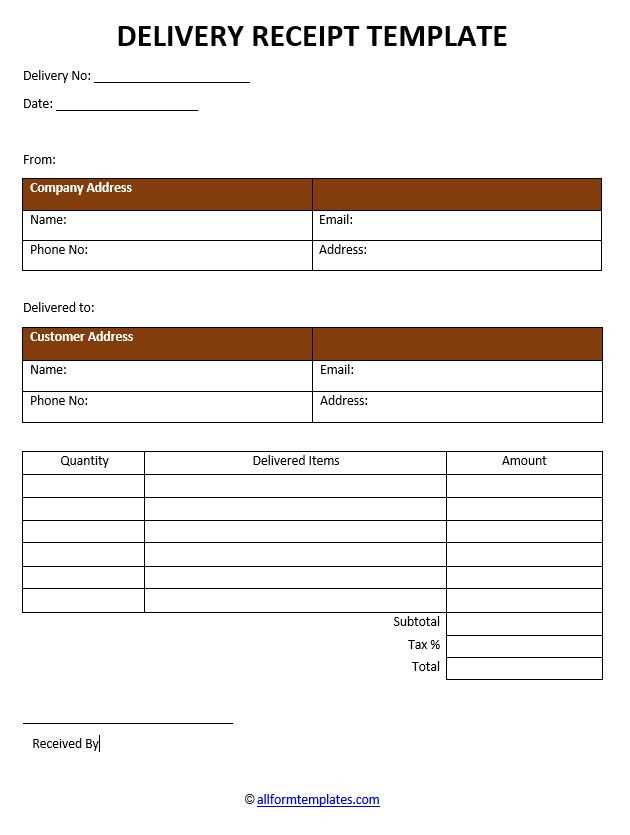

Include the necessary details on each receipt. This typically involves the business name, address, contact information, date of transaction, list of purchased items or services, their prices, taxes, and total amount paid. Each element should be easy to read and unambiguous.

Specify acceptable payment methods clearly. Whether you accept cash, card, or digital payments, list them on the receipt or within the policy. This avoids confusion and makes it clear to customers what payment options are available.

Set timeframes for refunds or returns. If your business offers refunds, provide a clear policy on how receipts play a role in processing returns or exchanges. Define any time limits and conditions for returns, such as product condition or packaging requirements.

State the responsibility for keeping receipts. Make it clear whether customers are expected to retain receipts for warranty purposes, refunds, or exchanges. This helps reduce disputes and sets expectations up front.

Address digital receipts as part of your policy. Specify if and how digital receipts are provided, especially for online purchases. Clarify whether they serve the same function as printed receipts and include the same details.

Ensure compliance with tax regulations. Include any legally required information related to tax, such as tax identification numbers or sales tax breakdowns. This is crucial for both legal compliance and customer clarity.

Include instructions for receipt errors. In case of errors on receipts, offer a process for correction or issuing a new receipt. This can include contacting customer service or visiting the store for adjustments.

Creating a Clear Receipt Format for Your Business

Ensure your receipt format is straightforward and easy to read. Focus on clarity and consistency, so customers can quickly find the necessary details. Here are key elements to include:

- Business Information: Display your company name, address, phone number, and email at the top. Make this information prominent for easy reference.

- Date and Time: Clearly show the date and time of the transaction. This helps with record-keeping and can be important for returns or disputes.

- Receipt Number: Include a unique identifier for each transaction. This makes tracking sales and addressing customer inquiries more efficient.

- Itemized List: List each item purchased with a description, quantity, price, and any applicable taxes. Break down totals so customers can easily verify their purchase.

- Payment Method: Indicate whether the transaction was made by cash, credit card, or other methods. This provides transparency and helps resolve potential payment issues.

- Total Amount: Display the final amount paid, including taxes and discounts, if applicable. Make sure this is clearly visible to avoid confusion.

- Return Policy: Briefly include your store’s return or exchange policy, especially if it’s relevant to the transaction.

Keep your format clean and uncluttered. Use a legible font and maintain consistent spacing between sections. This approach reduces the likelihood of errors and increases customer satisfaction.

Implementing Digital Receipts in Your Operations

Begin by integrating a reliable digital receipt system into your sales process. Choose a platform that supports email or SMS delivery, ensuring it is easy for customers to access and store their receipts. Aim for an approach that minimizes paper waste while offering customers a seamless experience.

Choose the Right Software

Select software that connects with your point of sale (POS) system. Many modern POS systems offer built-in options for digital receipts. If not, look for third-party solutions that integrate smoothly with your existing setup. Prioritize systems that allow for customization, ensuring receipts reflect your brand’s identity.

Communicate with Customers

Let customers know they can opt for a digital receipt at the time of purchase. Make the process clear and quick to encourage participation. Offer a brief explanation at checkout or via signage to avoid confusion. Ensure your staff is trained to explain how customers can receive their receipts digitally.

Verify that digital receipts include all the necessary details such as transaction date, itemized list, and payment method. Make it easy for customers to view or download their receipts, and provide an option to resend them if lost.

Monitor the effectiveness of your digital receipt system and adjust as needed to ensure smooth operations. Collect feedback from customers and employees to improve the process and eliminate any friction points.

Legal and Tax Considerations for Your Receipt Policy

Make sure your receipt policy includes clear details on sales tax collection. Indicate the applicable tax rates for each transaction based on local regulations, as tax obligations vary depending on location. Specify whether taxes are included in the listed price or added separately at checkout.

Be transparent about refund policies and ensure they align with consumer protection laws in your jurisdiction. Clearly state any conditions under which a refund may be offered, such as defective products or services not rendered, and include the timeline for processing refunds. Failure to comply with refund regulations can lead to legal disputes.

Incorporate data protection standards into your receipt policy if you handle customer information. Ensure your receipts do not expose sensitive customer details unnecessarily, and confirm compliance with relevant data privacy laws like GDPR or CCPA. Limit the amount of personal information on receipts, and avoid collecting unnecessary data unless legally required.

Verify that your receipt policy complies with record-keeping requirements. Many tax authorities mandate businesses to retain records of sales for a specified period, often ranging from three to seven years. Maintain accurate and accessible records to avoid complications during audits.

If you offer digital receipts, make sure they comply with electronic transaction laws. Ensure digital receipts are legally valid in your region, and that they include all necessary information, such as business details, transaction dates, and tax information. Consider offering customers an option to receive paper receipts if required by law.

Lastly, update your policy as needed to reflect changes in tax laws, consumer rights, or data protection regulations. Staying informed and adjusting your receipt policy will prevent legal issues down the line.