If you’re managing a business or just need a receipt for a transaction in Ireland, it’s important to have a well-structured template. A clear and professional receipt ensures both parties understand the details of the purchase or payment. It also helps maintain proper financial records for future reference.

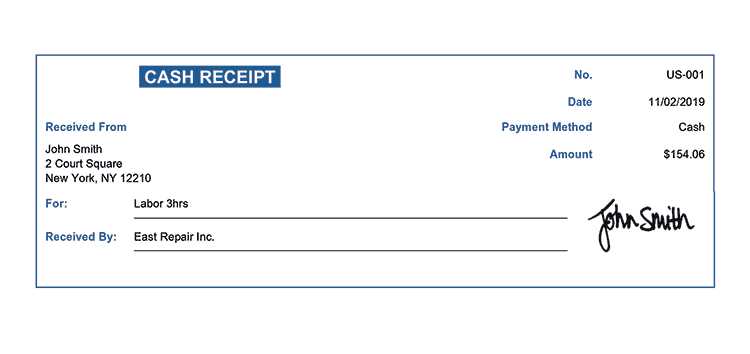

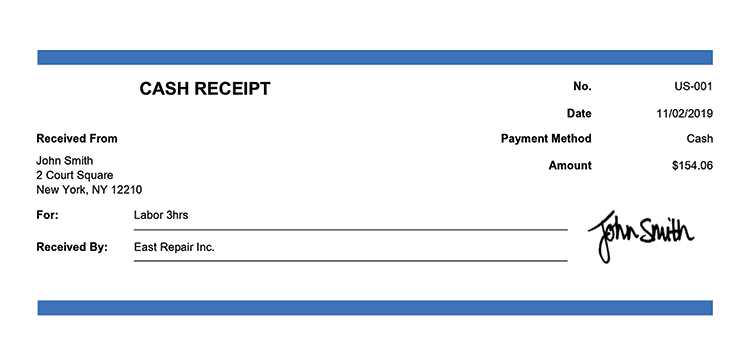

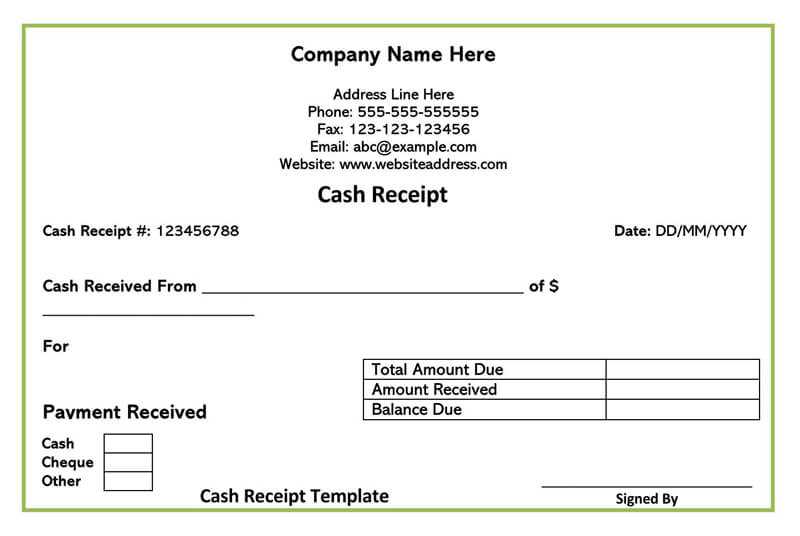

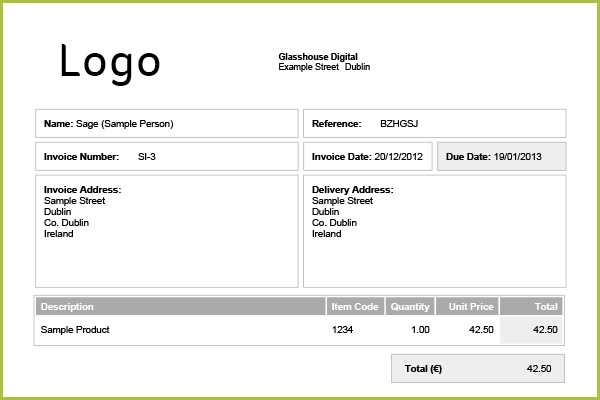

For a straightforward receipt, start with your business name and contact information. Include the date of the transaction and a unique receipt number for reference. The list of purchased items or services, along with their individual prices, should follow. Don’t forget to mention any taxes applied, especially if you’re registered for VAT. Lastly, clearly state the total amount paid and the payment method.

Depending on the nature of your business, you may want to include additional details such as your business registration number or specific terms and conditions related to returns or warranties. Adjust the template to suit your needs while keeping it simple and easy to understand for your customers.

Having a consistent receipt format not only streamlines your record-keeping but also builds trust with your clients. This simple document can prevent confusion and provide a clear summary of the transaction for both parties.

Choosing the Right Format for Your Receipt

To create a suitable receipt, select a format that aligns with your business needs and is compliant with Irish regulations. The format must be clear, concise, and fit within the standards set by tax authorities.

Standard Receipt Structure

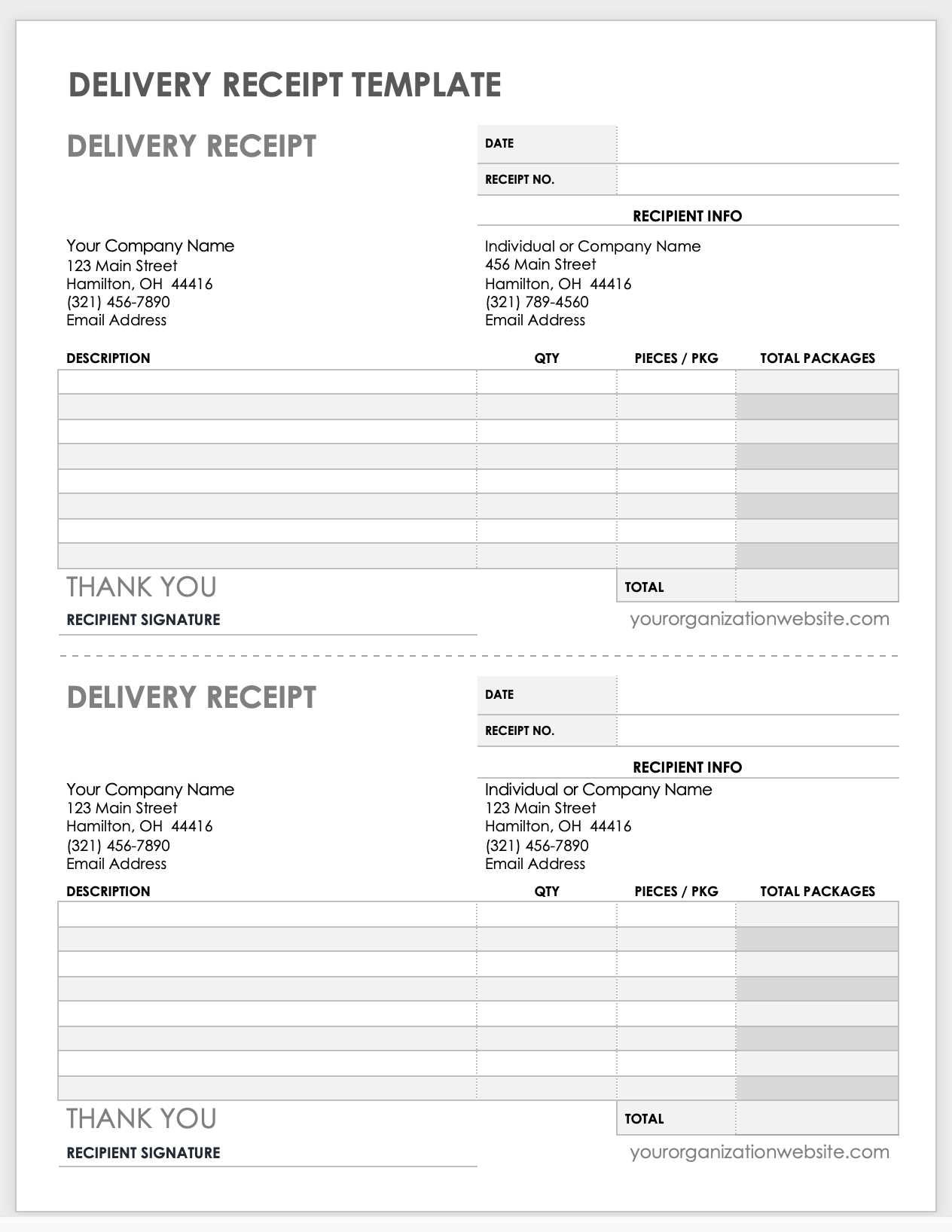

Ensure your receipt includes the following key elements:

- Business Information: Company name, address, contact details.

- Date and Time: When the transaction occurred.

- Transaction Details: Description of the goods or services purchased.

- Amount Paid: Clearly stated total, including taxes.

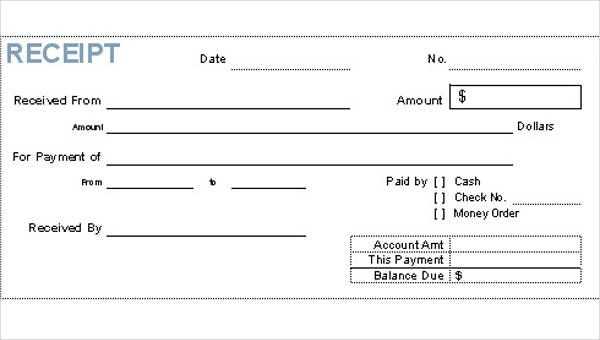

- Payment Method: Indicate if paid by cash, credit, debit, or other methods.

Legal Considerations

Receipt formats in Ireland must adhere to specific guidelines, particularly regarding VAT. Ensure the VAT number is visible if applicable, and maintain a proper record of all transactions for tax purposes.

Key Information to Include in a Receipt

Ensure the receipt clearly lists the date of the transaction. This helps both the customer and business for record-keeping purposes. Without it, the receipt could lose its value as proof of purchase.

Always include the full name of the business, as well as its contact details such as address, phone number, and email. This provides transparency and a point of contact for any follow-up questions or issues.

Itemized List of Purchased Goods or Services

Each product or service should be listed with its description, quantity, and price. This gives customers a clear breakdown of what they paid for, reducing potential confusion or disputes later.

Tax and Total Amount

Include the applicable tax amount separately. The total cost should reflect the subtotal plus any taxes, discounts, or additional fees. Clearly showing this ensures customers understand how the final amount was calculated.

Customizing Your Receipt Template

Adjust the layout of your receipt template to match your business style and needs. Focus on clarity and easy navigation for both you and your customers. Include your business logo at the top for brand recognition, and make sure the contact details are visible. If you offer multiple payment options, list them clearly so the customer can quickly verify how the transaction was processed.

For the itemized list, ensure that each product or service is described briefly with the correct pricing. Customize the font size and style to keep everything legible and professional. Consider adding a section for discounts, taxes, and total amounts to avoid confusion.

Incorporate your company’s return or refund policy at the bottom of the receipt to maintain transparency. Also, leaving space for a signature can be helpful for certain transactions that require verification or acknowledgment.

Finally, tailor the template to your local requirements, such as including VAT or other tax details as necessary. Make sure the overall design is straightforward and easy to read, with enough space between elements to prevent clutter.

Legal Considerations for Receipt Creation in Ireland

Receipts in Ireland must comply with specific regulations. Businesses are required to provide accurate and clear documentation of sales transactions. The document should include the name of the business, the amount paid, the date of the transaction, and a description of the goods or services sold. It’s crucial to ensure that receipts are legible and contain enough detail for both the buyer and the seller to verify the transaction.

The Consumer Protection Act mandates that all goods and services sold must be accurately represented on the receipt. Any misleading or false information can result in legal consequences. Additionally, receipts serve as proof of purchase, which can be critical in disputes or warranty claims.

If your business is VAT-registered, receipts must show the VAT number, the amount of VAT paid, and the VAT rate applied. For electronic receipts, the same information must be provided as on paper versions, ensuring transparency and adherence to the law.

It’s also advisable to retain copies of all receipts for a minimum of six years, as required by the Irish tax authorities. Failure to keep proper records can lead to penalties in the event of an audit or tax review.

Using Templates in Accounting Software

Templates in accounting software streamline invoicing, expense tracking, and other financial documentation. They save time by eliminating the need to create documents from scratch, ensuring consistency and accuracy across all records. Start by selecting a template that fits your needs, whether it’s for invoices, receipts, or financial statements.

Customizing Templates for Your Business

Customize templates to reflect your business logo, contact details, and preferred currency format. This will maintain a professional appearance and reduce errors. Most accounting software allows you to add fields for specific tax rates, discount structures, and payment terms tailored to your services or products.

Automating Repetitive Tasks

Set up recurring invoices or expense reports through templates to save effort on tasks that repeat regularly. Automation ensures that no information is missed, and all transactions are processed promptly, providing a clear overview of financial performance without manual input every time.

Common Mistakes to Avoid When Creating Receipts

Double-check your calculation to avoid errors in the final total. A small mistake can lead to confusion and incorrect payment records. Always verify the prices of items or services, ensuring that they match the listed rates or agreements.

Another common issue is missing information. Be sure that all relevant details, such as the date, business name, and contact information, are included. Skipping any key components can make a receipt incomplete and less professional.

Using unclear formats or fonts may confuse the person receiving the document. Choose a clear, easy-to-read font and maintain a clean layout. Too much clutter can make it hard to identify important details quickly.

| Common Mistakes | Impact |

|---|---|

| Incorrect calculation | Leads to confusion and disputes |

| Missing key information | Reduces clarity and professionalism |

| Poor formatting | Causes difficulty in reading and understanding |

Keep your records accurate and simple, and always test your creation before issuing it to customers.