When creating a receipt template, simplicity and clarity are key. Focus on including the most relevant information, such as the seller’s details, transaction date, list of purchased items, their quantities, prices, and total amount. This ensures both the customer and the seller have an accurate record.

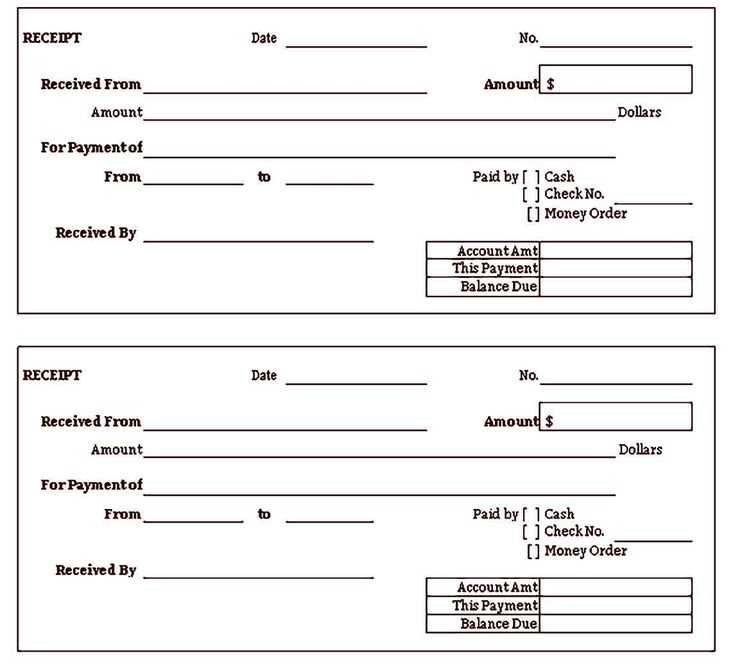

Design your template with clearly defined sections. Use bold text for headings and prices to make them easy to locate at a glance. Consider adding a space for a unique transaction ID or a reference number, which can help with tracking or customer service needs.

Avoid clutter by limiting unnecessary details. Include just enough to confirm the transaction and ensure that the document serves its purpose effectively. Lastly, make sure your receipt is easy to customize for different transactions or business models.

Receipt Template: Practical Insights

Customize the layout to match your brand’s identity. Clear fonts, a simple color palette, and an intuitive structure will make the receipt both functional and appealing. Place the key elements like the transaction date, itemized list, and total cost in prominent positions for quick access.

Streamline Data Entry

Automating the population of fields such as customer information and transaction details can save time and reduce errors. Leverage software that supports integration with your sales systems for smooth data flow.

Include a Clear Call to Action

Always leave space for a follow-up action, such as encouraging customers to leave feedback or directing them to a website for future purchases. A simple “Thank you” goes a long way in building rapport and encouraging repeat business.

Creating a Custom Receipt Template

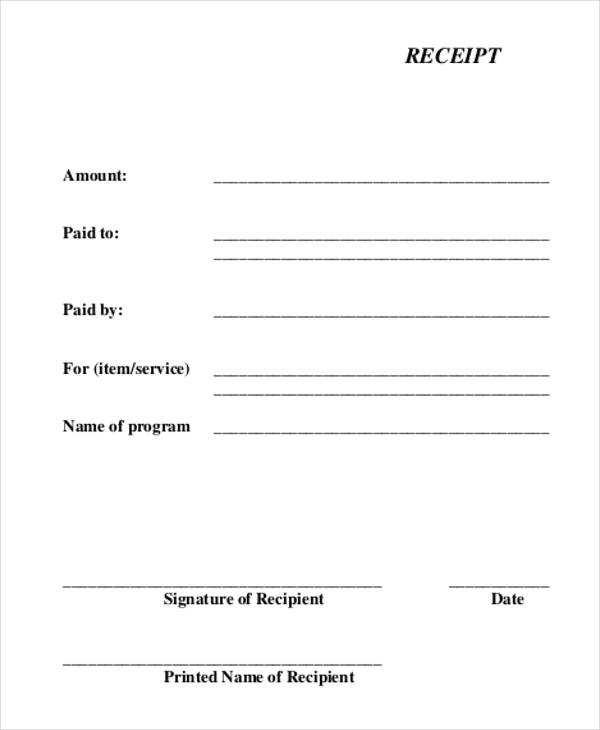

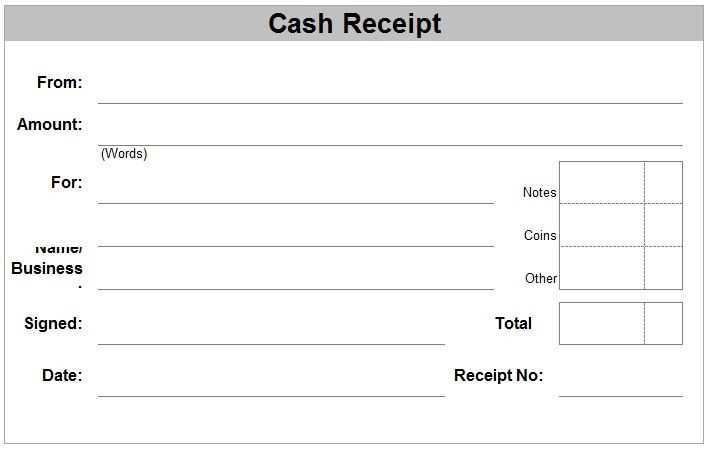

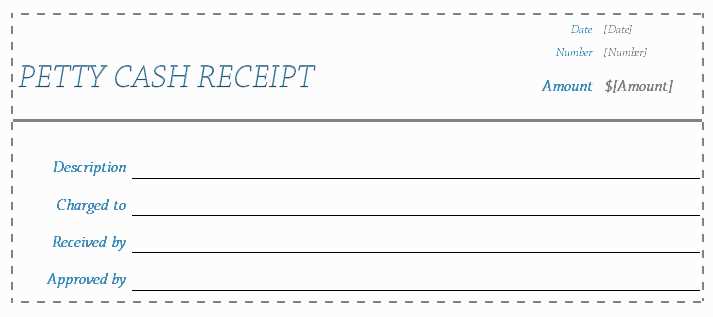

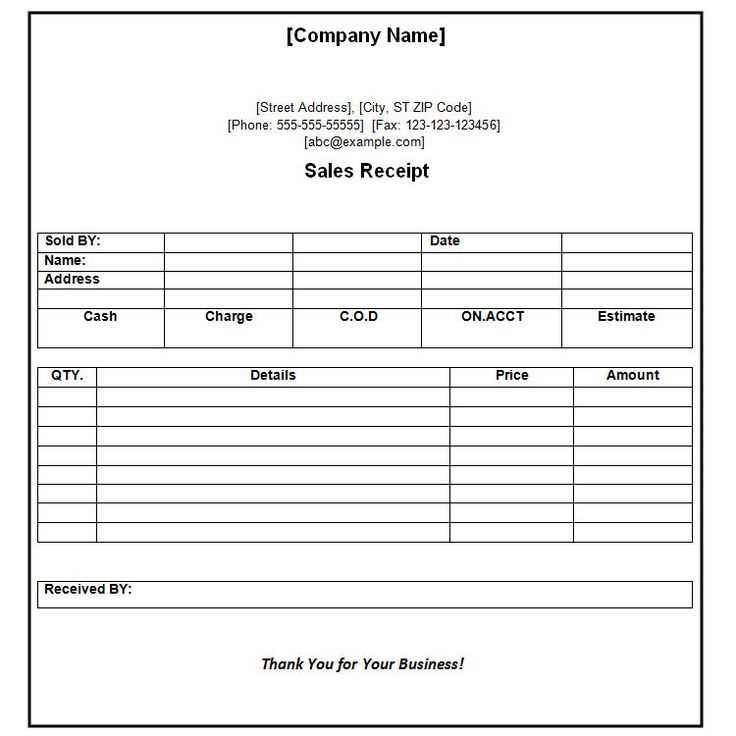

Begin by defining the layout of your receipt. Use a clean and structured approach to organize the information logically. Divide the receipt into clear sections such as the header, transaction details, and footer.

The header should include the business name, address, contact details, and a unique receipt number for easy reference. Ensure that the text is easily readable by selecting appropriate fonts and sizes.

Next, focus on transaction details. Include the following:

| Item | Quantity | Price | Total |

|---|---|---|---|

| Product Name | 1 | $20.00 | $20.00 |

| Service Charge | 1 | $5.00 | $5.00 |

Include any applicable taxes and discounts below the itemized list. Make sure tax information is clearly marked to avoid confusion. You may also want to display the total amount paid and payment method.

Finish with a footer that might include the return policy, company website, or any additional notes. Keep this area clean and concise. Use a border or line to visually separate it from the rest of the receipt for a professional look.

Incorporating Essential Information in Templates

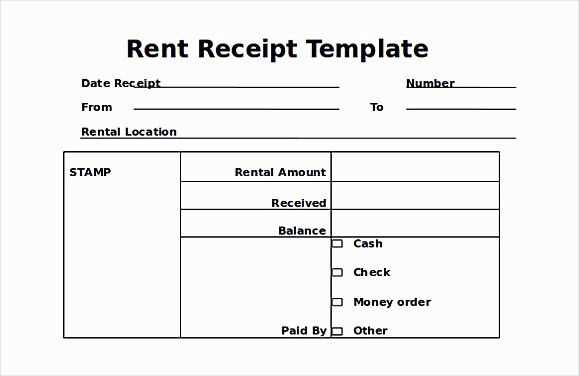

Include specific details that directly relate to the purpose of the template. This improves clarity and ensures that all necessary data is readily accessible. Begin with fields that capture core transaction information, such as date, transaction ID, and the names of the parties involved. These are non-negotiable components that ensure the template serves its intended function.

Data Points to Include

- Transaction ID: This helps track the process and verify its authenticity.

- Date: Always capture the exact date to avoid confusion.

- Parties Involved: Ensure names or business identifiers are clearly stated.

Additional Information for Accuracy

- Amount or Quantity: Make sure this field is visible and precise.

- Terms of Service or Payment: Specify the conditions to avoid misunderstandings later.

- Contact Details: Ensure that at least one method of communication is included for follow-ups.

Every template should focus on simplifying the capture of necessary data while maintaining flexibility for adjustments. By adhering to these guidelines, templates can serve as streamlined tools for completing tasks with minimal confusion.

Adapting Receipt Designs for Different Businesses

Tailoring receipt designs to suit the specific needs of different businesses helps enhance customer experience and supports branding efforts. The design should align with the business model, customer base, and the type of transaction being processed.

1. Retail Businesses

For retail stores, receipts should clearly display the list of purchased items, prices, taxes, and any applicable discounts. A simple, clean design works best, with enough space for product details and a company logo for brand recognition. Offering a section for return or exchange policies can also be beneficial.

- Include itemized product list

- Show total, tax, and discount breakdowns

- Branding with logo and store details

2. Service-Based Businesses

Service providers, such as salons or repair shops, need receipts that reflect the services rendered and time spent. Adding a section for tips or gratuity is helpful in industries where these are common. Ensure there is enough space for appointment dates or next service reminders to keep the customer engaged.

- Highlight service description and duration

- Include payment options (cash, card, etc.)

- Consider adding service reminders or promotions

By adjusting receipt designs based on business type, you ensure both practicality and a seamless customer experience while reinforcing your brand identity.

Formatting Dates and Currency Correctly

Always use the appropriate date format for your target audience. In the United States, the common format is MM/DD/YYYY, whereas many European countries prefer DD/MM/YYYY. Keep your dates consistent throughout the receipt to avoid confusion. If your business operates internationally, consider displaying both formats or using the ISO standard (YYYY-MM-DD) for clarity.

Handling Currency Properly

Display currency amounts with clear symbols or abbreviations. For example, use “$” for US dollars, “€” for euros, and “£” for pounds. It’s important to include two decimal places even when the amount is a whole number, like “$25.00.” Avoid using commas in large numbers, as they can differ by region–opt for a period to separate thousands in most cases.

Consistency Is Key

Ensure that both date and currency formats align with your company’s standards or regional preferences. Mixing formats can lead to confusion and diminish the professionalism of your receipts. Keep everything uniform to make the information easy to read and understand.

Ensuring Template Compatibility with Payment Systems

Ensure your template supports the specific formatting standards of various payment systems. Customize the structure to match the expected data input and output, adhering to the requirements for transaction details, customer information, and security features. Use the recommended fields and formats outlined by each payment provider, such as date formats, currency symbols, and transaction identifiers. Additionally, validate compatibility across different platforms to avoid display issues or transaction errors.

Test your template with multiple payment processors to ensure smooth integration. Some systems may require custom API integrations or specific protocols for secure communication. Regularly update your template to accommodate any changes in payment system guidelines or software updates. Keep a close eye on any new features or security patches that could impact compatibility.

Use flexible design options that can adapt to various screen sizes and devices, maintaining readability and functionality. Double-check that all interactive elements, such as buttons and forms, align with the payment system’s usability standards. With careful attention to these details, your template will maintain seamless communication between your system and the payment service providers.

Automating Receipt Generation and Distribution

Integrate receipt generation systems with your point-of-sale or transaction management software for seamless automation. This will allow you to automatically create receipts based on transaction data without manual input. Use templates to standardize the format, ensuring consistency across all transactions. Leverage API integrations to send receipts directly to customer emails or messaging platforms after each purchase.

Streamlining the process requires setting up triggers within your system to activate receipt generation immediately after a successful transaction. These triggers can be linked to payment confirmation or order completion. Once generated, the receipt can be sent through automated email services or even directly to a mobile app, reducing the need for paper copies.

Consider offering multiple receipt formats, such as PDF or digital wallet-compatible versions. This flexibility caters to different customer preferences while maintaining an eco-friendly approach. Implementing automation not only improves customer experience but also enhances business operations by reducing time spent on manual tasks.

Regularly monitor the system’s performance to ensure proper function and resolve any errors in real-time. This can be done through automated notifications or logging systems that alert administrators to potential issues, ensuring continuous service without disruption.