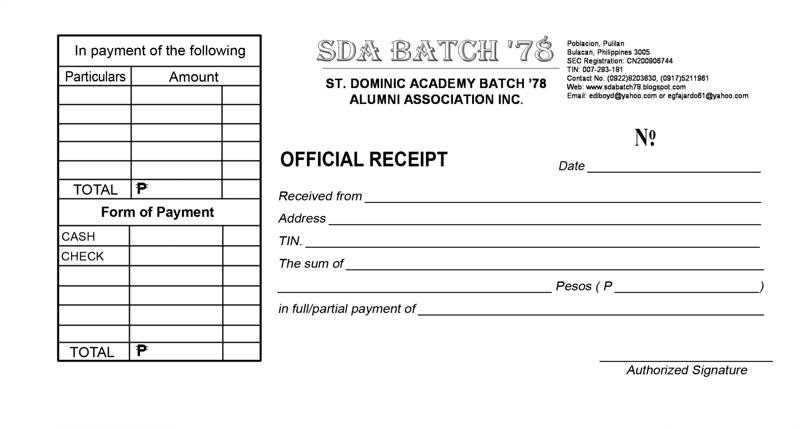

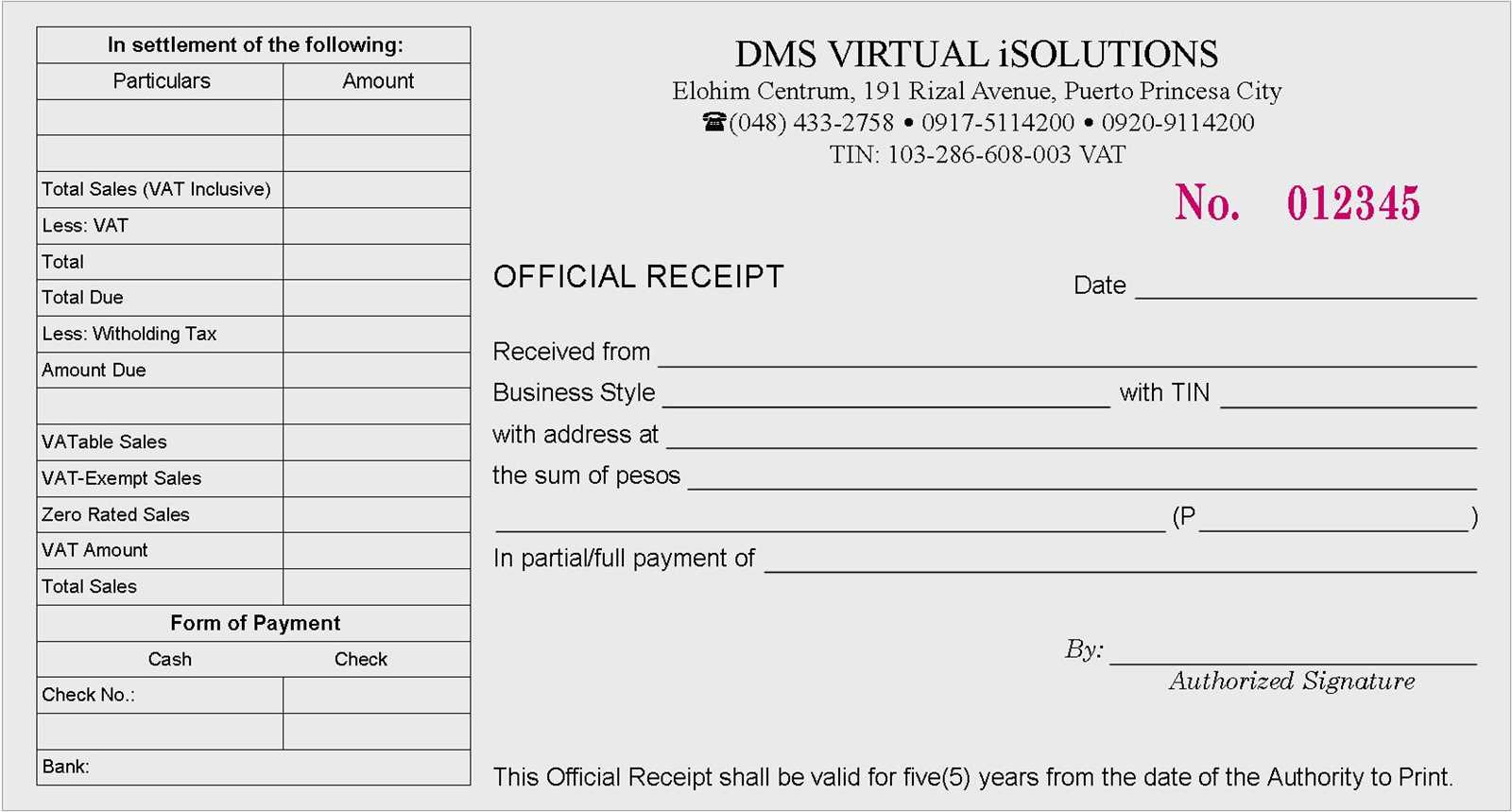

Need a legally compliant and professional-looking receipt template in the Philippines? The Bureau of Internal Revenue (BIR) requires official receipts for transactions involving goods and services, so using the correct format is crucial. A proper receipt must include the business name, TIN, address, date, serial number, item details, total amount, and authorized signature.

For freelancers, small businesses, or corporations, choosing the right template saves time and ensures compliance. A BIR-registered official receipt differs from a simple cash receipt, as it must be printed by an accredited printer and include a BIR permit number. If you’re issuing receipts for non-VAT transactions, indicate “NON-VAT” and specify the percentage of tax applied.

Downloadable receipt templates in Word, Excel, or PDF format make customization easy. Whether you need a cash receipt for retail sales or an official receipt for service fees, ensure the format meets Philippine tax regulations. Double-check details before issuance, as errors can cause tax filing issues. A well-structured receipt protects both buyers and sellers while maintaining transparency in business transactions.

Receipt Template Philippines: Practical Guide

To create a receipt template for use in the Philippines, focus on including the basic details required by local law. A clear, well-structured template should contain the business name, address, contact information, and tax identification number (TIN). Make sure it includes a breakdown of the transaction, such as the date, itemized list of goods or services, quantity, unit price, and the total amount due. This layout ensures that your receipts are legally compliant and easy for customers to understand.

Key Elements of a Receipt Template

Incorporate the following components to make your receipt template complete and valid:

- Business Details: Include the name, address, and TIN of your business. The TIN is a required field for all official receipts in the Philippines.

- Transaction Information: List the date, description of goods or services, quantity, price per unit, and total amount paid. If applicable, specify discounts or taxes.

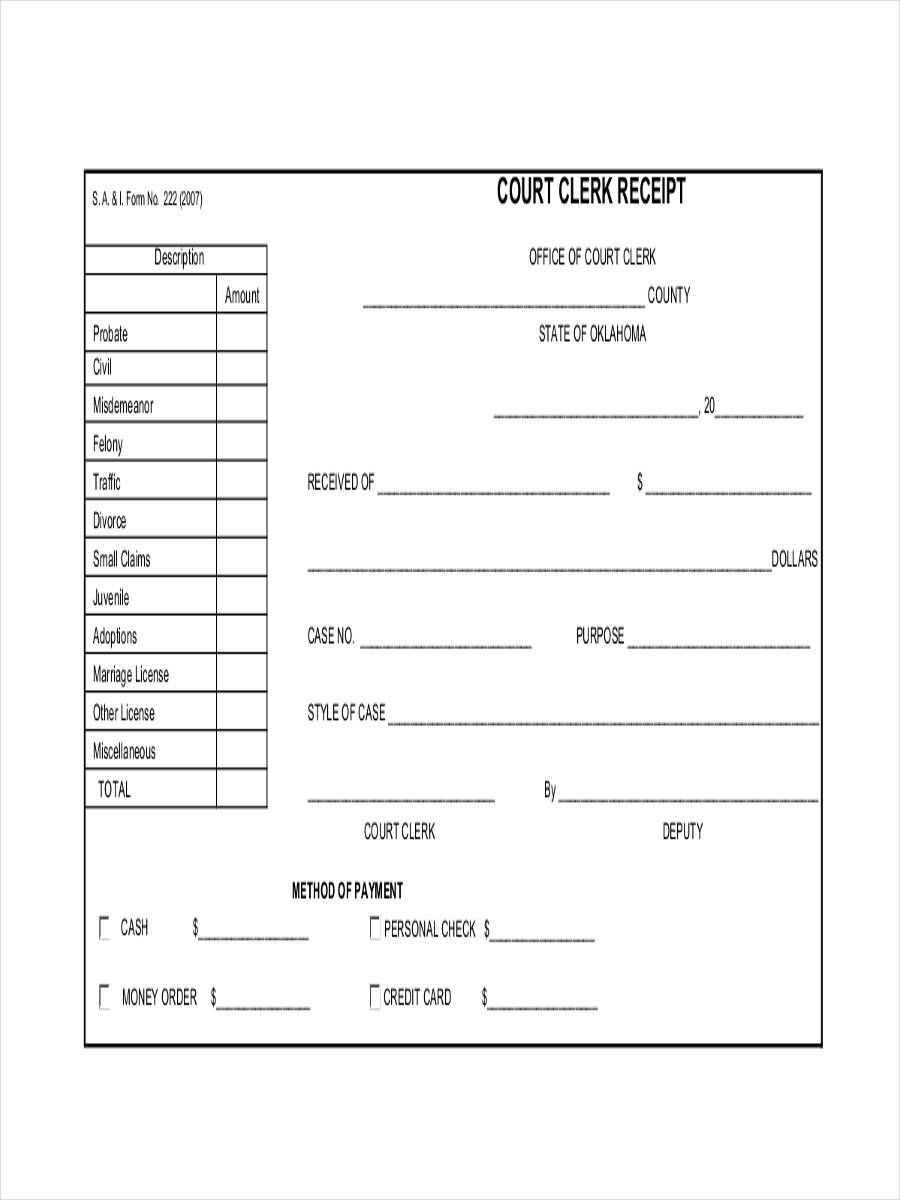

- Payment Method: Clearly indicate whether the payment was made in cash, via credit card, or any other method.

- Official Receipt Number: For tracking purposes, assign a unique receipt number to each transaction.

Formatting Tips

Keep the receipt design simple and organized. Use clear headings for each section to guide the customer’s eye. You can use a basic table format to display itemized information. Make sure your business logo is placed at the top for easy identification. Include clear section separations to avoid confusion.

Following these guidelines will make your receipt template both practical and compliant with the requirements in the Philippines.

Legal Requirements for Receipts in the Philippines

In the Philippines, receipts must include specific details to comply with local tax laws. Businesses are required to provide customers with an official receipt or sales invoice for transactions, especially for goods or services sold that exceed PHP 25. The receipt should include the following details:

- Business Name and Address: Clearly printed and easily identifiable.

- Taxpayer Identification Number (TIN): This is essential for all registered businesses.

- Invoice or Receipt Number: A unique number to prevent duplication and ensure proper tracking.

- Date of Transaction: Reflect the exact date of the purchase.

- Description of Goods or Services: Include a brief yet clear description of the item(s) or service provided.

- Amount Charged: The total cost, including tax, must be shown.

- VAT Details: If the business is VAT-registered, it must indicate the VAT rate and the breakdown of the tax.

VAT and Non-VAT Registered Businesses

VAT-registered businesses must issue receipts showing VAT-inclusive prices and VAT details, including the percentage rate. Non-VAT businesses, however, do not need to show VAT on receipts. These businesses may issue receipts without a VAT number but still need to adhere to the other legal requirements.

Electronic Receipts

Electronic receipts are also accepted, provided they contain the same required details. Businesses must ensure these receipts are issued through a registered system with the Bureau of Internal Revenue (BIR).

Key Elements to Include in a Receipt Template

Make sure your receipt template includes the following key details for clarity and legal compliance:

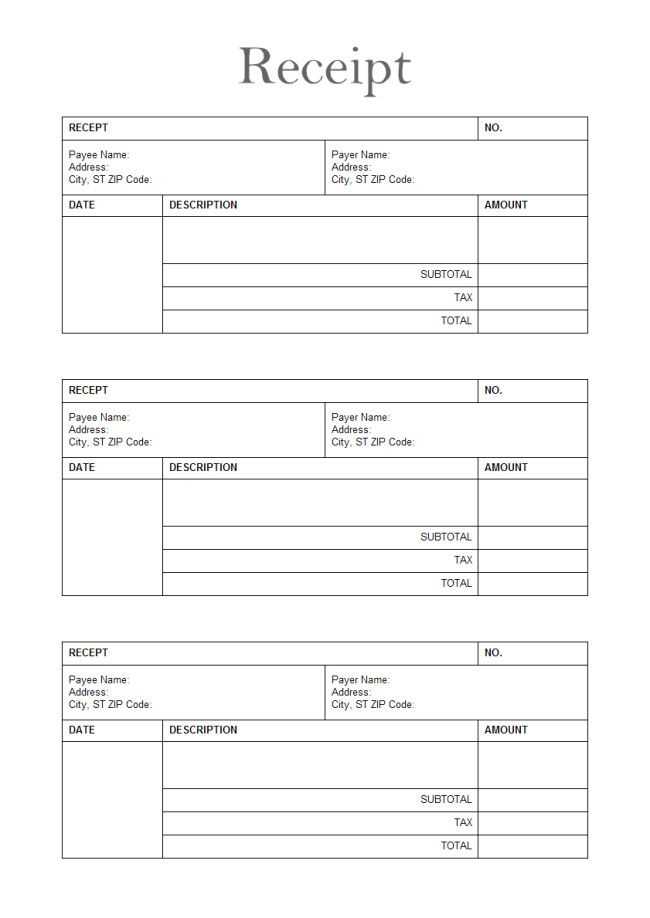

1. Business Information: Display your business name, address, contact number, and email address. This helps customers easily identify where the transaction took place.

2. Transaction Date and Time: Clearly list the date and time of the transaction. This provides a reference point for both the buyer and seller.

3. Receipt Number: Assign a unique number to each receipt for easy tracking and reference. This is especially useful for accounting and managing returns or exchanges.

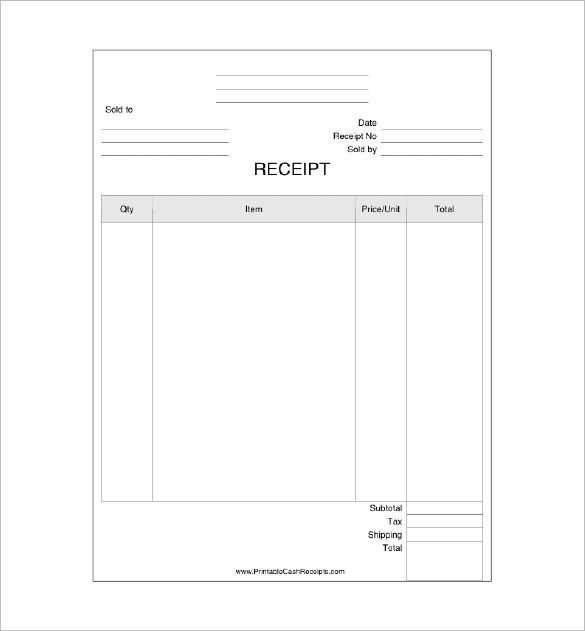

4. Itemized List: Include a detailed list of all items purchased, along with their quantity and price. This ensures transparency in the transaction.

5. Total Amount: Clearly display the total cost, including taxes, discounts, and any additional fees. Transparency in pricing helps avoid confusion.

6. Payment Method: Indicate whether the customer paid by cash, credit card, or other methods. This confirms how the transaction was completed.

7. Tax Information: Include the applicable taxes, such as VAT, along with the tax rate and the total tax amount. This is necessary for compliance with local tax regulations.

8. Refund Policy: If applicable, add a brief note about your refund or exchange policy. This helps customers understand the terms in case they need to return an item.

9. Signature (if applicable): For certain transactions, especially those involving large amounts, include a space for signatures from both parties as proof of agreement.

10. Company Logo (optional): Adding your logo can enhance your brand visibility and give your receipt a professional look.

How to Create a Printable and Digital Receipt Format

To create a receipt that works for both printed and digital formats, follow these steps:

1. Choose the Right Software or Tool

- Use simple tools like Microsoft Word, Google Docs, or more specialized software like Adobe InDesign for detailed formatting.

- If you’re working with digital receipts, opt for online receipt generators or accounting software that supports digital exports (PDF, PNG, etc.).

2. Include Necessary Receipt Information

- Business Details: Business name, logo, address, contact details.

- Date and Time: Exact date and time of the transaction.

- Transaction Information: Item description, quantity, price, and total amount.

- Payment Method: Specify if it was cash, card, or online payment.

- Invoice/Receipt Number: Unique reference number for easy tracking.

- Tax Information: Include tax rates and amounts if applicable.

3. Format for Readability

- Ensure alignment of all details for neatness (e.g., use tables for itemized lists).

- Use clear, legible fonts and maintain appropriate spacing between sections.

- For digital receipts, keep file size manageable by using compressed formats like PDF.

4. Make It Customizable

- Allow space for adding customer-specific details, like name or address, if necessary.

- In digital formats, incorporate links to your business website or social media for easy access.

5. Test Your Format

- Test printing the receipt on different paper sizes (A4, letter) to ensure proper layout.

- Check that digital receipts open correctly across various devices and platforms.