Creating a receipt template tailored for farmers requires simplicity and clarity. A well-structured template ensures that all important details are included while maintaining a professional appearance. The first step is to include basic fields such as the buyer’s name, address, contact details, and date of the transaction.

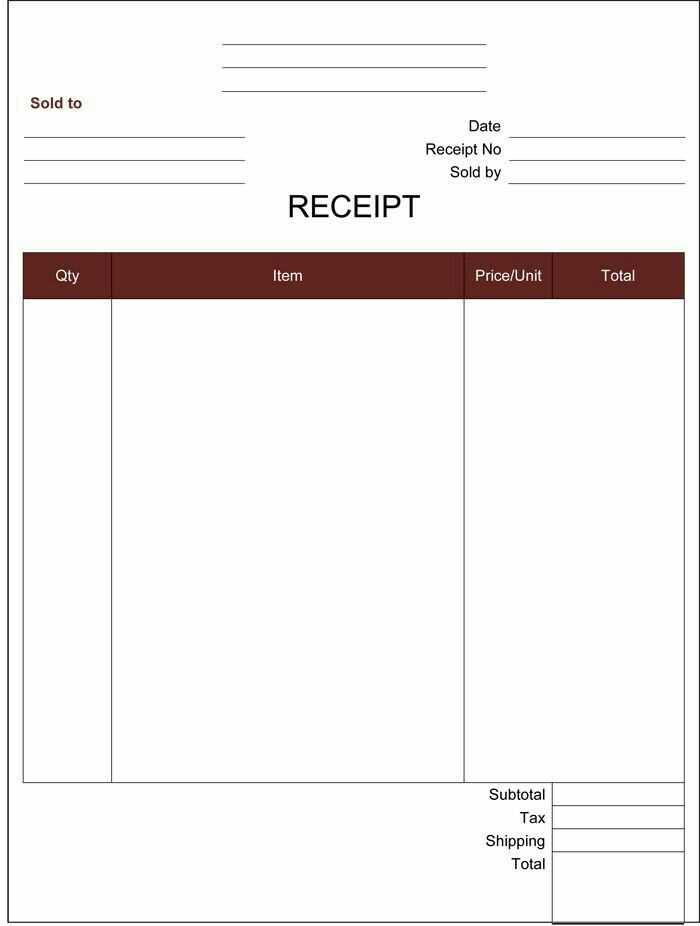

Include clear item descriptions for each product or service sold. For instance, if you’re selling produce, specify the quantity, type of crop, and unit of measurement. This helps both the seller and buyer keep accurate records. Additionally, it’s wise to include the price per unit and total cost to avoid confusion.

Don’t forget to add payment terms at the bottom of the receipt. This could cover payment methods, due dates, and any applicable taxes. Providing this information makes it easier for farmers to track their finances and stay compliant with local regulations.

A well-crafted receipt template also leaves space for notes or special instructions, offering flexibility for unique transactions. By making these updates to your receipt, farmers can streamline their business practices and maintain transparent records.

Receipt Template for Farmers

For a straightforward receipt template tailored to farming transactions, include the following key details:

1. Farm Information: Start with the farm’s name, address, and contact information at the top. This allows for easy identification and ensures that the document is linked to the correct business.

2. Buyer Details: Add the buyer’s full name and address. Including this makes the transaction clear and traceable.

3. Date of Transaction: Clearly state the date the transaction took place. This helps both parties keep accurate records for tax and financial purposes.

4. Itemized List of Goods: List each item sold, along with quantities, prices per unit, and total cost for each item. Be specific about the product, such as “bushels of corn” or “liters of milk,” to avoid confusion.

5. Total Amount: Sum up the total cost of all items. It’s good practice to break this down into subtotals if there are different categories or types of products.

6. Payment Method: Mention the method of payment used, whether it’s cash, check, or bank transfer. This will provide clarity for both buyer and seller regarding how the transaction was completed.

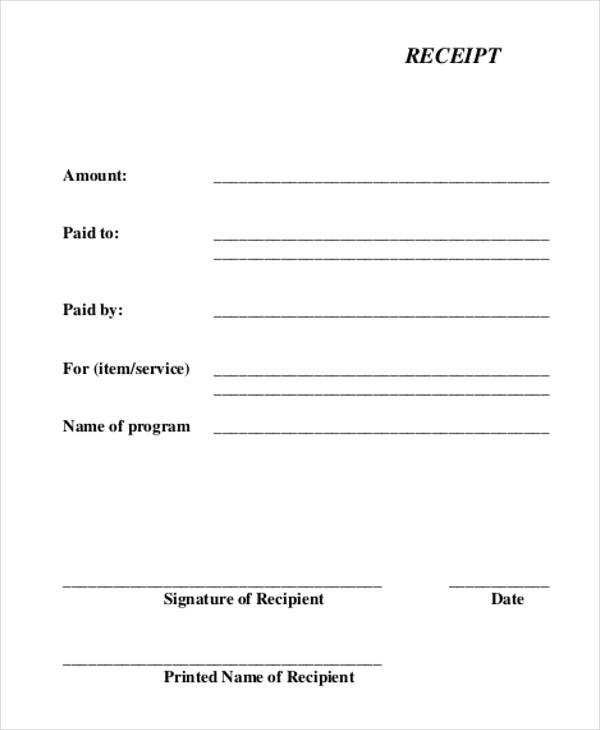

7. Signatures: Have both the seller and buyer sign the receipt. This confirms the agreement and makes it a legally binding document.

8. Additional Notes: If there are any discounts, special agreements, or future delivery details, include them at the bottom. This keeps everything transparent and helps avoid misunderstandings.

Having a clean and clear template allows farmers to maintain organized financial records and provides transparency in all transactions. Tailoring it to specific needs can further improve clarity and ease of use.

Choosing the Right Format for Farm Receipts

Farm receipts should reflect the nature of the transaction with clarity and precision. Use a straightforward, simple layout that highlights key details such as product type, quantity, price, and payment method. Avoid unnecessary design elements or complicated structures. Keep your format consistent to ensure records are easy to review and store.

A good template should include essential information, such as the seller’s and buyer’s names, business address, and date of purchase. Include a detailed breakdown of items sold or services provided, specifying unit prices and totals. A separate space for any applicable taxes helps ensure transparency.

Consider using software or tools that allow you to generate receipts in PDF or Excel formats, making it easier to store and retrieve records. These formats are widely accepted, easy to print, and compatible with various accounting systems.

If transactions are frequent, consider setting up a template that auto-fills basic information like farm name, address, and tax number, reducing the time spent on manual input while maintaining accuracy.

Lastly, ensure the format is adaptable to future changes. The receipt should easily accommodate extra fields if new information needs to be added down the line, without causing confusion or making the receipt difficult to read.

Key Information to Include in a Receipt

A receipt for a farm transaction should clearly outline all the relevant details for both parties involved. Here’s what to include:

1. Seller’s Information

Ensure the receipt includes the seller’s name, business name, and contact details (address, phone number, or email). This helps verify who is providing the goods or services.

2. Buyer’s Information

If applicable, include the buyer’s name and contact details. This is particularly important for larger transactions or ongoing business relationships.

3. Date and Time

Clearly state the date and time of the transaction to provide a proper record for both parties. This is essential for inventory management and financial tracking.

4. Itemized List of Products or Services

List each item purchased, including quantity, description, and unit price. This transparency prevents misunderstandings and ensures that both parties agree on the transaction terms.

| Product Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Fresh Tomatoes | 10 kg | $3.00 | $30.00 |

| Organic Lettuce | 5 heads | $2.00 | $10.00 |

5. Total Amount Due

Sum up the total amount due, including any taxes or additional fees. It should be clearly distinguished from the subtotal to avoid confusion.

6. Payment Method

Specify the method of payment (cash, credit card, check, etc.). This helps both the seller and buyer confirm the payment details for their records.

7. Transaction ID or Receipt Number

Assign a unique transaction ID or receipt number to each transaction. This is useful for tracking and referencing specific purchases later on.

Customizing the Template for Different Products

Adjust your receipt template by adding specific product details such as type, quantity, and price structure. Each product has unique characteristics, so ensure your template reflects these variances clearly. For instance, dairy items might include volume measurements like liters, while produce may use weight or count as the unit of measure. Customize the fields accordingly to maintain accuracy and clarity.

Product Type Fields

Different products require different information. Include custom fields for products like machinery or livestock to capture important data such as model numbers, breeding details, or serial numbers. For crops, consider adding harvesting date or batch identification to keep track of production and sales effectively.

Unit Price and Discounts

For products with varying pricing or seasonal discounts, include dynamic fields for adjusting prices based on product category or quantity purchased. This ensures the receipt remains adaptable for promotions and price changes throughout the year.

Digital vs. Paper Receipts: Which Works Best?

Digital receipts are the better option for farmers who want easy access and organization. With digital copies, you can store them in the cloud, making it easier to track and retrieve them when needed. These receipts take up no physical space, reducing clutter in your workspace and allowing you to quickly access them from any device.

Paper receipts, on the other hand, are a tangible option. They don’t require a device or internet access. However, they are prone to fading, getting lost, or being damaged, making them less reliable in the long run. Plus, managing a large number of paper receipts can become overwhelming and take up unnecessary space.

- Speed and convenience: Digital receipts are faster to store, and you can search for them quickly when needed. Paper receipts require more time to organize and search through physical piles.

- Environmental impact: Digital receipts have a smaller environmental footprint compared to paper ones. Reducing paper use helps minimize waste and saves trees.

- Security: Digital receipts can be encrypted and backed up, reducing the risk of loss. Paper receipts are vulnerable to physical damage and theft.

- Legal and tax purposes: Both formats can serve as proof of purchase, but digital receipts often come with easier tracking and organization, especially when using specific apps for farmers.

In summary, digital receipts are a more practical, secure, and eco-friendly solution, making them a preferred choice for farmers aiming for better organization and easier management of transactions.

Ensuring Legal Compliance in Receipt Design

Include clear and accurate details on every receipt, such as the business name, address, contact information, and tax identification number (TIN). Make sure the date and time of the transaction are displayed, along with a description of the products or services provided and their prices.

Ensure the receipt specifies the method of payment used, such as cash, card, or other forms. If applicable, include tax breakdowns like VAT or sales tax and clearly indicate the applicable tax rates. Be sure to follow any local regulations related to invoicing and documentation.

For farmers, it is crucial to state any exemptions or subsidies received during the transaction, especially if agricultural goods are involved. This ensures transparency and keeps the business compliant with tax reporting requirements.

Design the receipt in a way that it can be easily understood by customers, avoiding complicated terms or abbreviations. This will not only keep your transactions clear but also prevent confusion in case of audits or disputes.

Stay up to date with the local legal requirements for receipts, as regulations may vary depending on your country or region. Keep an eye on industry guidelines to ensure that your receipt design remains compliant and up to date. Consider seeking advice from a legal expert to ensure full compliance with the laws relevant to your farm business.

Integrating Receipts with Accounting Systems

Link your receipt templates directly with accounting software to streamline financial tracking. This integration reduces manual data entry and minimizes errors. Choose a system that supports automatic receipt capture from various sources like email, mobile apps, or scanned documents. Set up synchronization between the receipt database and your accounting platform to ensure smooth transaction recording in real-time.

Automated categorization of receipts can save hours by grouping expenses into predefined categories, such as equipment, supplies, or labor. Customize the software to match your farm’s specific accounting needs. Additionally, ensure that your receipt formats align with your accounting system’s requirements, whether it’s a simple CSV file or a more complex API integration.

Cloud-based solutions offer easy access to financial data from any location, which is particularly beneficial for farm operations with multiple locations. Always back up data regularly to prevent any loss of financial information. With a solid integration in place, your accounting systems will update automatically, providing an accurate, real-time overview of farm expenses.