Creating a receipt template without VAT is a straightforward task that can save time and ensure accuracy in transactions where VAT does not apply. If your business operates in regions or industries where VAT is not required, you can simplify your accounting processes with a clear and easy-to-use template.

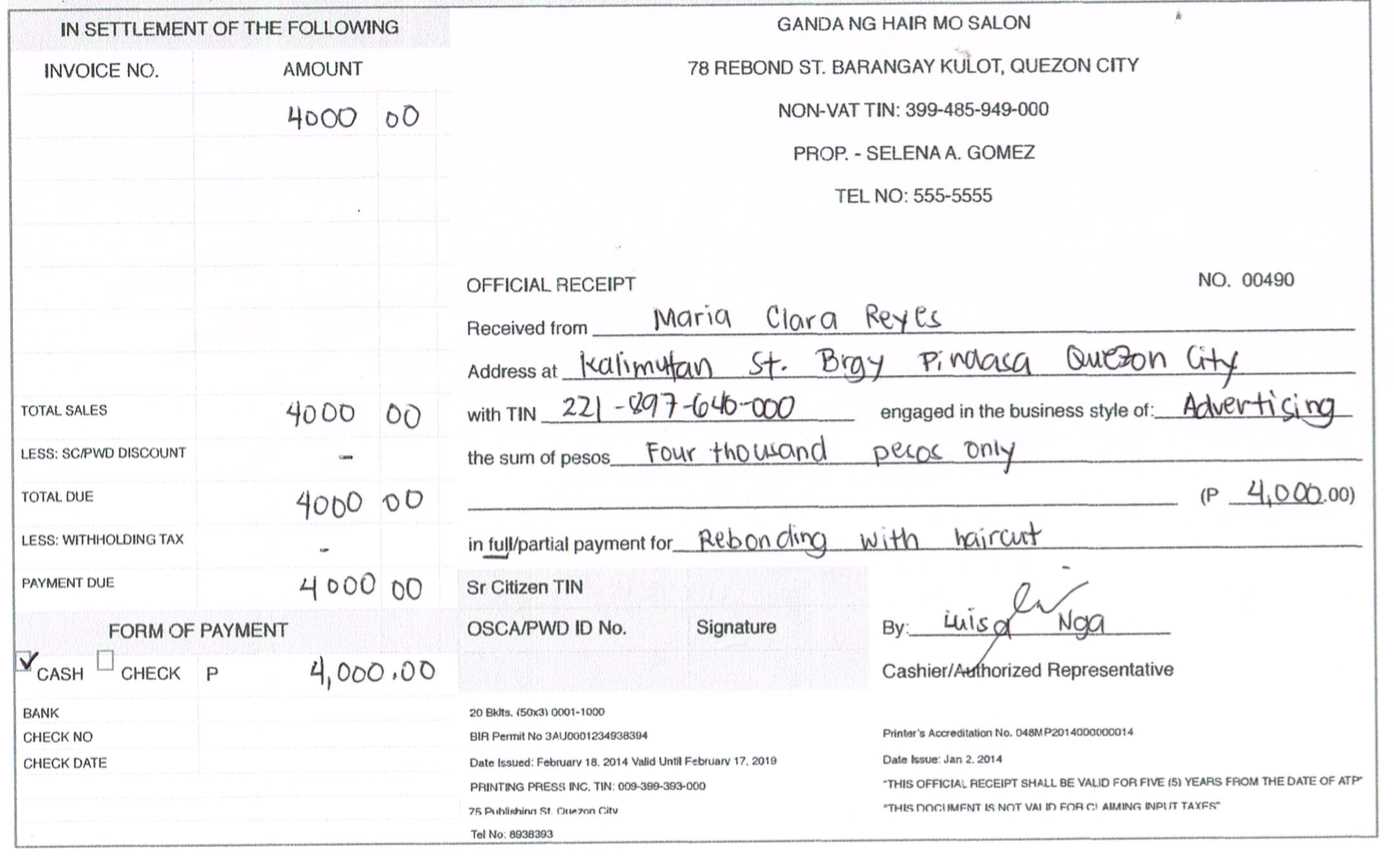

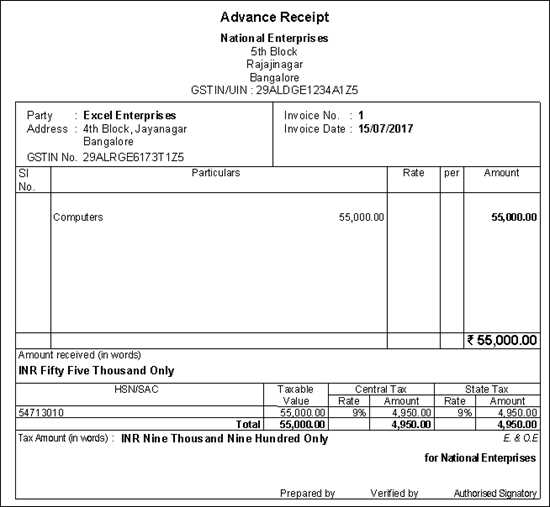

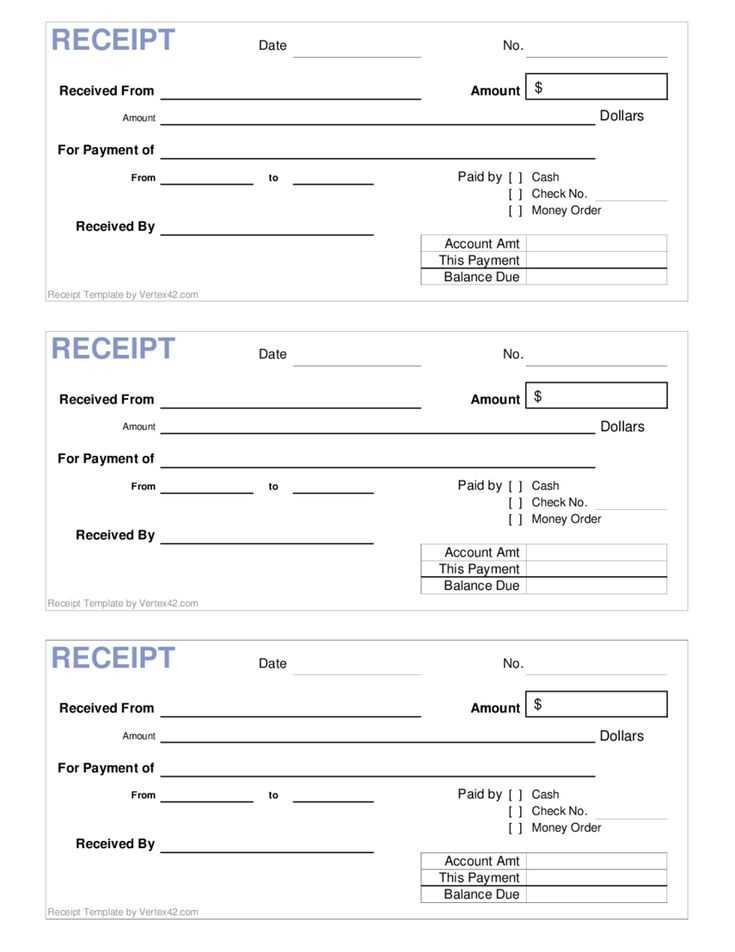

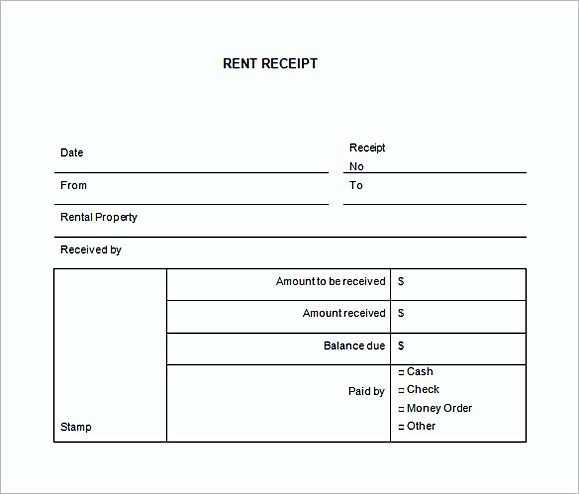

Start by including the basic components of a receipt: the name and address of the seller, the buyer’s details, date of transaction, and a unique receipt number. For clarity, make sure to list the items or services provided, along with their individual costs. Since there is no VAT involved, clearly mark “No VAT” or “Exempt from VAT” on the receipt to avoid confusion.

It is also important to keep the total amount due visible, ensuring the buyer understands that no tax has been added to the cost. By using a simple format that omits VAT-related fields, businesses can ensure smooth transactions while remaining compliant with tax regulations in their respective locations.

Here is the corrected text:

To issue a receipt without VAT, ensure the receipt clearly states that VAT is not applicable. Use the phrase “No VAT” in the appropriate section where taxes are normally listed. Be transparent with the customer about the absence of VAT and, if needed, provide an explanation based on your local tax regulations.

Formatting Tips

Place the “No VAT” note near the price breakdown or total amount. This ensures that the customer can easily see that no tax was applied to their purchase. If your business has a tax exemption status, consider including that information to avoid confusion.

Invoice Details

In addition to the “No VAT” mention, include all other required details such as the transaction date, company name, and receipt number. This guarantees compliance and maintains clarity in your records.

Receipt Template No VAT: A Practical Guide

Creating a VAT-free receipt template is straightforward, but accuracy is key. Begin by ensuring that the receipt includes the necessary details: your business name, address, contact information, and transaction specifics. Clearly state that no VAT was charged, along with a brief explanation if required (e.g., “VAT exempt due to [reason]”). The total amount must reflect the net cost, with no VAT amount added. You can further personalize the receipt with unique elements like your company’s logo or payment methods.

Common Mistakes to Avoid When Using VAT-Free Receipt Templates

Avoid omitting the VAT-exempt statement on your receipts, as this can confuse customers or tax authorities. Ensure that the total amount reflects only the net value, not including VAT. Double-check that the reason for VAT exemption (if applicable) is clearly stated. This clarity prevents misunderstandings and ensures that you’re meeting legal requirements. Additionally, ensure your template is consistent with local regulations on VAT exemption for your business type.

Customizing Your No VAT Template for Different Industries

Different industries may require tailored receipt templates. For example, a nonprofit organization might need to include a note about donations being VAT-exempt, while a service-based business should specify the nature of the service to justify the VAT exemption. Be aware of any industry-specific regulations that govern VAT exemptions and adapt your template accordingly. This will not only maintain compliance but also enhance the professionalism of your business.