Use clear, sequential numbers for receipt templates to stay organized and streamline financial tracking. A consistent numbering system helps businesses maintain accurate records and reduces the chances of errors.

Choosing a Numbering System

Choose a system that fits your needs. Common approaches include:

- Simple sequential numbers: 1, 2, 3, 4, etc. This is straightforward and easy to track.

- Date-based numbering: Use the date as part of the receipt number (e.g., 20230210-001 for February 10, 2023). This adds context to each transaction.

- Custom prefixes: Adding letters or codes for specific departments or categories (e.g., INV-001 for invoices or PUR-100 for purchase receipts).

Sequential Numbering Benefits

A simple, sequential system ensures each receipt is unique and easy to trace back. It provides a logical order, helping with bookkeeping, tax filing, and audits. Avoid gaps or duplicate numbers to maintain integrity and consistency in your records.

Advanced Numbering Strategies

If your business deals with multiple locations or types of transactions, consider adding specific prefixes or suffixes. This method offers quick identification and improves organization. For example, receipts from different stores could use store codes (e.g., NY001 for New York store). For high-volume transactions, adding a year or month helps separate receipts by time period (e.g., 2023-001).

Maintaining Accuracy in Numbering

Keep a record of all numbers used. This helps prevent accidental reuse and ensures accurate tracking. If using a digital system, let the software handle the numbering automatically. This avoids human error and speeds up the process.

- Automated systems: Many POS systems assign numbers automatically, ensuring continuity and minimizing manual input.

- Manual tracking: If using a manual system, maintain a log or spreadsheet where you document each receipt number and its corresponding transaction.

Common Mistakes to Avoid

- Skipping numbers or leaving gaps, which can create confusion or lead to untracked receipts.

- Reusing numbers, which can cause record-keeping issues and complicate audits.

- Using too complex of a system, which may confuse employees or customers.

Receipt Template Numbers

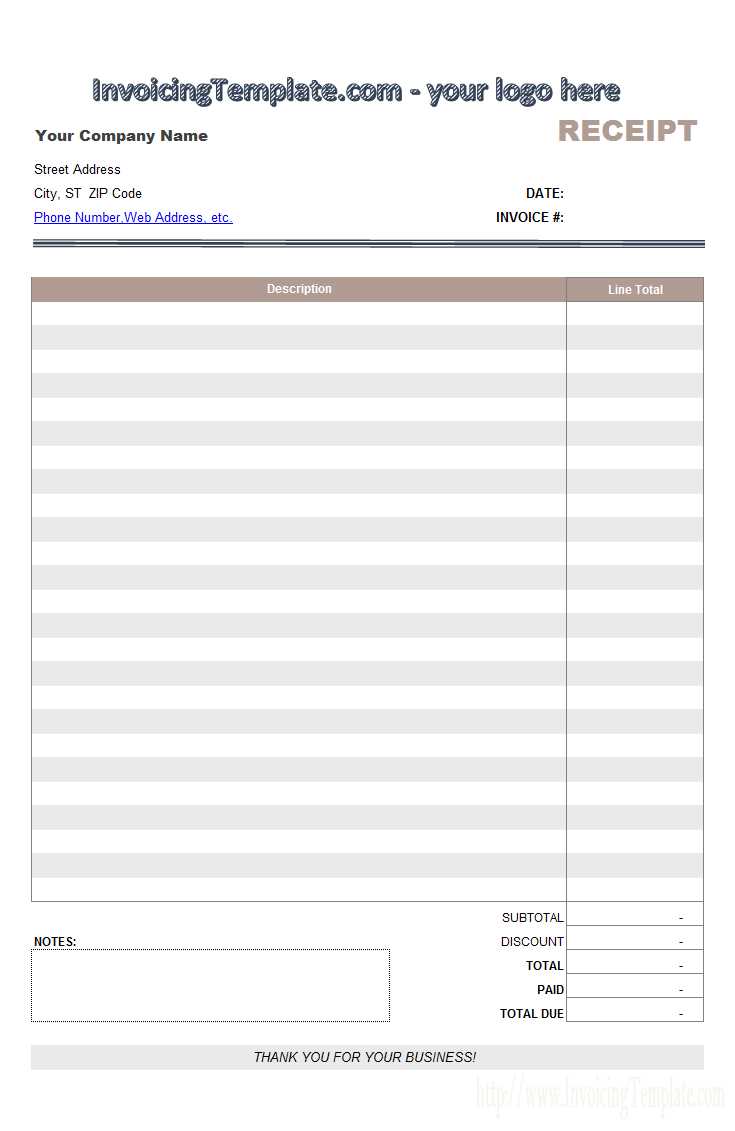

Choosing the Appropriate Format for Receipts

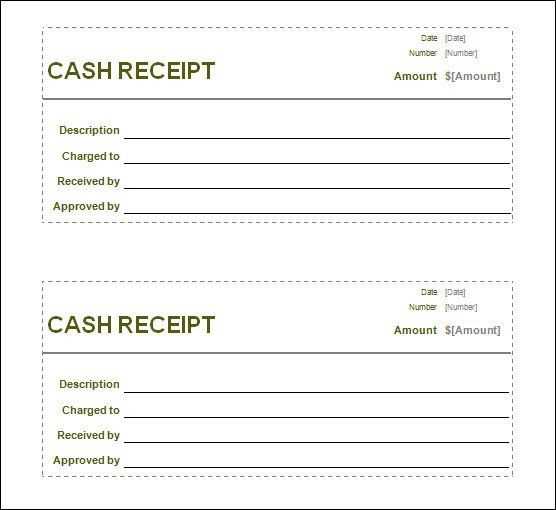

How to Organize Numbers Sequentially

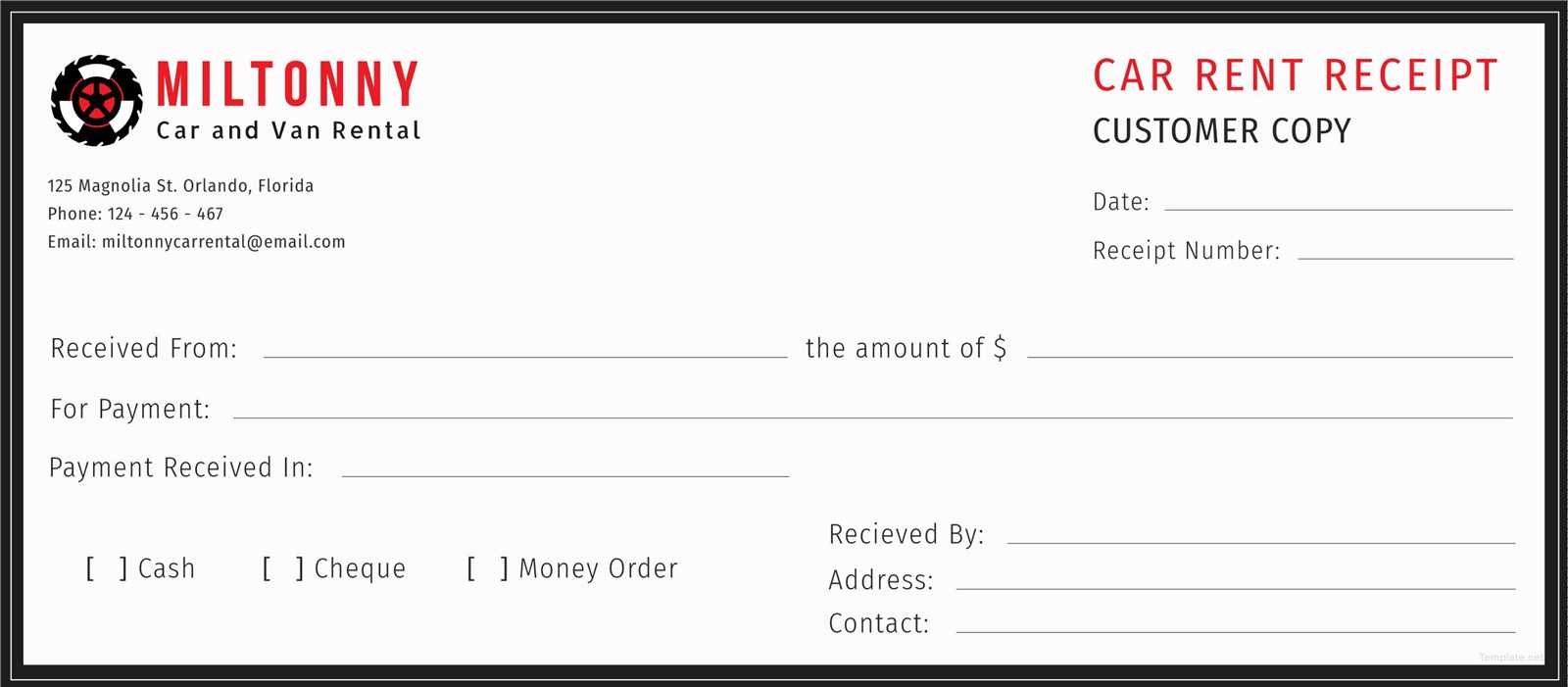

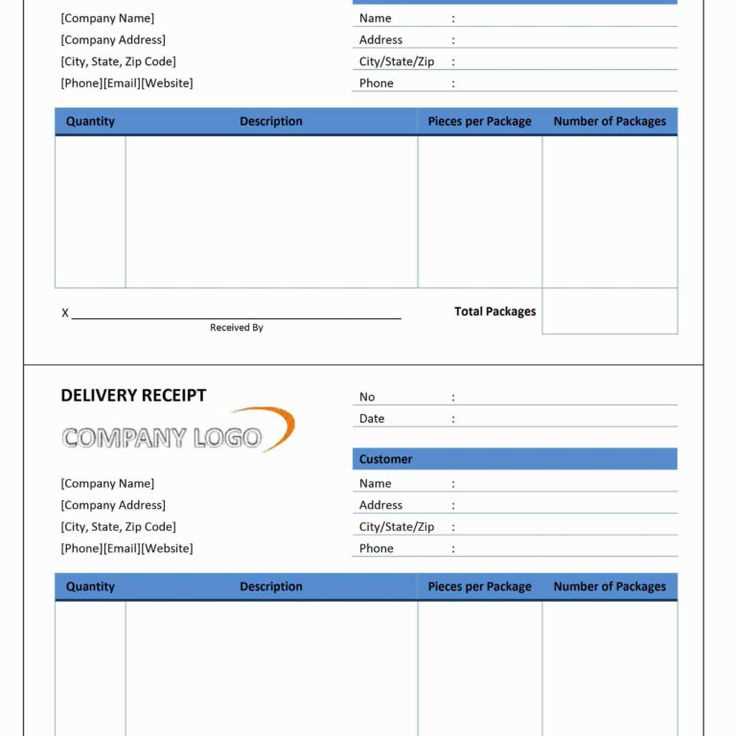

Customizing Numbering for Various Needs

Common Errors in Numbering and Their Prevention

Integrating Numbers with Accounting Software

Legal Aspects of Numbering Systems

Start with a clear and consistent format that suits your business needs. For most businesses, a numerical format like “INV-0001” or “RCP-1234” works best. Choose a format that makes sense for the type of transactions you handle and the industry you’re in. This approach helps create a professional impression while remaining practical.

Numbers should follow a sequential order to avoid confusion and maintain accurate records. To ensure proper organization, use a system that increments with each receipt. If you need to restart numbering periodically, document the starting point for each period (e.g., monthly or yearly) to avoid duplicates and ensure consistency across records.

Tailor your numbering system based on specific business needs. For example, include department codes or customer identifiers if your business operates in multiple sectors or handles various customer types. This customization adds structure and simplifies tracking, particularly for large-scale operations or businesses with high transaction volumes.

Common errors include skipping numbers or duplicating receipt numbers. To avoid this, use automated systems that track receipt numbers or implement manual checks to verify each receipt number before issuing it. Implementing a control mechanism such as regular audits will prevent discrepancies and help maintain a reliable system.

For seamless integration with accounting software, ensure your numbering format aligns with the software’s requirements. Most accounting systems can automatically import receipt numbers, but some may require a specific structure. Double-check the compatibility between your system and accounting software to prevent data entry issues and improve workflow efficiency.

Legal considerations include adhering to tax and regulatory requirements regarding receipt numbering. Ensure that your numbering system is consistent and traceable, as many countries mandate unique identification numbers for audit and tax purposes. Failure to comply could result in penalties or issues during audits.