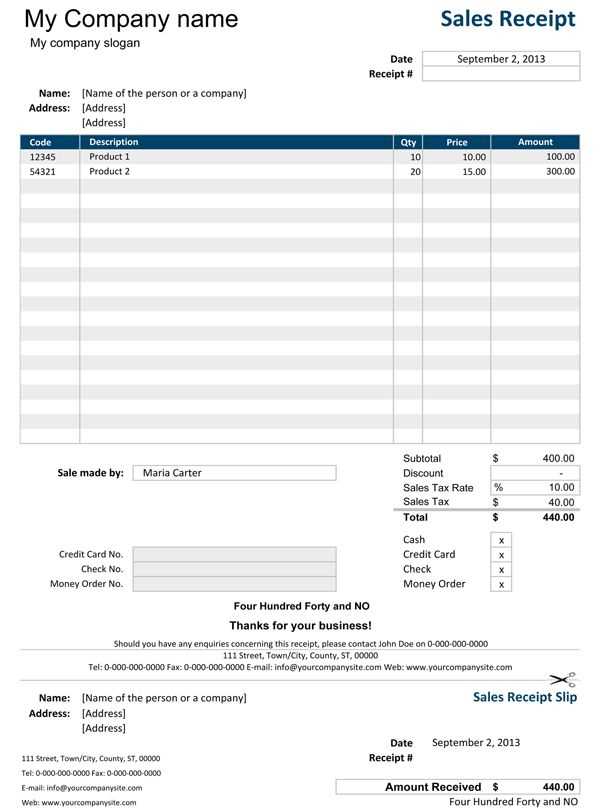

When designing a receipt with a subtotal template, clarity and simplicity are key. Begin with a clean layout that clearly distinguishes each section: item details, subtotal, taxes, and final total. This helps the customer easily review their purchase and ensures that no information is missed.

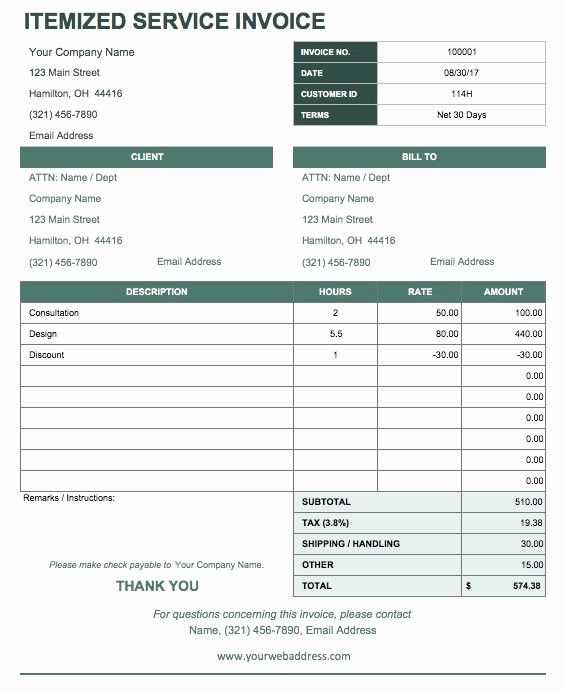

For accuracy, include the name of each item, its quantity, unit price, and the extended price. Make sure that the subtotal reflects the sum of the item prices before taxes and any discounts. Keep the subtotal section separate and bolded for easy identification.

Including taxes is just as important. Display the tax rate and the amount calculated based on the subtotal. This ensures transparency and builds trust with the customer, showing exactly how the final total is derived.

Finally, end with the total amount due, clearly separated from the rest of the details. A well-organized receipt template with a visible subtotal section makes transactions smoother and more professional.

Receipt with Subtotal Template

For creating a clean and functional receipt template with a subtotal, organize the layout into sections: items, subtotal, tax, and total. Ensure the subtotal is clearly separated from the tax and total amounts for easy comprehension. Each item should include a description, quantity, price, and total cost. You can align the text and numbers properly to maintain clarity and readability.

Start by listing items with corresponding quantities and unit prices. Next, calculate the total cost for each item and add them up for the subtotal. Below the subtotal, display any applicable tax or discounts. At the bottom, show the grand total, which includes the subtotal plus tax or minus any discounts.

Include clear labels for each section, such as “Item”, “Quantity”, “Price”, “Total”, and “Subtotal”. Keep the format consistent and use a simple font for better visibility. Ensure that all calculations are correct, especially when dealing with percentages for taxes or discounts.

For added convenience, you can add a space for customer information and a thank-you note at the bottom, which helps personalize the receipt while keeping the financial details concise.

Creating a Simple Receipt Template with Subtotal

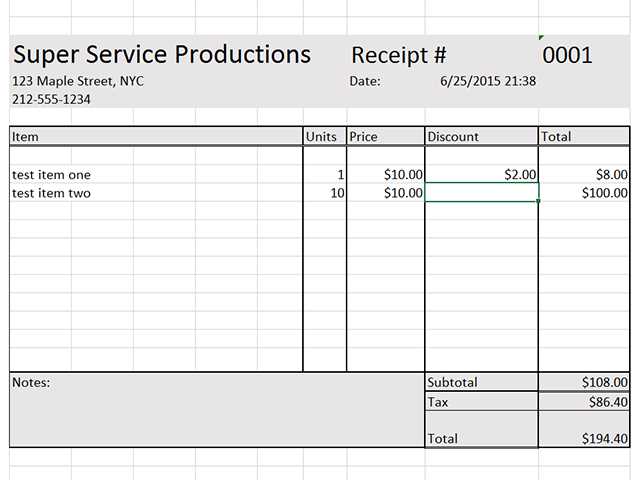

To create a basic receipt template with a subtotal, structure the document in clear sections: item list, subtotal, taxes, and total amount. Start with a simple table layout for the itemized list, including columns for the item description, quantity, unit price, and total price for each line.

Use the following layout for your receipt:

| Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Item 1 | 2 | $10.00 | $20.00 |

| Item 2 | 1 | $15.00 | $15.00 |

At the bottom of the table, calculate the subtotal by summing the total prices for each item. Display the subtotal clearly in a separate row to make it easy for customers to identify. For instance, if your items are priced at $20.00 and $15.00, the subtotal would be $35.00.

| Subtotal | $35.00 |

Once the subtotal is established, you can add tax calculations. Depending on your tax rate, multiply the subtotal by the rate (e.g., 8%). Finally, display the total amount, including taxes.

| Tax (8%) | $2.80 |

| Total | $37.80 |

With this setup, the customer can clearly see the subtotal, taxes, and final total in a well-organized format. Make sure to use appropriate spacing and alignment for a professional look.

Customizing Your Template for Multiple Items and Discounts

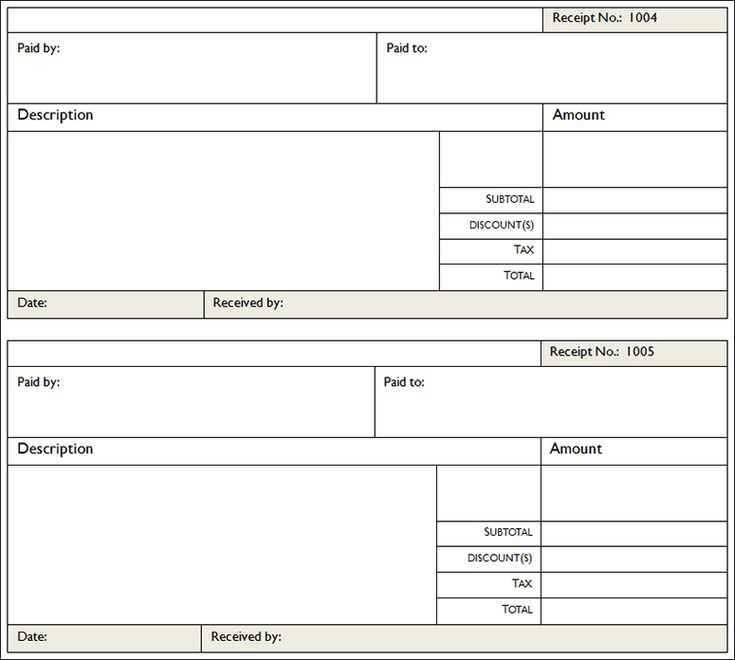

To manage multiple items and discounts efficiently in your receipt template, structure the layout to accommodate itemized details and deductions clearly. Use separate sections for each product, subtotal, discounts, and total.

- Itemized List: Create rows for each item, showing the name, quantity, unit price, and total price. Ensure these elements align well for readability.

- Subtotal Section: After listing all items, include a subtotal line. This should sum the individual totals for each item, giving customers a clear picture of the base cost before discounts.

- Applying Discounts: Deduct the discount amount under a separate heading. Make it clear if the discount is applied to specific items or as a general reduction on the total.

- Tax and Fees: If applicable, add a line for taxes and any other fees after the subtotal but before the final total.

Use clear labels for each section, and position discounts and taxes so they don’t confuse the customer. Avoid cluttering the template with too much detail; focus on simplicity and clarity. A well-organized format ensures both you and the customer can quickly verify the transaction details.

- Align Pricing and Discounts: Align product prices with their discount values and clearly show how much is being saved. This makes the receipt more transparent.

- Provide Discount Breakdown: For multiple discounts, provide a line for each one, indicating what the discount is for (e.g., seasonal sale, promotion). This increases transparency.

Keep the total amount distinct and clearly labeled to ensure no confusion about the final charge. The subtotal, discounts, and taxes should all be clearly separated, allowing easy tracking for both parties.

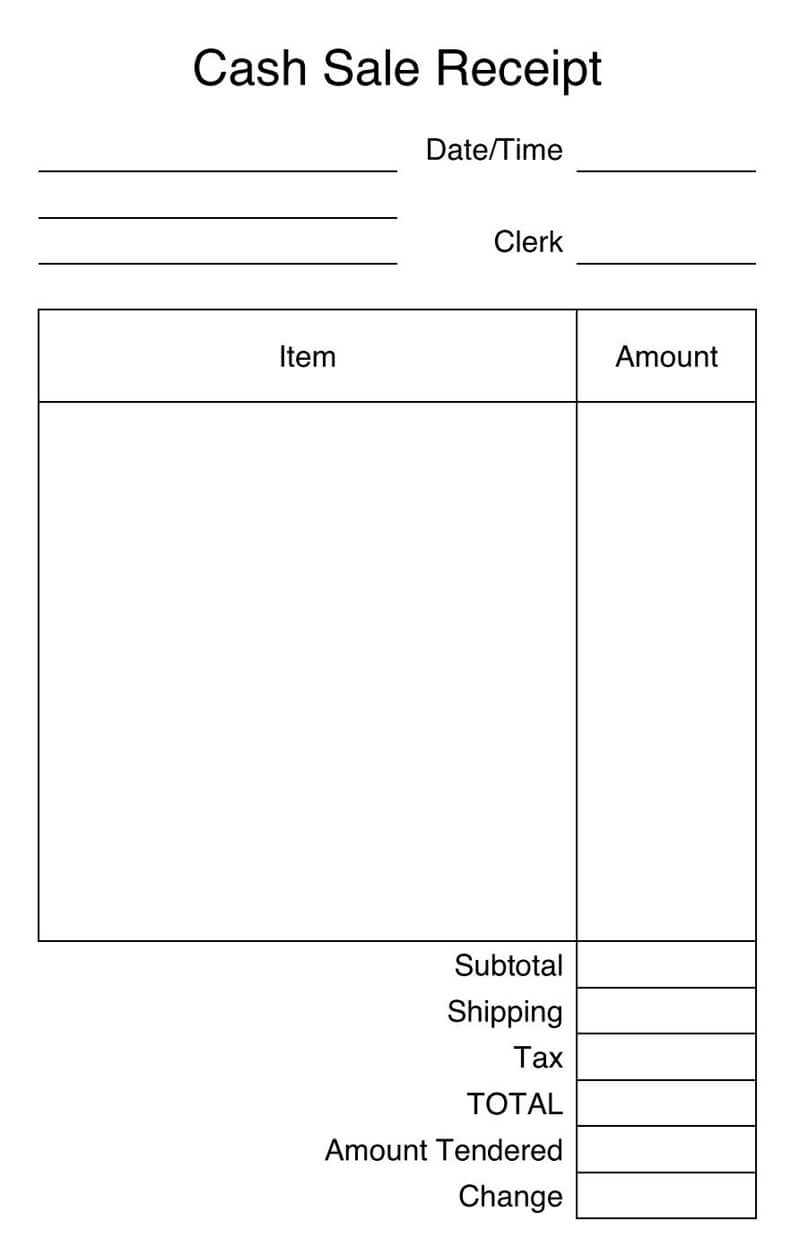

Formatting the Subtotal Section for Clarity and Professionalism

Ensure the subtotal section stands out with clear separation from other parts of the receipt. Use a larger, bold font for the subtotal label to make it immediately recognizable. The amount should be prominently displayed, often in a different color or enclosed in a box for visual distinction.

Align the subtotal information to the right for consistency with other numerical data. Keep the font size consistent with the rest of the receipt but make sure it’s slightly larger for better visibility. Avoid cluttering the subtotal line with unnecessary information.

Use spacing to create a clean break before and after the subtotal. A small gap above and below the subtotal section adds focus and makes it easy to scan. If you include taxes or discounts, show them on separate lines with clear labels, keeping the subtotal line clean and direct.

Choose a simple and professional font that enhances readability. Avoid using decorative fonts that could confuse the customer. A clear, sans-serif font works well for numbers and totals.

Ensure the currency symbol is properly placed and aligned with the number. It should be close to the amount, but not intrusive, maintaining the clean look of the subtotal section.