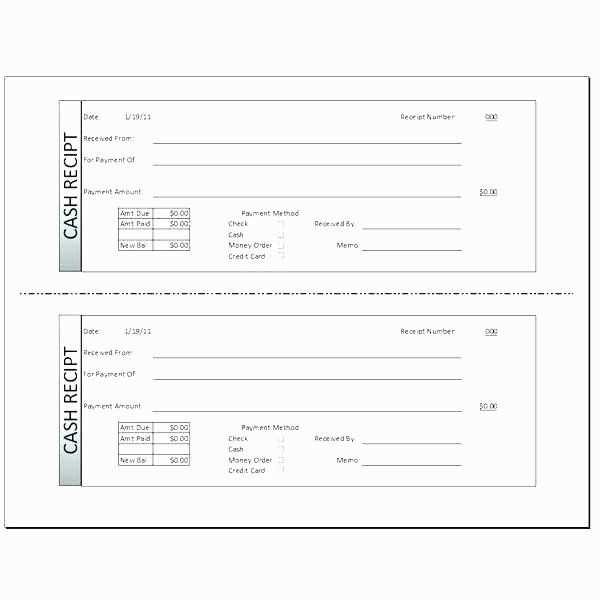

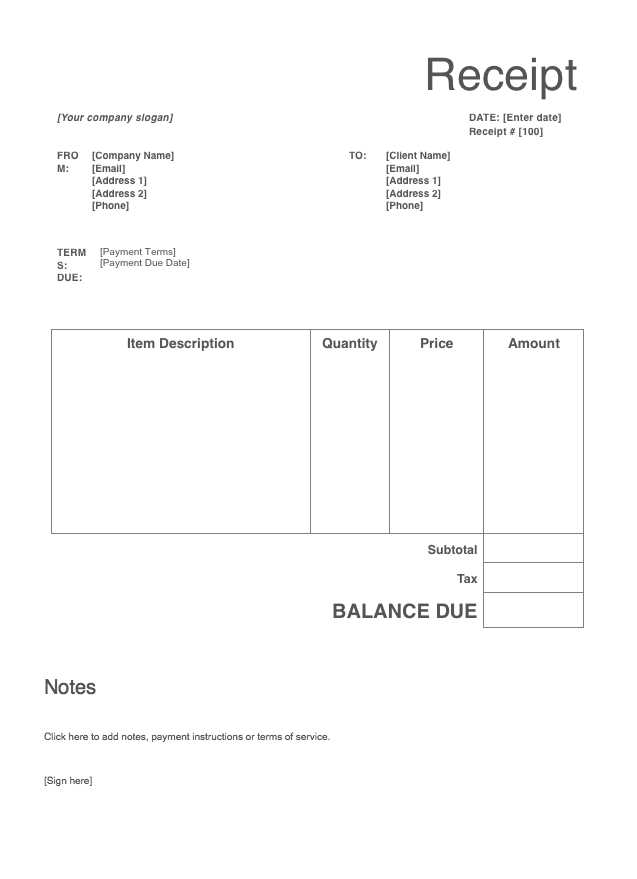

To create a professional and clear receipt for work done, start with the date of the transaction and a unique receipt number for easy reference. This helps both parties track the service and payment details without confusion. Next, list the work completed, being as specific as possible to avoid misunderstandings. For example, instead of simply writing “service provided,” detail the tasks completed, such as “repair of water pump” or “installation of software update.” This ensures transparency and builds trust.

Break down the charges clearly. Provide a description of the cost for each task or service, whether it’s an hourly rate or a flat fee. It’s also important to specify if any materials or parts were purchased separately. This gives your client a full understanding of where their money is going. Don’t forget to include any applicable taxes or discounts, as these can significantly affect the final amount.

Finally, wrap up with the total amount due, and provide payment instructions. Include your payment methods, such as bank transfer details or online payment links. If applicable, outline payment terms, including the due date or any late fees. A well-organized receipt offers clarity and encourages timely payment while reinforcing your professionalism.

Here’s the revised text where words are not repeated more than 2-3 times:

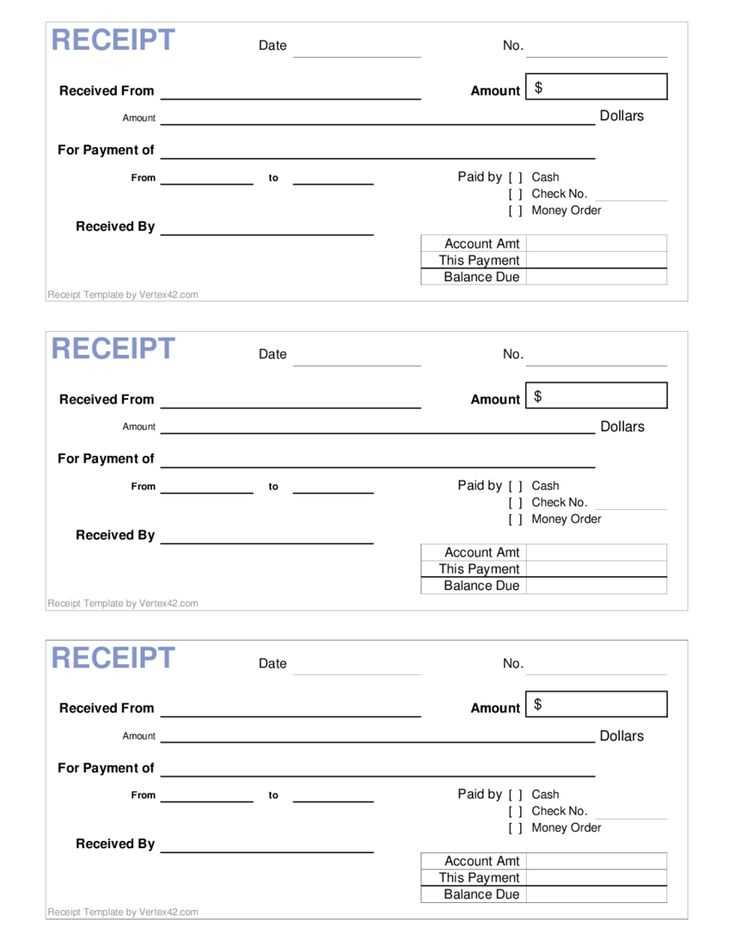

Keep the format simple and clear. A receipt should clearly outline the work performed, with a breakdown of services, hours worked, and the total cost. This structure prevents confusion and helps both parties stay on the same page.

- Work Description: Clearly list each task or service provided. Avoid vague terms.

- Hours Worked: Specify the time spent on each task to justify the total charge.

- Payment Terms: Include due dates, payment methods, and any applicable taxes.

- Total Cost: Provide a summary of charges, detailing any discounts or additional fees.

Ensure the receipt reflects accurate pricing and terms. This minimizes disputes and supports a transparent work process. Keep records to ensure clarity in case further communication is needed.

- Receipt Template for Services Completed

A receipt for services completed should include all relevant details to ensure clarity for both parties. Start with your business name, contact information, and date of the transaction. Clearly state the service provided with a concise description. List any additional charges, if applicable, such as travel fees or extra labor hours.

Make sure to break down the pricing into individual line items for transparency. For each item, include the unit cost, quantity, and total cost. If taxes apply, show the tax rate and the total tax amount separately.

At the bottom, provide a total amount due for the service, along with any payment instructions or methods accepted. Optionally, include a section for notes or terms where specific agreements or conditions can be mentioned. End with your payment confirmation number or receipt number for reference.

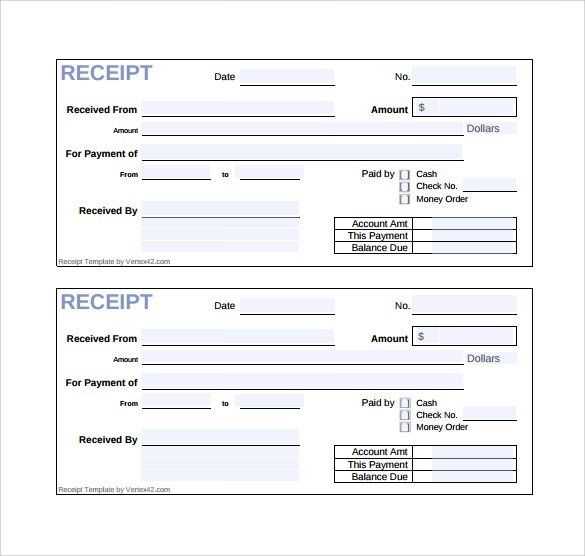

Begin with clear identification of both the service provider and client. Include the full name or company name, address, and contact details. This information helps both parties reference the transaction if needed.

Next, specify the date the services were provided and include a unique receipt number for easy tracking. This can be helpful for future inquiries or records.

Describe the services rendered with as much detail as necessary. Be concise but specific enough to avoid confusion. Include hourly rates, flat fees, or other pricing methods, as well as the total amount charged for each service item.

Ensure that tax information, if applicable, is included. Specify the tax rate and amount charged, making it clear whether the total is before or after taxes.

Summarize the total amount due, making sure it is clearly distinguished from other charges, like taxes or discounts. Any outstanding balances should be listed as well.

Finally, include payment terms and methods used. Indicate if payment was made in cash, credit, or other means, and if applicable, note the date of payment or any future due dates for remaining amounts. This helps avoid misunderstandings regarding payment completion.

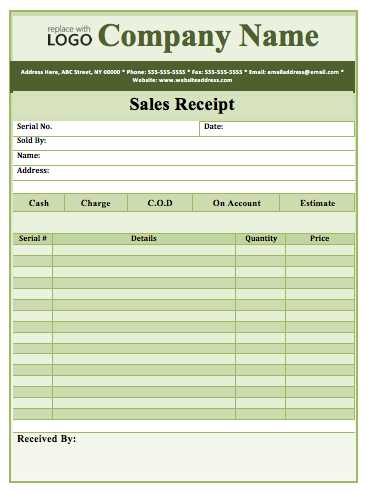

Begin with identifying the key components that define the work being done. A structured template should always include the task description, the time frame, and the cost breakdown. Each type of work will require its own unique approach, whether it’s technical repairs, creative services, or consulting tasks.

For tasks involving repairs or installations, the format should highlight parts or materials used, labor hours, and any service fees. For consulting services, include a brief overview of the consultation, hours spent, and a clear statement of fees per hour or per project.

| Work Type | Required Details | Example Breakdown |

|---|---|---|

| Technical Work (Repairs) | Description, materials, labor hours, service fees | Repair of device, parts cost: $50, labor: 2 hours |

| Creative Work (Design, Art) | Project overview, time spent, flat rate or hourly fee | Logo design, 3 hours, rate: $100/hr |

| Consulting Services | Consultation type, hours spent, fee per hour | Business strategy advice, 4 hours, $150/hr |

It’s helpful to maintain consistency across different templates. This makes invoicing and tracking easier for both the service provider and the client. Keep it simple but detailed enough to reflect all aspects of the work done. Make sure the layout is clean and readable, offering an easy-to-understand summary of the completed work.

Specify clear payment terms to avoid misunderstandings. Include the due date for payment, such as “Due within 30 days” or “Payment due upon completion.” Make sure to mention the accepted payment methods, like bank transfer, credit card, or PayPal, to ensure both parties are aligned on how transactions will occur.

Clarify any early payment discounts or late fees. For instance, you can offer a 5% discount if paid within 10 days or charge a 2% fee for payments past the due date. Be specific about when these adjustments apply.

Consider outlining your payment schedule if the work spans multiple stages. For example, a portion can be due upfront as a deposit, with subsequent payments tied to project milestones or a final balance due upon completion.

To ensure your receipt is complete, include the relevant tax details. Begin by specifying the tax rate applied to the goods or services. This can be a percentage or a fixed amount, depending on your local tax regulations.

Next, display the tax amount clearly, showing it separately from the total price. For example, if the item costs $100 and the tax rate is 10%, the tax amount should appear as $10, with the total coming to $110.

| Description | Amount |

|---|---|

| Item Price | $100 |

| Tax (10%) | $10 |

| Total | $110 |

If applicable, include your tax identification number (TIN) or VAT registration number on the receipt. This helps businesses and customers verify tax obligations. Keep in mind that local regulations may require you to include specific tax information, so check with your tax authority to ensure compliance.

Adapt the receipt format based on the specific needs of your client or business. Here are key points to consider:

- Client Information: Ensure all relevant client details are included, such as their name, address, and contact details. Customize for both personal and business clients by adding the business registration number if necessary.

- Itemized List: Break down the services or products provided in a clear and detailed manner. Depending on the client, you might want to include descriptions, quantities, and unit prices to avoid confusion.

- Tax Information: If the client requires tax details, clearly state applicable tax rates and amounts. Businesses may need a VAT breakdown, while personal clients may not require it.

- Payment Methods: List the payment methods used for transparency. If clients use multiple methods (e.g., part cash, part credit), specify each transaction accordingly.

- Due Dates: Include payment due dates where applicable. Businesses may have specific invoicing cycles that need to be reflected on the receipt.

Customize each receipt to match the client’s preferences and business practices to ensure clarity and compliance. Regularly review your receipt format to align with any changes in client expectations or industry standards.

When choosing between digital and physical receipts, consider your storage preferences and how you plan to organize receipts long-term. Digital receipts are easy to store and search for, saving physical space and making retrieval faster. However, they rely on digital devices and cloud storage, meaning you need to have access to these tools to keep track of your receipts effectively.

Security and Backup

Digital receipts offer the advantage of being backed up in the cloud or on secure devices, reducing the risk of loss. Physical receipts can fade over time or get damaged, making them less reliable for long-term storage. On the flip side, digital receipts require protection from hacking or data loss, which can be mitigated with strong passwords and encryption.

Environmental Impact

Digital receipts reduce paper usage, contributing to less waste and a smaller environmental footprint. Physical receipts, while sometimes necessary for legal or tax purposes, generate paper waste, often printed with excess ink or non-recyclable materials. If reducing your environmental impact is a priority, digital receipts are a better choice.

Meaning preserved, repetitions minimized.

Be clear and concise when drafting a receipt for work completed. Focus on highlighting the main details: the service provided, the date of completion, and the total amount due. Avoid cluttering the document with unnecessary information or phrases. This allows the recipient to quickly understand the purpose of the receipt without distractions. Keeping the content straightforward helps maintain clarity.

Structure the Information Simply

Start with a brief description of the work done, followed by the total cost. Organize the amounts clearly, using bullet points for different tasks if necessary. This ensures transparency and makes it easy to review the receipt. Keep the tone professional, but ensure it’s easy for the reader to follow the information presented.

Avoid Redundancy

Repetition only complicates the document. Once the key details are provided, move on without reiterating points unnecessarily. Use straightforward language, focusing solely on the information that supports the purpose of the receipt. Redundant statements do not add value and can lead to confusion or make the document appear cluttered.