As a self-employed individual, keeping receipts is an important part of managing your finances and fulfilling tax obligations. You should hold onto receipts for a minimum of 5 years from the end of the tax year in which the expense was made. This is the standard requirement for most tax authorities, including HMRC in the UK and the IRS in the United States. Keeping them for this period ensures you’re prepared for any potential audits or discrepancies.

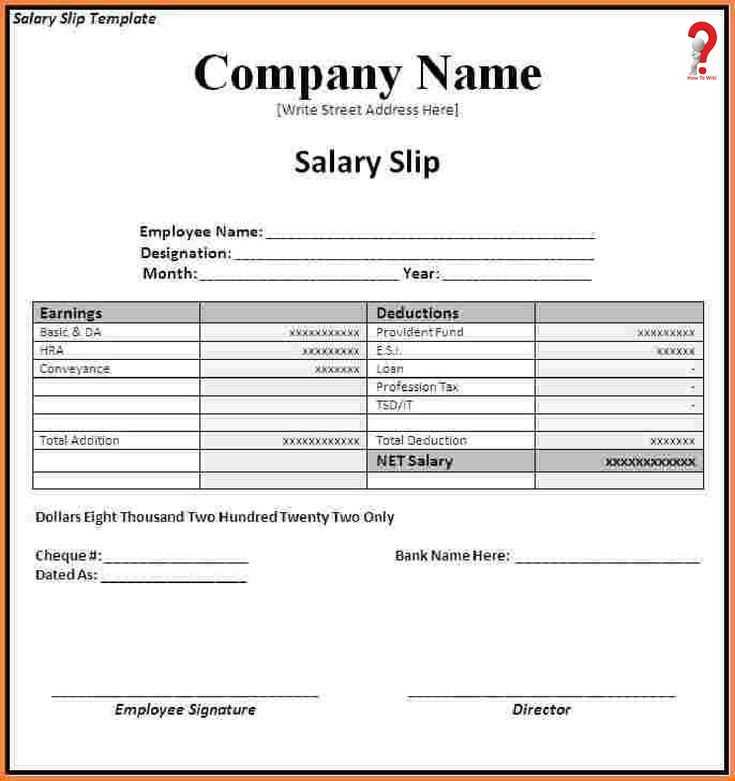

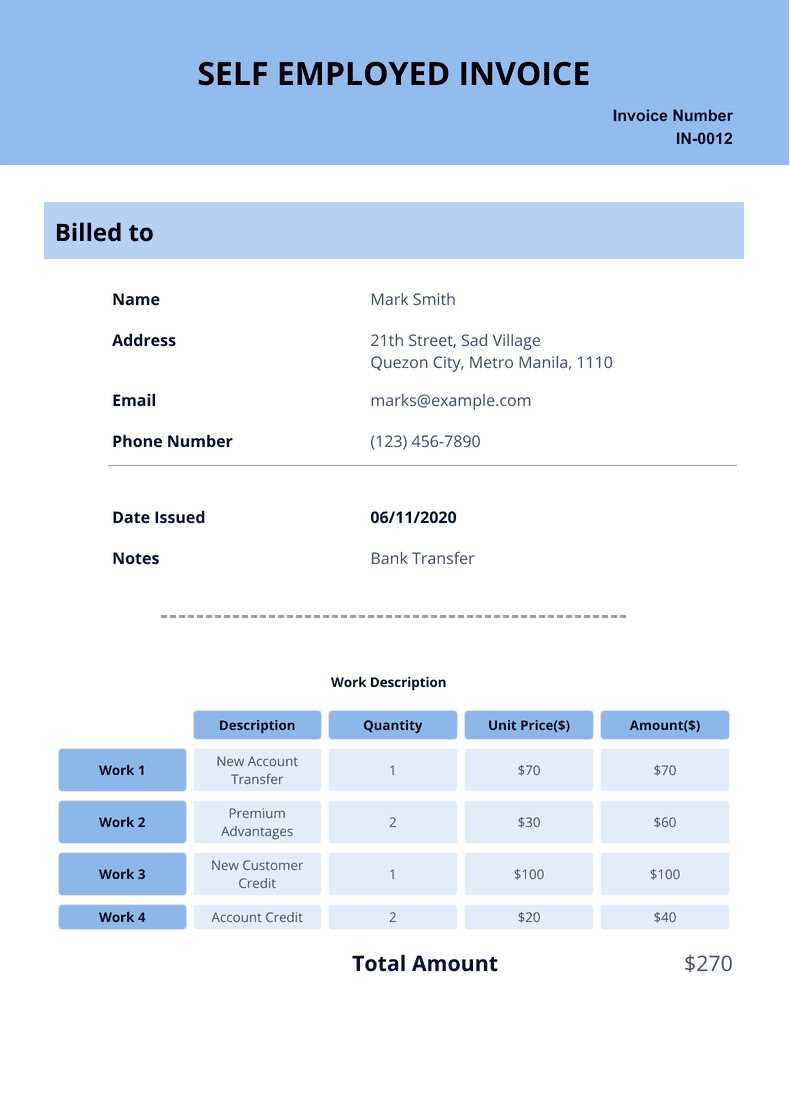

Receipts serve as proof of your expenses, which can be deducted from your taxable income. Without them, you could miss out on tax savings or face challenges during an audit. To make things easier, organizing your receipts in a structured template will help you track your expenses efficiently. Using a receipt template will also allow you to store essential information like the date, vendor, amount, and purpose of each purchase.

It’s also wise to keep digital copies of your receipts. Scanning or photographing them ensures they’re preserved even if the physical copies fade or get lost. In the event of an audit or tax review, digital backups can be quickly accessed and shared. Consider storing these files in a secure cloud system for easy retrieval whenever needed.

Sure! Here is the revised version of your text, with repetitions minimized while maintaining the original meaning:

Self-employed individuals must keep receipts for tax purposes for a minimum of five years. The tax authorities typically allow this period to ensure they have enough time to review past claims or audits. You should keep physical or digital copies of receipts to support any business expenses reported on your tax returns.

Why It Matters

Proper record-keeping helps avoid issues with tax audits or discrepancies. If you are ever selected for an audit, having receipts ready shows that you have documented expenses accurately. Organizing receipts promptly saves time and protects you from penalties.

How to Store Receipts

You can choose to store your receipts digitally using apps that scan and organize them. Make sure that digital copies are legible and accessible. If you prefer paper copies, keep them in a safe, dry place to prevent damage. Using folders or filing systems by category is helpful when searching for specific documents.

- Receipts Template for Self-Employed: Retention Period

Self-employed individuals must retain receipts for tax and accounting purposes. Generally, you should keep receipts for at least 5 years from the end of the tax year they relate to. This period aligns with the time frame HM Revenue and Customs (HMRC) may assess your tax returns. Failing to retain proper documentation could lead to complications during an audit or tax review.

Retention Period for Tax and Accounting

For self-employed individuals, receipts are required as proof of income and expenses. You need to maintain a record of business transactions for 5 years after the 31 January submission deadline of the relevant tax year. For example, receipts from the 2024 tax year should be kept until 31 January 2029. This period allows HMRC to check for discrepancies or errors in your filed tax returns.

Exceptions and Special Cases

While the standard retention period is 5 years, some receipts or documents, like those related to assets (e.g., property or machinery), may need to be kept longer, as these affect depreciation or capital gains calculations. Always consult with a tax professional if you are unsure about any exceptions to the general rule.

As a self-employed individual, you must keep receipts for tax purposes. The legal retention period for receipts can vary by country, but most jurisdictions require a minimum of 5 to 7 years. This allows tax authorities to review your records if necessary.

For tax compliance, storing receipts in an organized manner is just as important as the duration. Receipts must be stored in a way that preserves the information, whether digitally or physically. For digital receipts, ensure proper backups and security measures are in place.

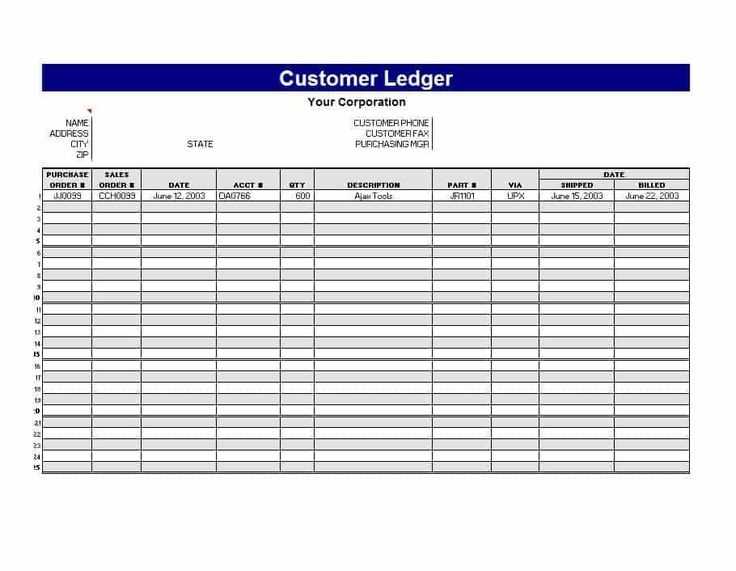

Here are key points to consider:

| Receipt Type | Retention Period | Storage Method |

|---|---|---|

| Business Expenses | 5-7 years | Digital or Paper (legible copies) |

| Income Records | 5-7 years | Digital or Paper |

| Bank Statements | 5-7 years | Digital or Paper |

Make sure receipts are easy to access in case of an audit. Using digital tools for organizing receipts can simplify this process and keep your business compliant with tax regulations.

Keep your receipts for at least three years from the date you file your tax return. This timeframe aligns with the IRS recommendation for audits, claims, or amendments. If you’re self-employed, maintaining accurate records is crucial, as it can help prove your income, deductions, and expenses in case of any IRS review.

If you file a claim for a loss or if your records support deductions on your taxes, hold onto receipts for seven years. This period applies if you claim a bad debt deduction or loss from worthless securities.

If you’re unsure about which receipts to keep, focus on those for major purchases or business expenses that are deductible. Items like office supplies, vehicle expenses, or equipment purchases should be stored properly for easy access. When in doubt, keeping receipts longer than required can provide additional peace of mind. However, avoid cluttering your space with unnecessary paperwork–organize and dispose of receipts that are no longer relevant after the retention period expires.

Sort receipts into specific categories, such as office supplies, travel expenses, or client meetings. This way, you can quickly find the ones you need for tax filing or expense tracking.

Physical Receipts

Use a dedicated folder or envelope for each category. Label each container clearly to avoid mixing different types of expenses. For example, create separate folders for supplies, client meals, or transportation costs. If you have many receipts, consider dividing them by month or quarter.

Digital Receipts

Scan or take photos of your physical receipts and store them in a cloud service. Create folders for each category, and label the files with specific dates or descriptions. Consider using apps that can automatically categorize receipts, making it easier to search through your files when needed.

- Set up an easily searchable file naming system. Include the date, vendor, and category in the file name (e.g., “2025-01-15_OfficeSupply_ABCStore”).

- If you’re using apps, regularly upload new receipts to maintain up-to-date records.

By keeping receipts well-organized, you reduce the time spent searching for documents and avoid the stress of losing important records. Additionally, it can simplify tax reporting and other financial activities.

Discarding receipts too soon can lead to serious issues when it comes to taxes or business expenses. Without proper documentation, you might struggle to prove the legitimacy of your expenses if the tax authorities ask for proof. This can result in penalties, fines, or even audits. Keeping receipts too short of a time period may also lead to missed deductions, which could affect your overall financial health.

In case of disputes with clients or suppliers, discarded receipts may prevent you from defending your position. If you can’t verify a transaction or show evidence of a purchase, you might face difficulties getting reimbursed or resolving conflicts effectively.

It’s critical to maintain your receipts for the recommended period, typically up to 7 years. Doing so ensures you’re prepared for any financial review, audit, or legal inquiry that may arise. Keep receipts organized, as this habit can save you a lot of trouble down the road.

Retain digital receipts for a minimum of 5 years. This period aligns with IRS regulations for self-employed individuals, who must keep records of expenses and income for tax purposes.

- Store receipts in secure cloud storage or a dedicated receipts management system. Ensure the files are backed up regularly to avoid loss of data.

- Save receipts in formats like PDF, JPG, or PNG. Maintain clarity so that all important details are legible for future reference or audits.

- Record additional details such as date, amount, vendor, and purpose of the expense. This helps with proper categorization and tax reporting.

If you scan paper receipts, ensure the resolution is high enough to preserve all information. Regularly review your files to make sure they are organized and easy to find when needed.

After the 5-year retention period, securely delete digital receipts using a method that ensures data cannot be recovered.

Shred all physical receipts once you’ve passed the retention period. This is the best way to ensure sensitive information is completely destroyed. Use a cross-cut shredder, as it provides more security than strip shredding by cutting receipts into small, unreadable pieces.

If you’re dealing with digital receipts, delete them from your storage or cloud service. It’s important to empty the trash bin afterward to avoid recovery. If you’ve scanned receipts for backup, make sure to permanently erase files using secure deletion software to prevent data retrieval.

For tax-related documents, check with your tax authority for specific guidelines on how long to keep scanned copies. Some jurisdictions may allow you to discard records sooner once they are stored digitally.

When disposing of receipts, keep in mind that many of them contain personal and financial information. Always ensure that sensitive data is securely wiped or destroyed, leaving no trace behind.

How Long to Keep Receipts for Self-Employed Tax Purposes

Keep receipts for at least 5 years. This aligns with the IRS’s statute of limitations for tax audits. If your business expenses are audited, you may be asked to provide documentation for up to 3 years back. However, retaining receipts for 5 years ensures you’re covered in case of any audit or need for further verification.

For businesses that claim deductions, such as expenses for equipment or home office costs, it’s also wise to hold onto receipts longer than the minimum requirement, especially for larger investments. Some accountants recommend keeping receipts for longer periods in specific situations, like if your assets depreciate over time.

Store them in a way that makes them easy to access. Digital copies are a great alternative, as long as they are legible and securely backed up. Scanning receipts and organizing them by category can save time in case of an audit.