Creating receipts for your transactions doesn’t have to be complicated. With the right template, you can streamline the process and ensure accuracy every time. A well-structured receipt not only helps you keep track of your sales but also provides your customers with clear and concise proof of purchase. Whether you’re a small business owner or managing a larger operation, using a reliable receipt template is key to maintaining professionalism.

For UK businesses, it’s important to comply with legal requirements while ensuring your receipts are informative. The template should include key details like your business name, the item description, prices, and VAT where applicable. You can customize these templates based on the nature of your business, making them as simple or detailed as you need. Online tools and software offer easy-to-use solutions that let you adjust templates to suit your branding and the specifics of your sales process.

Using a receipt template allows you to avoid the hassle of manually writing out each one. Templates ensure consistency, reducing errors that could lead to misunderstandings or financial discrepancies. Additionally, they save time, especially when you need to issue a receipt quickly. Look for templates that are easy to download, customize, and print to fit your needs. With these in hand, your business will be set for smooth transactions and excellent customer service.

Receipts Templates UK

Using templates for receipts is an easy way to ensure accuracy and save time. These templates help businesses streamline the process of issuing receipts to customers while ensuring compliance with UK tax regulations.

Several online platforms offer free and customizable receipt templates. These templates can be tailored to suit the specific needs of your business, such as adding your logo, payment methods, or VAT details. Popular software like Microsoft Excel or Google Sheets also provides templates that can be adapted for receipt purposes.

To find the right receipt template, consider the following options:

- Online Generators: Websites like Invoice Simple and Free Invoice Generator allow you to create receipts instantly by entering the relevant details. These templates are downloadable and customizable.

- Spreadsheet Templates: Excel and Google Sheets have built-in receipt templates that offer flexibility, such as adding taxes or custom fields for more detailed transactions.

- Accounting Software: Tools like QuickBooks and Xero include receipt templates that are automatically filled with customer and transaction data, making the process even smoother.

Make sure the template you choose meets the UK legal requirements for receipts. These include the business name, contact details, date of transaction, itemized list of purchased goods or services, total amount paid, and VAT breakdown if applicable.

By selecting the right template and keeping it customized to your needs, issuing receipts becomes a seamless process. Regular updates and adjustments ensure that the template continues to serve your business needs effectively over time.

How to Create Custom Receipt Templates

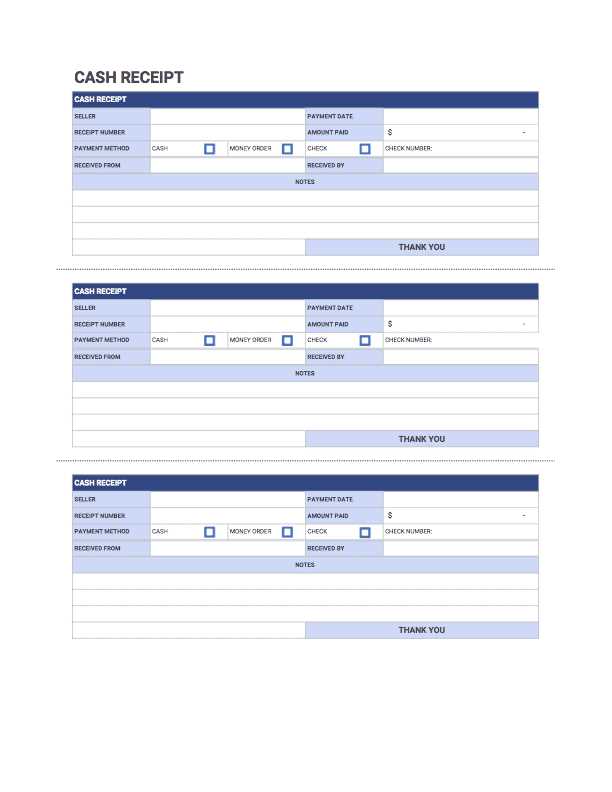

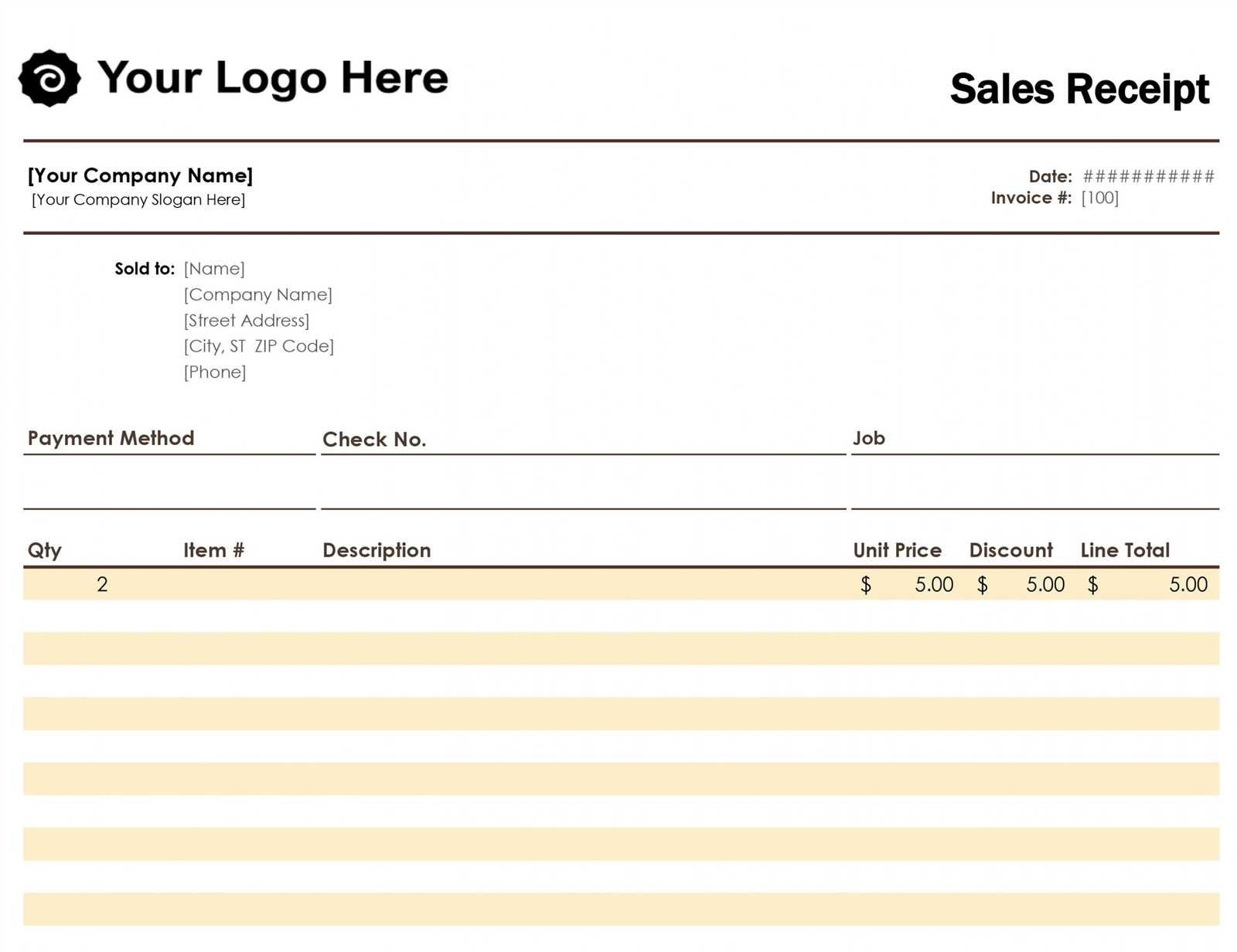

Begin by selecting a software tool that allows for customization, like Microsoft Word, Google Docs, or specialized invoice generators. Choose a clean, professional layout to ensure clarity. A simple grid design works well for receipts, with clear sections for items, prices, taxes, and totals. Make sure the sections are aligned neatly, ensuring no confusion for the customer.

Organize Key Information

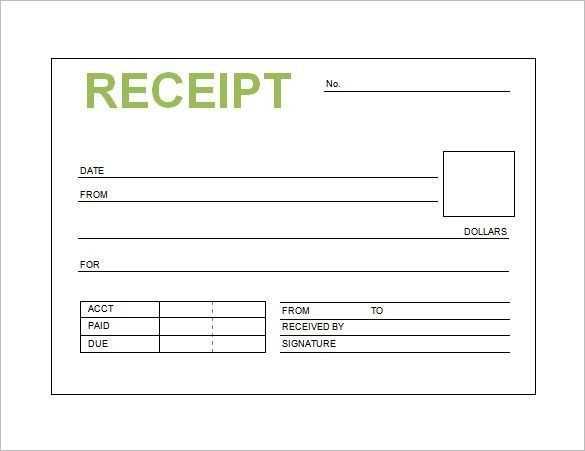

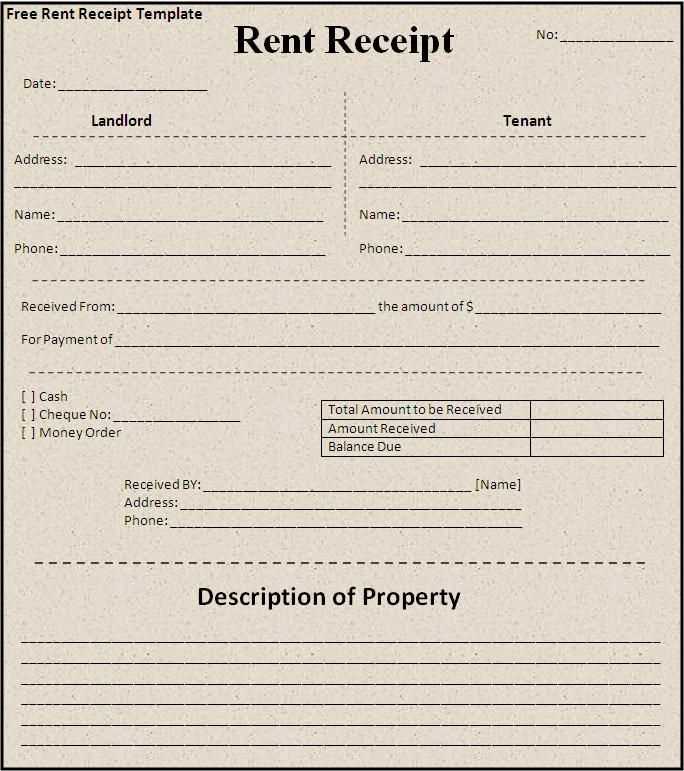

Include essential details like the business name, contact information, and a unique receipt number. Specify the transaction date and payment method to provide a clear record. Ensure you have a separate area for item descriptions, quantities, unit prices, and the total price. This layout prevents any ambiguity, making it easy for customers to understand their purchase.

Personalize the Template

Customizing your template adds a professional touch. Add a logo, choose a color scheme matching your brand, and adjust the font to ensure readability. If you are running a shop, consider including your website or social media links to encourage further engagement. Keep the design simple and intuitive–focus on functionality rather than unnecessary embellishments.

Choosing the Right Receipt Format for Your Business

Choose a receipt format that aligns with your business size and customer needs. For small businesses, a simple text-based template works well for in-person transactions. Use basic details: date, item description, amount, and payment method. For larger businesses or online sales, consider a more structured format that includes your logo, contact info, and tax details, providing clarity and a professional appearance.

If you run a service-based business, include service descriptions, hourly rates, and total time worked. This approach not only ensures accuracy but builds trust with clients. On the other hand, if your business involves high volumes of sales, an itemized receipt with product details and applicable taxes is crucial for both customers and accounting purposes.

Adapt your format to your transaction method. For electronic receipts, use formats that are easy to store and share, like PDFs or digital invoices. Make sure your template is mobile-friendly if customers access it through their phones. For paper receipts, use a clear and readable font, with enough space between lines for easy comprehension.

Finally, keep in mind that simplicity and transparency are key. The easier it is for customers to understand their receipt, the more likely they will appreciate your service. Choose a format that suits your workflow, is easy to implement, and enhances the customer experience without unnecessary complexity.

Legal Requirements for Receipts in the UK

In the UK, businesses are not legally required to provide receipts for every transaction, but they must do so if the customer requests one. Receipts must include key information such as the date of the transaction, the amount paid, and the business name. Additionally, if the sale involves VAT, the receipt must clearly show the VAT amount and the business’s VAT registration number.

For businesses registered for VAT, receipts need to follow specific VAT invoicing rules. A valid VAT receipt must include details like the total amount, VAT rate, and the breakdown of the VAT. The receipt should also show the seller’s VAT registration number and the invoice number for proper record-keeping.

If a customer is paying for a service or product under a guarantee or warranty, receipts must contain proof of purchase. Keeping receipts is a legal requirement for some businesses, especially when managing consumer rights or claims.