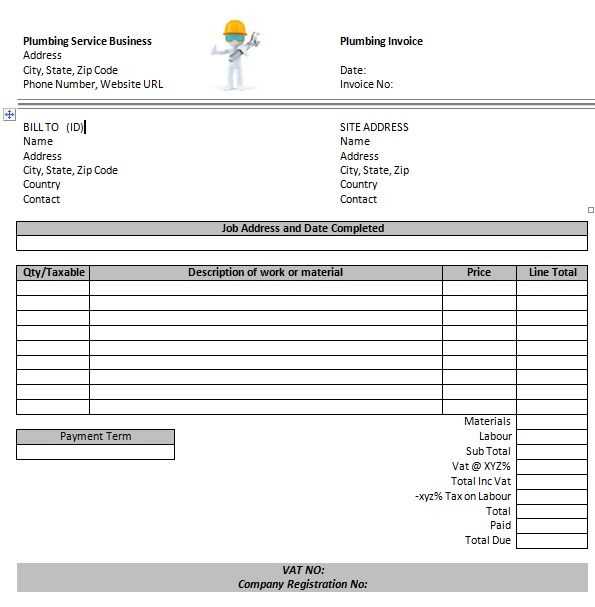

Use a simple, clear template to issue receipts for your work. Start by including the basic details like your name or business name, contact information, and the date of the transaction. These elements make your receipt recognizable and help with future reference.

List the service or product provided, with a brief description, quantity, and price for each. It’s important to break down costs so your client can see what they are paying for. Keep the totals at the bottom for easy tracking.

Ensure you add a unique receipt number for each transaction. This will help you stay organized and prevent any confusion in case of disputes or tax reviews. Always include payment details such as the method used (cash, bank transfer, etc.).

Finally, include a line for your signature or a confirmation of receipt. This adds professionalism and gives both parties peace of mind about the transaction’s validity.

Sure! Here’s the revised version with reduced repetition:

To create a receipt template for self-employed individuals, focus on clarity and accuracy. Include the date, a unique receipt number, your business name, and contact details at the top. List each item or service provided, along with the corresponding price and quantity. Ensure the total is clearly shown at the bottom, including tax if applicable.

Use a consistent layout for easy readability. A well-structured receipt will help both you and your clients keep track of transactions. Remember to add any legal disclaimers or payment terms if required by your region.

For extra detail, consider adding your business logo to personalize your receipt and strengthen your brand identity. A clean, professional look can also help you stand out, especially when dealing with multiple clients or businesses.

Lastly, always save a copy of each receipt for your records. This will help you maintain organized financial documents and make tax filing smoother.

Detailed Guide on Creating Receipt Templates for Self-Employed Individuals

To create a receipt template for self-employed individuals, start by ensuring the template is clear and includes all necessary components. Begin with the basic elements: the business name, address, and contact details. Make sure this information is prominently displayed at the top of the receipt.

Next, include the date of the transaction. This helps both you and your clients keep accurate records. Below the date, specify the transaction details: a description of the goods or services provided, quantity, unit price, and total cost. This is important for both tax purposes and to avoid any disputes later on.

Don’t forget to list the tax amount separately. If your business charges VAT or any other taxes, make sure to break it down clearly on the receipt. This section should include the tax rate and total amount of tax collected. If no tax is charged, state “Tax Not Applicable” clearly.

Include payment method details: whether the payment was made by cash, credit card, or another method. This information can be useful if any payment disputes arise.

Finally, add a unique receipt number for easier tracking and referencing. A sequential numbering system helps with organization and ensures you can quickly locate past transactions when needed.

Here’s a basic template outline you can follow:

| Business Name | Your Business Name |

|---|---|

| Business Address | Your Address |

| Contact Information | Your Contact Info |

| Date | MM/DD/YYYY |

| Receipt Number | Unique Number |

| Description of Service | Details of Product/Service |

| Quantity | 1 |

| Unit Price | $Price |

| Total | $Total |

| Tax | $Tax Amount |

| Payment Method | Cash/Credit/Other |

Adjust this template as needed to fit your specific business requirements and local regulations. Once your template is ready, save it in a format that is easy to update and reuse, such as a Word document or PDF.

Begin with your business details: Include your business name, address, and contact information at the top. This ensures clarity and professionalism.

Add a unique receipt number: Every receipt should have its own identifying number. This helps with organization and tracking for both you and your client.

List the purchased items or services: Clearly describe each product or service provided. Include quantity, individual prices, and the total cost for each item or service.

Show the total amount: Clearly display the final total after any taxes or discounts. This ensures both you and the customer can easily verify the final amount paid.

State the payment method: Include details on how the customer paid, whether by cash, credit card, or another method. This serves as an important reference for both parties.

Provide additional details: Include space for any relevant notes, such as return policies, warranties, or thank you messages. These can add value and clarity for your customers.

Keep the layout straightforward. Use a clean font and ensure all information is easy to read. A simple structure avoids confusion and helps create a professional impression.

When creating receipts for different services, tailor the details to reflect what was actually provided. This ensures transparency and helps clients easily understand the breakdown of their payment.

- Service Name: Clearly state the specific service rendered. For example, “Website Development” or “Consulting Session – 2 Hours.”

- Hours or Time Spent: If applicable, list the hours worked or the duration of the service provided. For example, “2 hours” or “3 days.” This helps clients see the value behind the charge.

- Itemized Costs: Include any individual charges for specific tasks, materials, or extra services. For instance, “Materials – $50” or “Premium Service – $100.”

- Discounts: If discounts apply, list them clearly. Example: “10% off for repeat clients – $30.”

- Additional Fees: Specify any extra charges, such as “Rush Fee – $20” or “Travel Fee – $15,” to avoid confusion.

- Tax Breakdown: Always list the applicable tax amount and rate for transparency. Example: “Sales Tax (7%) – $20.”

- Payment Details: Mention the payment method, whether it’s “Paid by Credit Card” or “Paid in Cash.” This creates a clear record for both you and your client.

By adjusting the receipt to match the specifics of your services, you help your clients easily track what they paid for while maintaining clear documentation for yourself.

Ensure the receipt template is clear and contains all necessary details without overcomplicating it. One common mistake is missing key information, like the full name of the business, contact details, or a breakdown of items/services sold. Always include a unique transaction number and a date, as these elements serve as critical reference points for both you and your client.

Missing Tax Information

Not specifying the tax rate or amount can create confusion for both parties. If applicable, include the tax percentage and total tax value to maintain transparency in the transaction.

Inconsistent Formatting

Use consistent fonts, headings, and spacing. Inconsistent formatting can make the receipt look unprofessional and harder to read. Stick to a simple, clean design, making sure the layout flows logically from top to bottom.

Errors in math or miscalculating totals can result in misunderstandings and delays in payment processing. Always double-check calculations to avoid such issues.

Lastly, not keeping a copy of the receipt can cause problems later on. Save all issued receipts in a secure system for easy access and reference in the future.

For a receipt template tailored to self-employed individuals, begin by including your business name and contact details at the top. This helps customers identify the source of the transaction. Clearly state the date of the transaction and the unique receipt number to maintain an organized record.

Itemize the services or goods provided, with a brief description of each, along with their respective prices. Include the total amount at the bottom, making it easy to see the sum of all charges. If applicable, add tax details or discounts in a separate line for transparency.

To ensure accuracy, avoid any ambiguity in the descriptions and pricing. Each item should be listed with clarity so both parties understand the transaction. A final step is to include payment method details–whether cash, bank transfer, or other methods used–providing evidence of the transaction process.