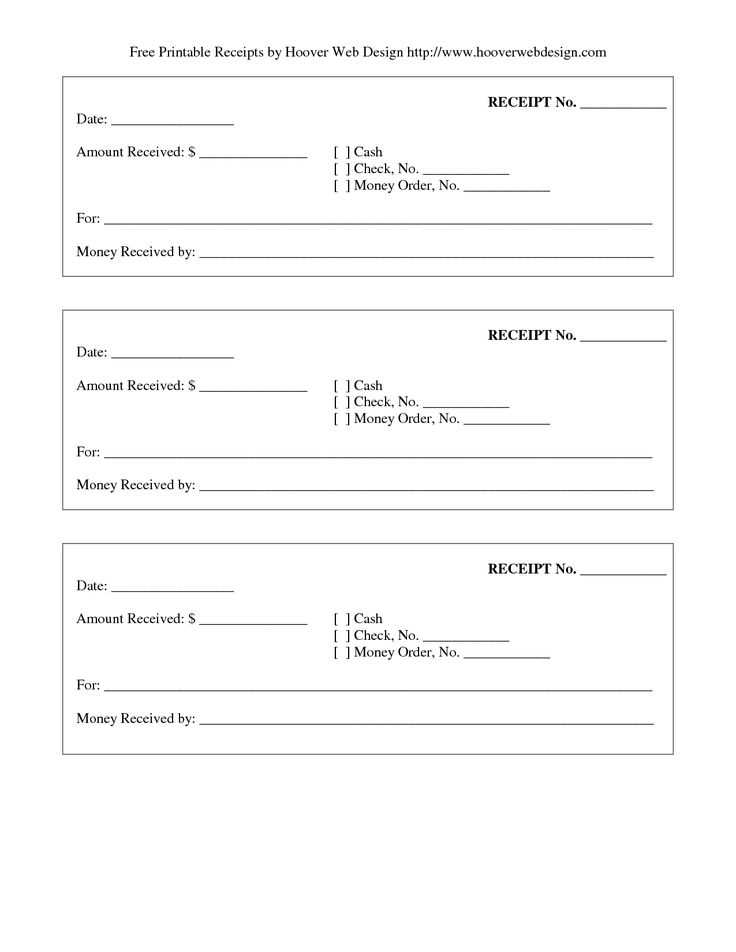

For an accurate and professional receipt, make sure to include the necessary transaction details such as the customer’s name, date of purchase, and store location. List each item separately with its corresponding price. This will help both the store and the customer keep track of the purchase in case any returns or exchanges are needed.

Include a section at the bottom for the total amount paid, any taxes, and the payment method used (e.g., credit card, cash, gift card). It’s also useful to add a receipt number for easier reference. This allows for quick identification of the transaction should any issues arise later.

For a clean and organized receipt template, ensure there is sufficient space between each section. Use a legible font and proper alignment to enhance the clarity of the document. Double-check that all the information matches the transaction records before issuing the receipt.

Here’s the rewritten text with minimized repetitions:

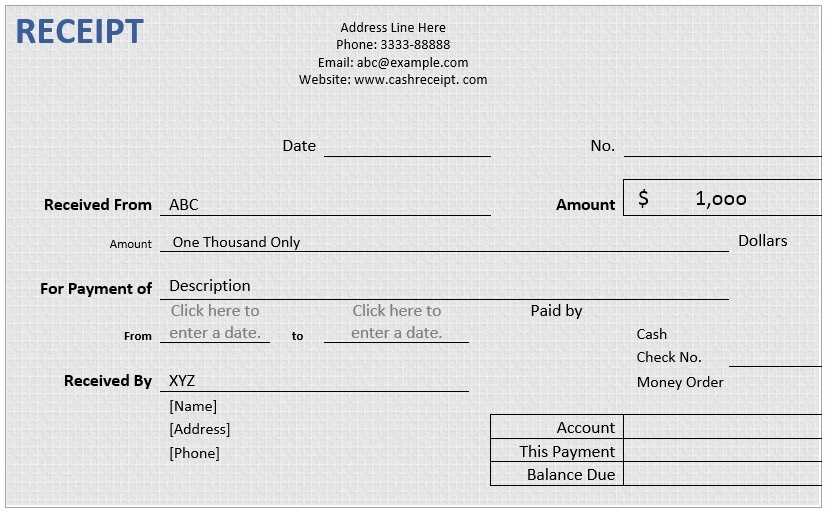

To create a clean and functional receipt template for Toys “R” Us, focus on clear structure. Begin with the store’s name, address, and contact details at the top. Below, include transaction specifics: item names, quantities, unit prices, and totals. Break down taxes and discounts in separate lines for clarity. Ensure the subtotal is distinct from the final amount, including tax. At the bottom, provide payment method details and a space for return information. Design with readability in mind, and keep the layout simple yet informative. This approach enhances customer understanding and ensures easy access to transaction details.

Receipt Template Toys R Us

How to Create a Customized Toys R Us Receipt

Best Tools for Designing Your Receipt

Steps to Include All Necessary Purchase Details

How to Integrate Taxes and Discounts into Your Receipt

Saving and Printing Your Template for Future Use

Common Mistakes to Avoid When Creating a Toys R Us Receipt

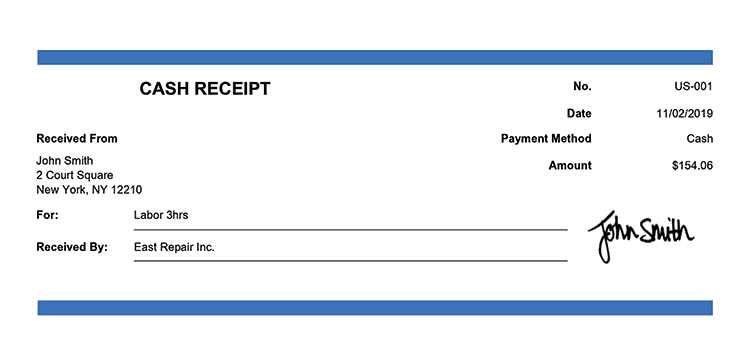

Creating a customized Toys R Us receipt requires careful attention to detail. Start by choosing the right software or online tool that supports receipt creation. Tools like Microsoft Word, Google Docs, or specific receipt design platforms like Invoice Generator can help streamline this process.

When designing your receipt, ensure you include the following details: the store name, address, and contact info. List the items purchased with their descriptions, quantity, and price. Add a total at the bottom, including applicable taxes and discounts. You should also consider adding a unique receipt number for easy reference in case of returns or exchanges.

Integrating taxes and discounts is simple when using automated receipt templates. Most receipt-making tools will allow you to enter tax rates and discount amounts. Double-check your calculations to avoid errors. Ensure tax is added after any discounts are applied for accurate pricing.

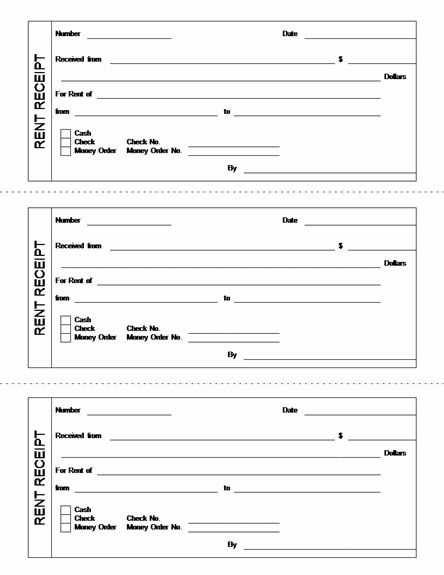

Once your receipt template is complete, save it for future use in a format like PDF or DOCX for easy editing. Printing it is straightforward, and you can use it whenever you need to create receipts for future purchases.

Avoid common mistakes such as omitting key purchase details, failing to clearly display taxes and discounts, or leaving out store contact information. Ensure your receipt is clear and professional to prevent any confusion or misunderstandings with customers.