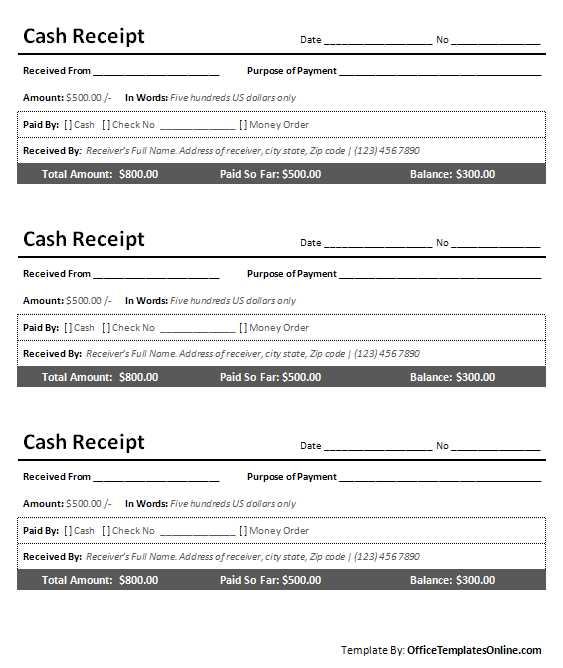

To correctly process a car receipt template, focus on extracting the total amount from the document with precision. The total amount is typically listed at the bottom of the receipt and should reflect the final cost after all applicable taxes, fees, and any additional charges. Ensure that this figure matches the sum of all individual items listed above it, as discrepancies could indicate errors or adjustments that require attention.

Double-check the tax and fee breakdown before finalizing the total. In many receipts, tax and additional fees are shown separately. Be sure to account for these elements to ensure the total reflects all payments made. If the template includes discounts or promotions, verify that these have been properly applied to avoid miscalculations.

Cross-referencing with payment records is another important step. Ensure the total matches the amount paid, whether by credit card, cash, or another method. This helps identify any issues such as incomplete payments or refund discrepancies, ensuring everything aligns correctly on your financial records.

Here’s the corrected version where words are not repeated more than 2-3 times:

Ensure clarity in your car receipt template by including the total amount at the top. Specify any additional fees, taxes, or discounts below the main total. This approach avoids confusion for both parties and creates a clean, easy-to-read format. Make sure to list each individual item and its corresponding cost. A well-organized template ensures that the receiver can quickly verify and understand the charges. When indicating payment method, avoid redundancy; simply state “paid by” followed by the method used. Lastly, double-check the accuracy of the total amount, ensuring there are no discrepancies or missed calculations.

- Receive from Total Amount of Car Receipt

To accurately receive the total amount listed on a car receipt, follow these steps:

- Check the final price: Verify that the total amount matches the sum of the car price, taxes, fees, and any applicable discounts.

- Examine payment method: Ensure that the payment method used is reflected in the receipt and that any financing terms, if applicable, are properly listed.

- Review the breakdown: Make sure the receipt clearly shows all individual charges, including vehicle price, registration fees, and other add-ons.

- Confirm receipt accuracy: Ensure all details on the receipt are correct, including the car model, VIN number, and the date of purchase.

- Verify refund policies: If there’s any mention of refunds, check how the total amount may change based on returned items or adjustments.

By paying close attention to these details, you can ensure that you have received the correct total amount and avoid any discrepancies later.

Car receipts often present a detailed breakdown of charges that make up the total amount. Carefully reviewing these sections helps ensure all costs are clear and correct. Each category typically includes the base price, additional fees, and taxes. Identifying how much each component contributes to the total is key for accurate record-keeping and understanding your financial commitment.

Base Price

The base price is the fundamental cost of the car or service. This amount is typically listed prominently in the receipt. It reflects the initial cost before taxes, fees, or any optional services. Knowing this amount helps to evaluate whether any additional services or upgrades were added to your purchase.

Additional Charges

Additional charges may include delivery fees, documentation fees, or charges for added features like extended warranties, insurance, or service packages. Always confirm these costs, as they can vary based on the seller or dealership. Ensure the listed charges align with what was agreed upon during the transaction.

Taxes and Fees are also included in the total amount, and understanding the breakdown of taxes is important to ensure they are calculated correctly. Some states or regions have specific car-related tax rules that may apply. Check these charges for accuracy.

Reviewing the breakdown ensures transparency and helps in verifying that all fees and charges are justifiable and correctly applied. Keep a copy of the receipt for your records in case of discrepancies later.

Look for the following points to easily identify key information on a car receipt:

- Vehicle Identification Number (VIN): This unique number helps confirm the car’s identity. It usually appears at the top or near the itemized details of the receipt.

- Dealer Information: Make sure the dealership name, address, and contact details are clearly listed. This ensures the receipt is legitimate and from the correct seller.

- Date of Purchase: The date is often shown near the top. It’s crucial for warranty purposes and for tracking ownership.

- Amount Paid: Review the total payment amount, including taxes and fees, clearly displayed at the bottom of the receipt.

- Itemized List: Check for a breakdown of charges, including the base price of the car, add-ons, and any additional services. This section helps you spot discrepancies and understand the cost breakdown.

Extra Considerations

- Sales Tax: Ensure the sales tax is calculated properly based on your location.

- Payment Method: This section confirms how you paid–whether via financing, cash, or trade-in. Look for any financing terms or down payments listed.

By focusing on these sections, you can quickly confirm that all information on the receipt is correct and aligns with your purchase agreement.

Always include taxes and fees in the final total when preparing a car receipt. These charges vary based on location, vehicle type, and specific regulations in your area. Typically, you’ll calculate sales tax, which is a percentage of the car price. Ensure that the tax rate matches the one established by the local government or state. If the car is being rented, an additional rental tax may apply.

Other fees may include environmental or disposal charges, especially if the vehicle is being leased. These fees help cover the cost of vehicle recycling or environmental initiatives. Additionally, registration and title fees are often required for both the purchase and rental of a vehicle. Be specific with these charges to avoid confusion.

Don’t forget to add any administrative fees or documentation fees that may apply to processing paperwork. These charges are typically standard, but the amounts can vary depending on the dealership or service provider. Double-check your local requirements and make sure you’re accurately calculating each of these components.

Finally, some receipts may include an insurance fee or optional coverage for the car. If you provide this option, clarify its cost, whether it’s an additional charge or part of the overall rental or purchase agreement.

Modify your car receipt template to fit your business needs by following these steps:

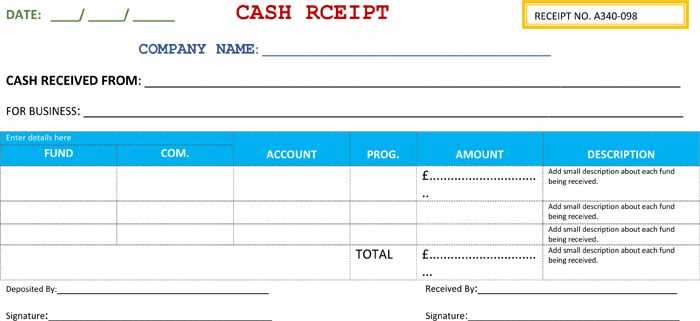

1. Identify Your Business Information

Update the template with accurate business details like name, logo, address, contact information, and tax ID. This ensures customers can easily identify where the receipt originated.

2. Customize the Layout

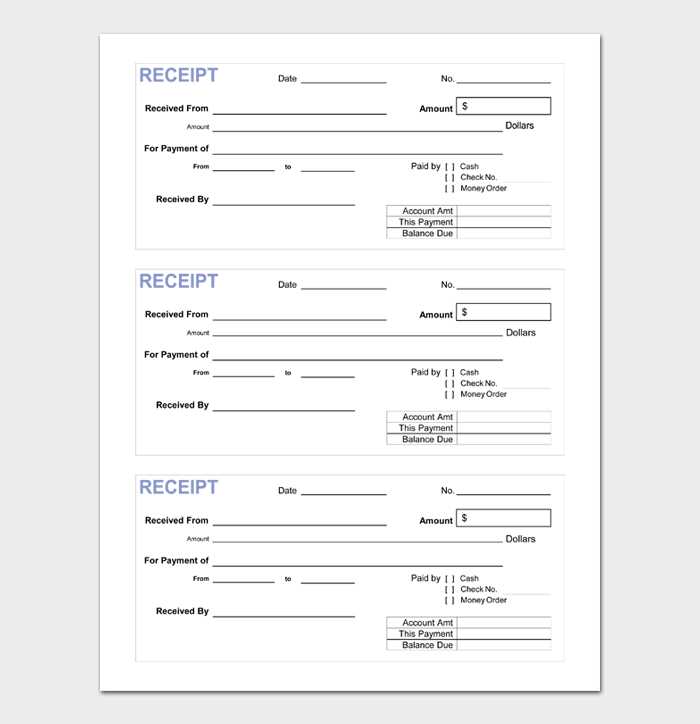

Adjust the receipt’s structure to suit your brand’s style. Consider sections like vehicle details, transaction summary, and payment methods. Keep it clear and organized, using appropriate headings to guide the reader.

3. Include Required Legal Information

Ensure that the receipt contains necessary legal details. This may include tax rates, warranties, return policies, or service disclaimers. These elements protect your business and clarify terms for customers.

4. Add Payment Breakdown

Clearly list the total amount, applicable taxes, and any discounts. You can break down payments by type (e.g., cash, card) for transparency. Consider including payment method details for future reference.

| Item | Quantity | Price | Total |

|---|---|---|---|

| Car Sale | 1 | $20,000 | $20,000 |

| Sales Tax (5%) | – | – | $1,000 |

| Total | – | – | $21,000 |

5. Include Customer Details

Make sure the customer’s name, address, and contact information are correctly captured. This helps for follow-ups, recalls, or servicing and serves as a reference for both parties.

6. Incorporate Terms and Conditions

Specify terms like payment due dates, return policies, or any other agreements related to the transaction. This can be a short paragraph or a link to a detailed document on your website.

7. Test the Template

Before you start using the modified template regularly, test it. Print or email a few receipts to ensure the layout is readable, and all information is accurate and aligned properly.

8. Save and Use the Template

Once everything is set, save the updated template as a master copy. Use it to generate new receipts for each car sale, ensuring consistency across all transactions.

Ensure your receipt templates for car transactions meet legal standards by including key elements such as accurate vehicle details, clear pricing breakdowns, and tax information. This minimizes the risk of disputes and maintains transparency in transactions.

Accurate Vehicle Information

Include the car’s make, model, year, VIN (Vehicle Identification Number), and odometer reading at the time of sale. These details are critical for identification and to comply with local regulations requiring specific vehicle data in sales records.

Tax and Financial Details

Clearly state the sales price, applicable taxes, and any additional fees in a detailed, itemized format. Ensure that all calculations are correct and in line with the jurisdiction’s tax rates. Failure to do so can lead to tax-related penalties or legal challenges.

Ensure the receipt clearly states the correct date of the transaction. This helps avoid confusion, especially for customers or tax purposes. A missing or incorrect date can lead to disputes or complications when trying to track a purchase.

Always include a detailed breakdown of the total amount. Avoid vague descriptions like “car purchase” or “services rendered.” Be specific, listing the car make, model, and the exact services provided if applicable. This helps both parties understand the transaction fully and ensures transparency.

Accurately include the tax amount. Many overlook adding or calculating the correct tax percentage. Double-check local tax regulations to avoid discrepancies that may create issues down the line.

Check that both the buyer’s and seller’s information are correctly listed. Names, addresses, and contact details should be accurate. Mistakes here could make it difficult to verify the transaction if any issues arise later.

Ensure all payment methods are clearly noted. If the payment was made via check, credit card, or cash, document it. Lack of this information can cause confusion in case a refund or verification is needed.

Always use a clear and readable format. Avoid cluttering the receipt with unnecessary information. This keeps it easy to follow, ensuring that all essential details are highlighted and accessible at a glance.

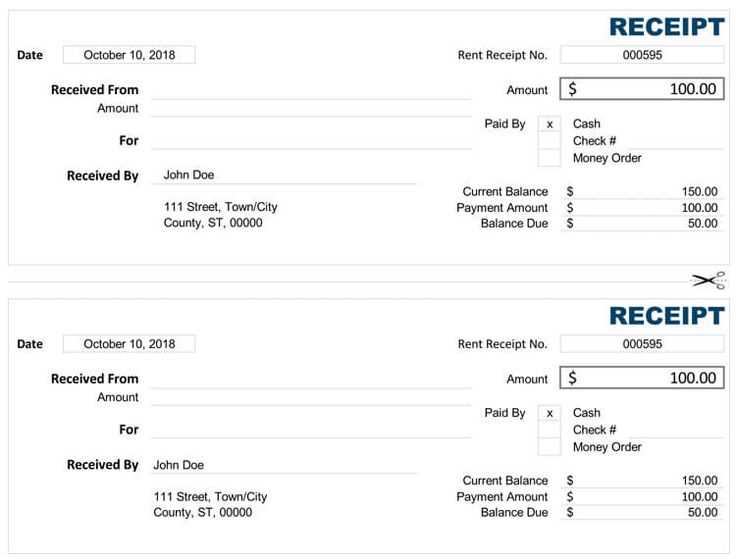

Start by reviewing the receipt template to identify key components such as the total amount, taxes, discounts, and payment methods. Make sure each section is clearly marked and easy to interpret.

Key Elements to Check

Verify the following details are included and accurate:

- Total Amount: This should reflect the exact sum after all taxes and discounts have been applied.

- Payment Method: Ensure the method (cash, credit card, bank transfer) is properly noted.

- Invoice Number: Every receipt should have a unique number for tracking purposes.

- Itemized List: Ensure all products or services are listed with their prices and quantities.

- Date and Time: These help confirm the transaction took place on the correct date.

Confirm Accuracy

Double-check the total amount and breakdown to ensure they match the final charge. If discrepancies are found, contact the vendor for clarification.