Need a simple and professional receipt template in Spanish? Whether you’re a freelancer, small business owner, or just handling personal transactions, a well-structured receipt helps maintain clear records and ensures transparency. Below, you’ll find key elements to include and practical tips for customization.

A standard Spanish receipt, or recibo, should contain essential details: seller and buyer information (nombre, dirección, NIF/CIF if applicable), date (fecha), description of goods or services (descripción), total amount (importe total), and payment method (método de pago). For businesses, adding tax details like IVA (Value Added Tax) is crucial.

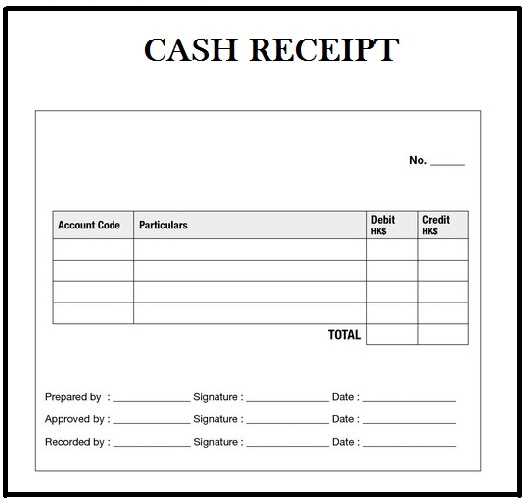

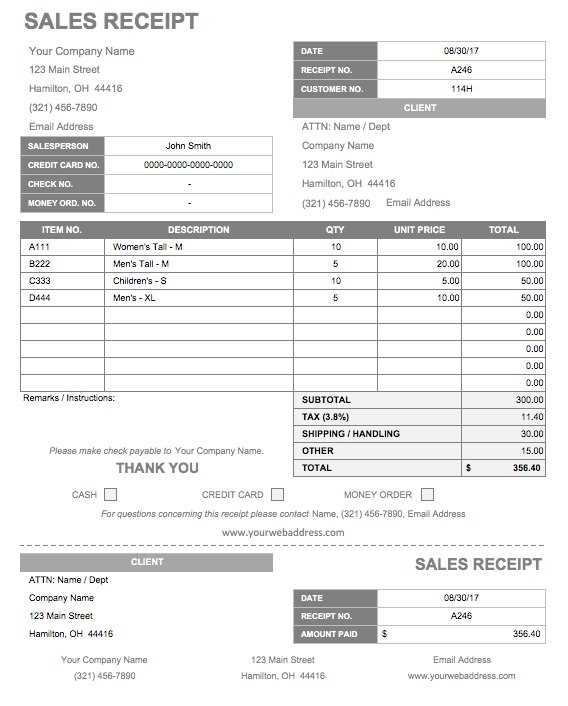

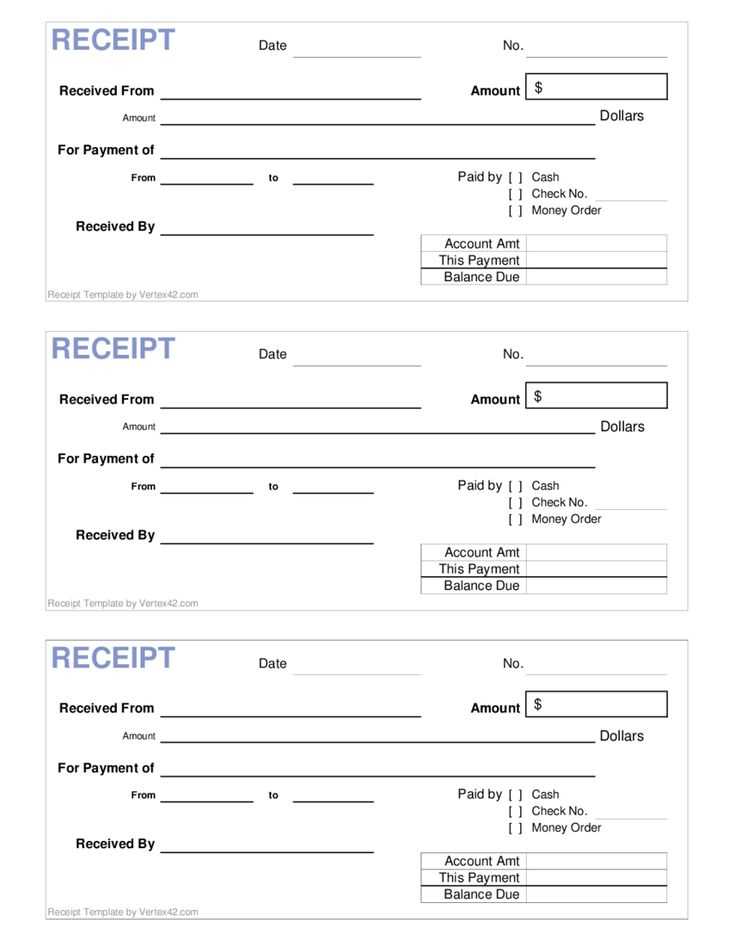

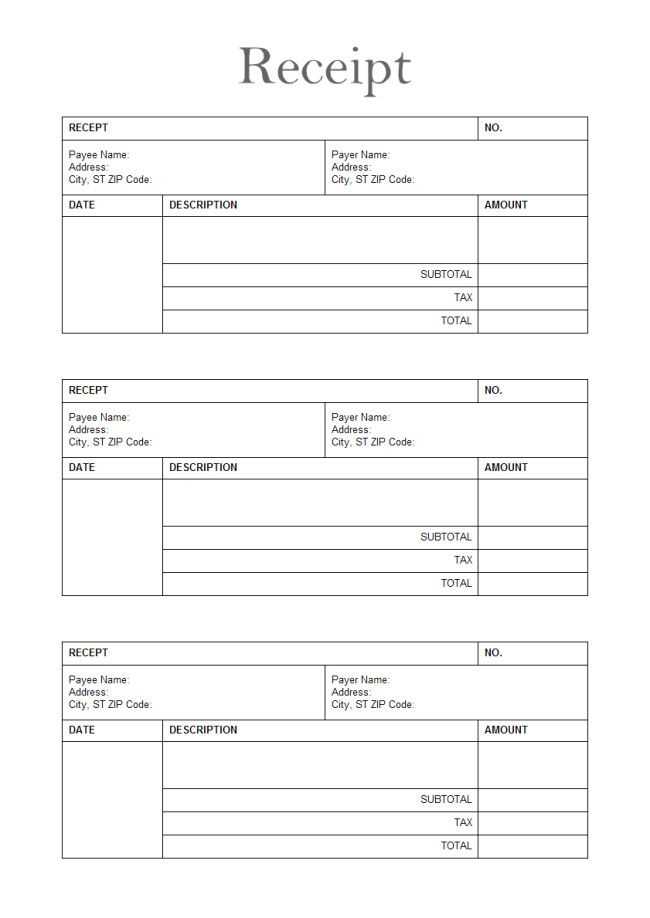

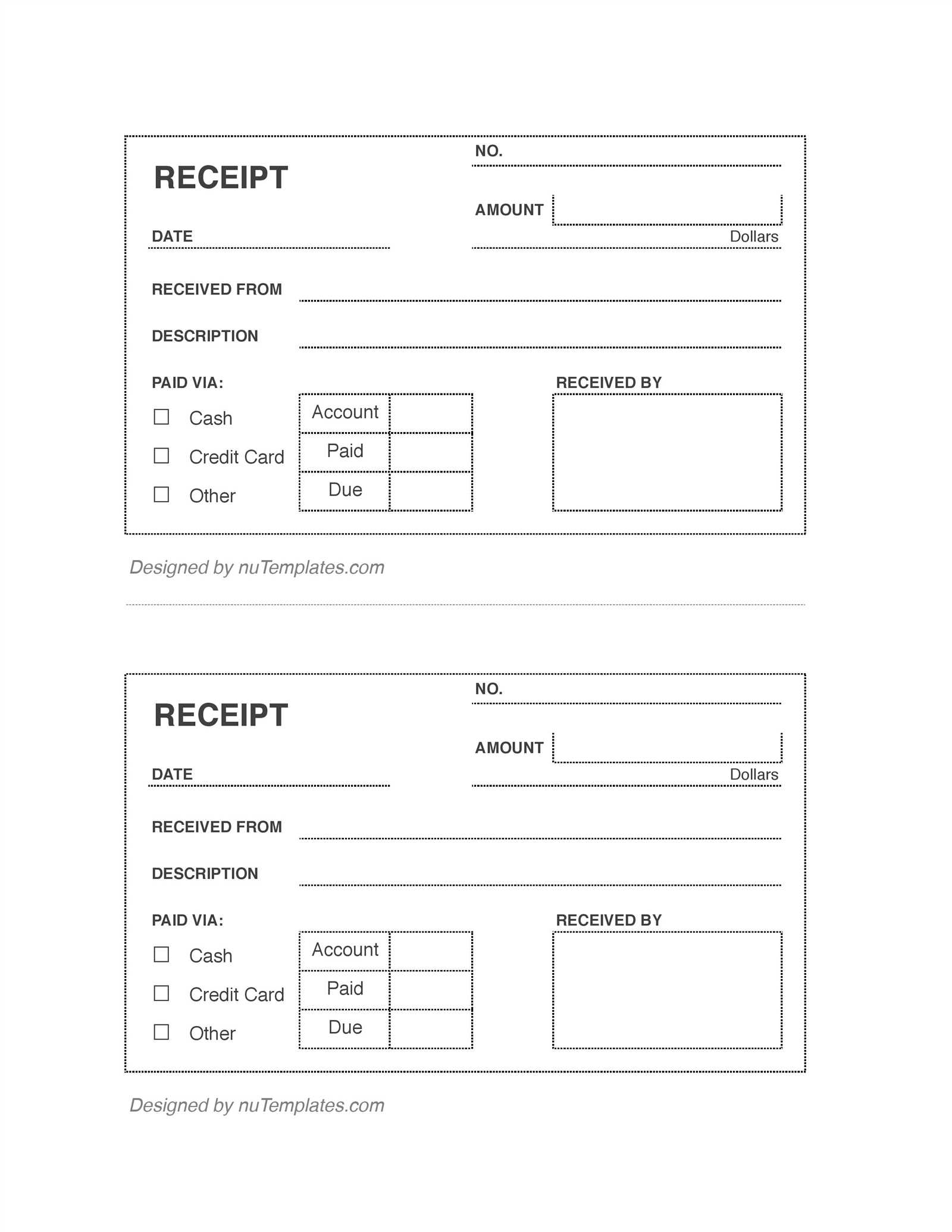

To save time, consider using a ready-made template. Many online resources offer editable receipt templates in Spanish in formats like PDF, Word, or Excel. If creating your own, keep the layout clear, use a professional font, and ensure all necessary fields are included. Adding a signature field can also enhance credibility.

Whether printing or sending receipts digitally, accuracy is key. Double-check calculations, ensure correct legal terms, and format the document for easy readability. A well-prepared receipt not only enhances professionalism but also helps with bookkeeping and compliance.

Receipt Template in Spanish

Use a structured receipt format to ensure clarity and legal compliance. A standard Spanish receipt should include:

Essential Fields

A well-formatted receipt should contain:

- Fecha: The date of issuance.

- Nombre y dirección del emisor: The seller’s name and address.

- Nombre del cliente: The buyer’s name (optional but recommended).

- Descripción de productos o servicios: A clear breakdown of items or services provided.

- Subtotal y total: The cost before and after applicable taxes.

- Método de pago: Indication of whether payment was made in cash, card, or transfer.

- Número de recibo: A unique identifier for record-keeping.

Legal Considerations

In Spain and many Latin American countries, receipts often require tax details such as a NIF (Número de Identificación Fiscal) or RFC (Registro Federal de Contribuyentes in Mexico). If issuing receipts for business purposes, ensure compliance with local regulations.

For convenience, digital templates in PDF or Excel formats streamline the process, offering pre-filled fields and automatic calculations. When using a template, verify that it aligns with regional tax laws.

Key Elements of a Spanish Receipt Template

A proper Spanish receipt template must include the seller’s full business details, such as the legal name, tax identification number (NIF/CIF), and complete address. This information ensures compliance with tax regulations and allows for easy verification.

The receipt must clearly state the date of issuance. Spanish tax authorities require receipts to reflect the exact transaction date, which is crucial for bookkeeping and VAT reporting.

Each receipt should have a unique reference number. This numbering must follow a sequential order without gaps, helping both businesses and customers track payments and prevent discrepancies.

Itemized details of the transaction are essential. The description should specify the product or service provided, quantity, unit price, and total cost. If VAT (IVA) applies, the breakdown should show the net amount, VAT percentage, and total including tax.

Payment details must be specified. Indicate whether the transaction was paid in cash, by card, or through another method. If the payment is pending, the receipt should note it as “Pendiente de pago.”

The total amount must be displayed prominently, ensuring that the subtotal, VAT, and final total are easy to read. If the business is VAT-exempt, the receipt should reference the applicable tax law justifying the exemption.

A legally compliant Spanish receipt includes a disclaimer regarding returns or refunds, aligning with consumer protection laws. If applicable, add terms such as “No se admiten devoluciones” or specify the return period.

Finally, digital receipts should include an electronic signature or QR code linking to the invoice verification system, ensuring authenticity and legal compliance.

Common Legal Requirements for Receipts in Spanish-Speaking Countries

Ensure your receipts meet legal standards by including the required information. Most Spanish-speaking countries mandate specific details for tax compliance and consumer protection.

Mandatory Information on Receipts

- Tax Identification Number (TIN) – Businesses must include their unique tax ID, such as NIF in Spain, RUC in Peru, or CUIT in Argentina.

- Business Name and Address – Full legal name and registered address must appear on the receipt.

- Customer Information – Some countries require the buyer’s tax ID and name, especially for high-value transactions.

- Receipt Number – A sequential number ensures traceability and compliance with tax regulations.

- Date and Time – Precise transaction timing helps with accounting and legal verification.

- Description of Goods or Services – A clear list with itemized pricing, including quantity and unit price.

- Total Amount and Taxes – The final cost must break down applicable taxes like VAT (IVA in many countries).

Additional Considerations

- Electronic Receipts – Many tax agencies require digital receipts with an official verification code.

- Language Requirements – In some regions, receipts must be in Spanish or include a translation.

- Retention Period – Businesses must store copies for a set number of years (e.g., five in Mexico, six in Chile).

Following these requirements avoids penalties and ensures proper tax reporting. Always check the latest regulations in your country to stay compliant.

How to Customize a Spanish Receipt Template for Your Business

Adjust the receipt template to match your business requirements by adding the company’s legal information. Include the business name, tax identification number (NIF or CIF), address, and contact details at the top. This ensures compliance with Spanish tax regulations and builds trust with customers.

Modify Currency and Tax Details

Ensure the currency is set to euros (€) or the one relevant to your transactions. For VAT (IVA), indicate the applicable percentage (e.g., 21%, 10%, or 4%) and display both the subtotal and total with tax included. If your business is exempt from VAT, specify “Exento de IVA” with the corresponding legal justification.

Personalize Item Descriptions

Use clear, professional descriptions for products or services. Avoid generic terms like “Servicio” or “Producto” and instead specify details such as “Mantenimiento de jardín” or “Reparación de motor”. This improves clarity and helps customers with bookkeeping.

Save the customized template as a reusable digital file (PDF or Excel) and, if applicable, integrate it with your invoicing software for automation. This simplifies record-keeping and ensures consistency across all issued receipts.