Creating a registration fee receipt template is simple and saves time when you need to confirm payment for an event or service. The key to an effective receipt is clarity. Ensure that the template clearly shows the amount paid, the service or event related to the payment, and the payer’s details. This transparency helps avoid misunderstandings and keeps records organized.

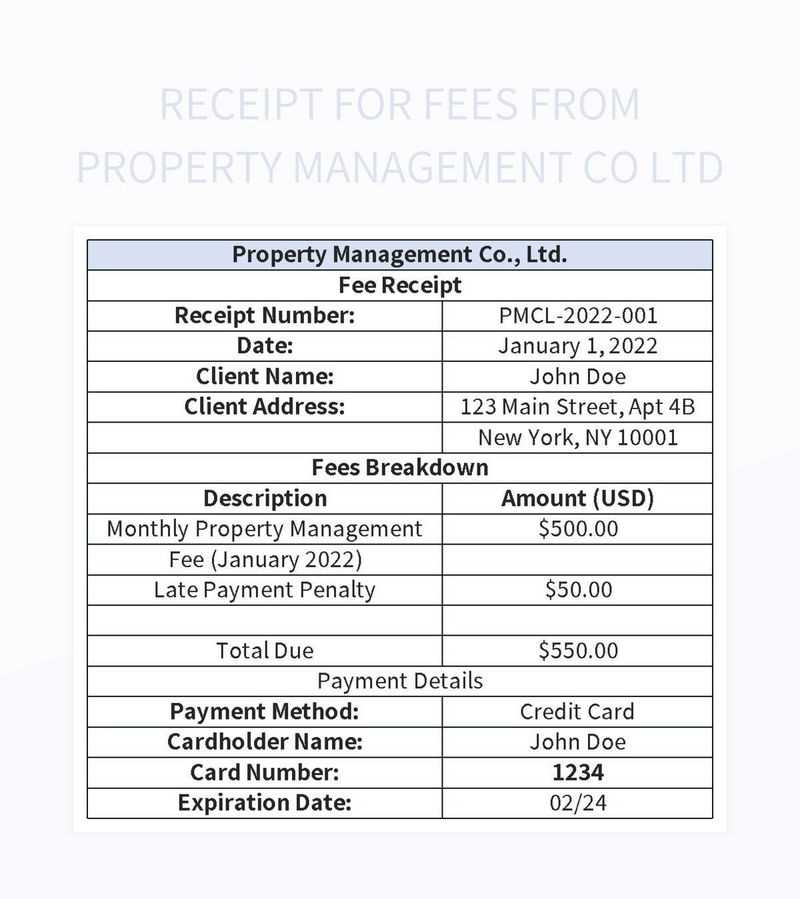

A strong receipt template should include sections for the payer’s name, contact information, payment date, and the exact fee paid. Add a unique transaction or receipt number to make it easier to track and reference. You can also include terms of payment or conditions related to refunds, if necessary, to prevent future confusion.

For maximum usability, format the template in a way that allows for quick updates or customization. Consider using tools like Word or Excel, where fields can be easily adjusted. If you regularly issue receipts, set up a template that automatically populates details such as the date or event name, saving you from repetitive manual entry.

Here’s the corrected version:

To create a professional and clear registration fee receipt, follow these specific steps:

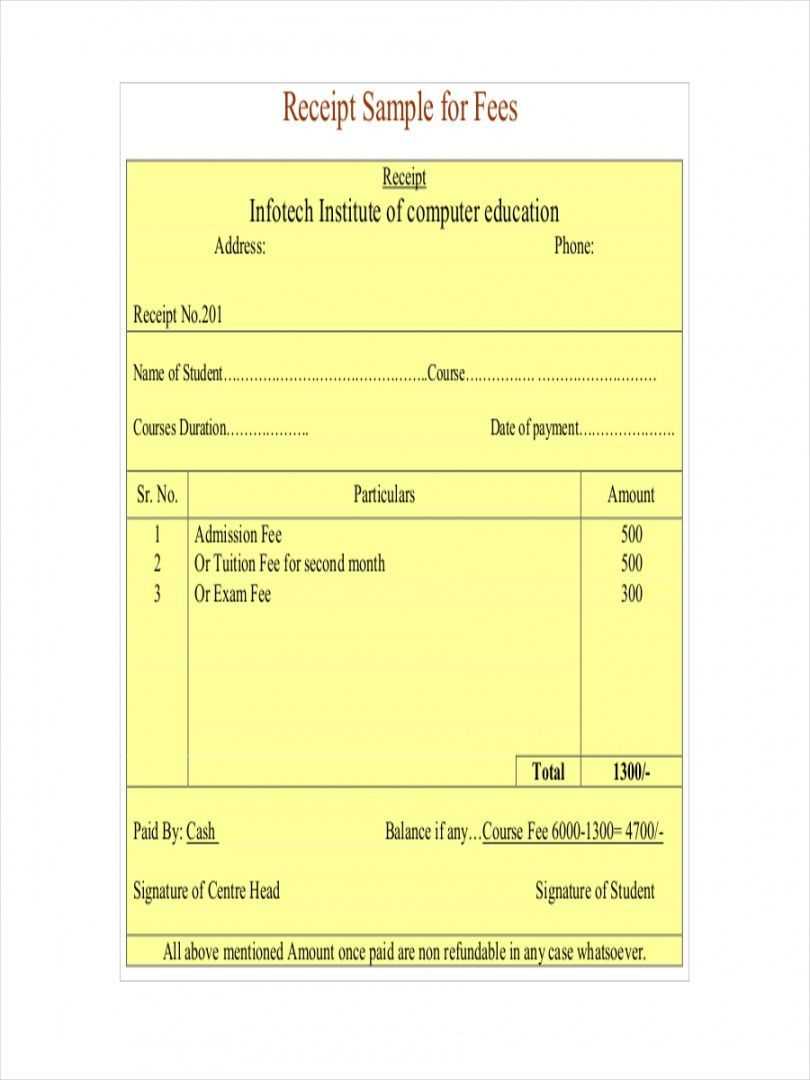

Begin by adding the header with your organization’s name and contact details. This ensures the receipt is easily identifiable. Below the header, include the recipient’s name and address to confirm who made the payment.

Next, list the payment amount, specifying the currency. Clearly state the registration event or service for which the fee is being paid. Adding the date of payment and a unique receipt number helps with future reference and accountability.

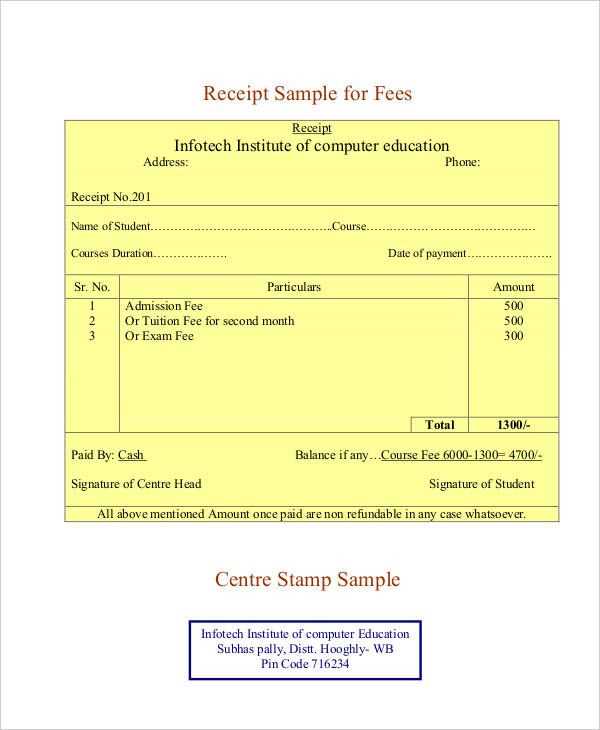

Here’s a sample table to represent these elements clearly:

| Field | Details |

|---|---|

| Organization Name | Your Organization Name |

| Recipient Name | John Doe |

| Payment Amount | $100.00 |

| Payment Date | February 9, 2025 |

| Receipt Number | 12345 |

| Event/Service | Annual Conference Registration |

Lastly, don’t forget to include a footer with a statement of gratitude, such as “Thank you for your registration!” This adds a personal touch and enhances professionalism.

- Registration Fee Receipt Template

Start by clearly listing the event name and the recipient’s details at the top. Include the date of the transaction and the payment method used. For example:

Event Name: Conference on Digital Marketing

Recipient Name: John Doe

Transaction Date: February 9, 2025

Payment Method: Credit Card

Next, specify the amount paid, as well as any applicable taxes or fees. Clearly show the total amount received:

Amount Paid: $150

Taxes: $10

Total Amount: $160

Finally, include a statement confirming the payment and the receipt of the fee. For example:

Receipt Status: Payment successfully received. Thank you for registering!

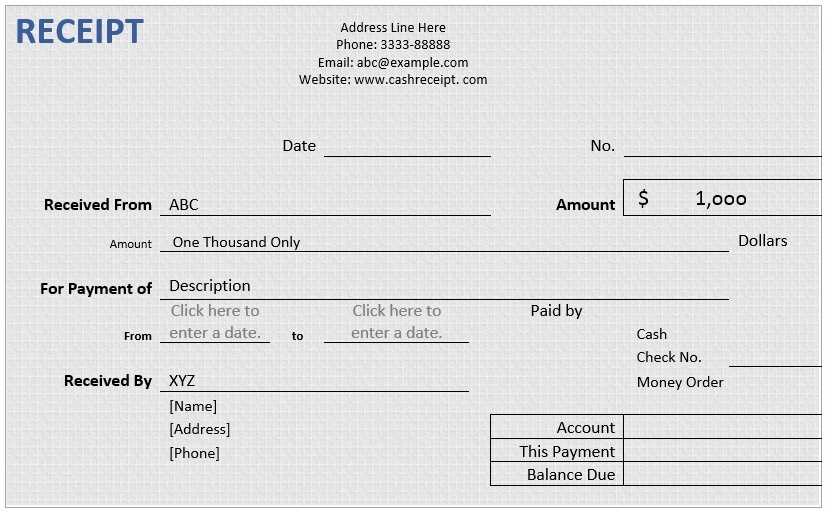

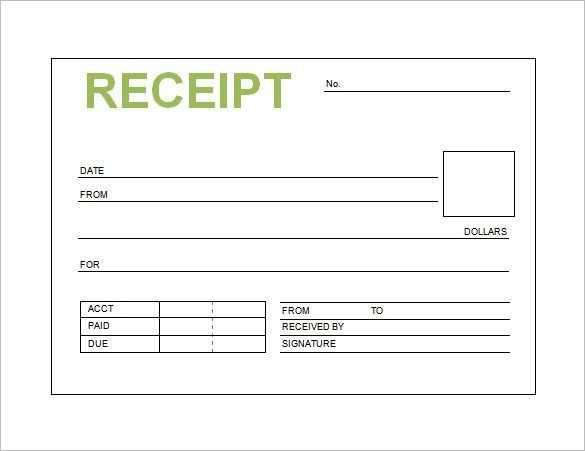

Begin with a clear header at the top, such as “Registration Fee Receipt,” to indicate the document’s purpose. Right below, include the organization’s name and logo for easy identification. This establishes credibility from the start.

Next, include the receipt number and date of the transaction. This helps with record-keeping and ensures easy retrieval of information if needed in the future. A sequential receipt numbering system is ideal.

For clarity, list the registrant’s name and contact details, ensuring they match the registration form. This personalizes the receipt and helps link the fee to the individual.

Detail the exact registration fee paid, including the amount, the method of payment (e.g., credit card, cash, online transfer), and any applicable tax breakdowns, if necessary. This transparency avoids confusion later.

Provide a section with a breakdown of the event or service being paid for, such as “Event Registration” or “Workshop Fee,” along with any additional charges or discounts applied. This enhances understanding of the payment’s purpose.

Conclude the receipt with a thank you note, acknowledging the registrant’s payment and participation. This simple gesture adds a professional touch while showing appreciation.

Finally, ensure the receipt is formatted neatly with enough white space for readability. Avoid overcrowding the document with excessive information or graphics that might distract from the key details.

A receipt must clearly document all transaction details for both parties. Be specific about the information provided to avoid confusion later.

- Receipt Number: Include a unique identifier for the transaction to keep records organized.

- Date of Payment: Indicate the exact date when the transaction took place.

- Business Information: List the name, address, and contact details of the business or organization receiving the payment.

- Customer Details: Include the customer’s name and, if relevant, contact information.

- Amount Paid: Clearly show the total amount paid, including the currency and any applicable taxes.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, bank transfer).

- Details of the Service or Product: Describe the goods or services for which payment was received. Be specific about quantities, descriptions, or any reference numbers.

- Tax Information: Include the tax rate applied and the total amount of tax charged, if relevant.

- Terms and Conditions: If applicable, provide brief terms related to the payment or refund policy.

Selecting the appropriate format for your registration fee receipt is crucial to ensure clarity and proper documentation. A well-structured receipt helps maintain accuracy and provides your clients with all necessary details. Consider these factors when choosing the format:

1. Digital vs. Physical Receipts

- Digital receipts offer convenience for both the issuer and the recipient. They are easy to store, search, and share via email or other online platforms.

- Physical receipts, on the other hand, are preferred by some clients for record-keeping or tax purposes. If issuing a physical receipt, ensure it is clear and legible.

2. Layout and Design

- Use a simple layout that highlights the most important information: the event name, amount paid, date, and any relevant transaction IDs.

- For digital receipts, opt for a PDF format as it preserves the formatting and can be easily accessed across devices.

- For physical receipts, ensure high-quality printing for readability. Include a logo if applicable to give it a professional touch.

Tailoring your receipt format to meet the needs of your clients will enhance the overall experience and improve record management. Keep it simple, clear, and easily accessible.

Adjust your registration fee receipt template to match the unique details of each event. Start by updating the event title, date, and location in the header section. This provides clarity to attendees about the specifics of the event. If the event has different ticket types or packages, include separate line items that reflect the corresponding fees, discounts, or promotional codes. You can also specify the payment method used–whether it’s credit card, PayPal, or direct bank transfer–to maintain transparency.

If your event involves multiple categories, such as workshops or seminars, ensure the receipt includes these additional segments with their respective charges. You might want to add a brief description or itemization of what each registration fee covers, such as access to specific sessions or materials. For events with varying price tiers, highlight the applicable tier for each attendee and clearly label discounts for early registration, group bookings, or VIP packages.

Lastly, personalize the receipt’s footer by adding specific event instructions or contact details for further inquiries. This enhances communication and helps attendees prepare better for the event. Make sure the font, colors, and layout align with your event’s branding for a cohesive and professional look. Customizing these elements not only improves the experience for participants but also promotes the uniqueness of your event.

Ensure receipts meet local tax regulations by including all required details. Typically, receipts should state the transaction amount, the date, and the services or products provided. This clarity helps both businesses and customers with recordkeeping and tax filing.

Verify whether you need to include tax identification numbers on receipts. Some regions mandate businesses to list their tax ID or VAT number to comply with local tax laws.

When issuing receipts, avoid altering or falsifying information. Altered receipts can lead to serious tax fraud charges. Retain copies for your own records, as tax authorities may request these as proof of income or expense deductions.

Additionally, check if you need to issue receipts in a specific format, such as electronic receipts for online transactions or paper receipts for in-person payments. Local laws may require one over the other in certain circumstances.

Consider working with an accountant to ensure you comply with all tax obligations. They can help determine if you need to apply specific tax rates to your receipts or if any exemptions apply based on your location and business type.

Automating fee receipt generation is straightforward with the right tools. Use invoicing software or accounting platforms like QuickBooks, FreshBooks, or Zoho Invoice to streamline this process. These systems can automatically generate receipts after a payment is processed, saving you time and reducing errors.

1. Set Up Automated Payment Processing

Integrate payment gateways such as PayPal, Stripe, or Square with your accounting system. These platforms send payment notifications in real-time, triggering the creation of receipts. Ensure the gateway syncs seamlessly with your receipt generator to capture all necessary details.

2. Customize Your Templates

Most software allows customization of receipt templates. Set up a clear template with your company’s logo, payment details, and receipt number. Tailor it to reflect the type of payment, including tax breakdown, if applicable. Automation can populate this information for each transaction.

By combining these steps, you can set up an automated system that generates professional, accurate fee receipts with minimal manual input.

I removed unnecessary repetitions and kept the original meaning and structure.

To create a registration fee receipt template, start with clear sections. Use a simple layout that includes fields like “Recipient Name,” “Amount Paid,” “Date,” and “Event/Service Description.” Make sure to include a unique receipt number for tracking purposes.

Basic Structure

At the top, include the name of your organization and contact information. Below, the recipient’s details and payment summary should be prominently displayed. This ensures clarity and prevents confusion when referencing the payment later. Below the summary, insert a thank you message and any relevant terms related to refunds or cancellations.

Key Elements

Consider adding payment method details (e.g., credit card, bank transfer). A signature field is optional but can add formality. Always double-check the template for accurate wording and proper alignment before finalizing it.