Creating a clear and concise receipt template can streamline transactions and enhance professionalism in business communications. Start by including the recipient’s name and the total amount received, ensuring accuracy. It’s best to break down the payment details, listing any applicable taxes, discounts, or additional charges.

Next, specify the method of payment, whether cash, card, or another form, and include the transaction date. For clarity, it can also be helpful to add any reference number or transaction ID, which simplifies future inquiries or records tracking.

Ensure that your template remains adaptable to various transaction scenarios, making it suitable for different industries and payment structures. This flexibility can help maintain consistency across all receipts while meeting specific business needs.

Sure! Here’s a detailed HTML plan for an informational article on the topic “Receipt Template This Acknowledges” with six practical and specific headings: htmlEditReceipt Template: Acknowledging Transactions

1. Key Elements of a Receipt Template

Every receipt template should include certain fundamental components to ensure clarity and accuracy. Start with the date and time of the transaction, followed by a brief description of the items or services provided. Clearly list the price of each item, the total amount paid, and any applicable taxes. Additionally, include the payment method used, whether it’s cash, credit, or another form.

2. Structuring Transaction Details

List transaction specifics in an organized, easy-to-read format. This could be in a tabular form for clarity, with item descriptions in the left column and amounts or quantities in the right. This structure provides a quick overview of what was purchased and the corresponding price for each item or service.

3. Including Acknowledgment Language

Ensure your template contains explicit acknowledgment language, confirming the transaction has been completed. Phrases such as “Paid in full” or “Thank you for your payment” serve this purpose effectively. This communicates that both parties have agreed to the terms, ensuring transparency.

4. Including Business Information

To establish legitimacy, include business details such as name, address, phone number, and email. This allows customers to reach out for further inquiries. For businesses with an online presence, include the website or social media handles for easy reference.

5. Using Professional Formatting

Choose a clean, professional font and keep the layout simple. Avoid cluttering the receipt with unnecessary information. Use bolding or underlining for critical details like the total amount paid or payment method. This ensures customers can quickly scan the receipt for essential information.

6. Customizing for Specific Transactions

Consider custom fields that cater to specific transaction types. For example, if providing a service, you may want to add sections for the employee’s name or job description. If dealing with sales, add the SKU number and specific product details. Tailoring the receipt template to your needs ensures it meets all requirements and reduces confusion for both parties.

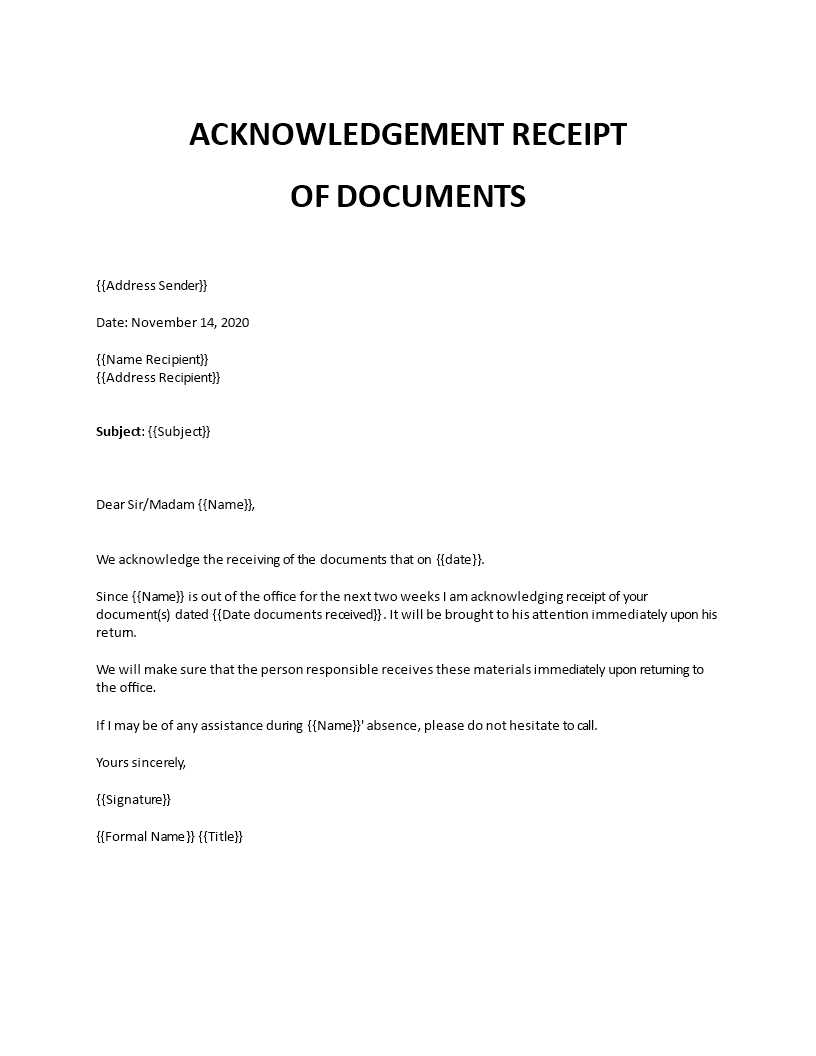

Understanding the Core Purpose of Receipt Templates

Receipt templates provide a clear, standardized structure for documenting transactions. They ensure that both the business and the customer have a consistent record of purchases. This reduces misunderstandings and provides a reliable reference in case of disputes or returns.

By using a template, businesses can save time, ensuring that all relevant details–like date, amount, items purchased, and payment method–are captured correctly. This level of consistency is especially useful when dealing with a high volume of transactions.

Receipt templates also help streamline record-keeping, making it easier to track sales, manage inventory, and comply with tax regulations. For small businesses, this simplicity can be a significant time-saver, freeing up resources for other critical operations.

Additionally, templates can be customized to include a company logo or contact information, improving branding and professionalism. This small touch can make receipts not just functional but also a marketing tool in the customer’s hands.

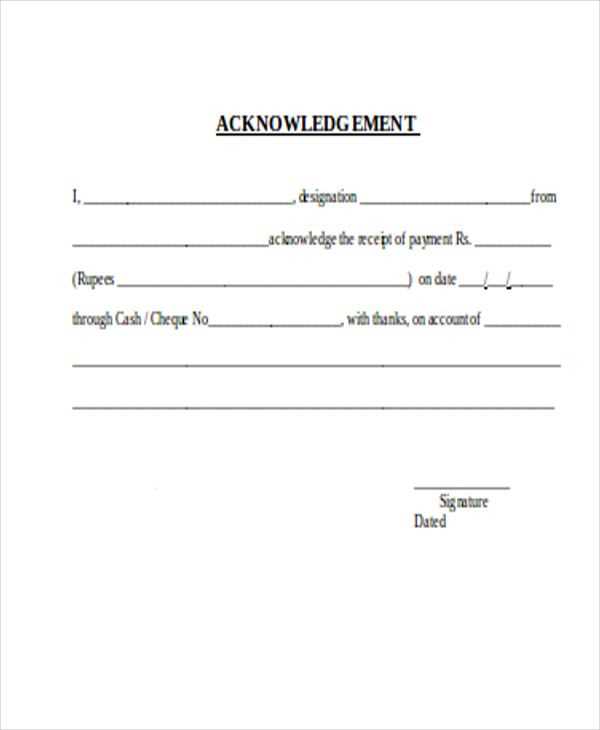

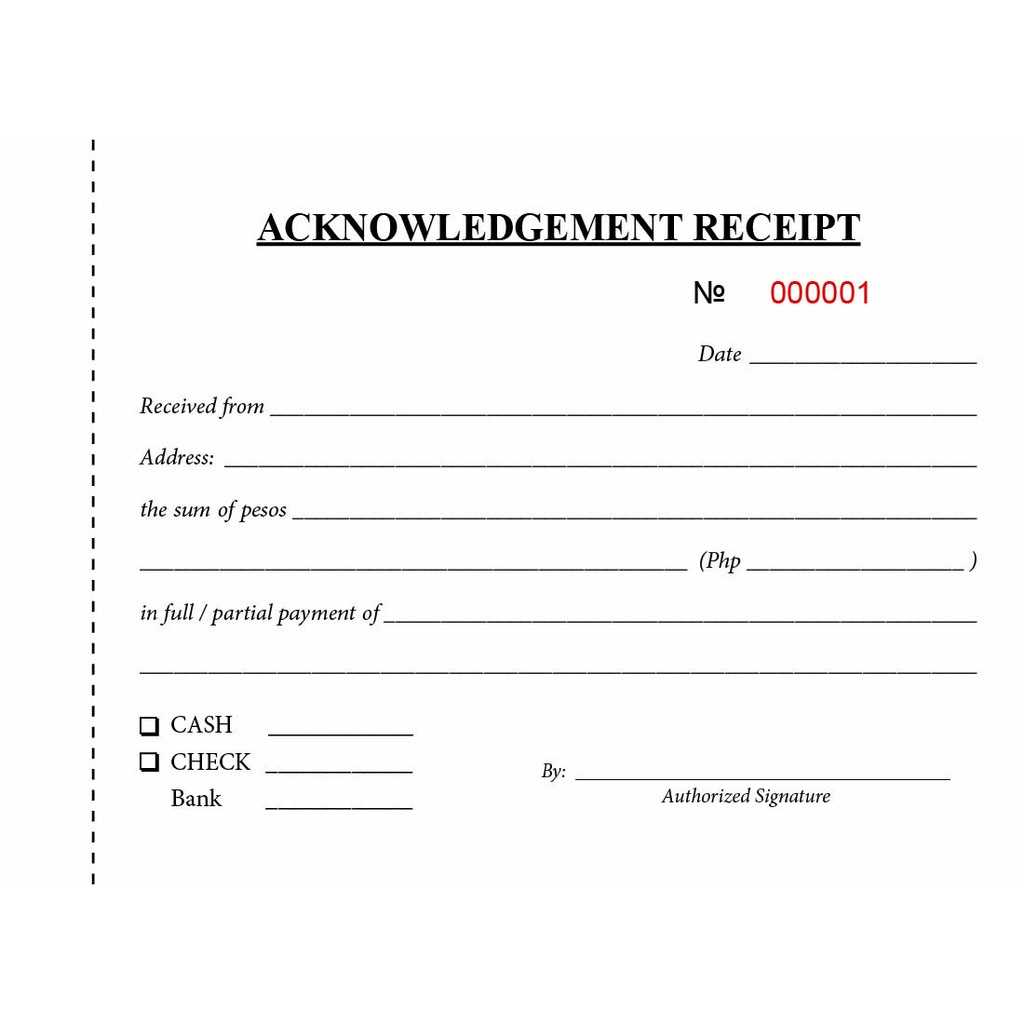

Key Elements to Include in a Receipt Acknowledgement

Include the full name of the person or business receiving the payment. Clearly state the amount being acknowledged and the currency used. Specify the date of the transaction, ensuring the acknowledgment matches the actual date of receipt. Mention the method of payment–whether cash, credit card, or another form. If applicable, provide any reference or invoice number for easy tracking. Indicate a description of the goods or services received, highlighting key details such as quantity or type. Finally, ensure the signature of the person issuing the receipt, or include their contact details for verification purposes. This information helps confirm the legitimacy of the transaction and provides clarity for both parties involved.

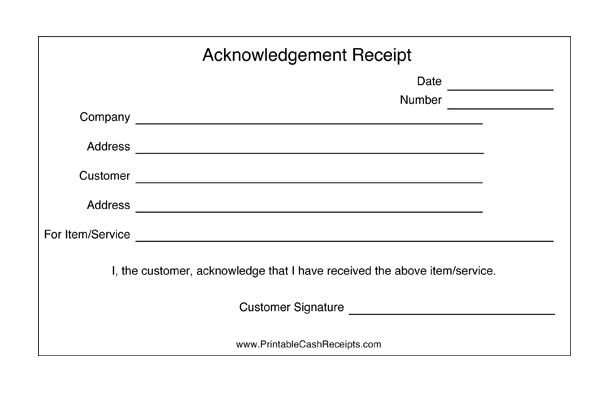

How to Customize a Receipt Template for Your Business

First, adjust the layout of the receipt to match your brand’s visual identity. Choose a clean, easy-to-read font and set your company logo in a prominent location. Keep the design simple to ensure customers can quickly identify key information.

Next, modify the fields to reflect the specifics of your transactions. Include the business name, address, and contact details. Make sure there is space for the customer’s name, purchase details, itemized list, tax rate, and total amount.

Consider adding additional sections such as a “Thank You” message or customer feedback options. Personalizing the receipt with such elements creates a more engaging experience for the customer. Also, leave space for promotional codes or future discounts if relevant.

| Field | Description |

|---|---|

| Business Information | Include your company name, address, phone number, and website |

| Customer Information | Optionally, include customer name or membership details |

| Itemized List | Provide a clear breakdown of each item purchased |

| Taxes | Display applicable tax rates and amounts for transparency |

| Total Amount | Clearly show the total to be paid |

| Footer | Optionally, add a personalized message or discount offer |

Lastly, save your template as a reusable document or a digital template. Ensure that it is compatible with your point-of-sale software for seamless integration. Keep updating the template as your business evolves, adding or removing fields as needed.

Common Mistakes to Avoid When Acknowledging Transactions

Always double-check the accuracy of the transaction details before sending an acknowledgment. Failing to verify the amount, date, and recipient information can cause confusion and undermine trust.

- Missing Transaction Information: Avoid leaving out key transaction elements like reference numbers or payment methods. Omitting these details makes it difficult for the recipient to track and verify the payment.

- Incorrect or Vague Language: Avoid using ambiguous terms in your acknowledgment. Be clear and specific about what is being acknowledged, whether it’s a partial payment or a full transaction.

- Delayed Acknowledgments: Sending acknowledgments days after the transaction creates uncertainty. Make sure to send them immediately after the transaction is processed.

- Failure to Confirm Receipt: Always confirm the receipt of funds. Not doing so can leave the recipient unsure whether their payment was received.

- Ignoring Communication Preferences: Respect the preferred method of acknowledgment, whether email, SMS, or a receipt in-app. Not following this can lead to frustration for the recipient.

- Unprofessional Formatting: Keep the acknowledgment clean and easy to read. Over-complicated layouts or hard-to-read fonts detract from the professionalism of the communication.

- Not Including Contact Information: Always provide contact details for any questions or follow-ups. Missing this information can lead to delays in resolving potential issues.

By avoiding these common mistakes, you can ensure smoother, more efficient transactions and build stronger relationships with your recipients.

Best Practices for Ensuring Legal Compliance in Receipts

Include all required information. At a minimum, receipts should display the seller’s name, address, and contact details. Make sure to include the transaction date, a detailed list of items or services purchased, and the total amount paid, including taxes and discounts. Some jurisdictions also require a unique transaction ID or reference number to link the receipt with the corresponding transaction record.

Ensure the correct tax information is stated. If applicable, specify the tax rate and the total amount of tax collected on the transaction. Different regions have specific rules on how tax should be calculated and displayed. It’s important to stay updated on the relevant tax laws for your location.

Provide clear payment details. Indicate the method of payment, whether it’s cash, credit card, or another method. This transparency helps protect both the business and the consumer in case of disputes or returns.

Make use of readable formatting. The information should be legible and easy to understand. Avoid using overly complex fonts or layouts. A well-organized receipt ensures compliance with consumer protection laws that may require businesses to offer easily accessible documentation of purchases.

Comply with data protection regulations. If personal information is included, such as a customer’s name or email address, ensure it is securely stored and shared in accordance with data privacy laws like GDPR or CCPA. Avoid collecting more personal information than necessary for the transaction.

Incorporate your business’s refund and return policy. Some regions require businesses to outline their policies regarding refunds and exchanges directly on receipts, ensuring customers are aware of their rights at the point of purchase.

Regularly review your receipt practices. Stay updated on local and international legal requirements. This is crucial to avoid fines or legal complications arising from outdated or incomplete receipt formats. Regular audits and consultations with legal experts can help maintain compliance.

Digital vs. Paper Receipts: What’s More Suitable?

Digital receipts are increasingly becoming the preferred option. They save space, are easier to store, and allow for quick retrieval when needed. Paper receipts, while familiar, can be easily misplaced and degrade over time, especially when exposed to heat or moisture.

Advantages of Digital Receipts

Digital receipts are eco-friendly and help reduce paper waste. They can be stored in email inboxes or cloud storage, making them searchable. Many digital payment platforms automatically generate receipts, which eliminates the need to manually request one. They’re also easily shared, which is practical for expense tracking or warranty claims.

Advantages of Paper Receipts

Despite their decline, paper receipts offer a tangible record that doesn’t rely on internet access or digital tools. They are straightforward and can be kept on hand for quick reference, making them useful for individuals who prefer physical documentation. Paper receipts also serve as backup in case of system failures or issues with electronic devices.