Creating a receipt for child care services should be clear and professional. Use Adobe tools to design a template that ensures all necessary details are captured accurately and in a user-friendly format. A well-structured receipt helps both parents and providers keep track of payments and services rendered.

Start by including key information such as the child’s name, the provider’s name, the date of the service, and a breakdown of the charges. You can also add payment methods and any applicable taxes for complete transparency. This will make the receipt not only a proof of payment but also a valuable record for future reference.

The template can be easily customized in Adobe software to include a company logo, address, and contact details. Use clear headings, such as Services Provided, Total Amount, and Payment Status, for better organization and readability. With Adobe’s powerful tools, you can adjust fonts, colors, and layout to ensure the receipt looks polished while maintaining readability.

Here’s the improved version with reduced repetitions while maintaining clarity and correctness:

To create a professional and concise receipt template for child care services in Adobe, ensure that all necessary details are clearly displayed. Include fields for the child’s name, date of service, service hours, and the total amount due. Structure the document so that the client can quickly identify all relevant information.

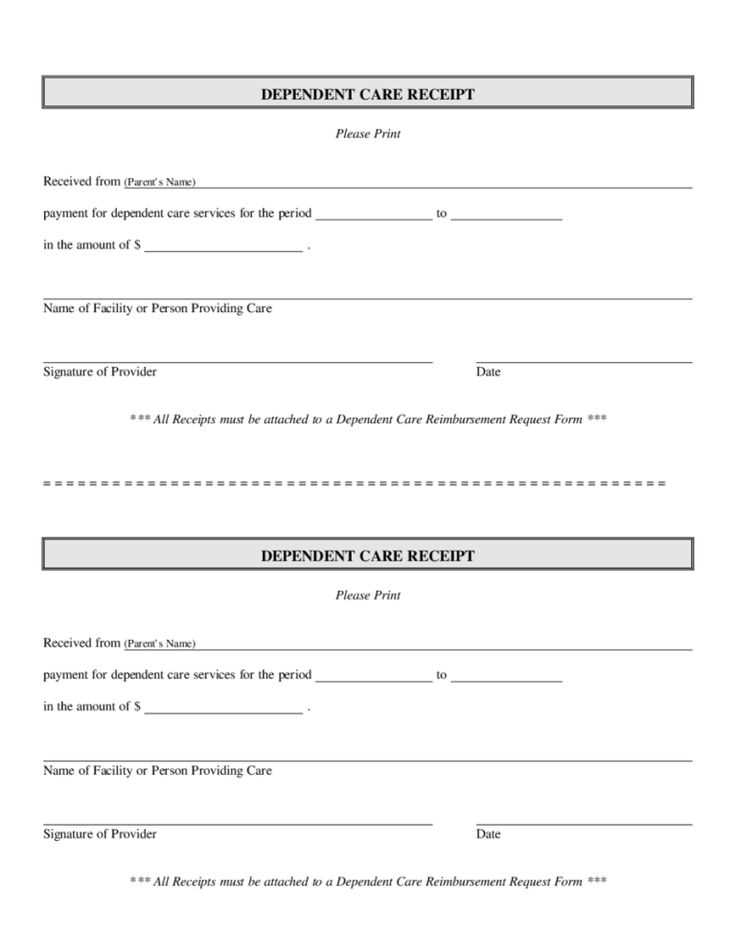

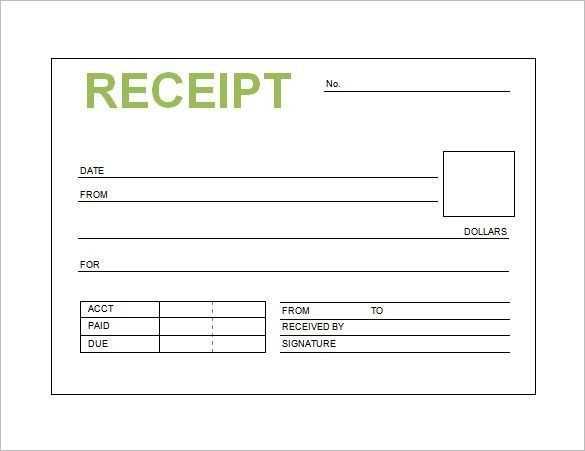

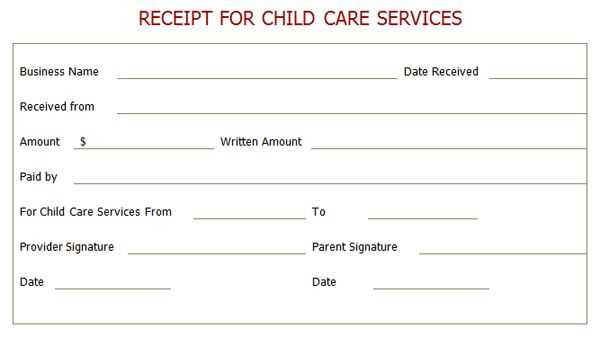

Receipt Layout

Start with a clear header that includes your business name, contact information, and a title indicating that it’s a receipt. Below the header, provide a section for the client’s information, such as their name and address, along with the date the service was provided.

Service Breakdown

List the child care services provided in a table format. Each row should detail the type of service, the hours worked, and the rate charged. Ensure the total at the bottom of this section accurately reflects the sum of all services.

Finally, include a footer with payment instructions or thank-you notes to make the receipt both functional and professional.

- Receipt Template for Adobe Child Care Services

Design a receipt template that reflects the specific needs of child care services. This template should be easy to customize and include all the necessary details. Start by incorporating the business name, address, and contact information at the top of the receipt. Include a clear title such as “Child Care Services Receipt” to avoid any confusion.

Key Elements to Include

Make sure to list the services provided, along with the corresponding dates and rates. For instance, include daily or weekly charges, as well as any additional fees for extended hours or special care services. A breakdown of the charges helps the recipient understand exactly what they are paying for.

Don’t forget to add payment details, such as the amount paid, the method of payment (e.g., cash, check, credit card), and the transaction date. Also, it’s a good idea to include a unique receipt number for future reference.

Final Touches

End the receipt with a thank you message or a note of appreciation for the client’s business. This adds a professional touch and helps maintain positive customer relationships. Keep the layout clean and organized, ensuring the most important information stands out.

Lastly, ensure that your template is compatible with Adobe programs, allowing for easy edits and printing. This will save time and ensure consistent documentation for each transaction.

Design a receipt template in Adobe by selecting a clean layout. Start with the provider’s name, business name, and contact details at the top. This gives the document a professional look. Below, add a heading like “Child Care Receipt” to make the purpose clear.

Use a table for clear organization. Set columns for essential information such as child’s name, dates of service, hours worked, hourly rate, and total amount. Include additional rows for extra charges or discounts.

Leave space for payment details, including the method and receipt number. Add a signature section for both the provider and the client, ensuring the document’s authenticity.

Save the template as a reusable PDF. Include form fields for easy entry, allowing quick updates for future receipts. Test with sample data to check alignment and spacing, adjusting where necessary.

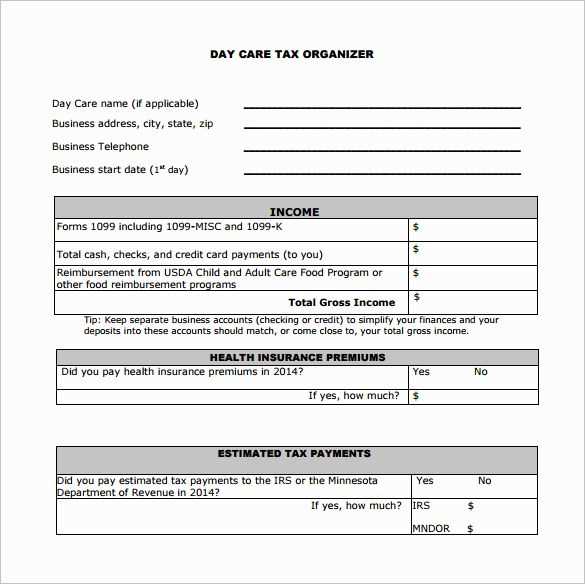

Break down the total cost clearly by listing all charges, taxes, and payments. This ensures transparency and helps avoid confusion.

- Itemized Charges: Include the cost of services or products, listing each one individually. Specify quantities and prices where applicable.

- Tax Information: State the tax rate applied and the total tax amount separately. If there are multiple types of taxes, list them individually, such as state, local, and federal taxes.

- Discounts and Adjustments: If discounts, promotions, or credits are applied, show these amounts and explain the reason for the adjustment. It helps clarify the final price.

- Total Payment: Provide the final amount due after adding taxes and applying discounts. Also, list the payment method (e.g., credit card, cash, check). If multiple payments were made, detail each one.

By clearly outlining the breakdown, both the customer and provider can review the charges and ensure accuracy in the transaction.

Ensure that your child care receipt template includes accurate details such as the provider’s name, business address, tax identification number, and the dates of service. These elements are necessary for legal purposes, especially when the receipts are used for tax deductions or reimbursement claims.

Clearly state the amount paid, listing both the total cost and any applicable taxes. This transparency helps both parents and providers stay compliant with tax regulations. Also, make sure the format complies with your local regulations by verifying with a tax professional.

Incorporate a breakdown of services rendered. Detail each service with the respective amounts to provide clarity. Some regions require this level of transparency to avoid issues during audits or claims.

Ensure the receipt includes a clear statement about the nature of the payment. For example, specify if the payment is for a deposit, a monthly fee, or for additional services like field trips or special events.

Finally, regularly update your template to match any changes in tax laws or legal requirements. This proactive approach will keep you compliant and ready for any financial or legal review.

Ensure that your receipt template includes a clear structure, with each section of the document properly organized. Start by listing the services provided, specifying the dates and hours of care. Then, include the total amount, taxes if applicable, and any discounts. Use clear headings to separate each part of the receipt. Add a space for the child’s name and the caregiver’s details at the top for easy identification.

Always include the payment method and the total sum in a visible area, ensuring that all necessary details are easy to spot. Consider including a brief note about any terms or policies regarding payments, such as late fees, to avoid confusion later on.

Make sure the receipt template is easy to edit for any future modifications or updates. Use a format that supports quick adjustments to services or pricing without disrupting the layout. Save your template in a format that is compatible with commonly used applications for accessibility and easy printing.