Use a clear and organized receipt template to keep your financial records tidy and professional. A well-designed template ensures you capture all the necessary details, from transaction amounts to the purpose of each service. This approach makes it easier for your clients to understand their payments and helps you stay on top of your income for tax purposes.

Include the following key elements in your template:

- Business Name and Contact Info: Start with your business name, address, phone number, and email. This is crucial for both you and your client for future correspondence.

- Receipt Number: Assign a unique number to each receipt for easy tracking.

- Client Details: Include the client’s name and contact information.

- Date of Transaction: Make sure to note the date when the payment was made.

- Description of Services: Provide a brief yet clear description of the services provided or goods sold.

- Amount Paid: Include the total amount, broken down into clear categories (e.g., hourly rate, product cost, taxes).

- Payment Method: Specify how the payment was made (e.g., cash, card, check, bank transfer).

With this template, managing your receipts becomes straightforward. It also builds trust with clients, as they can easily reference their payment history for accounting or reimbursement purposes. Stay consistent with your receipt format, and your financial tracking will become seamless.

Here are the corrected lines with repetition minimized:

For a self-employed individual creating a receipt template, clarity and accuracy are crucial. Here’s a refined list of common elements to include, ensuring all necessary details are clear and concise.

- Receipt Number: A unique identifier for each transaction.

- Date of Transaction: The exact date when the service or product was provided.

- Business Name: Your business name or your full name if you’re a sole proprietor.

- Contact Information: Your phone number or email for follow-up inquiries.

- Description of Service/Product: A brief, clear explanation of what was provided.

- Amount Charged: The total charge, including any applicable taxes.

- Payment Method: Indicate how payment was made (cash, card, etc.).

- Signature: Your signature or a digital equivalent, verifying the transaction.

By keeping each line clear and focused on a specific piece of information, you ensure that the receipt is both professional and easily understandable for the client. This format eliminates redundancy while maintaining all necessary details.

- Receipt Template for Self-Employed Individuals

For self-employed individuals, creating an accurate receipt template is a key step in maintaining clear financial records. A well-organized receipt ensures both the service provider and client have a consistent understanding of the transaction. Here’s a simple structure for your template:

| Section | Details |

|---|---|

| Receipt Number | Assign a unique number to each receipt for easier tracking. |

| Client Information | Include the full name and address of the client or business. |

| Date | Include the date the service was provided or the payment was made. |

| Service/Product Description | List the specific service or product provided with a clear, detailed description. |

| Amount | Indicate the total amount due, breaking it down by service or product if necessary. |

| Payment Method | Specify whether the payment was made via cash, card, bank transfer, etc. |

| Tax Information | If applicable, list any taxes applied to the transaction, including VAT or sales tax. |

| Signature | Include a space for the service provider’s signature to confirm the transaction. |

This template helps both parties keep accurate records for future reference. You can customize the fields based on your specific needs or the services offered. Keep a copy of each receipt for your own tax reporting and record-keeping purposes.

To create a straightforward receipt template for freelancers, focus on clarity and necessary details. Here’s a step-by-step guide:

- Header: Include your name or business name and contact information at the top. Add the word “Receipt” clearly visible, so it’s unmistakable.

- Receipt Number: Generate a unique receipt number for each transaction. This helps in tracking your finances and preventing confusion in the future.

- Date: Make sure to record the date the payment was received. This will keep your records up-to-date for tax purposes and personal reference.

- Client Information: Include the client’s name, address, and contact details. This establishes clarity on who made the payment.

- Itemized List of Services: Break down the services or products you provided. Include a brief description, quantity, and rate per item. This level of detail avoids ambiguity.

- Total Amount: Clearly indicate the total amount the client paid. If taxes or additional fees are involved, show those separately.

- Payment Method: Specify how the payment was made (e.g., credit card, bank transfer, cash). This provides transparency on the transaction type.

- Notes or Additional Terms: Use this space to include any additional information, such as late payment penalties or warranty details.

- Footer: Close with a thank-you note and a reminder about any future services. This leaves a professional touch.

Once you’ve set the structure, keep the design clean and easy to read. Avoid overloading the template with unnecessary elements. Simplicity and organization are key in creating a professional receipt that clients will appreciate and understand quickly.

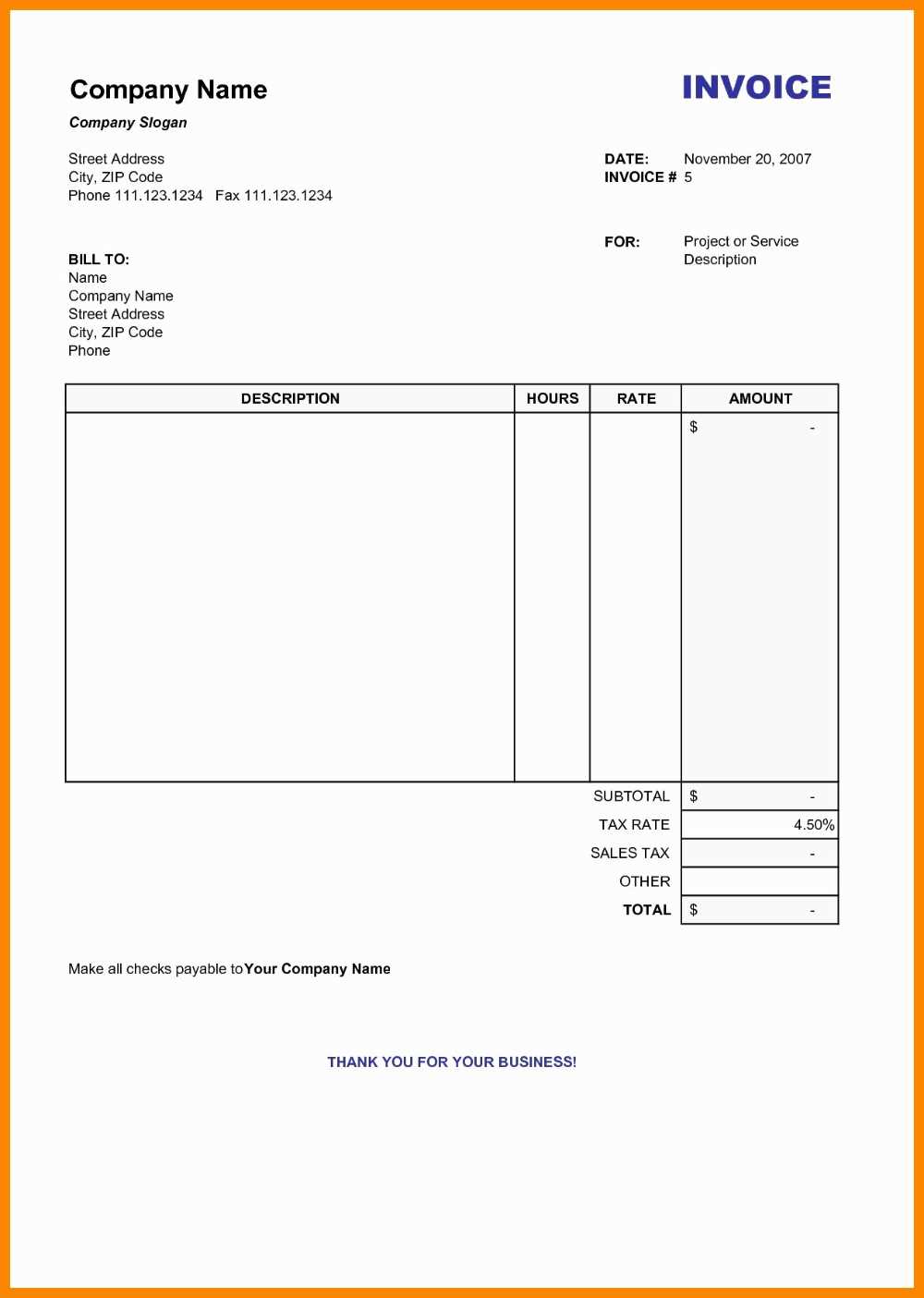

Include the following key components in your invoice to ensure clarity and professionalism:

1. Contact Information

Make sure your name or business name, address, phone number, and email are visible. This ensures the client knows who sent the invoice and how to reach you. Don’t forget to add their details as well.

2. Invoice Number and Date

Assign a unique number to each invoice. This helps keep your records organized and ensures you can track payments easily. Also, include the issue date to establish when the payment is due.

3. Payment Terms

Clearly state the due date for the payment. Specify whether late fees will apply if the payment is not made by the agreed-upon date.

4. List of Services or Products

Describe the products or services you provided, including the quantity and rate for each item. This ensures the client understands what they are paying for and eliminates confusion.

5. Total Amount Due

Summarize the total amount owed, including any applicable taxes or discounts. Make sure the math adds up so your client can easily verify the amount.

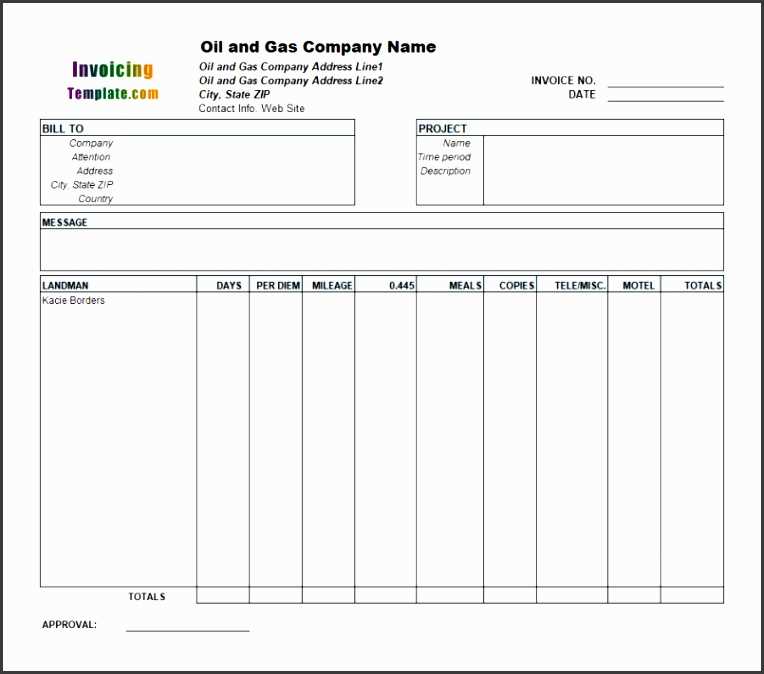

Adjust your receipt template to match the service you’re offering. For hourly services, include fields like “Hours Worked” and “Hourly Rate.” For project-based services, break down the invoice into project phases, detailing the work done at each stage. You can also add a “Materials Used” section if you charge for materials separately. Make sure to leave space for discounts or adjustments if applicable.

For consulting or coaching services, include a “Session Details” section, specifying the duration and type of consultation. If you provide recurring services, add a section for “Subscription Period” to clarify billing intervals. Use clean and simple language to make the breakdown clear for your client.

Tailor your template by adjusting the currency format, tax rates, and payment terms to match the region or service-specific needs. Keep the layout intuitive for both you and your clients to avoid confusion. Update your template regularly to reflect any pricing or service changes.

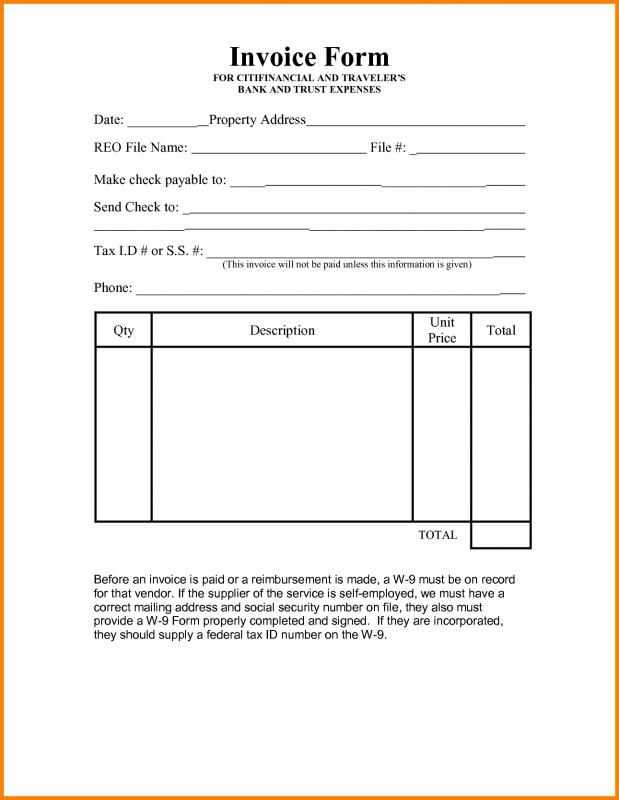

Provide a clear structure in your receipt template. Start with your business name, address, and contact information at the top. This ensures the client knows exactly who issued the receipt. Include the date of the transaction and a unique receipt number for reference.

Transaction Details

List the products or services provided, including a brief description and quantity, if applicable. Each item should have a unit price, with a clear total amount for each line. At the bottom of the list, include the subtotal, taxes (if applicable), and the final total amount due.

Payment Information

Clearly state the method of payment–whether cash, credit card, or another form. If a deposit or partial payment was made, mention the balance due and any payment terms that apply. This helps to avoid confusion and makes tracking payments easier.