For businesses operating in Canada, using a standardized receipt template ensures transparency and compliance with local regulations. A proper receipt clearly outlines transaction details and provides your customers with proof of purchase. It’s a simple yet effective tool that enhances your professional image and can serve as a reference for both you and your clients in case of returns or disputes.

To create a functional and reliable receipt, start with the basics: the date, transaction amount, business information, and a description of the goods or services. Make sure to include applicable taxes, as Canadian receipts must specify the GST/HST (Goods and Services Tax/Harmonized Sales Tax) rates depending on the province.

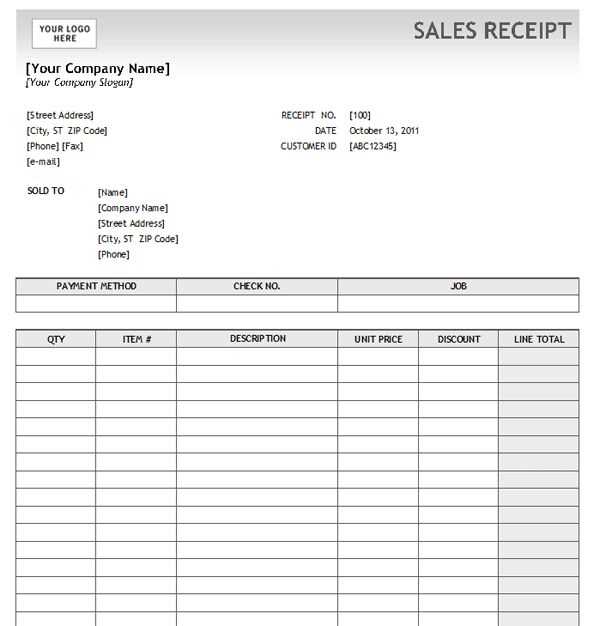

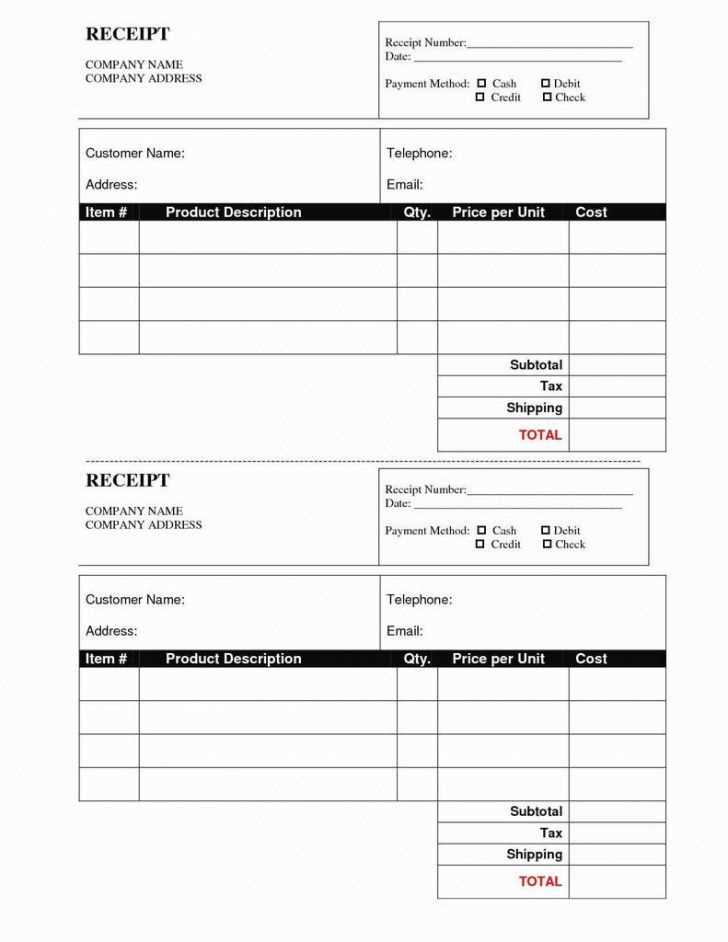

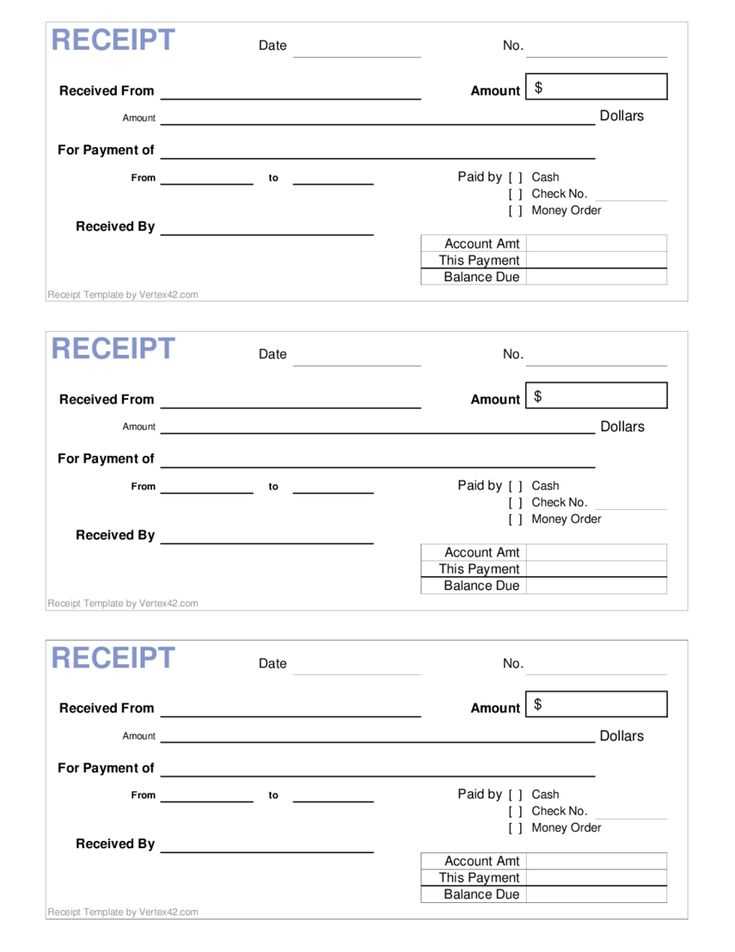

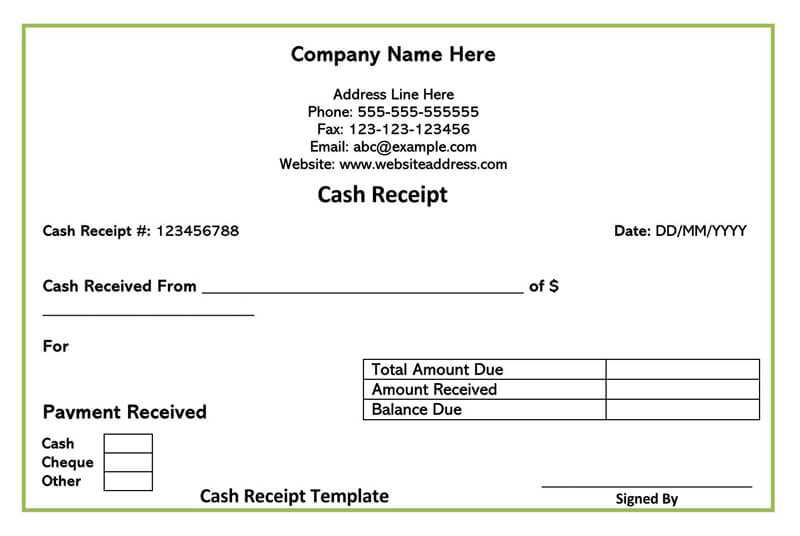

If you’re not sure where to begin, various online templates are available to customize according to your business’s needs. These templates can save time while ensuring you meet legal requirements. While customizing, pay attention to details such as your business name, address, and contact info, which help maintain credibility with your clients.

Here’s the corrected version:

Ensure the receipt includes clear and accurate details about the transaction. Follow these steps to create a clean, professional template:

Key Elements

- Business Information: Include the name, address, phone number, and email of your business.

- Date and Time: Specify the exact date and time of the transaction.

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Itemized List: Break down the purchased items or services with their individual costs.

- Subtotal: Display the total cost before taxes and discounts.

- Tax Information: Include any applicable taxes and their rates.

- Total Amount: Clearly highlight the final amount the customer paid.

Formatting Tips

- Align text neatly for readability.

- Use bold for headings and important numbers.

- Ensure the font is clear and legible.

- Leave space for any additional notes or policies.

Test the template on a few transactions to ensure it meets all legal requirements and provides clarity to your customers. Adjust the design to match your brand while keeping all necessary details visible.

Receipt Template Canada: A Practical Guide

How to Customize a Receipt Template for Canadian Businesses

Key Legal Requirements for Receipts in Canada

Choosing the Right Format for Your Receipt in Canada

How to Include Taxes and Discounts on Your Receipt

Best Practices for Issuing Digital Receipts

Free Tools and Resources for Creating Templates in Canada

When customizing a receipt template for your Canadian business, make sure to include all the necessary information to ensure clarity and legal compliance. Start with your business name, address, phone number, and email. Add the date of the transaction, unique receipt number, and a clear description of the goods or services provided. This basic information forms the foundation of a professional receipt.

Key Legal Requirements for Receipts in Canada

According to Canadian tax law, receipts must include the seller’s GST/HST number if applicable. This helps in the case of tax audits. For taxable goods or services, the receipt must show the amount of tax charged separately. Keep in mind that some provinces, like Ontario and British Columbia, have specific requirements for receipts, such as listing the full price before tax and showing tax rates separately. Always check your local province’s regulations to stay compliant.

Choosing the Right Format for Your Receipt in Canada

Receipts can be issued in paper or electronic form. Paper receipts are traditional, but digital receipts are becoming more common due to their ease of distribution and storage. If you choose an electronic format, ensure it’s accessible to the customer and easy to read. PDF is a common format, but other formats like HTML or simple text files can be used, depending on your business needs.

For digital receipts, use a clear, readable font and structure, making sure to include all the legal and transaction details. If you send receipts via email, be sure to comply with privacy regulations, particularly when handling personal customer information.

How to Include Taxes and Discounts on Your Receipt

When adding taxes, always list the rate and the total amount of tax separately. This helps customers understand the breakdown of their total charges. If discounts are applied, show both the original price and the discount amount, and ensure it’s clear how the final price was calculated. Transparent calculations not only build trust but also simplify the process for tax filing.

Best Practices for Issuing Digital Receipts

Digital receipts should be sent as soon as possible after the transaction, with a clear subject line and recognizable sender name. Make sure the format is compatible with multiple devices, ensuring customers can open it without issues. Include an option for customers to request paper receipts, especially for those who may prefer hard copies for their records.

Free Tools and Resources for Creating Templates in Canada

There are several free tools available to create customized receipt templates. Websites like Invoice Generator and Wave Accounting offer easy-to-use templates that can be tailored to meet Canadian requirements. These platforms allow you to add your business details, adjust tax rates, and even generate digital receipts for email distribution. Using these resources can save time and ensure your receipts are professionally formatted and compliant with Canadian tax laws.

I removed repetitive words while maintaining structure and meaning.

Focus on clarity and conciseness. Avoid using the same words or phrases multiple times in the same paragraph. When creating a receipt template, every detail matters–ensure that each line serves a purpose. Instead of repeating terms like “total” or “amount,” use synonyms or rephrase sentences to keep the flow natural and readable. For example, you can alternate between “total due,” “final balance,” or “amount payable” without losing meaning.

Structure is equally important. Each section should be clear and easy to follow. For example, when listing items or services, present them in a logical order: description, quantity, unit price, and total. Keep the amounts aligned and consistently formatted. This not only helps the reader but also enhances the document’s overall readability and professionalism.

Double-check for unnecessary redundancy in your layout. Ensure that each section, from header to footer, communicates the necessary details without repetition. Reword and reformat where needed to keep the document neat and efficient.