To create a receipt for Missouri expoughment, it is important to follow specific guidelines to ensure compliance with state requirements. Begin by including the date of the transaction, the total amount paid, and a brief description of the service provided. This will allow for easy tracking and clear understanding of the payment details.

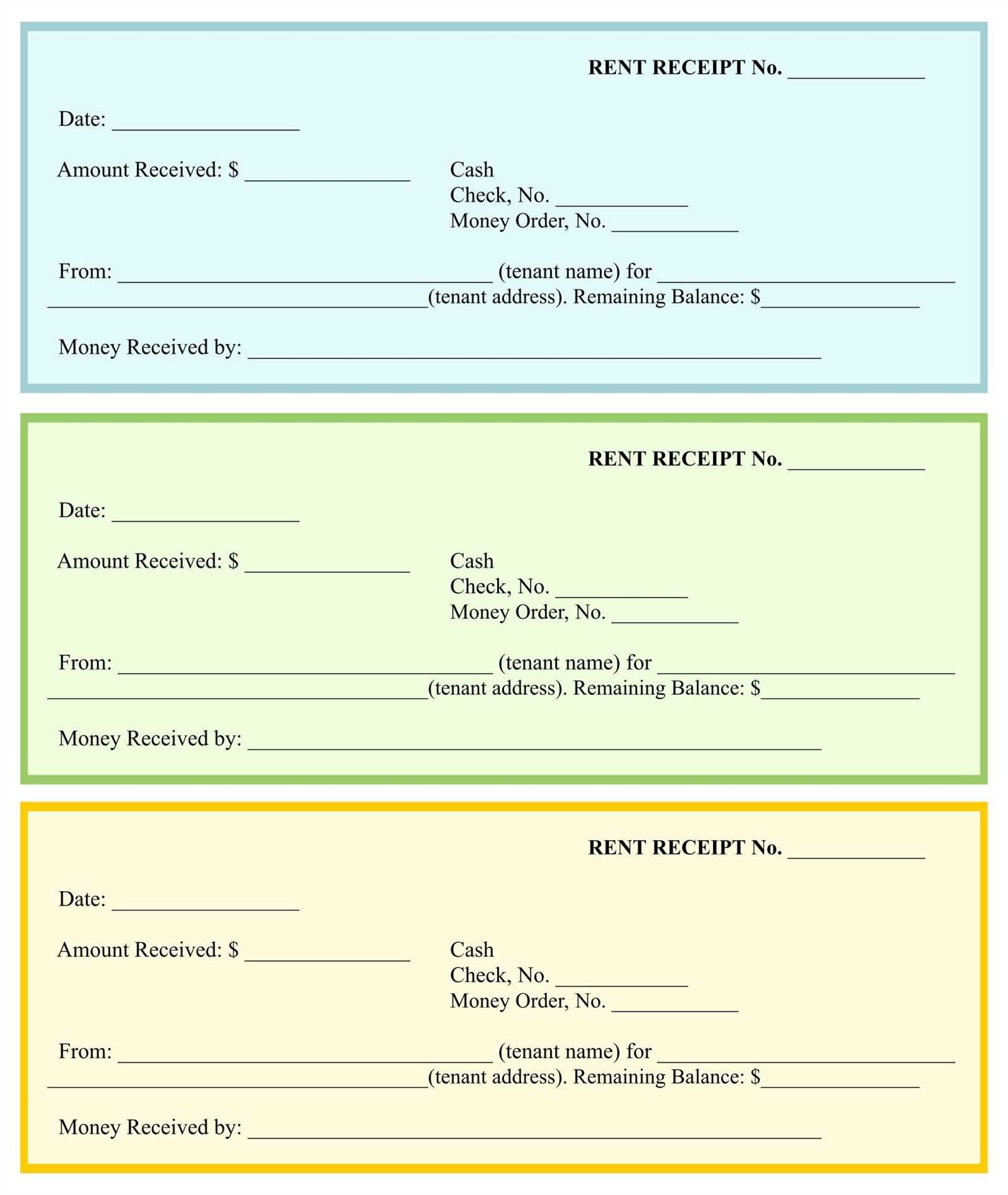

Make sure to include the payer’s and receiver’s full names, addresses, and contact information. This information helps establish clear identification of both parties involved in the transaction. It is also recommended to list the method of payment, whether it was by check, credit card, or another method, to provide transparency in the transaction process.

Finally, include any applicable taxes or fees associated with the expoughment, ensuring that the total reflects these costs. Keeping your receipt accurate and organized will help in case of any future inquiries or audits.

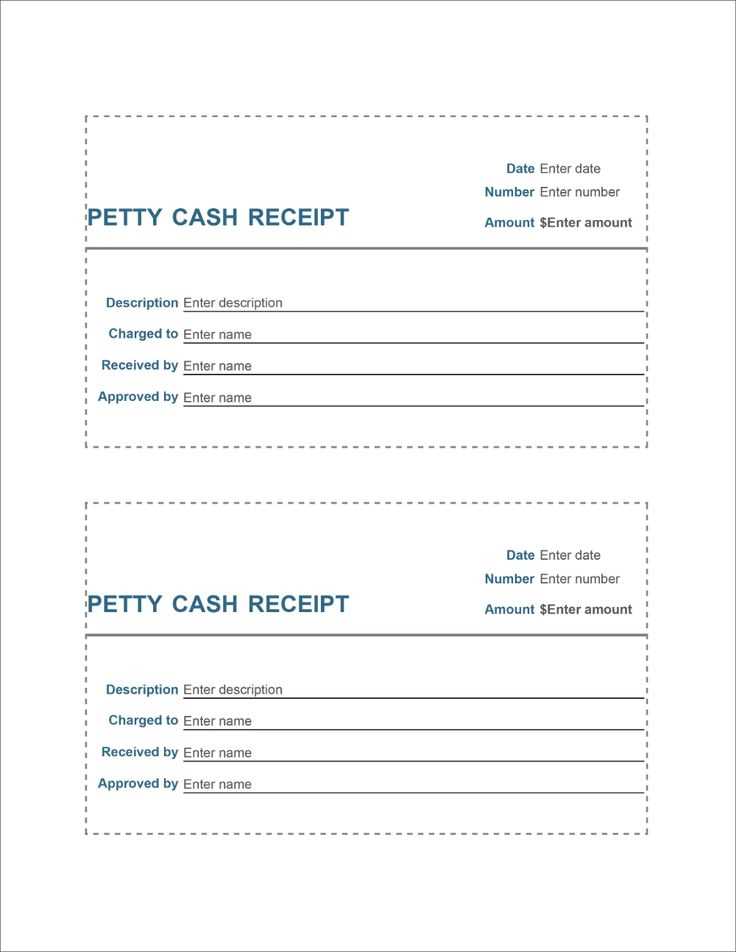

Receipt Template for Missouri Expoughment

Use this structured template for Missouri Expoughment transactions to ensure clarity and compliance with local regulations.

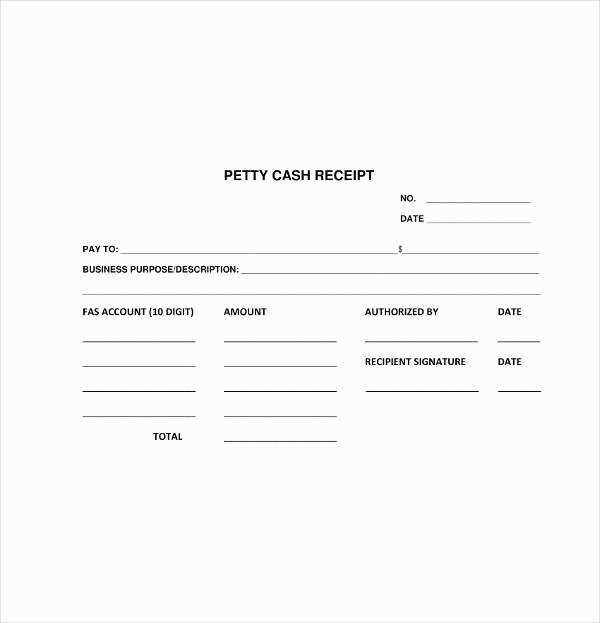

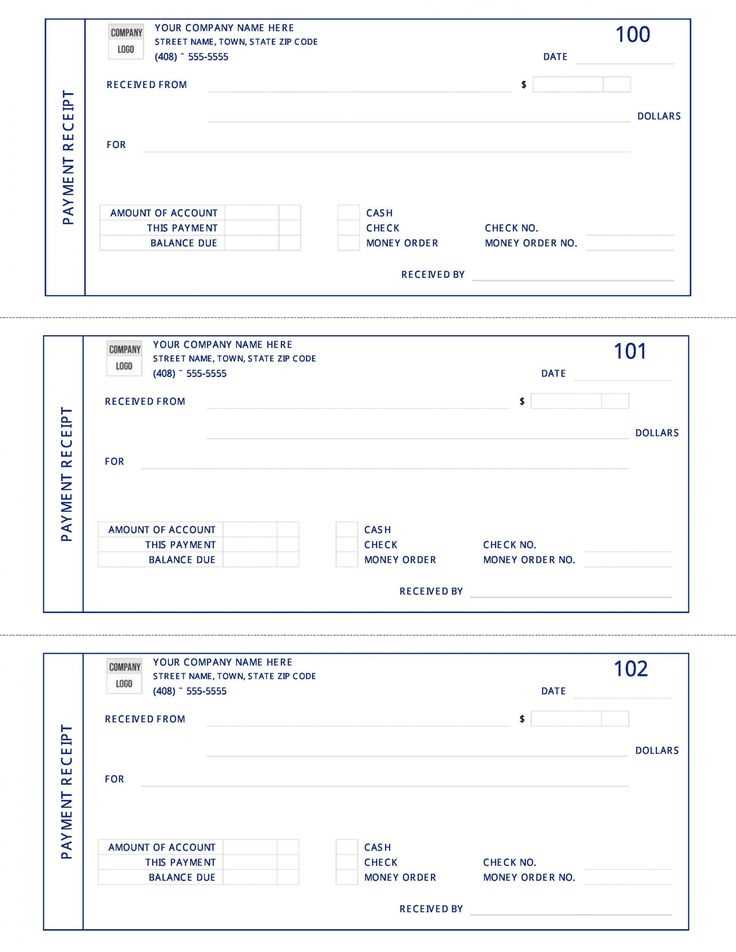

Begin with the header containing the name of the business or service provider. Include the full address, contact details, and a unique identification number for easy reference.

Next, list the customer’s details, including their full name, address, and contact information. Include the date and time of the transaction.

Itemize the goods or services provided. Specify the quantity, description, unit price, and total for each item or service. If applicable, include taxes and any discounts applied.

Ensure the total amount due is clearly indicated at the bottom, showing a breakdown of the charges. Provide payment information, whether the payment was made by cash, credit, or another method.

Include any relevant terms and conditions, such as return policies or warranties, to provide transparency for both parties.

Lastly, sign and date the receipt to authenticate the transaction and ensure it aligns with legal requirements for Missouri Expoughment transactions.

Step-by-Step Guide to Creating a Valid Template

Begin by gathering all necessary information that needs to appear on the receipt. This includes transaction details, business name, contact information, and any specific legal or tax-related requirements unique to Missouri. Organize these elements in a clear and structured format for easy accessibility.

Next, decide on the layout of your receipt. Ensure the following fields are included:

| Field | Description |

|---|---|

| Business Name | Provide the full name of the business issuing the receipt. |

| Business Address | Include the physical address where the business operates. |

| Transaction Date | Indicate the exact date of the transaction. |

| Receipt Number | A unique identifier for the transaction. |

| Itemized List | Break down the purchased items or services, showing quantity and price. |

| Subtotal | Total cost of the items before tax. |

| Tax | Include applicable tax based on Missouri state regulations. |

| Total | The final amount due, including tax. |

After organizing the information, format the receipt to be easily readable. Use clear fonts, appropriate spacing, and labels for each section to avoid confusion.

Ensure the template adheres to Missouri’s receipt requirements, which may include providing information such as business identification number or a disclaimer about refund policies. Double-check for any state-specific mandates that may affect receipt details.

Lastly, test the template by filling it with sample data to ensure all fields are displayed correctly and align properly. Adjust margins or spacing if needed to ensure it prints clearly on standard paper sizes.

Key Legal Information to Include in Your Receipt

Always include the following legal details to ensure your receipt complies with Missouri’s requirements:

- Business Name and Address – Clearly state the full name of your business and its physical address.

- Tax Identification Number (TIN) – Include your business’s TIN for tax reporting purposes.

- Date of Transaction – The exact date when the purchase or service was completed must be specified.

- Description of Goods or Services – Itemize the products or services provided with a clear description.

- Amount Paid – Indicate the total price paid, including any taxes or fees.

- Method of Payment – Specify whether the payment was made by cash, check, credit card, or other methods.

Additional Legal Notes

- Refund and Return Policies – If applicable, provide a statement regarding any return or refund policies.

- Consumer Rights – Ensure your receipt includes information on consumer rights under Missouri law, especially for warranties or disputes.

Customizing the Template for Different Transaction Types

Tailor the receipt template for various transaction types by adjusting the layout to match specific needs. For cash transactions, ensure that the total amount paid and change given are clearly displayed. Use a bold font for the “Total” field and a separate section for the “Change” to prevent confusion.

For Credit or Debit Card Payments

For credit card transactions, include a section for the card type and the last four digits of the card number. Ensure the authorization code and transaction ID are visible for tracking purposes. Make room for any processing fees that may apply, with a separate line for these fees to avoid any misunderstandings.

For Refunds or Exchanges

When customizing the receipt for refunds or exchanges, show a clear indication that this is a reversal of a previous transaction. Include the original receipt number and the reason for the refund or exchange. Make sure the “Refund” or “Exchange” label is prominent to distinguish this from a regular sale.