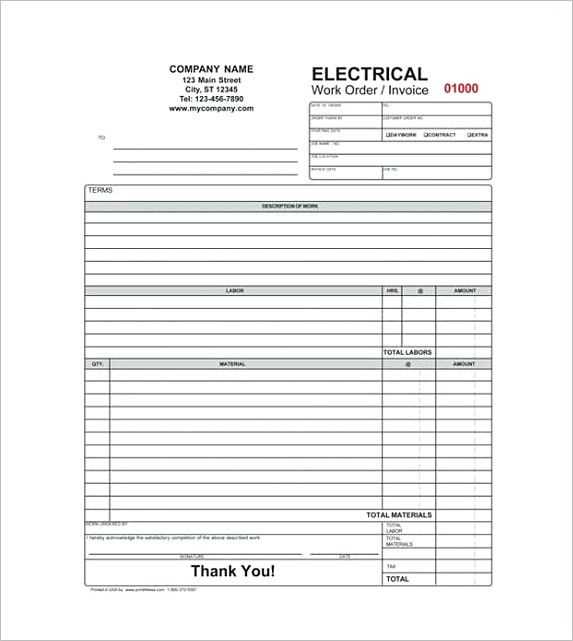

Creating a receipt for a contractor can save time and provide clear documentation for both the contractor and the client. A well-structured receipt template ensures all necessary details are included, making the transaction transparent and professional.

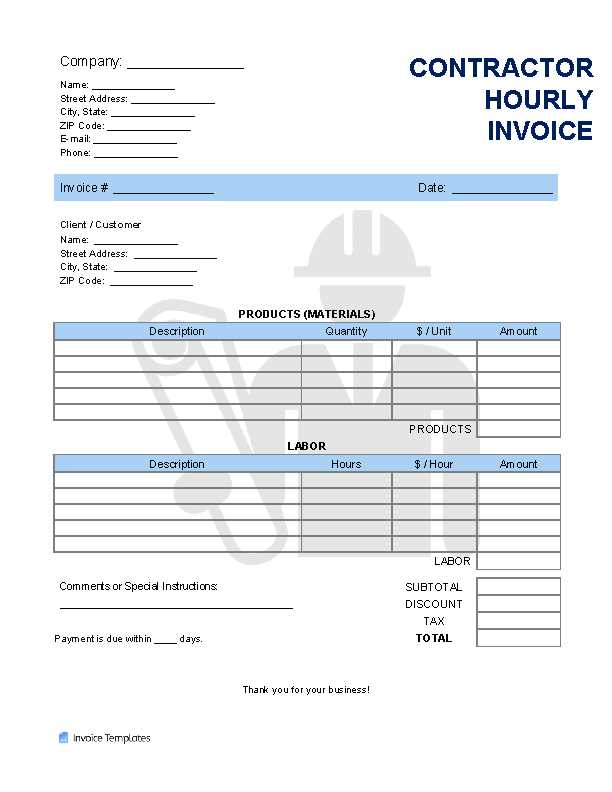

First, make sure the template includes the contractor’s full name or business name, along with contact information. This allows clients to reach out if needed and confirms the identity of the service provider. Next, include the date of service and a breakdown of the tasks completed. This adds clarity to what the client is paying for and avoids any misunderstandings later on.

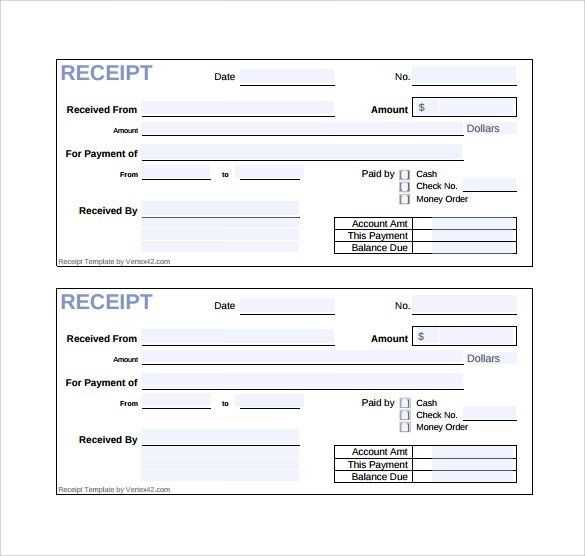

Don’t forget to list the payment method used, whether it’s cash, check, or digital payment. This helps keep a clear record for tax or accounting purposes. Finally, include a total amount paid and any additional terms, such as whether the payment is final or if further payments are expected. This simple structure will ensure both parties have a record of the agreement.

Here’s the revised version:

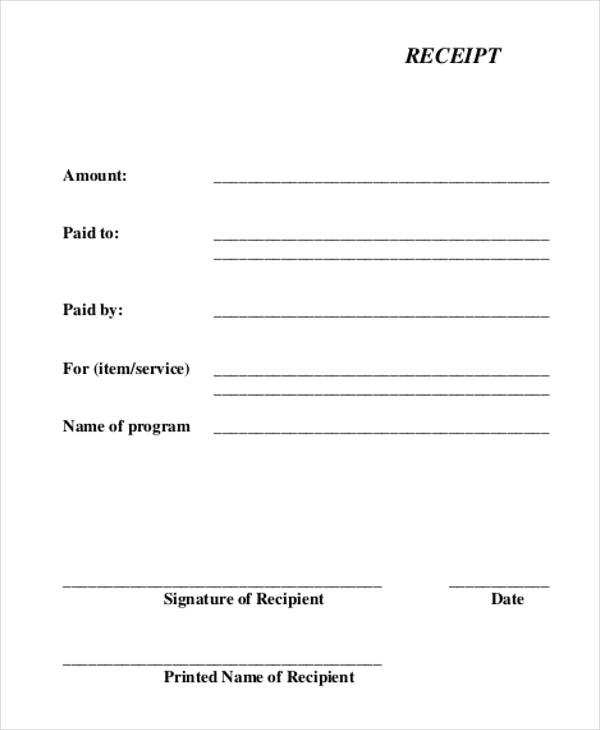

Ensure the receipt clearly identifies the contractor and client with full names, addresses, and contact information. Include the date of service or work completion, specifying any key details like project name or contract number if applicable. List the services provided with corresponding fees, and indicate any discounts or adjustments made. Break down payments received, specifying the method (e.g., cash, bank transfer) and the amount. If applicable, include the remaining balance, along with payment terms and due date. Provide a section for both parties to sign, confirming the accuracy of the details provided. Double-check that all amounts, names, and terms are correct before issuing the receipt.

Receipt Template for Contractor

How to Structure Payment Details in a Contractor Receipt

Information to Include for Legal Compliance in a Contractor Receipt

Customizing a Receipt Template for Various Project Types

Start by including clear payment details in your contractor receipt. Specify the total amount received, breaking it down into any relevant sections such as materials, labor, or other services. Use precise figures to prevent any misunderstanding. If applicable, note the payment method–whether it’s cash, check, or bank transfer. Include the date of payment to ensure clarity regarding transaction timelines.

Information to Include for Legal Compliance

For legal validity, include contractor’s details such as full name, business name (if any), and license number (if required). Additionally, provide the client’s full name and contact information. This establishes transparency and keeps all parties accountable. Keep track of any taxes applied to the payment, and make sure the receipt clearly reflects this information, adhering to local tax laws. Lastly, include a statement confirming the work was completed or services rendered as agreed upon, ensuring the receipt holds up in case of any disputes.

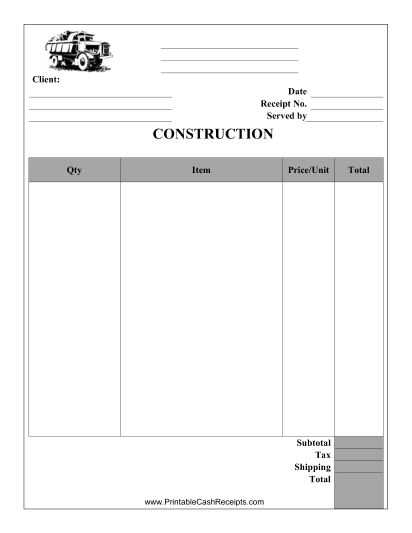

Customizing the Receipt Template

When adapting the receipt template for different projects, account for the project’s specifics. For construction jobs, list materials, hours worked, and additional expenses, if any. For freelance work, focus on service hours and any fixed fees. Including project milestones or deadlines on the receipt helps contextualize the payment within the project timeline, making the receipt more relevant to both parties. Adjust the format based on project scope and the client’s preferences, whether it’s a simple breakdown or a more detailed report of services provided.