Law firms benefit from using tailored receipt templates to maintain clear and organized financial records. These templates streamline billing, making it easier for clients and attorneys to track transactions. A good receipt template includes key details like the client’s name, service description, date, amount paid, and payment method.

Using customizable templates allows law firms to ensure compliance with industry standards and client expectations. They can quickly adjust the template for different services or payment methods, such as hourly rates, flat fees, or retainer payments. Being consistent in how receipts are presented helps avoid confusion and establishes a professional image.

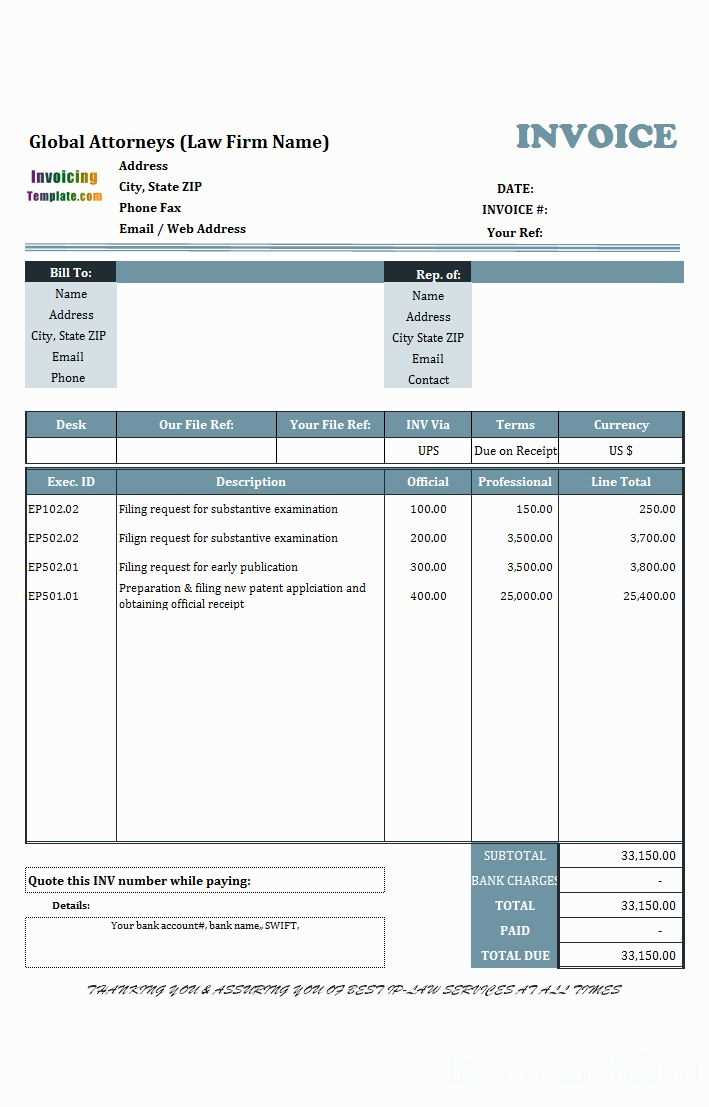

Additionally, incorporating specific terms related to the legal industry on receipts, like matter numbers, case references, or invoice codes, improves clarity. This helps both the client and firm maintain an accurate history of services rendered. With templates designed for different use cases, law firms can focus on client work rather than spending time creating receipts from scratch.

Receipt Templates for Law Firms

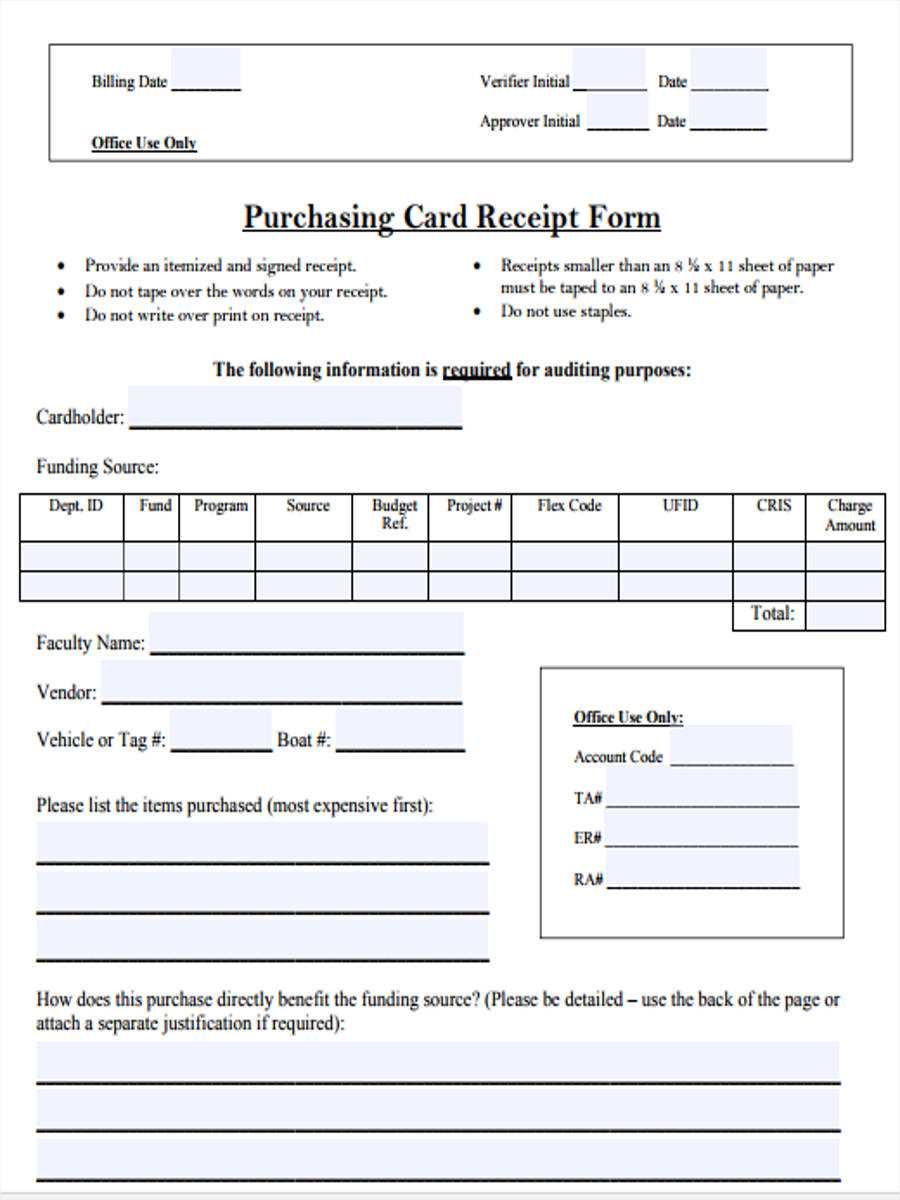

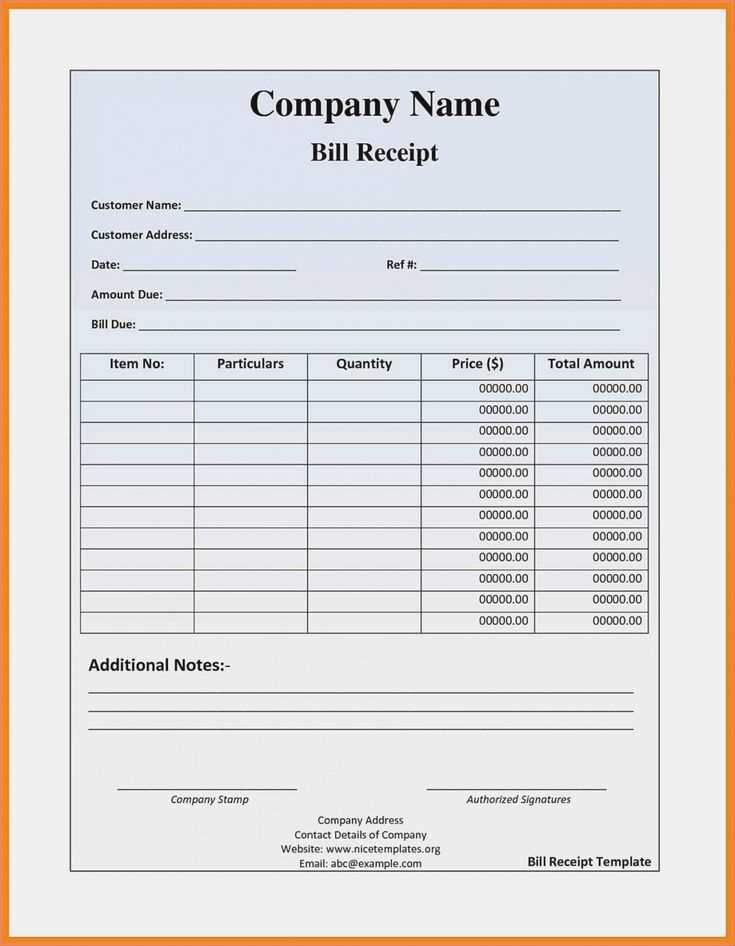

Law firms can streamline their billing process by utilizing receipt templates that meet both legal and business requirements. Start by ensuring your template includes clear sections for the law firm’s name, address, contact details, and a client identifier. Include the date of service, description of services provided, and an itemized breakdown of fees. This makes it easier for clients to understand what they are being charged for.

Key Components of a Law Firm Receipt Template

A good receipt template should be simple but comprehensive. Each entry should have a specific label such as “Consultation Fee,” “Court Filing Fee,” or “Legal Research Charge” to avoid confusion. Ensure that tax rates are included if applicable, and the total amount due should be clearly stated at the bottom. Include a section for payment method and confirmation (such as a check number or credit card transaction ID). These details help maintain transparency with clients and ensure accurate record-keeping.

Customizing Receipts for Different Services

For law firms handling multiple practice areas, customize your templates to reflect specific types of services. For example, receipts for family law services might include different terminology and itemization than those for corporate law or criminal defense. Customization ensures that your receipts are both relevant and appropriate for the service provided, improving client satisfaction and reducing the likelihood of disputes.

Customizing Templates for Legal Billing

Adjust your legal billing templates to align with the specific needs of your firm and clients. Focus on incorporating detailed billing categories that are relevant to your practice area. This ensures clarity and transparency in every invoice. Tailor sections like billable hours, hourly rates, and case-specific charges based on your pricing structure.

Ensure your template includes an easily accessible breakdown of the services provided. This can help clients understand how their fees are being applied, reducing potential misunderstandings. Also, include space for attorney or paralegal names, dates, and the work performed to maintain clear records for both parties.

| Template Feature | Customization Options |

|---|---|

| Header Information | Firm name, logo, contact info, and client’s details |

| Billable Hours | Breakdown by task, date, and professional |

| Rate Structure | Hourly rates, flat fees, or contingency rates |

| Line Item Details | Case-specific services with descriptions |

| Payment Terms | Due dates, late fees, or payment methods |

Incorporating these elements allows for a more structured and client-friendly billing experience. Regularly review and update the template to ensure it meets any new legal billing regulations or changes in your firm’s operations.

Incorporating Client Details and Case Information

Include all relevant client information in the header section of the receipt. This should encompass the client’s full name, contact information, and any identification number related to the case. Accurate record-keeping helps avoid potential confusion later.

Client Information

- Full Name

- Contact Information (address, phone number, email)

- Case Number

- Date of Retainer Agreement

Case Information

- Type of Legal Service Provided

- Details of Legal Matter

- Billing Structure (hourly, flat fee, retainer, etc.)

- Total Amount Charged

Ensure clarity when detailing case information. This makes it easier to track case progress and aids in identifying any outstanding amounts or payments. Avoid vague references, as specific details can prevent misunderstandings.

Compliance with Legal Industry Standards

Law firms must ensure receipt templates align with established standards set by governing bodies and legal associations. Adherence to these standards mitigates risk, ensures clarity, and promotes professional credibility. Templates should include all necessary legal disclaimers and accurate financial data, reflecting a commitment to transparency.

Incorporating Relevant Disclaimers

Receipts should contain legally required information such as the firm’s license number, professional qualifications, and applicable state or jurisdiction regulations. Specific disclaimers must address potential conflicts of interest or legal limitations regarding the receipt’s use in official matters. Failing to include such details could lead to compliance issues and jeopardize the firm’s standing.

Data Security and Privacy Considerations

Legal professionals must comply with data protection laws like GDPR and CCPA when processing client information. Receipt templates should be structured to avoid unnecessary storage of sensitive data. Where possible, digital receipts should employ encryption methods, ensuring secure transmission and storage of any personal information.